Can You Claim Sales Tax Back In New York For example you owe use tax if you live in New York City drive your car to New Jersey for service and then drive back to New York You may owe an additional local sales and use tax if you are a resident of a county or city when you make your purchase and you buy property or a service in a New York State county or city that has a lower

The 8 875 New York Sales Tax consists of 4 5 New York City tax 4 New York State tax and 0 375 Metropolitan Commuter Transportation District surcharge Prices are always shown without tax in all shops and restaurants in New York If you are registered for sales tax purposes you can claim a credit for sales tax you overpaid paid by mistake or collected but then repaid to your customers You can then apply the credit to reduce the tax you owe on your sales tax return This bulletin explains what you need to know when applying for a sales tax credit

Can You Claim Sales Tax Back In New York

Can You Claim Sales Tax Back In New York

https://blog.irishtaxrebates.ie/wp-content/uploads/2022/01/Blog-Image-how-do-i-claim-tax-back.jpg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

How To Claim Back Sales Tax Paid On Business Purchases

https://wtcca.com/wp-content/uploads/2022/04/shutterstock-1496216543.png

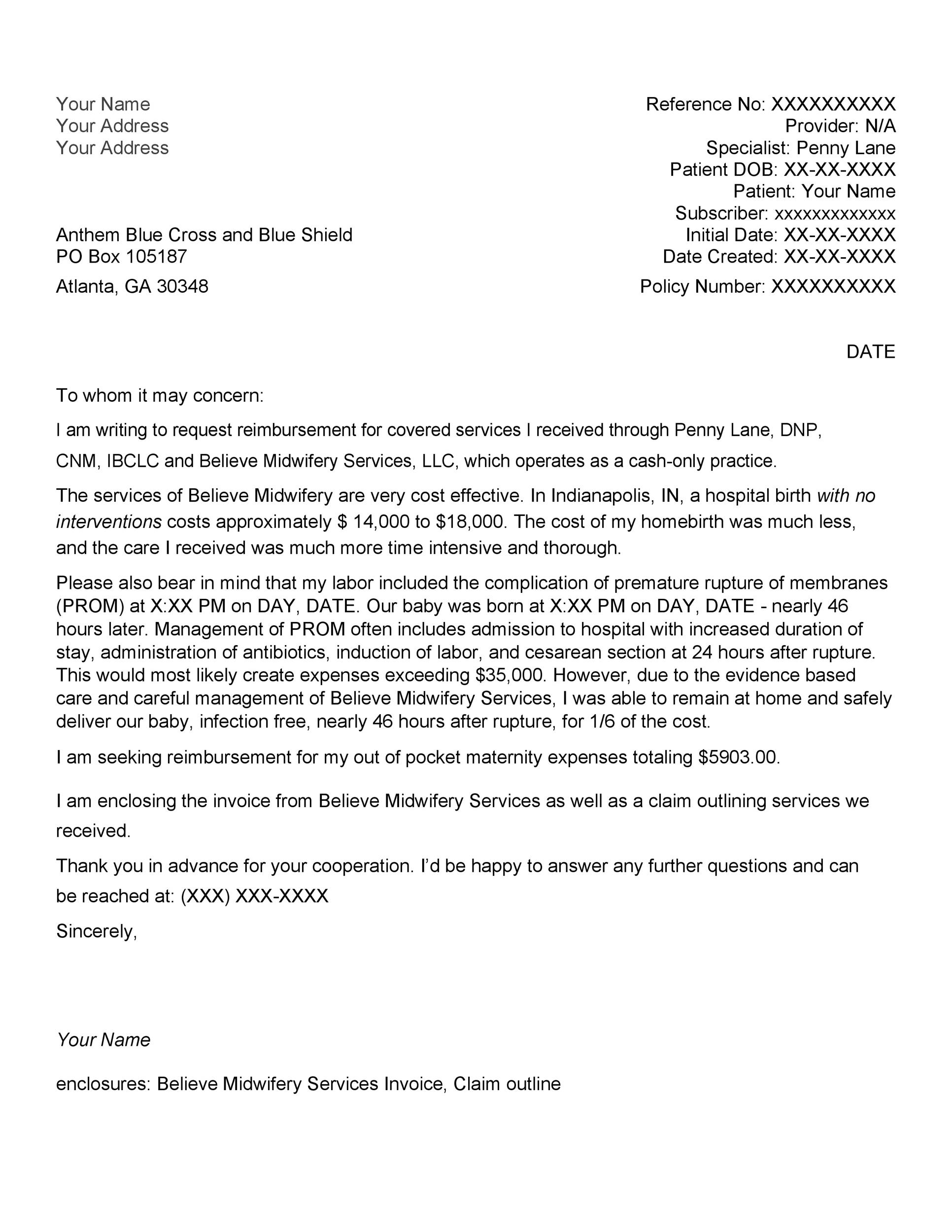

New York State sales tax exemption documents For example even though wholesalers may never collect sales tax because all of their purchases and sales are for resale and therefore are eligible for exemption from sales tax they must still be registered to legally issue and accept most exemption documents Claim refunds You have the right to receive interest if you paid more tax than you owe i e made an overpayment and don t receive your refund by the legal deadline The deadline varies by tax type If we discover after an audit assessment or enforcement proceeding that we owe you a refund we must inform you so that you can

You can deduct NYC sales tax via the state and local tax SALT deduction but doing so comes with some big caveats File sales tax returns If you re registered for sales tax purposes in New York State you must file sales and use tax returns quarterly part quarterly monthly or annually with the department Even if your business did not make any taxable sales or purchases during the reporting period you must file your sales and use tax return by the

Download Can You Claim Sales Tax Back In New York

More picture related to Can You Claim Sales Tax Back In New York

NY Trip Sincera

https://sinceraty.files.wordpress.com/2012/07/dsc_0077.jpg

.png?width=688&name=image (9).png)

Claimable Sales Tax

https://help.projectworks.io/hs-fs/hubfs/image (9).png?width=688&name=image (9).png

Can I Claim Back Tax Paid In The US

https://static.wixstatic.com/media/2c594f_b812a2711a8b485fa22aed6239949d4e~mv2.jpg/v1/fill/w_1000,h_667,al_c,q_90,usm_0.66_1.00_0.01/2c594f_b812a2711a8b485fa22aed6239949d4e~mv2.jpg

