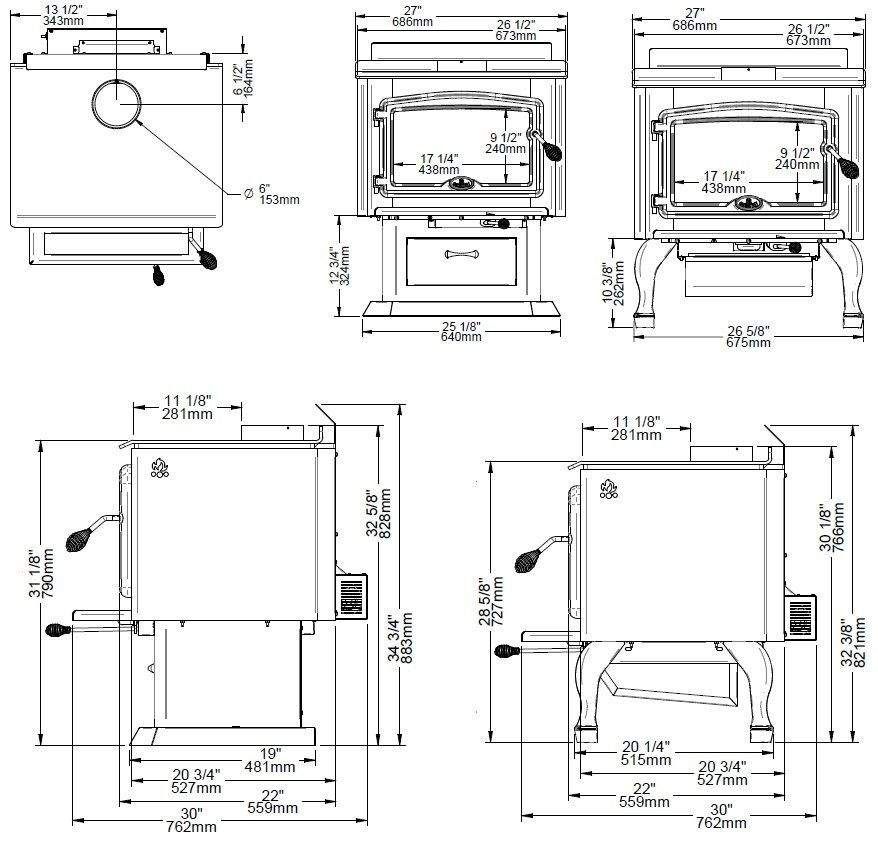

Can You Claim Wood Stove On Taxes Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide The answer is no In fact most wood stoves inserts and fireplaces on the Market do not qualify Why The legislation aimed at helping consumers get more

Can You Claim Wood Stove On Taxes

Can You Claim Wood Stove On Taxes

https://i.pinimg.com/originals/9f/f9/ae/9ff9aebd4e7a0cb3ce495d94f73fe0e8.jpg

Federal Tax Credit Wood Stove 2022 Get What You Need For Free

https://www.onfiresantarosa.com/upgrade/wp-content/uploads/2022/11/wood-and-pellet-heater-tax-credit.jpg

Maitri Homestead Morso 1410 Wood Stove Install First Impressions

http://4.bp.blogspot.com/-kfGlhNS6kxg/VJSd2mmxb2I/AAAAAAAAGiI/xjmnsSctkGI/s1600/IMG_2405.jpg

Beginning with the 2023 tax return you will file in 2024 you can claim a 30 tax rebate on your federal income tax return To claim your tax rebate you will need documents about the purchase and Biomass Stoves Boilers Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal

From January 1 2023 through December 31 2032 taxpayers who install qualifying wood and pellet stoves will receive a 30 tax credit that is capped at 2 000 annually based A The tax credit was signed into law on December 21 2020 and stoves purchased and installed in 2021 and 2022 will qualify for the 26 tax credit In 2023 the tax credit

Download Can You Claim Wood Stove On Taxes

More picture related to Can You Claim Wood Stove On Taxes

Heated Up How To Claim The 300 Stove Tax Credit

http://2.bp.blogspot.com/-ne9Y8DBs1Nw/VJnJ2asKmnI/AAAAAAAABSU/ywsCdeqMvxA/w1200-h630-p-k-no-nu/Home_Energy_Tax_Credit_IRS_Form_5695.png

Sequoia Wood Stove And Fireplace From Kuma Stoves Wood Stove Hearth

https://i.pinimg.com/originals/27/74/af/2774af91ca2e69fe63c7e7bfa2e691c1.png

Century Heating FW2900 EPA Certified 2 100 Sq Ft Wood Stove On Pedes

http://factorypure.com/cdn/shop/products/CB00026_FW2900_front_snippet-removebg_1.png?v=1632368500

Is there a federal tax credit available for wood stoves Absolutely For those purchasing highly efficient wood stoves a tax credit of 30 can be claimed Anyone who is eligible for the Federal Biomass Stove 25 C Tax Credit can claim a 30 tax credit based on the combined cost of the unit and installation The credit is capped at 2 000 annually This is a

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in In 2021 and 2022 U S consumers buying highly efficient wood stoves and larger residential biomass heating systems will be able to claim a 22 tax credit The

10 Safety Rules For Using A Wood Stove By PuroClean Huntington NY

https://miro.medium.com/v2/resize:fit:860/0*Cb8-BXpUHxcvx3QP

950 WOOD STOVE AC01421 5 FRESH AIR INTAKE KIT FOR WOOD STOVE ON LE

http://www.capofireside.com/cdn/shop/products/AC01421_web_001-Large_1200x1200.jpg?v=1643264548

https://www.hpba.org/Advocacy/Biomass-Stove-Tax-Credit

Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

HES240 Wood Burning Stoves Line Olympia Chimney

10 Safety Rules For Using A Wood Stove By PuroClean Huntington NY

Wood Burning Cook Stove Bistro Drolet

Osburn 2000 Wood Stove With Blower

High Efficiency Wood Stove Legend III Drolet

What Can You Claim As Tax Deductible Expenditure When Working From Home

What Can You Claim As Tax Deductible Expenditure When Working From Home

Century Heating S250 EPA Certified 1 200 Sq Ft Wood Stove On Pedesta

Tata Wood Stove On Behance

Insurance 7 What Can You Claim For And How To Claim Insurance 7

Can You Claim Wood Stove On Taxes - Beginning in 2021 if you purchase and install a wood or pellet stove or larger residential biomass heating system with a Thermal Efficiency Rating of at least