Can You Claim Tax Back From Europe To request a refund claimants must send an electronic refund claim to their own national tax authorities who will confirm the claimant s identity VAT identification number and the validity of the claim The request will then be forwarded to the

In the European Union it means that you can only claim a tax refund when you re actually leaving the EU zone you won t be able to claim a refund of the VAT if you re only traveling between two EU countries Spend enough money in Europe and you may be able to get some of it back in the form of a VAT value added tax refund Such refunds are now easier to get than they were a few years ago often you can claim your refund before

Can You Claim Tax Back From Europe

Can You Claim Tax Back From Europe

https://spunout.ie/wp-content/uploads/elementor/thumbs/iStock-578803708-p8t2vdrhkugxghvp3h88c385n21gx1vpthv16wjs1k.jpg

3 Ways To Claim Tax Back WikiHow

https://www.wikihow.com/images/c/ca/Claim-Tax-Back-Step-15-Version-2.jpg

How To Claim Tax Back Ireland Tax Returns Submitted In 3 Easy Steps

https://www.mytaxrebate.ie/wp-content/uploads/2022/02/How-It-Works-1.png

The tax refund counter where you can collect your refunds is normally located within the departure area after immigration The staff there will then process your request and return the tax to you in cash in the currency of To claim the VAT refund you will have to depart from Europe Merely crossing an internal border between two countries is not enough To qualify as an export the items you bought have to leave Europe Do items I bought online qualify for a

Based on the guidelines set by the European Union non EU residents can get a VAT refund on goods purchased in Europe if they show the purchased items and appropriate VAT refund Claimants must send an application to the national tax authorities in the EU country where they incurred the VAT see VAT refunds country guide Full rules and procedure to follow can be found in Directive 86 560 EEC

Download Can You Claim Tax Back From Europe

More picture related to Can You Claim Tax Back From Europe

How To Claim Tax Back From Revenue Everything You Need To Know As

https://www.thesun.ie/wp-content/uploads/sites/3/2022/12/handundeuroscheinejpg-JS742132287.jpg?w=960

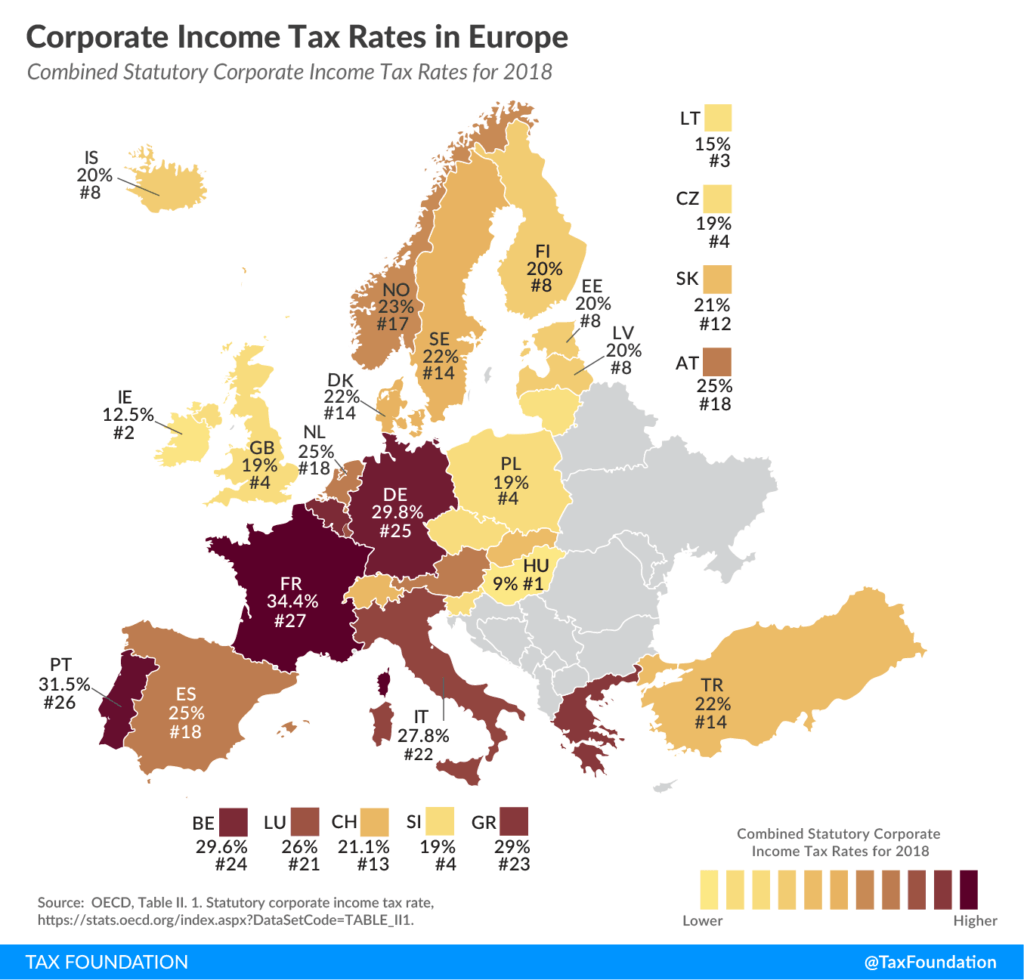

Corporate Income Tax Rates Across Europe 2018 Chart TopForeignStocks

https://topforeignstocks.com/wp-content/uploads/2019/02/Corporate-Tax-Rates-Across-Europe-2018-1024x980.png

