Can You Claim Tax Relief For Washing Work Clothes Updated 5 April 2024 If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 100s of tax for up to five years of expenses You can reclaim whether it s just a branded T shirt or if you re a

The standard amount you can claim back is 60 per tax year this can be more depending on your job Tax relief is applied to the 60 which will normally be at a rate of 20 or 40 Submitting a claim through HMRC s online portal is straightforward and takes about 15 minutes Customers can use the handy online tool to check eligibility and a full list of work expenses

Can You Claim Tax Relief For Washing Work Clothes

Can You Claim Tax Relief For Washing Work Clothes

https://phantom-marca.unidadeditorial.es/901044baf3c0b051252a326a6ff71d9a/crop/0x0/1300x730/resize/1320/f/jpg/assets/multimedia/imagenes/2021/12/30/16408614090996.jpg

Can You Claim Clothing As A Business Expense Stem Rural

https://stemrural.co.nz/wp-content/uploads/2022/11/jacket.jpg

Tax Relief For Domestic Companies Amendments Made To Incom Flickr

https://live.staticflickr.com/65535/48780569303_2f7ef8375f_b.jpg

Tax relief can t be claimed for the initial purchase of the uniform unless you re self employed or you ve bought the uniform yourself and your employer has not reimbursed you If you need to regularly wash your uniform The uniform tax return is a tax relief you can claim if you re responsible for washing repairing and replacing your work uniform without any reimbursement from your employer The government will refund the tax you

Commonly you claim a tax relief if you have to wear a specific uniform or specialised clothing that your employer doesn t provide for you You must be obliged to wear this uniform to work to be able to claim If maintaining your uniform s cleanliness requires regular washing you could potentially seek tax relief for these expenses However if your workplace offers washing facilities that you opt

Download Can You Claim Tax Relief For Washing Work Clothes

More picture related to Can You Claim Tax Relief For Washing Work Clothes

Company Tax Relief 2023 Malaysia Printable Forms Free Online

https://ringgitplus.com/en/blog/wp-content/uploads/2022/03/income-tax_everything-you-should-claim_ya2021.jpg

Can You Claim Tax Relief For Working From Home shorts tax YouTube

https://i.ytimg.com/vi/2OkRxA3A2_o/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYPiA7KH8wDw==&rs=AOn4CLAJI4-gRouBIwwNRK_w7WVxVIop9w

Employees Can You Claim Tax Relief For Expenses Of Working From Home

https://media-exp1.licdn.com/dms/image/C4E12AQHIStDbsLKPTQ/article-cover_image-shrink_720_1280/0/1607943720896?e=2147483647&v=beta&t=aIT3B2rJgJhzvbbagqjQLNEhub5duLM-x7xW7_HMgRg

A uniform tax rebate is a refund of the tax that you have paid on the cost of washing repairing and replacing clothing that you have to wear as a uniform for work in any given tax year If eligible for the refund the rebate can You can claim allowable business expenses for uniforms protective clothing needed for your work costumes for actors or entertainers You cannot claim for everyday clothing even if you

In particular you may be able to claim a flat rate allowance per year for the cost of washing your uniform or specialist clothing at home repairing or replacing small tools for If as part of its normal tax admin HMRC sends you a P810 Tax Review form to check your tax code is correct you can also fill this in to claim tax relief For expenses over

Can You Claim The Home Office Tax Deduction If Ve Been Working Remotely

https://images.mktw.net/im-300624?width=700&height=466

Go Direct To Get Tax Relief On Work Expenses

https://www.punchline-gloucester.com/images/user/14837_fullsizeoutput_2511.jpeg

https://www.moneysavingexpert.com/rec…

Updated 5 April 2024 If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 100s of tax for up to five years of expenses You can reclaim whether it s just a branded T shirt or if you re a

https://www.taxrebateservices.co.uk/tax-faqs/...

