Can You Claim Online Courses On Your Taxes According to the IRS if you re taking online courses that maintain or improve skills in your current business or job you might be able to deduct the education

Topic no 513 Work related education expenses You may be able to deduct the cost of work related education expenses paid during the year if you re A self There is no limit on the number of years you can claim the credit It is worth up to 2 000 per tax return American opportunity tax credit The American Opportunity Tax Credit

Can You Claim Online Courses On Your Taxes

Can You Claim Online Courses On Your Taxes

https://www.gannett-cdn.com/-mm-/d8340c24781da72edad3ed5c705ee2a1eba422cf/c=0-22-2114-1217/local/-/media/2017/01/29/USATODAY/USATODAY/636213215291027598-GettyImages-518322266.jpg?width=3200&height=1680&fit=crop

How To Save On Your Taxes And Other Last Minute Tax Tips The New York

https://static01.nyt.com/images/2022/04/09/business/08adviser-illo/08adviser-illo-superJumbo.jpg?quality=75&auto=webp

Your Guide To Self Employed HGV Driver Expenses Countingup

https://countingup.com/wp-content/uploads/2022/08/Copyofmaking-tax-digital-and-vat-hero1_8cd9a1ddc294707f88cf4d46c631e8ab_2000.png

When taking online classes there are a few things you need to know about how they affect your taxes You May be Eligible for Tax Credits Tuition fees and other That means you can deduct the class from your tax bill write off block Another tax break for your educational expenses You can t always claim your

To report the costs of work related education classes and workshops record the expenses as professional development against self employment income on Schedule C Just like enrolling in a traditional university students taking online courses can utilize a variety of tax credits and deductions to help save money during tax season IRS

Download Can You Claim Online Courses On Your Taxes

More picture related to Can You Claim Online Courses On Your Taxes

QCD From IRA Save Big On Taxes While Helping Charity

https://i.ytimg.com/vi/f2Ygm8thh6o/maxresdefault.jpg

Should I Stay Or Should I Go A New Marriage Tax Calculator Can Help

https://imageio.forbes.com/specials-images/imageserve/579112786/0x0.jpg?format=jpg&width=1200

