Can You Claim Tax Relief For Working From Home During Covid HM Revenue and Customs HMRC is accepting tax relief claims for working from home due to coronavirus during 2021 to 2022 More than 550 000 employed workers have already claimed and are

If your employer does not pay you a working from home allowance for your expenses you can make a claim for tax relief during the year or after the end of the year You will get money back from the taxes you paid If you were forced to work from home during the pandemic the good news is you may still be able to claim tax relief even if you only worked from home for a short time Here Which explains what the rules are around getting tax relief for

Can You Claim Tax Relief For Working From Home During Covid

Can You Claim Tax Relief For Working From Home During Covid

https://img.rasset.ie/00132bae-1600.jpg

Different Ways To Claim Tax Relief When Working From Home

https://www.ridgefieldconsulting.co.uk/wp-content/uploads/2020/10/Different-ways-to-claim-tax-relief-when-working-from-home.jpg

Buildings Free Full Text Working From Home During COVID 19 And

https://pub.mdpi-res.com/buildings/buildings-13-00166/article_deploy/html/images/buildings-13-00166-g001.png?1673399049

From the current tax year 2022 23 onwards employees who are eligible can still make a claim for tax relief for working from home The claim can be made in self assessment SA returns online or on a paper P87 form Employees who have worked from home during the pandemic but are now returning to offices can still claim tax relief on household expenses for this tax year

During the pandemic and in a few cases since employees were allowed to claim tax relief on working from home expenses but you need to check first that you Were told to work from home by your employer You cannot claim tax relief if you chose to work from home Working from home tax relief is a UK government initiative aimed at helping workers offset the increased home related expenses incurred while working remotely during the COVID 19 pandemic Those eligible can claim a tax deduction for certain additional costs such as higher utility bills and internet expenses providing financial support to

Download Can You Claim Tax Relief For Working From Home During Covid

More picture related to Can You Claim Tax Relief For Working From Home During Covid

Buildings Free Full Text Working From Home During COVID 19 And

https://pub.mdpi-res.com/buildings/buildings-13-00166/article_deploy/html/images/buildings-13-00166-g004.png?1673399055

Cashtrak Employment Related Tax Relief Can You Claim Tax Relief On

https://uk.rs-cdn.com/images/uwsul-hl6ix/blog/8125cd44587a4cceea270be6929bbefa__839d/zoom668x445z100000cw668.jpg?etag=6ead2c2c63c5bac3a853a03accbc37eb

