Can You Deduct House Improvements On Your Taxes Home improvement tax deduction Qualifying improvements to your home that qualify for tax deductions What Home Improvements Are Tax Deductible in 2023 Most home improvements like putting on a new roof or performing routine maintenance don t qualify for any immediate tax breaks

Home improvements are tax deductible if they meet the three qualifying criteria Betterment Amounts paid to repair something that will increase the value of the home or to add a feature that There are multiple tax deductible home improvements you can undertake That new bedroom might just increase your refund In this article we ll show you what kinds of home improvements you can deduct from your taxes We ll even show how this can apply to rental properties

Can You Deduct House Improvements On Your Taxes

Can You Deduct House Improvements On Your Taxes

https://img.hechtgroup.com/1663815977999.a80ddf7e236158c3db9a35affdb4d746

Can I Deduct Health Insurance Premiums If I m Self Employed The

https://i2.wp.com/thedailycpa.com/wp-content/uploads/2017/06/36858563_xl.jpg?fit=3831%2C2554&ssl=1

Can You Deduct Property Taxes With A Standard Deduction

https://www.realized1031.com/hubfs/propertytaxes-1295797018.jpg#keepProtocol

When making upgrades most homeowners ask Are home improvements tax deductible Broadly speaking no However there can be exceptions Home improvements can potentially reduce your tax burden such as capital improvements and upgrades related to medical care or energy efficiency If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of

Tax Planning Are Home Improvements Tax Deductible By Jacqueline DeMarco Updated on January 18 2023 Reviewed by David Kindness Fact checked by J R Duren You typically can t deduct home improvements but a few updates come with tax benefits such as credits for energy efficient improvements Here s how they work You can t deduct the cost of home improvements These costs are nondeductible personal expenses But home improvements do have a tax benefit They can help reduce the amount of taxes you have to pay if and when you sell your home at a profit The cost of home improvements are added to the tax basis of your home

Download Can You Deduct House Improvements On Your Taxes

More picture related to Can You Deduct House Improvements On Your Taxes

Can You Deduct Gas On Taxes

https://taxsaversonline.com/wp-content/uploads/2022/07/Can-You-Deduct-Gas-On-Taxes-1-850x567.jpg

Preparing House For Sale Tax Deduction How To Get Benefits Tax

https://i.pinimg.com/originals/dc/b4/4f/dcb44f4207d6c494ab1ed28d943b00e1.jpg

Can I Deduct Home Improvements When I Sell My House House Poster

https://cdn.hswstatic.com/gif/home-improve-deduction-1-orig.jpg

The answer is yes but the deduction can t be taken until you decide to sell your home and successfully do so Keeping great records of all the improvements you ve made to your home over the years will allow you to reduce your Can I deduct home improvements on my tax return SOLVED by TurboTax 4457 Updated December 12 2023 On your personal residence the answer is usually no although you might qualify for certain kinds of energy related home improvements

Most home improvements aren t tax deductible but the IRS does specify situations in which you can write off expenses as you improve your home Here are home improvements that could The answer largely depends on the type of improvements If yours qualify as capital improvements you can get tax breaks but not until you sell your home

Home Equity Loans And Taxes What You Can And Can t Deduct

https://www.housedigest.com/img/gallery/home-equity-loans-and-taxes-what-you-can-and-cant-deduct/l-intro-1678217552.jpg

How To Deduct Rental Home Improvements On My Taxes Storables

https://storables.com/wp-content/uploads/2023/12/how-to-deduct-rental-home-improvements-on-my-taxes-1702821698.jpg

https://www. familyhandyman.com /article/what-home...

Home improvement tax deduction Qualifying improvements to your home that qualify for tax deductions What Home Improvements Are Tax Deductible in 2023 Most home improvements like putting on a new roof or performing routine maintenance don t qualify for any immediate tax breaks

https://www. investopedia.com /are-home-improvements...

