Can You Claim Tax Back On Charity Donations A Gift Aid declaration allows charities and community amateur sports clubs CASCs to claim tax back on eligible donations It s important that you keep records of

If you pay UK tax and donate to charity Gift Aid means the charity gets more And if you re a higher or additional rate taxpayer you can claim extra tax relief on the donation This For example if you are a higher rate taxpayer and donate 200 to a charity the charity can claim Gift Aid to make your donation 250 you pay 40 tax ie the higher rate

Can You Claim Tax Back On Charity Donations

Can You Claim Tax Back On Charity Donations

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

How To Legally Claim A Tax Deduction For Charitable Giving From Your

http://www.wealthsafe.com.au/wp-content/uploads/2015/02/charity-hand.jpg

Can I Claim Tax Back On Charity Donations Tax Walls

https://dollarsandsense.sg/wp-content/uploads/2015/12/Charity.jpg

If you re in a higher tax band at 40 then you can claim tax back on your donation as the charity can only claim up to the 20 tax rate This means that you are entitled to the Tax relief on charity donations can occur through schemes like Gift Aid Payroll Giving or when gifted in a will The information in this guide also explains where tax relief goes after donating

If you re a higher rate taxpayer you can also claim back the difference between higher rate and basic rate tax on the value of your donation For a 40 rate taxpayer that means for every 1 Gift aid is a tax efficient way for UK taxpayers to make donations to UK EEA registered charities Donating through gift aid means that charities can claim an extra 25p for every 1 they receive

Download Can You Claim Tax Back On Charity Donations

More picture related to Can You Claim Tax Back On Charity Donations

Can I Claim Tax Relief On Charitable Donations Saga

https://www.saga.co.uk/contentlibrary/saga/publishing/verticals/money/personal-finance/giving/can-i-claim-tax-relief-on-charitable-donations.jpg

How The New Tax Laws Could Affect Episcopal Charitable Giving

https://episcopalnewsservice.org/wp-content/uploads/2018/02/charity-tax-photos-offeryplate-Getty-Images.jpg-copy.jpeg

How To Claim Tax Deductions On Your Donations To Charity Mint

https://images.livemint.com/img/2022/07/10/1600x900/it_1657465224011_1657465240342.jpg

You can do this and still claim tax relief for the donation but you must keep records of the gift and the charity s request Without them you might have to pay Capital Through knowledge of schemes such as Gift Aid where charities can claim back a percentage of the tax paid on each donation tax advisers can add financial value to

You can include a deduction for the amount donated plus the 25 received by the charity the gross amount in your tax return You will receive a further 20 tax relief either in the tax year Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your

Can I Claim Tax Back On Charity Donations Tax Walls

https://images.csmonitor.com/csmarchives/2011/12/1219taxform.jpg?alias=standard_900x600nc

