Can You Claiming Charitable Donations On Taxes Without Receipts Learn how to navigate IRS rules for claiming charitable donations without receipts and ensure compliance with record keeping best practices Understanding the limits of

If you re claiming noncash donations you are better off claiming less than 500 to avoid the IRS charitable donations limit without receipt rule If you are claiming over 500 the If you give cash check or charge payments on one day to one organization of 250 or more you must have a receipt in your hands before filing your tax return If not you

Can You Claiming Charitable Donations On Taxes Without Receipts

Can You Claiming Charitable Donations On Taxes Without Receipts

https://irp.cdn-website.com/75ba66ee/dms3rep/multi/Augustblogs-03-f4513046.png

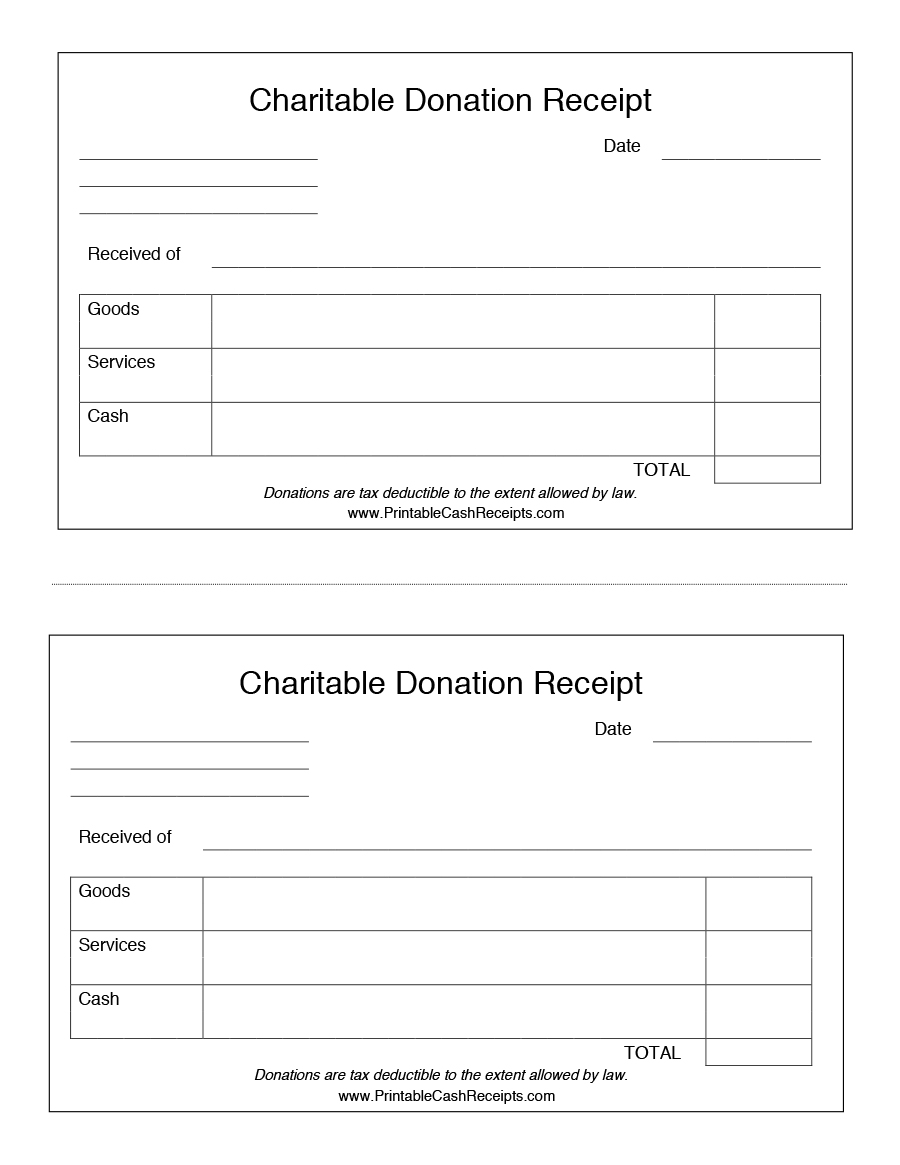

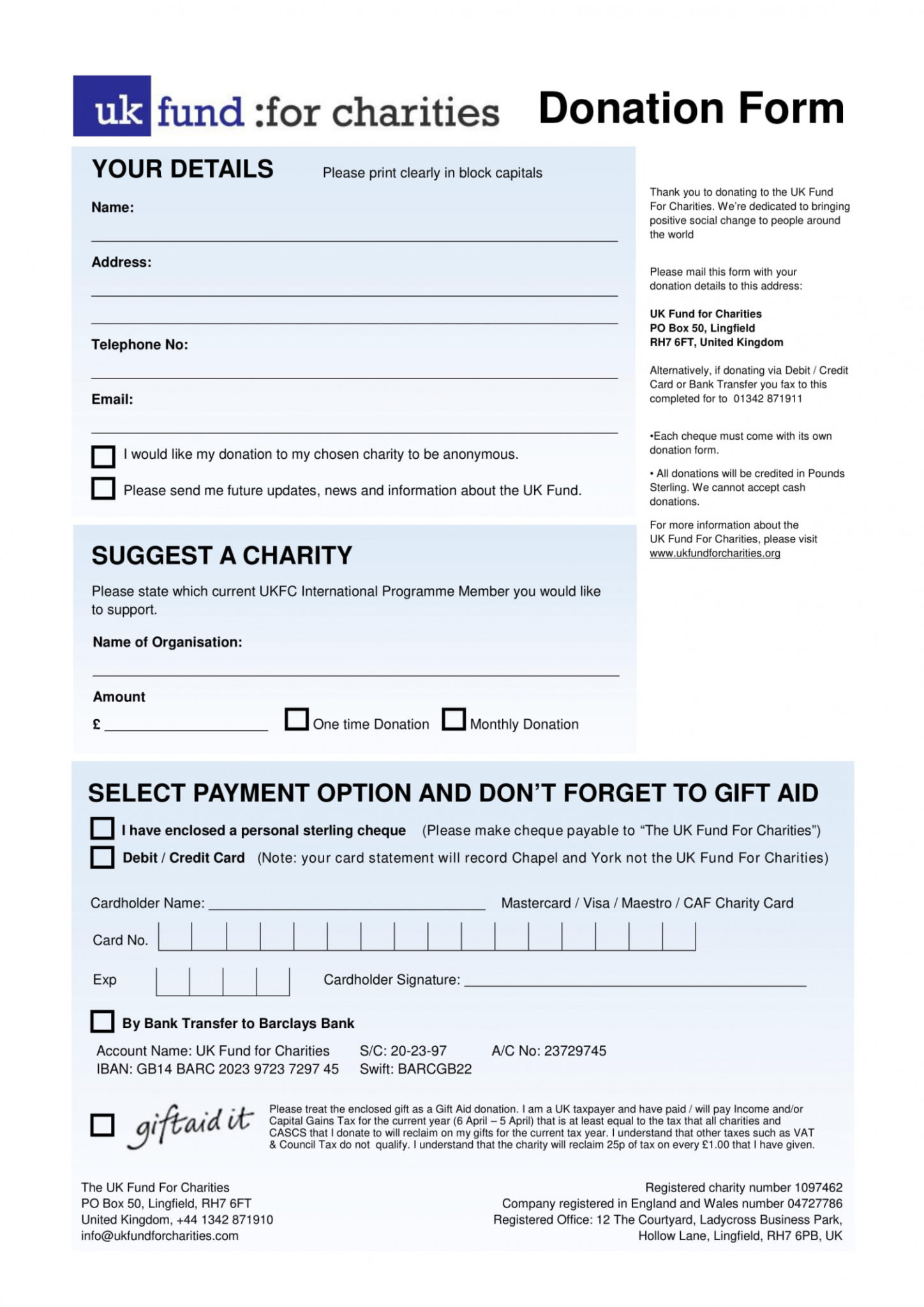

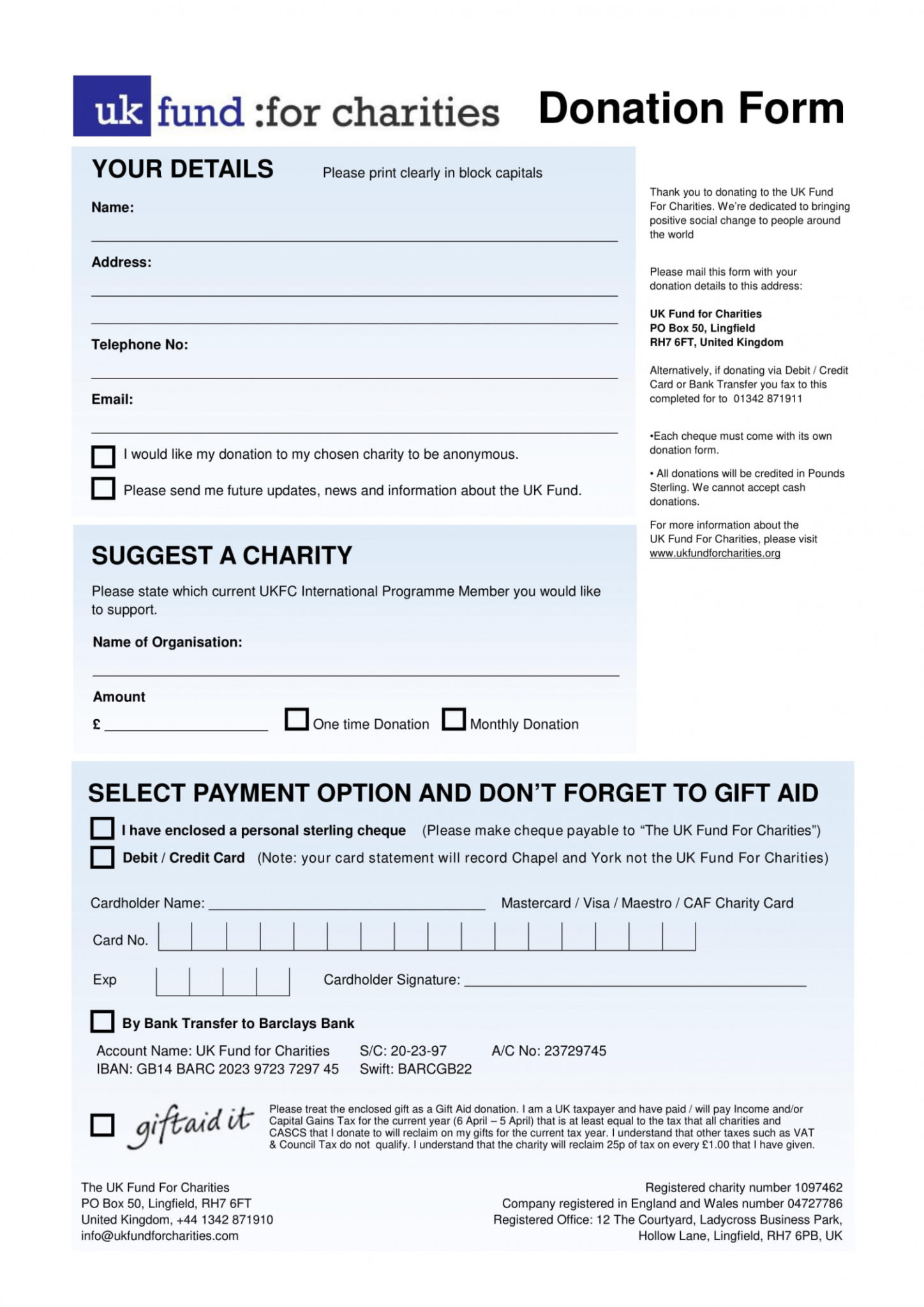

37 Donation Receipt Template Download DOC PDF Gordon s Comission

https://www.gordoncommission.org/wp-content/uploads/2020/05/Charitable-Donation-Receipt-1.png

Give A Donation Craigieburn Trails

https://www.craigieburntrails.org.nz/wp-content/uploads/2015/04/donations-giving-donate-charity-FinanceFox.jpg

For donations under 250 you can claim the deduction without a formal receipt but you ll need to provide some form of bank record such as a bank statement credit card Noncash donations from 250 to 500 in value require a receipt that includes the charity s name address date donation location and description of items donated Noncash donations over

For a cash donation of 250 or more you must have an acknowledgment from the charity stating the date and amount of the donation and whether you received any goods or What is the maximum amount you can claim for donations without providing a receipt For charitable donations you can claim up to 250 without needing a receipt However for donations above this amount you must provide a written

Download Can You Claiming Charitable Donations On Taxes Without Receipts

More picture related to Can You Claiming Charitable Donations On Taxes Without Receipts

501c3 Donation Receipt 501c3 Donation Receipt Template 501c3

https://i.etsystatic.com/25866327/r/il/4a86ed/4070870535/il_fullxfull.4070870535_gyqf.jpg

