Can You Claim Vat Back On Petrol Receipts There is VAT on petrol diesel and other fuels used by vehicles at the standard rate of VAT currently 20 Only VAT

You can only claim back VAT if you are VAT registered If you are an employee you won t be VAT registered As far as claiming back the petrol costs as expenses or getting If you ve kept your receipts it s possible to claim unclaimed VAT on for fuel used business trips for up to four years HMRC can come after you for four years worth of receipts to

Can You Claim Vat Back On Petrol Receipts

Can You Claim Vat Back On Petrol Receipts

https://gg.myggsa.co.za/can-you-claim-vat-on-petrol-in-south-africa-.jpg

How Far Back Can You Claim Vat In South Africa Greater Good SA

https://gg.myggsa.co.za/how-far-back-can-you-claim-vat-in-south-africa-.jpg

Can You Claim Vat Back On Fuel Without A Receipt 2024 Updated

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/can-you-claim-vat-back-on-fuel-without-a-receipt_447356-1.jpg

There are different ways of reclaiming VAT on fuel if you do not pay a fixed rate under the Flat Rate Scheme You can reclaim all the VAT on fuel if your vehicle is used only for If you are a VAT registered business paying mileage expense to you or your staff you can claim back VAT on the fuel only portion of the mileage expense but remember to

You must claim your VAT refund online via the authorities in the country where your business is based If you are eligible for a refund the authorities will pass on In reality only the VAT registered business receiving the supply can claim the VAT back If a purchase is made for your business but the invoice shows someone else s

Download Can You Claim Vat Back On Petrol Receipts

More picture related to Can You Claim Vat Back On Petrol Receipts

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

Who Can Claim Vat In South Africa Greater Good SA

https://gg.myggsa.co.za/who-can-claim-vat-in-south-africa-.jpg

Can You Claim VAT Back On Fuel YouTube

https://i.ytimg.com/vi/749I1hBjINc/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ab4HgAKAD4oCDAgAEAEYfyA3KDUwDw==&rs=AOn4CLDi0gj9PvsXVLxYspSIj3mVyqob1g

In order to claim the VAT on mileage claims a fuel receipt s covering the claim must be kept This can be confusing as you don t claim the VAT back on the fuel purchased so the receipt seems pointless When you make a mileage claim you submit for a refund for a portion of the VAT you pay on fuel UK public transportation is zero rated This means there is no VAT to claim a refund for However you may be

You can recover VAT where road fuel is delivered to your employees and paid for by them on your behalf for use in your business You must reimburse your If you drive your own car for business purposes other than a generic commute you can make a claim against the approved mileage allowance payment rate AMAP to get

How To Claim Back VAT VAT Guide Xero UK

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to VAT_claimingx2.1646877578209.png

Can You Claim Back VAT Without Receipt Accountant s Answer

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/10/Can-you-claim-back-VAT-without-a-receipt.jpg

https://goselfemployed.co/reclaiming-vat-on-…

There is VAT on petrol diesel and other fuels used by vehicles at the standard rate of VAT currently 20 Only VAT

https://www.reddit.com/r/AskUK/comments/ugmnje/can...

You can only claim back VAT if you are VAT registered If you are an employee you won t be VAT registered As far as claiming back the petrol costs as expenses or getting

How To Claim A VAT Refund Everything You Need To Know

How To Claim Back VAT VAT Guide Xero UK

Can You Claim VAT On Fuel In South Africa Greater Good SA

How To Claim VAT Back On Expenses Finance Blog Bookkeeping Software

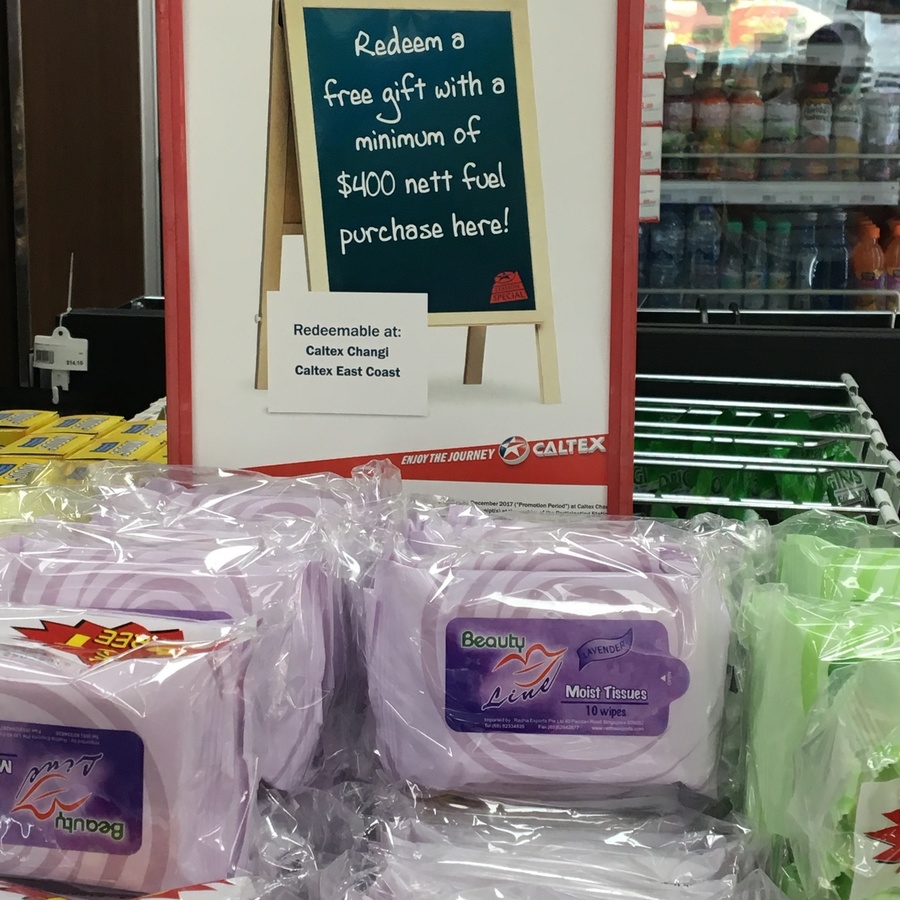

Collect Your Petrol Receipts From You Local Caltex And Redeem A Gift

What Does Your Receipt Or Purchase VAT Invoice Need To Contain To Keep

What Does Your Receipt Or Purchase VAT Invoice Need To Contain To Keep

Directors Issuing Fake VAT Invoices Receipts To Face 5 Years Jail Term

How To Claim VAT Back On Expenses Goselfemployed co

Can You Claim VAT On Travel Expenses Tapoly

Can You Claim Vat Back On Petrol Receipts - When it comes to claiming back VAT on fuel it can be a bit tricky So you ll need to make sure when you are claiming VAT on mileage that there is an