Home improvements are tax deductible if they meet the three qualifying criteria Betterment Amounts paid to repair something that will increase the value of the home or to add a feature that

Can You Deduct Mortgage Interest On Investment Property Commercial

Home Equity Loans And Taxes What You Can And Can t Deduct

Can You Deduct Your RV Travel Trailer Or Boat Mortgage Interest On

Is Home Insurance Tax Deductible In Canada Surex

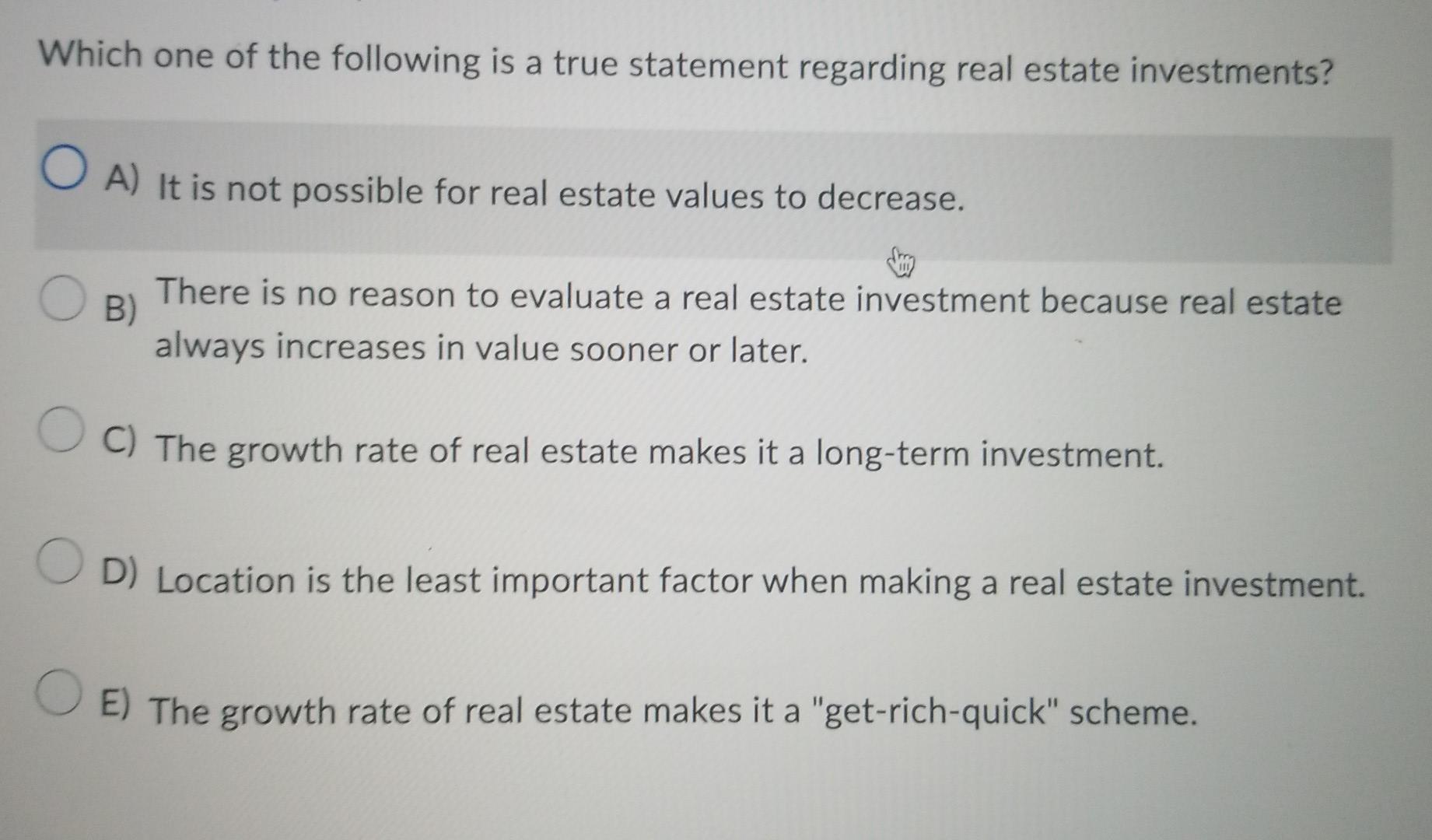

Solved Which One Of The Following Is A True Statement Chegg

Are Professional Conferences Tax Deductible

Are Professional Conferences Tax Deductible

Can You Deduct Any Home Improvements On Tax Remodeling Top

How Co op Owners Can Deduct Medical Expenses Scott M Aber CPA PC

Tax Deductible Donations FAQs

Can You Deduct House Improvements On Your Taxes - Most home improvements aren t tax deductible but there are a few exceptions you should know about before tax season comes around The rules on home improvements you can write off can be a little complicated but fear not We can simplify those rules and help you understand which home improvement projects are eligible for