If you re selling to customers in New York you need to charge sales tax but New York s rules can be confusing This guide will explain New York s sales tax system in simple terms to help you file correctly and avoid penalties We ll cover everything from tax rates to economic nexus laws This publication is a comprehensive guide to New York State and local sales and use taxes for businesses that sell taxable tangible personal property perform taxable services receive admission charges or operate a hotel or motel and restaurants taverns or other establishments that sell food and drink

Any sales tax collected from customers belongs to the state of New York not you It s your responsibility to manage the taxes you collect to remain in compliance with state and local laws Failure to do so can lead to penalties and interest charges Use tax is similar to sales tax but applied where goods are consumed rather then where purchased 1 Do you get a Tax Refund for Shopping in the US at Malls or Online Stores 2 Tax Refund State Sales Tax vs Federal Sales Tax 3 The US Government does not refund Sales Tax to Visitors 4 Requirements to get Tax Refund in USA as Tourist or Resident 5 Tips for Tax Refund as a Tourist or Resident in the US 6 Common FAQs

17 Things You Can t Claim In Your Tax Return Platinum Accounting

https://uploads-ssl.webflow.com/63cf642db9b930dbbc59f679/64239dce7da9f063710a18d8_43 - 17 things you can_t claim in your tax return.jpg

Is The Angel Tax Back

https://cdn.finshots.app/images/2023/02/Finshots--12234-02.png

https://www. tax.ny.gov /pit/file/sales_and_use_tax...

For example you owe use tax if you live in New York City drive your car to New Jersey for service and then drive back to New York You may owe an additional local sales and use tax if you are a resident of a county or city when you make your purchase and you buy property or a service in a New York State county or city that has a lower

https://www. newyork.co.uk /tax-free-shopping-new-york

The 8 875 New York Sales Tax consists of 4 5 New York City tax 4 New York State tax and 0 375 Metropolitan Commuter Transportation District surcharge Prices are always shown without tax in all shops and restaurants in New York

Register For Tax Preparation Services To Claim Tax Back YourMoneyBack

17 Things You Can t Claim In Your Tax Return Platinum Accounting

Tips For A Terrific First Trip To Ireland

EMC20 And The Retail Electricity Markets Back In New York

How To Claim Tax Back Ireland Tax Returns Submitted In 3 Easy Steps

Tips For A Terrific First Trip To Ireland

Tips For A Terrific First Trip To Ireland

How Write A Claim Letter Riset

Used Car Sales Agreement Template HQ Printable Documents

Can I Claim Tax Back For Work Uniform

Can You Claim Sales Tax Back In New York - You can deduct NYC sales tax via the state and local tax SALT deduction but doing so comes with some big caveats