Charity Charitable Giving Rises To Record Philanthropy Report Says

https://www.gannett-cdn.com/-mm-/67fef463a39005624a78a2069990821231cf35ec/c=0-125-2045-1280&r=x1683&c=3200x1680/local/-/media/2018/06/12/USATODAY/USATODAY/636643942202141206-GettyImages-515836063.jpg

4 Things To Know About Charitable Donations And Taxes The Motley Fool

https://g.foolcdn.com/editorial/images/463728/donations-jar_gettyimages-639389876.jpg

While you can claim a lot of your charitable donations are your taxes there are some instances where you can t write off contributions Some examples include if you donate to a non qualified charity forget to get a If you donated 2 or more to bucket collections by an approved charity organisation you can claim 10 max without a receipt Union and professional membership fees are generally

Understanding what qualifies as a charitable donation can aid you in maximizing your tax deductible donations and remaining IRS compliant How to claim charitable For example if you leave a donation of clothing valued at 100 at a charity s unattended drop box you can claim a deduction even without a receipt However if you drop

Stream Called To Communion About Claiming Charitable Donations On

https://i1.sndcdn.com/artworks-rk2g77p8Z7EH68Ql-fAfD3g-t500x500.jpg

Making Charitable Donations From Your IRA Financial Matters

https://www.attentiveinv.com/images/easyblog_articles/107/donations-sm.jpg

https://accountinginsights.org › how-much-can-you...

Learn how to navigate IRS rules for claiming charitable donations without receipts and ensure compliance with record keeping best practices Understanding the limits of

https://budgeting.thenest.com

If you re claiming noncash donations you are better off claiming less than 500 to avoid the IRS charitable donations limit without receipt rule If you are claiming over 500 the

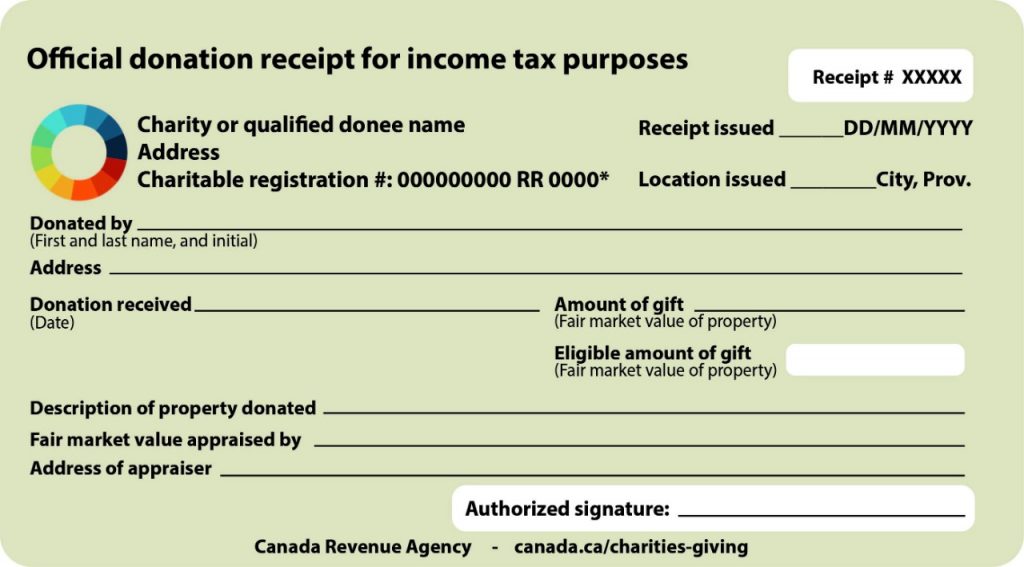

Donation Receipts For Providing Services Smith Neufeld Jodoin LLP

Stream Called To Communion About Claiming Charitable Donations On

Make Sure You Claim Your Charitable Tax Deductions On Form 1040 Or

Inspiring Tax Receipt For Donation Template

Charity Tax Breaks Extended Through 2014 Only

Printable Free 5 Charity Donation Forms In Pdf Ms Word Charitable

Printable Free 5 Charity Donation Forms In Pdf Ms Word Charitable

Last Minute Tax Tips For Year end Charitable Donations Kare11

Free Goodwill Donation Receipt Template PDF EForms

Browse Our Free Food Donation Receipt Template Receipt Template Card

Can You Claiming Charitable Donations On Taxes Without Receipts - In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the