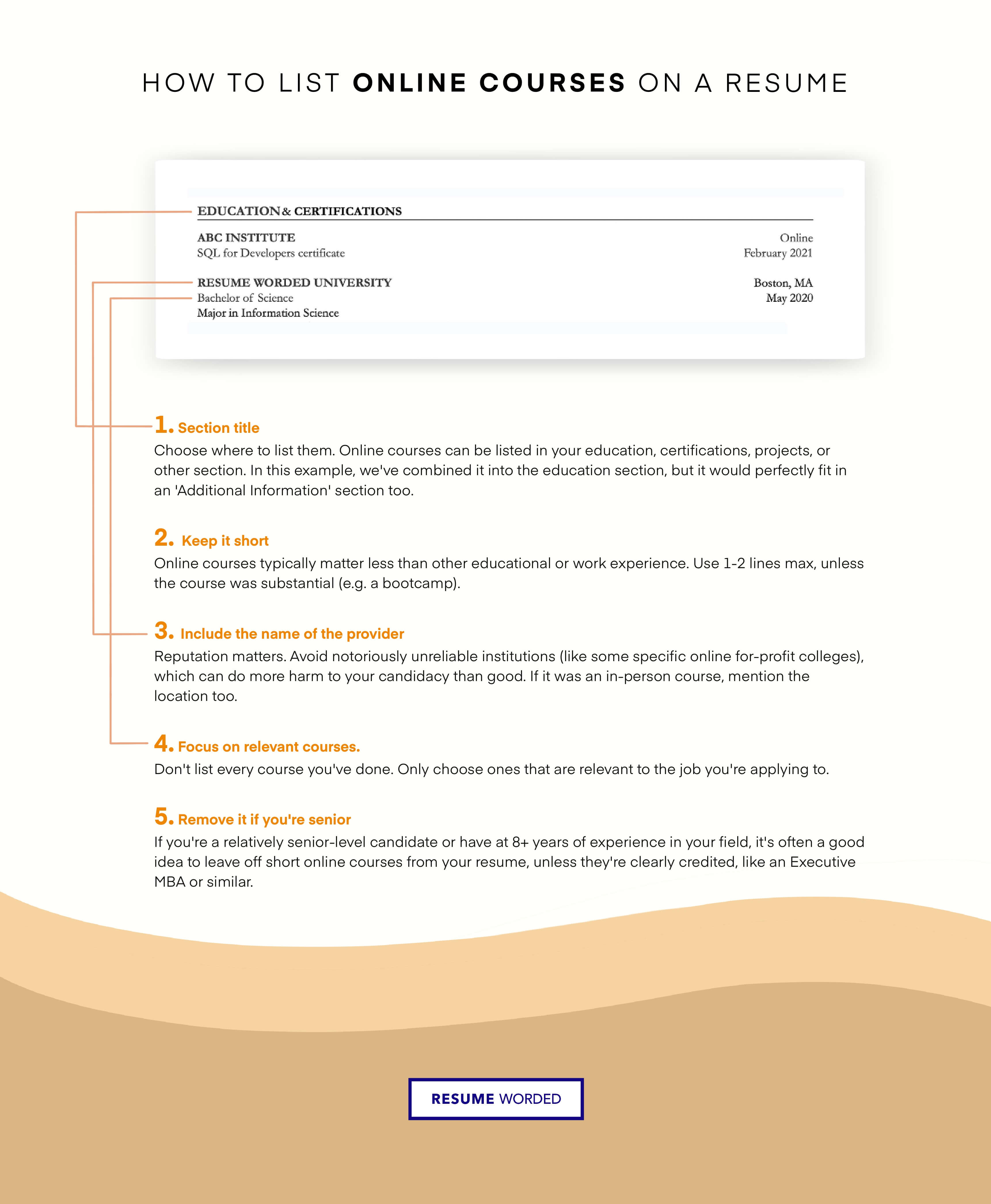

When And How To List Online Courses On A Resume 2023

https://resumeworded.com/blog/content/images/2022/04/Online_courses_-_small_size.jpeg

There is no limit on the number of years you can claim the credit It is worth up to 2 000 per tax return Who can claim the LLC To claim the LLC you must meet In general coding bootcamps can be considered tax deductible if your employment or salary will be adversely affected without the course if the training was

You may only claim the cost of your training courses if one of the following situations applies the course qualifies for the tuition credit in other words it was at a designated March 25 2020 Are you wondering Are online courses tax deductible While most people think that an online course is no different than one offered in a brick and mortar

Working From Home What Can You Claim And How Do You Claim It Public

https://www.publicaccountant.com.au/images/tax_consultant_.jpeg

Get Free Help On Your Taxes Island Senior Resources

https://senior-resources.org/wp-content/uploads/2023/02/Tax-help-1.png

https://teach.io/blog/are-online-courses-tax-deductible

According to the IRS if you re taking online courses that maintain or improve skills in your current business or job you might be able to deduct the education

https://www.irs.gov/taxtopics/tc513

Topic no 513 Work related education expenses You may be able to deduct the cost of work related education expenses paid during the year if you re A self

Doola On Twitter Are You Ready For Tax Season Join Us On 3 1 For

Working From Home What Can You Claim And How Do You Claim It Public

Tax Preparation Checklist Everything You Need To Get Ready For Tax

7 Last Minute Moves To Save On Your Taxes For 2021

Know Whether You Can Claim Input Tax Credit On Food

Mistakes To Avoid When Claiming Work From Home Tax Deductions Work

Mistakes To Avoid When Claiming Work From Home Tax Deductions Work

.png)

General 1 EC ACCOUNTING SOLUTIONS CPA

7 Tips To Save Money On Your Taxes Heritage Insurance

The Dangers Of Trying To Get A Refund On Your Taxes Icsid

Can You Claim Online Courses On Your Taxes - To report the costs of work related education classes and workshops record the expenses as professional development against self employment income on Schedule C