How To Successfully Complete The UK GOV PPI TAX R40 Refund Claim Form

https://i.ytimg.com/vi/fHARONBG43g/maxresdefault.jpg

If you re registered for business purposes in a country outside the UK you may use the scheme to reclaim VAT paid in the UK You can do this if you meet the 2 following To help you out we ve put together a complete guide to tax refunds in Europe so you can get your money back without any hassle Goods in European countries contain VAT value added tax This tax is automatically

In Europe there are two big tax refund organisations Global Blue and Planet formerly known as Premier Tax Free which you can approach depending on which company In Europe standard European Union Value Added Tax ranges from 8 to 27 percent per country Exact rates and purchase minimums change and vary with the type of goods being

Want To Claim Back Tax In Ireland Here Are The 3 Ways Any Employee Can

https://i.ytimg.com/vi/ozNnmmZyJD4/maxresdefault.jpg

How To Claim Tax Back When Leaving UK Adam Fayed

https://adamfayed.com/wp-content/uploads/2023/11/Claiming-Tax-Back-from-UK-After-Leaving-512x341.webp

https://taxation-customs.ec.europa.eu/t…

To request a refund claimants must send an electronic refund claim to their own national tax authorities who will confirm the claimant s identity VAT identification number and the validity of the claim The request will then be forwarded to the

https://www.claimcompass.eu/blog/en/h…

In the European Union it means that you can only claim a tax refund when you re actually leaving the EU zone you won t be able to claim a refund of the VAT if you re only traveling between two EU countries

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

Want To Claim Back Tax In Ireland Here Are The 3 Ways Any Employee Can

6 Methods To Reduce Your Tax In Ireland Cronin Co

All The Things You Can Claim On Your Taxes Tax Walls

Can You Claim Tax Back If You Make A Loss When Starting A Business

VAT Explained Everything You Need To Know About Value Added Tax In The

VAT Explained Everything You Need To Know About Value Added Tax In The

Tax Review For 2019 How To Claim Tax Back From A Tax Review

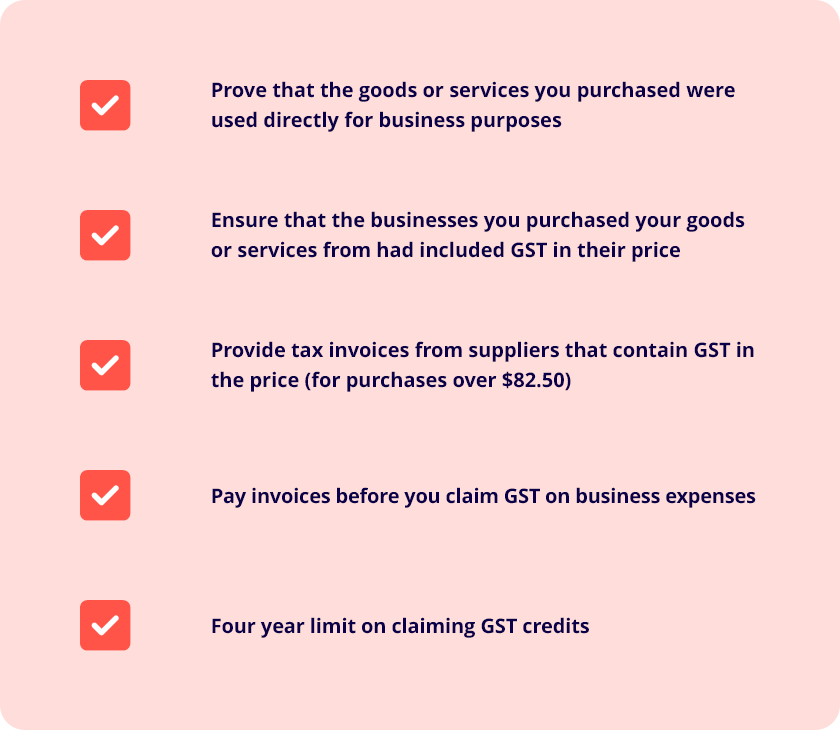

GST Refund Small Business Resources Reckon AU

Can I Claim Back Tax Paid In The US

Can You Claim Tax Back From Europe - To claim the VAT refund you will have to depart from Europe Merely crossing an internal border between two countries is not enough To qualify as an export the items you bought have to leave Europe Do items I bought online qualify for a