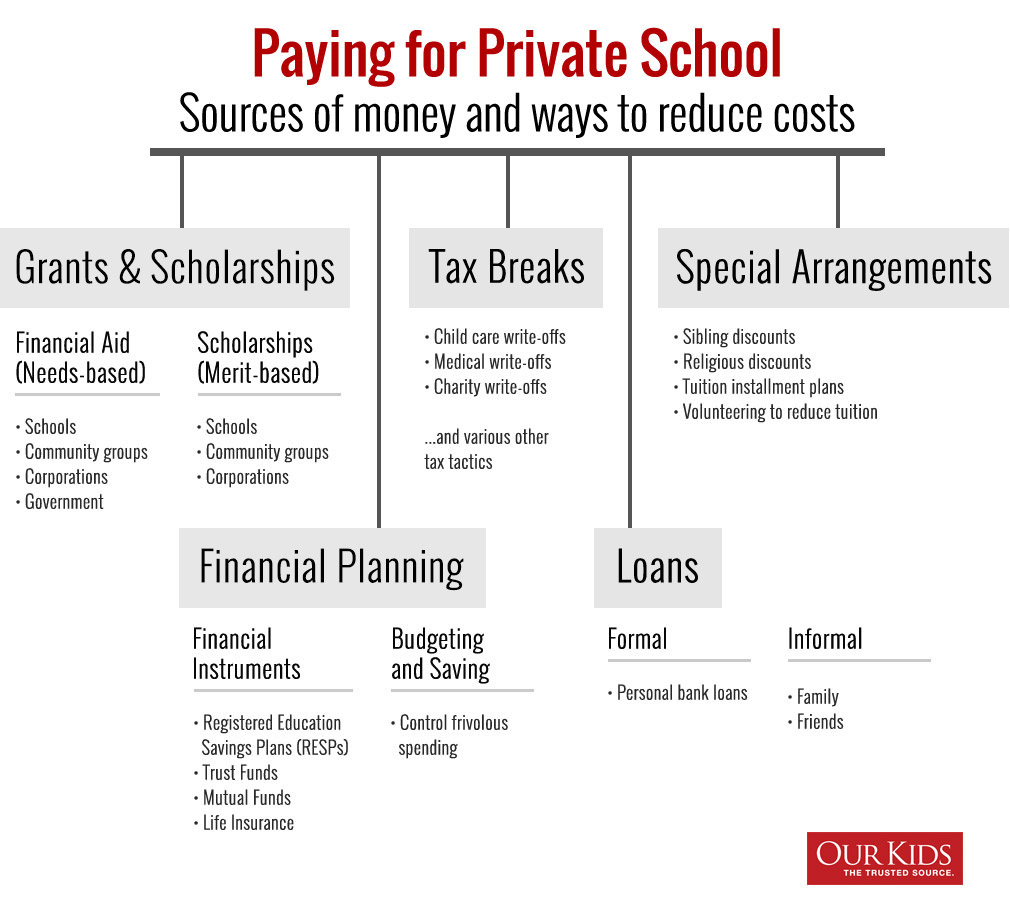

Can You Claim Private School Tuition On Taxes Generally you cannot claim your son s private school tuition as a tax deduction on your federal income tax return A few states do allow deductions for K 12 education and or

Find out if you can deduct private school tuition from your taxes and what other tax benefits are available for K 12 education costs Learn about 529 plans Coverdell accounts and special needs expenses Can you get tax deductions for private school tuition This guide explores federal and state tax benefits savings plans and financial aid options

Can You Claim Private School Tuition On Taxes

Can You Claim Private School Tuition On Taxes

https://i.ytimg.com/vi/ekntHds7qO8/maxresdefault.jpg

Can You Claim Private School Tuition On Taxes In Ontario School Walls

https://www.mondaq.com/images/article_images/818810a.jpg

Can You Claim Private School Tuition On Taxes In Ontario School Walls

https://www.ourkids.net/school/images/articles/paying-chart.jpg

Learn how to claim private school fees as donations or child care costs on your taxes See answers from TurboTax Live Assist Review and other users on this topic If your child attends a K 12 private school there is no federal tax deduction or credit you qualify for that will help pay for tuition not even school uniforms However once your child graduates and attends a college you re paying for

The straightforward answer to federal taxes is no Private school tuition for K 12 education is generally not tax deductible and the IRS does not allow deductions for elementary and secondary An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition and fees you

Download Can You Claim Private School Tuition On Taxes

More picture related to Can You Claim Private School Tuition On Taxes

Are Private Schools Nonprofit Organizations

https://www.privateschoolconsultant.net/img/1ad495250a692778b18b6f6925d89595.jpg?08

Can You Claim Private School On Your Taxes

https://www.privateschoolconsultant.net/img/798489340666b725875cbffce8994aca.jpg?29

Can You Claim Your Elderly Parents On Your Taxes The TurboTax Blog

https://blog.turbotax.intuit.com/wp-content/uploads/2011/07/can-you-claim-elderly-parent-on-taxes.jpg?resize=1200,630

You can take a deduction for qualifying educational expenses as an adjustment to income or in the form of a credit against taxes owed but not as an itemized deduction on Schedule A In some cases tuition paid to private educational Private school tuition isn t a direct deduction that you can take on your taxes Here are other related ways you could lower your tax liability

If your child is attending a private K 12 school because they have special education needs you may be able to get a tax break on the tuition The deduction requires a For example can you claim tax relief on private school fees Do private schools get government funding in the UK Is a donation to a private school tax deductible That s where we can help

Working From Home What Can You Claim And How Do You Claim It Public

https://www.publicaccountant.com.au/images/tax_consultant_.jpeg

Accounting For All The Beans Cilliers CPA Blog On Acounting And Tax

https://cillierscpa.files.wordpress.com/2021/10/tax.jpg

https://ttlc.intuit.com › ... › can-i-claim-my-child-s-private-school-tuition

Generally you cannot claim your son s private school tuition as a tax deduction on your federal income tax return A few states do allow deductions for K 12 education and or

https://www.thebalancemoney.com › tax-deduction-for...

Find out if you can deduct private school tuition from your taxes and what other tax benefits are available for K 12 education costs Learn about 529 plans Coverdell accounts and special needs expenses

/88623667-F-56a938af3df78cf772a4e575.jpg)

Can I Claim High School Tuition On My Taxes School Walls

Working From Home What Can You Claim And How Do You Claim It Public

Can You Claim Clothing As A Business Expense NH Associates

Can You Claim The Employee Retention Credit MichaelTritthart

Doola On Twitter Are You Ready For Tax Season Join Us On 3 1 For

Do Private Schools Pay Property Taxes Ccalv

Do Private Schools Pay Property Taxes Ccalv

Are Private Schools Corporations A Comprehensive Guide

5 Valuable Tips On How To Pay Trade School Tuition InterCoast Colleges

Know Whether You Can Claim Input Tax Credit On Food

Can You Claim Private School Tuition On Taxes - Private school tuition is not tax deductible on the federal level Unlike college tuition which is eligible for education tax benefits such as the American Opportunity Credit or the