Can You Claim Vat Without Receipt As you are VAT registered then legally any suppliers would need to provide you with a VAT invoice if you request it You will need this as evidence to reclaim the

You cannot claim more VAT than is shown on a valid VAT invoice VAT account You must keep a record of the VAT you charge on sales and the VAT you pay on your Contents Charging VAT When not to charge VAT VAT on discounts and gifts Reclaim VAT on business expenses Keeping VAT records Reclaim VAT on business expenses

Can You Claim Vat Without Receipt

Can You Claim Vat Without Receipt

https://www.carmoola.co.uk/hs-fs/hubfs/Can You Claim VAT on a Hire Purchase Deal.jpg?width=2280&height=1622&name=Can You Claim VAT on a Hire Purchase Deal.jpg

Can You Claim Vat On Fuel South Africa Greater Good SA

https://gg.myggsa.co.za/can-you-claim-vat-on-fuel-south-africa-.jpg

How Far Back Can You Claim VAT When Registering Tapoly

https://blog.tapoly.com/wp-content/uploads/2020/11/work-desk-freelancer-home-office-work-from-home-en-Y3DNF8G-768x512.jpg

Businesses often ask if they can claim input VAT without a VAT invoice The common misconception is that VAT cannot be recovered without an original paper receipt The easiest way to demonstrate input Even though you are required to keep VAT receipts for transactions of 25 or less you can claim back VAT without a receipt That s things like Telephone calls made from public or private telephones

VAT stands for Value Added Tax and a VAT receipt represents that tax on purchases you make from suppliers You ll often get your receipt at the time of purchase If a supplier doesn t give you a valid VAT invoice then in most cases you can t claim the VAT back There are some exceptions for example if you only get a till receipt with the supplier s VAT number on it you can claim

Download Can You Claim Vat Without Receipt

More picture related to Can You Claim Vat Without Receipt

Can You Claim VAT Back On Fuel YouTube

https://i.ytimg.com/vi/749I1hBjINc/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ab4HgAKAD4oCDAgAEAEYfyA3KDUwDw==&rs=AOn4CLDi0gj9PvsXVLxYspSIj3mVyqob1g

Can You Claim Back VAT Without Receipt Accountant s Answer

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/10/Can-you-claim-back-VAT-without-a-receipt.jpg

Can You Claim Vat Back On Fuel Without A Receipt 2024 Updated

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/can-you-claim-vat-back-on-fuel-without-a-receipt_447356-1.jpg

You may be thinking can you claim VAT without a receipt The short answer is no It s worth noting that letters of intent delivery notes and email correspondences How much do you know about VAT Did you know that any purchase over 250 needs a full VAT invoice not just a till receipt to reclaim the VAT Were you aware that you can

You can reclaim VAT on supplies of 25 or less without a receipt with the caveat that you can show that the supplier is VAT registered This 25 limit is tax As a VAT registered business you can normally reclaim VAT with valid receipts or invoices as evidence of the purchase However you can reclaim VAT on

Can You Claim VAT On Commission Paid

https://southafricanvatcalculator.co.za/wp-content/uploads/2023/06/Can-You-Claim-VAT-on-Commission-Paid.jpg