The standard amount you can claim back is 60 per tax year this can be more depending on your job Tax relief is applied to the 60 which will normally be at a rate of 20 or 40

Can We Claim Tax Relief On Items Bought To Be Able Fishbowl

Can You Claim The Home Office Tax Deduction If Ve Been Working Remotely

Understanding Fuel Expenses How Can You Claim Tax Relief Drivers Club

Claim Tax Relief For Additional Costs Of Working From Home

Employees Working From Home Can Claim Tax Relief

Tax Relief For Children 2021 Fill In The Declaration Now

Tax Relief For Children 2021 Fill In The Declaration Now

Mistakes To Avoid When Claiming Work From Home Tax Deductions Work

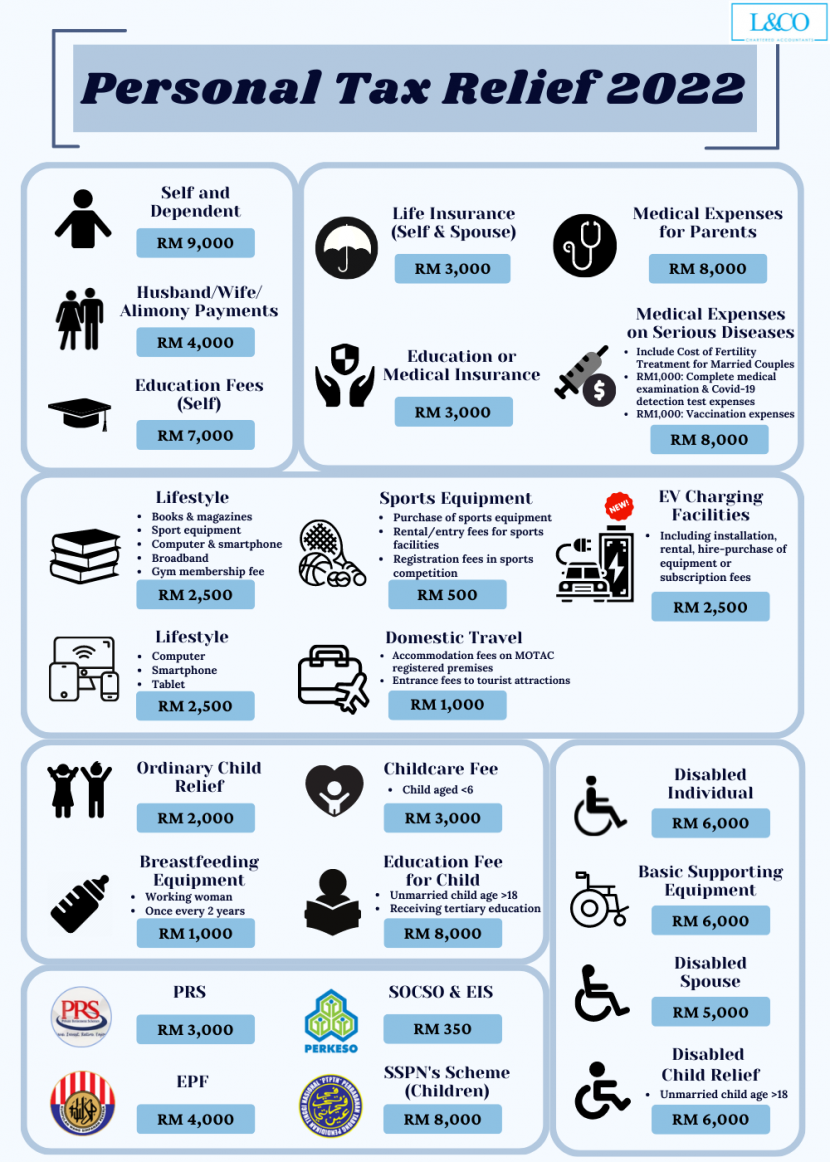

Personal Tax Relief 2022 L Co Accountants

Reimagining Fundraising Generic Submission Automating Tax Benefits

Can You Claim Tax Relief For Washing Work Clothes - The uniform tax return is a tax relief you can claim if you re responsible for washing repairing and replacing your work uniform without any reimbursement from your employer The government will refund the tax you