Can You Claim Parking On Taxes Canada Determine if the benefit is taxable Generally parking you provide or reimburse to your employees is a taxable benefit This includes situations where you provide parking to

Find deductions credits and expenses you can claim on your tax return to help reduce the amount of tax you have to pay If an employee is provided or reimbursed for parking the benefit is not taxable if all of the following apply COVID 19 caused a closure of the place of employment during the

Can You Claim Parking On Taxes Canada

Can You Claim Parking On Taxes Canada

https://groupenroll.ca/wp-content/uploads/2021/12/claiming-dependents-on-taxes-canada.jpg

How To Claim Rent On Taxes In 2022 2023 Filing Taxes

https://filingtaxes.ca/wp-content/uploads/2021/11/Taxes-you-will-You-Pay-on-Used-Cars-in-Canada-1.jpg

Can You Claim Supplements On Taxes Canada 27F Chilean Way

https://www.27fchileanway.cl/wp-content/uploads/2023/05/can-you-claim-supplements-on-taxes-canada.jpg

In most cases as a salaried employee you cannot claim monthly or even short term parking parking fees on your taxes However this is primarily only true for parking at Vehicle related business expenses you can claim on your tax return include gas insurance repair costs parking fees If you use your vehicle for both business and

As a Canadian you have the opportunity to make tax claims on your return We re covering the less commonly used deductions here Can you claim a car purchase on your taxes The purchase price of a new car itself is not something that can be claimed as an expense unless you are claiming a Capital Cost Allowance CCA as a depreciating asset for

Download Can You Claim Parking On Taxes Canada

More picture related to Can You Claim Parking On Taxes Canada

Can You Claim Home Improvements On Your Taxes CountyOffice YouTube

https://i.ytimg.com/vi/Kt1oSzozBIc/maxresdefault.jpg

Can I Claim Home Renovation Expenses On Taxes Prim Mart

https://primmart.com/wp-content/uploads/2022/03/Can-I-Claim-Home-Renovation-Expenses-on-Taxes.jpg

Can You Claim Workers Compensation Benefits From A Work Related Car

https://dpaynetwork.com/wp-content/uploads/2021/02/claim-workers-comp-insurance-from-car-accident.jpg

Did you use a vehicle for business purposes this past tax year This article explains what motor vehicle expense claims you can make on income tax in Canada and what kind of documentation you ll If your employer reimburses you for your expenses and includes the reimbursement as taxable income on your T4 Statement of Remuneration Paid you

Taxpayer tries to claim parking costs as medical expense claiming discrimination for travelling short distances Jamie Golombek Start gathering the You may be able to deduct amounts that you have paid for child care Line 21900 Moving expenses You may be able to deduct moving expenses if you move to continue your

Can You Deduct Attorney Fees On Tax Returns West Law Office

https://s3.amazonaws.com/law-media/uploads/83/24997/large/file5731302982029.jpg?1454989657

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

https://www.canada.ca/.../automobile/parking.html

Determine if the benefit is taxable Generally parking you provide or reimburse to your employees is a taxable benefit This includes situations where you provide parking to

https://www.canada.ca/en/revenue-agency/services...

Find deductions credits and expenses you can claim on your tax return to help reduce the amount of tax you have to pay

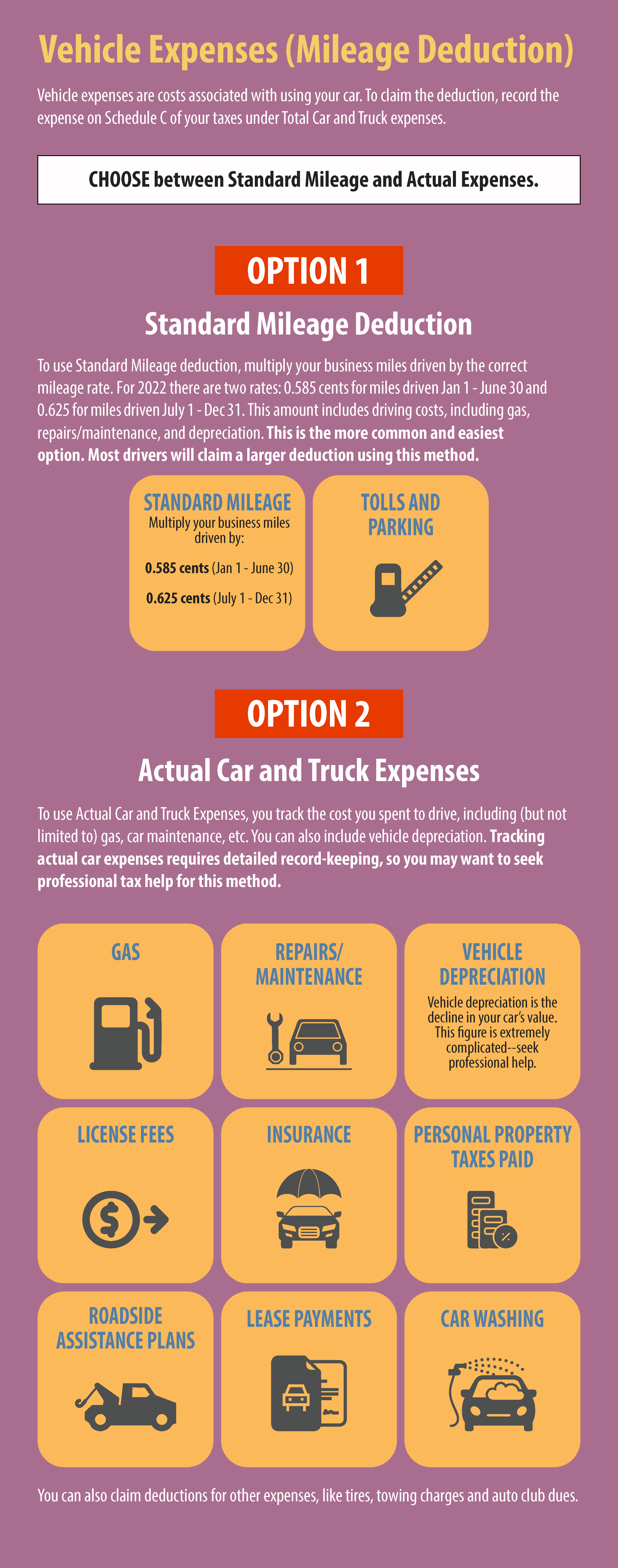

How To Claim The Standard Mileage Deduction Get It Back

Can You Deduct Attorney Fees On Tax Returns West Law Office

The Deductions You Can Claim Hra Tax Vrogue

AARP Can You Claim Social Security On Your Spouse s

Mistakes To Avoid When Claiming Work From Home Tax Deductions Work

How To Write Off Business Expenses Knowdemia

How To Write Off Business Expenses Knowdemia

Claiming Car Expenses On Tax One Click Life

Insurance 7 What Can You Claim For And How To Claim Insurance 7

Standard Deduction How Much Can You Claim On Your Declarations For

Can You Claim Parking On Taxes Canada - Can you claim a car purchase on your taxes The purchase price of a new car itself is not something that can be claimed as an expense unless you are claiming a Capital Cost Allowance CCA as a depreciating asset for