Can You Claim Vat On Charitable Donations Find out what a charity is how VAT affects charities how to treat a charity s income for VAT and what VAT reliefs a charity can get on what it buys

VAT If your company is VAT registered you ll need to account for VAT on the items you give away However you can apply zero VAT to the items even if you normally charge the You must register for VAT if your charity s VAT taxable turnover the total value of everything you sell that is not exempt from VAT is more than 90 000 You can choose to register if it s

Can You Claim Vat On Charitable Donations

Can You Claim Vat On Charitable Donations

https://gg.myggsa.co.za/can-you-claim-vat-on-fuel-south-africa-.jpg

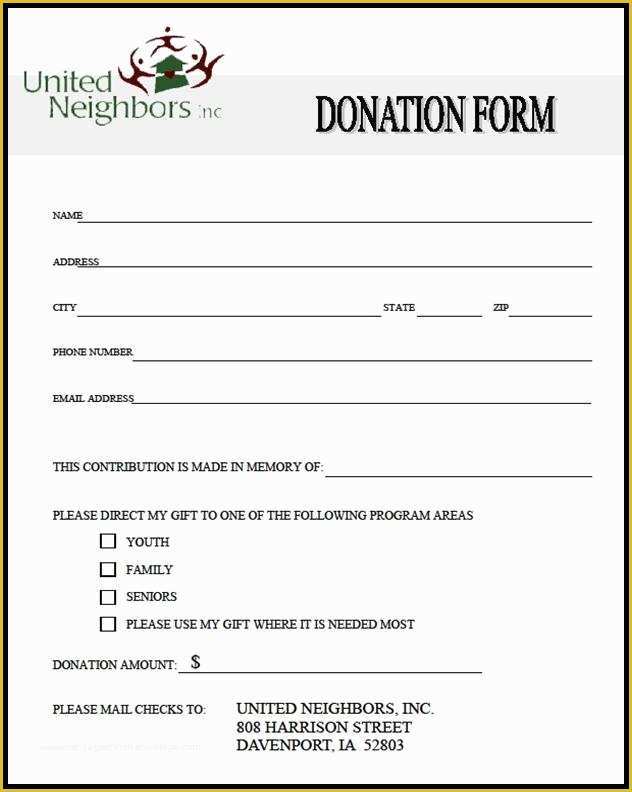

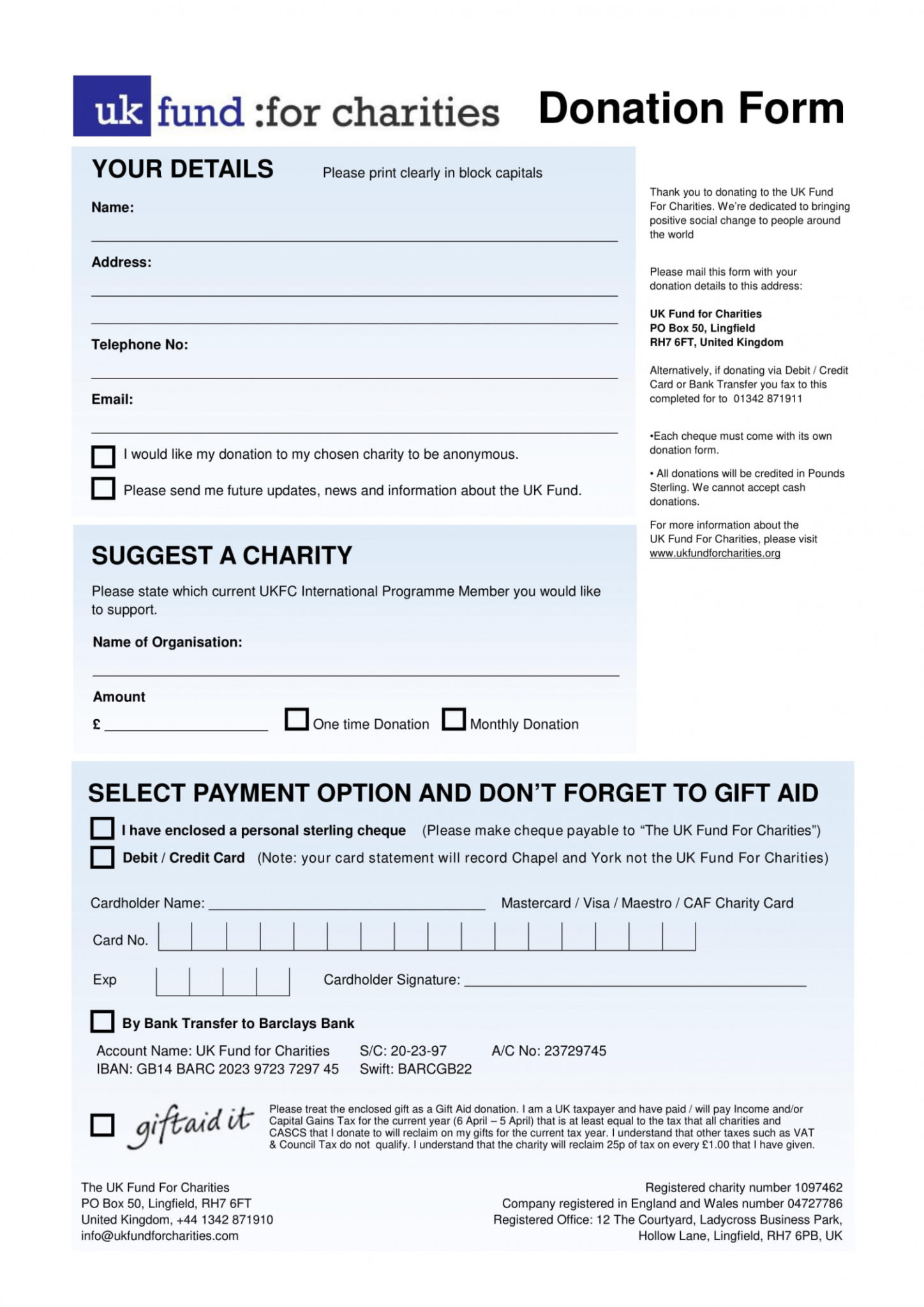

Charitable Donation Form Template Universal Network

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/charitable-donation-form-template.jpg

Surrey Coronavirus Response Fund Exceeds 1 Million Crispin Blunt MP

https://www.blunt4reigate.com/sites/www.blunt4reigate.com/files/2020-04/charitable-donations-1.jpg

Donation and grant income is not consideration for a supply and is a non business activity that falls outside the scope of VAT This is because this income is freely given with no strings Output VAT charged by a charity can be reclaimed as input tax if the receiver is registered for VAT and incurs it for business purposes If supplies are made to non VAT registered

There are conditions that charities need to meet to pay no VAT at the zero rate HMRC produce guidance notes that clarify what VAT reliefs charities can obtain on their purchases such as VAT treatment of donations grants and sponsorship In respect of donations these are normally a financial gift to a cause worthy of support by the donor As such provided nothing is given in return for the money it is a non conditional

Download Can You Claim Vat On Charitable Donations

More picture related to Can You Claim Vat On Charitable Donations

Can You Claim Vat Back On Fuel Without A Receipt 2024 Updated

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/can-you-claim-vat-back-on-fuel-without-a-receipt_447356-1.jpg

Give A Donation Craigieburn Trails

https://www.craigieburntrails.org.nz/wp-content/uploads/2015/04/donations-giving-donate-charity-FinanceFox.jpg

Donation Azam Foundation