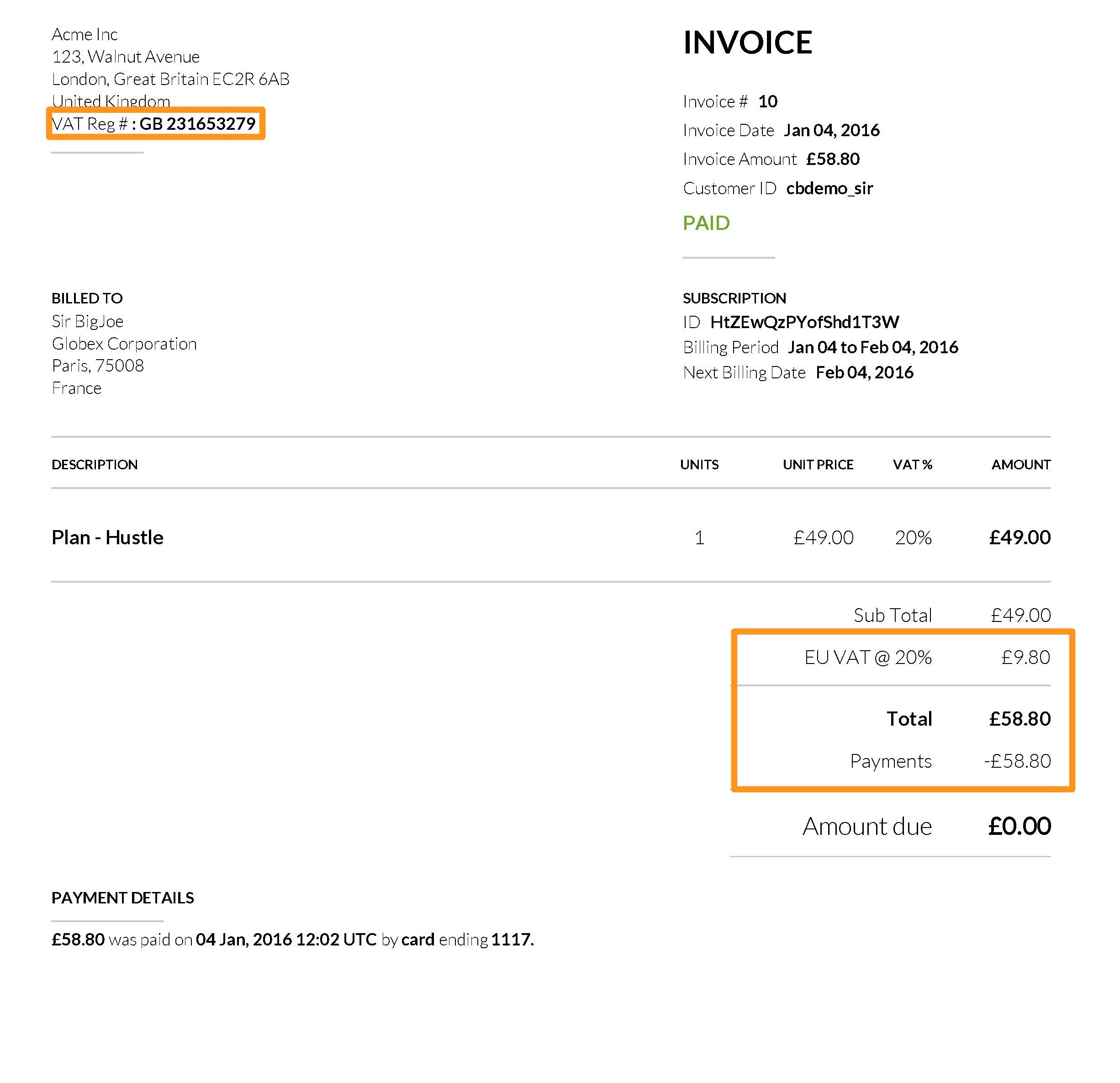

No Vat Invoice Invoice Template Ideas

https://simpleinvoice17.net/wp-content/uploads/2016/08/taxes-eu-vat-chargebee-docs-no-vat-invoice.png

https://community.hmrc.gov.uk/customerforums/vat/...

As you are VAT registered then legally any suppliers would need to provide you with a VAT invoice if you request it You will need this as evidence to reclaim the

https://www.gov.uk/charge-reclaim-record-vat/keeping-vat-records

You cannot claim more VAT than is shown on a valid VAT invoice VAT account You must keep a record of the VAT you charge on sales and the VAT you pay on your

How To Claim Back VAT VAT Guide Xero UK

Can You Claim VAT On Commission Paid

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

Can You Claim VAT On Entertaining Clients Employees YouTube

How To Claim A VAT Refund Everything You Need To Know

What Does Your Receipt Or Purchase VAT Invoice Need To Contain To Keep

What Does Your Receipt Or Purchase VAT Invoice Need To Contain To Keep

Know Whether You Can Claim Input Tax Credit On Food

Usps Certified Mail Receipt Alterapo

How Far Back Can I Claim R D Tax Credits R D Tax Credits Explained

Can You Claim Vat Without Receipt - The power to exercise a discretion and allow a person to reclaim input VAT without holding a VAT invoice is contained in the general regulations SI 1995 2518 reg