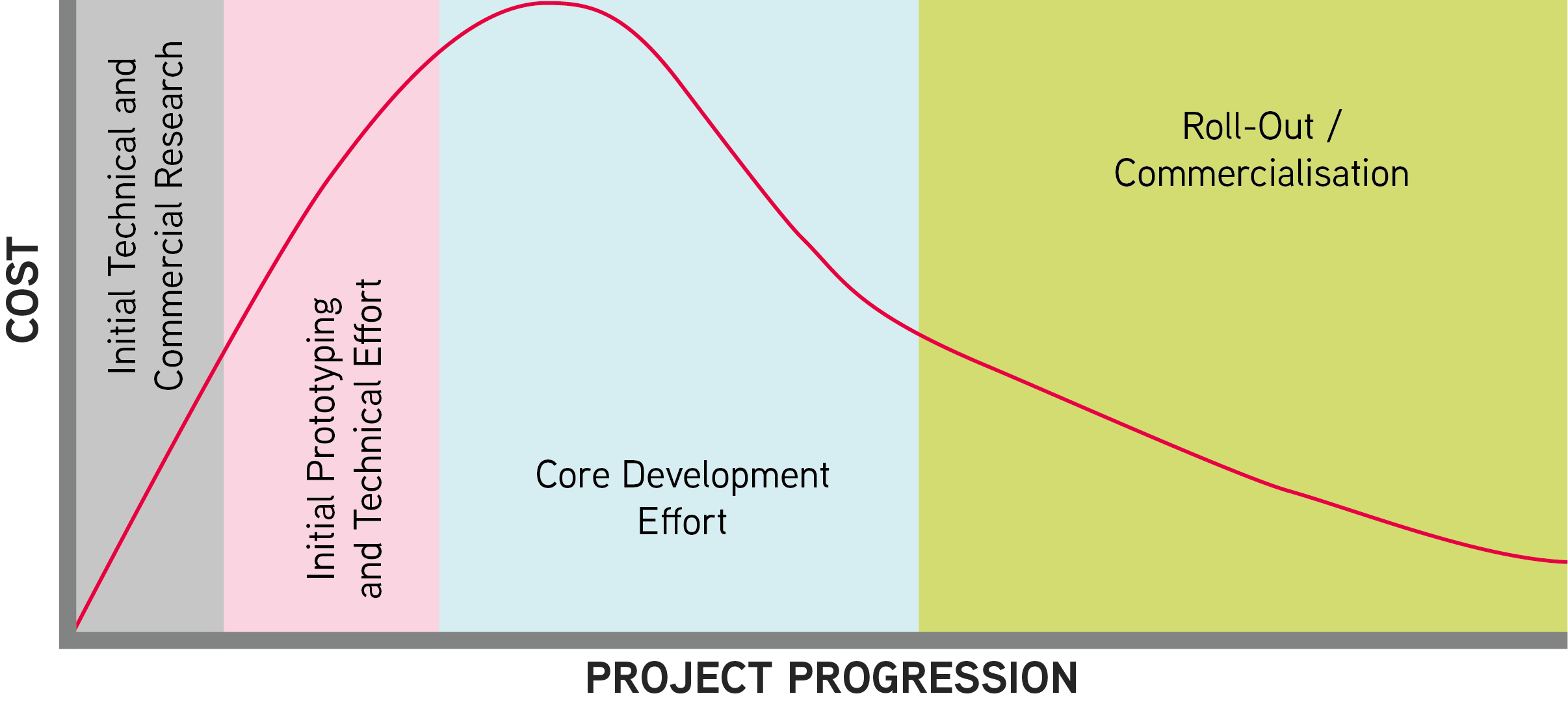

Can You Claim R D Tax Relief For New Product Development TBAT

https://www.tbat.co.uk/wp-content/uploads/2020/12/[email protected]

As a person who has been required to work from home during the COVID 19 pandemic you are likely to be eligible to claim back tax paid on your earnings to offset the extra energy expenditure associated with working at home The amount you can claim through the HMRC Working From Home Allowance depends on the duration you ve worked from home and your tax bracket As of the 2023 24 tax year you can claim 6 per week which adds up to 312 for the entire year if you worked from home for the full 52 weeks

Anyone who s been told to work from home by their employer to help stop the spread of COVID 19 can now claim tax relief You can claim if you ve been asked to work from home since 6th April even if it was only for one day On 6 April 2022 HMRC made it clear that if you claimed tax relief for working from home due to coronavirus you might not be eligible anymore With no legal requirement to work from home most hybrid workers are no longer able to claim this relief since it s now a choice rather than a necessity

Land Remediation Relief Can You Claim Fortus

https://i0.wp.com/www.fortus.co.uk/wp-content/uploads/2020/03/land-remediation-can-you-claim.jpg

Working From Home Tax Relief Firms Make Remote Working Permanent But

https://cdn.images.express.co.uk/img/dynamic/23/590x/Working-from-home-tax-relief-latest-news-HMRC-explained-remote-working-tax-HMRC-explained-1412364.jpg?r=1616181884250

https://www.gov.uk › government › news › working-from...

HM Revenue and Customs HMRC is accepting tax relief claims for working from home due to coronavirus during 2021 to 2022 More than 550 000 employed workers have already claimed and are

https://www.citizensinformation.ie › ... › eworking-and-tax-relief

If your employer does not pay you a working from home allowance for your expenses you can make a claim for tax relief during the year or after the end of the year You will get money back from the taxes you paid

HMRC 800 000 Make Tax Relief Claims For Working From Home During

Land Remediation Relief Can You Claim Fortus

Can You Claim Tax Relief On Office Furniture Spaceist

100 Tax Deductions For Business Owner Blogger College Student

Claim Tax Relief For Your Job Expenses SFB Group Nuneaton

So You ve Been Working From Home During COVID 19 Here s What It Means

So You ve Been Working From Home During COVID 19 Here s What It Means

Tax Relief YA 2023 10 Things You Should Know When Doing E Filing In 2024

Tax Relief Working From Home How To Claim Income Tax Allowance

Pension Tax Refund Can I Claim Tax Back On My Pension Lump Sum

Can You Claim Tax Relief For Working From Home During Covid - Working from home tax relief is a UK government initiative aimed at helping workers offset the increased home related expenses incurred while working remotely during the COVID 19 pandemic Those eligible can claim a tax deduction for certain additional costs such as higher utility bills and internet expenses providing financial support to