https://azamfoundation.org.pk/wp-content/uploads/2021/05/hub_12_18_charity-Hero-1200x900-1.jpg

As far as the nation s favourite tax is concerned we all know that there is no VAT payable on a genuine donation received by a charity or other organisation It is outside the scope of VAT because there is neither a supply of goods nor If you re donating items to a charity then VAT registered business can apply zero VAT to these if the charity intends to sell hire or export them So you can reclaim the VAT on the cost of

Tax relief on donations Gift Aid payroll giving leaving a gift in your will keeping tax records find a charity donating land property or shares One of the more complex tax issues charities face is working out whether the funding they receive be it from a grant making foundation or a public authority is a grant or a payment for

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

Printable Excel Donation List Template Printable World Holiday

https://www.heritagechristiancollege.com/wp-content/uploads/2019/05/fundraising-forms-templates-free-of-36-free-donation-form-templates-in-word-excel-pdf-of-fundraising-forms-templates-free.jpg

https://www.gov.uk/guidance/how-vat-affects-charities-notice-7011

Find out what a charity is how VAT affects charities how to treat a charity s income for VAT and what VAT reliefs a charity can get on what it buys

https://www.gov.uk/tax-limited-company-gives-to...

VAT If your company is VAT registered you ll need to account for VAT on the items you give away However you can apply zero VAT to the items even if you normally charge the

Can You Claim Vat On Motor Vehicle License Renewal Webmotor

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

Printable Free 5 Charity Donation Forms In Pdf Ms Word Charitable

Charitable Donations 2020 A K Burton PC

Charitable Deduction Rules For Maximizing Your Tax Return The Motley Fool

How To Ensure You Get Tax Relief On Charitable Donations

How To Ensure You Get Tax Relief On Charitable Donations

Making Charitable Donations From Your IRA Financial Matters

Can You Claim VAT On Donations Made To Charity In South Africa

Charitable Donations How Much Actually Goes To The Cause Caroline

Can You Claim Vat On Charitable Donations - Charities pay the reduced rate of 5 VAT on qualifying fuel and power see below provided that the resources are used for charitable non business activities such as providing free childcare