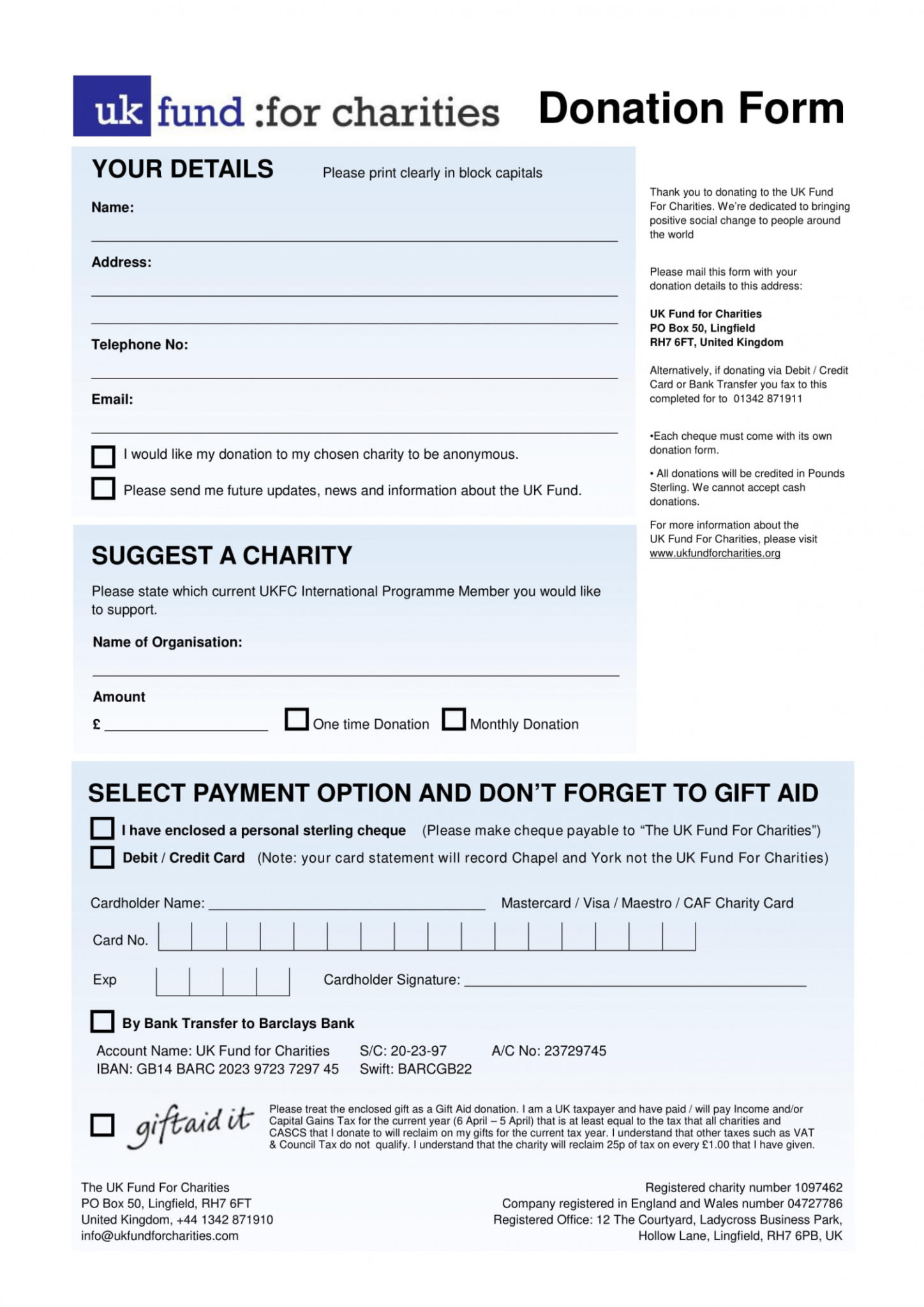

Printable Free 5 Charity Donation Forms In Pdf Ms Word Charitable

https://minasinternational.org/wp-content/uploads/2020/06/printable-free-5-charity-donation-forms-in-pdf-ms-word-charitable-donation-agreement-template-excel-1448x2048.jpg

https://www.gov.uk/guidance/gift-aid-declarations...

A Gift Aid declaration allows charities and community amateur sports clubs CASCs to claim tax back on eligible donations It s important that you keep records of

https://www.moneysavingexpert.com/family/gift-aid

If you pay UK tax and donate to charity Gift Aid means the charity gets more And if you re a higher or additional rate taxpayer you can claim extra tax relief on the donation This

The Average American s Tax Deductions By Income The Motley Fool

Can I Claim Tax Back On Charity Donations Tax Walls

3 Ways To Claim Tax Back WikiHow

Give A Donation Craigieburn Trails

All The Things You Can Claim On Your Taxes Tax Walls

Can I Claim Back Tax Paid In The US

Can I Claim Back Tax Paid In The US

Donations

How To Claim Tax Back Ireland Tax Returns Submitted In 3 Easy Steps

Donation Letter for Taxes Best Letter Template

Can You Claim Tax Back On Charity Donations - Tax relief on charity donations can occur through schemes like Gift Aid Payroll Giving or when gifted in a will The information in this guide also explains where tax relief goes after donating