Welcome to Our blog, a space where inquisitiveness fulfills information, and where day-to-day subjects come to be engaging discussions. Whether you're looking for insights on way of living, modern technology, or a little whatever in between, you have actually landed in the appropriate place. Join us on this expedition as we study the worlds of the ordinary and phenomenal, understanding the globe one article at once. Your trip right into the fascinating and varied landscape of our Can You Deduct Mileage To And From Work If Self Employed starts here. Check out the exciting web content that awaits in our Can You Deduct Mileage To And From Work If Self Employed, where we decipher the details of numerous topics.

Can You Deduct Mileage To And From Work If Self Employed

Can You Deduct Mileage To And From Work If Self Employed

Mileage Log For Taxes Requirements And Process Explained MileIQ

Mileage Log For Taxes Requirements And Process Explained MileIQ

Claim Medical Expenses On Your Taxes Health For CA

Claim Medical Expenses On Your Taxes Health For CA

Gallery Image for Can You Deduct Mileage To And From Work If Self Employed

Why Small Business Owners Should Deduct Their Mileage and How To Do It

When Can You Deduct Mileage Peavy And Associates PC

Tax Deductions You Can Deduct What Napkin Finance

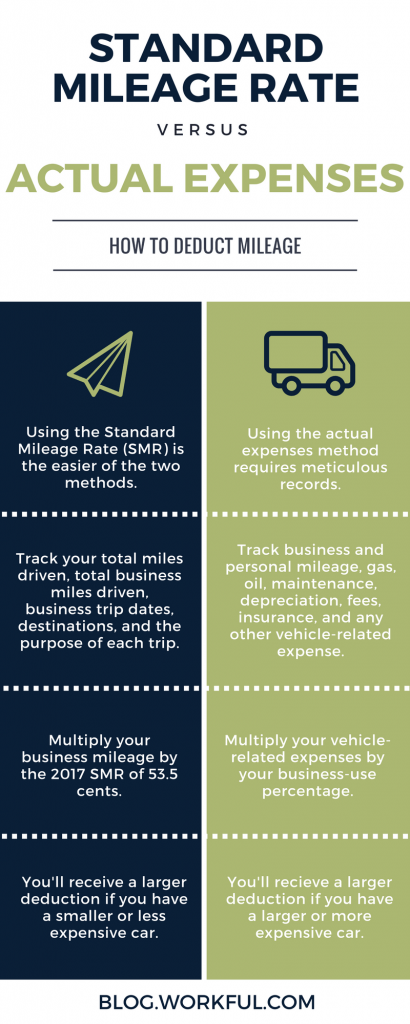

Mileage Deduction Standard Mileage Rate Workful Blog

Mileage Report Template

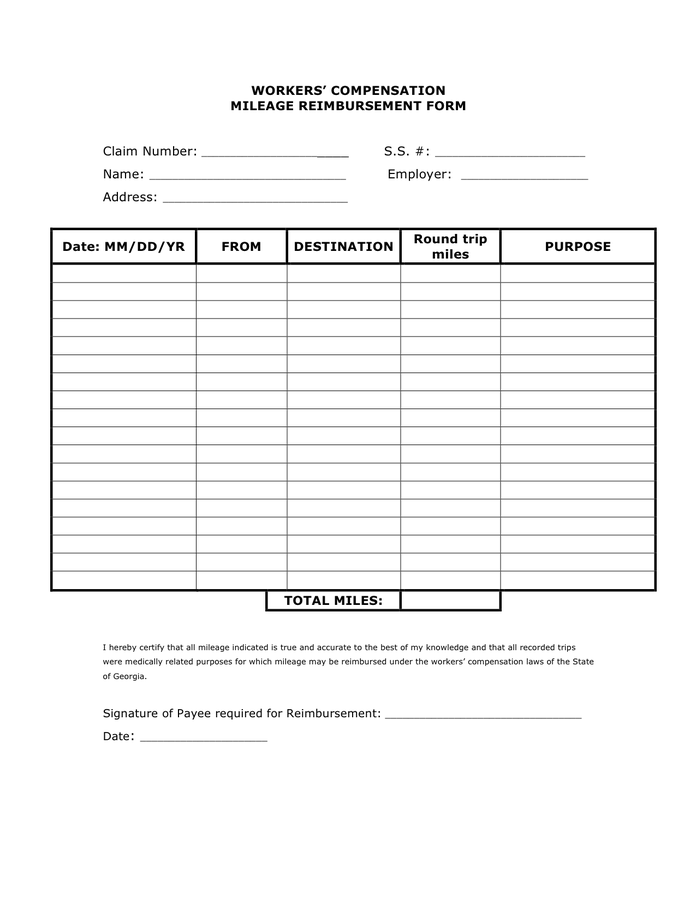

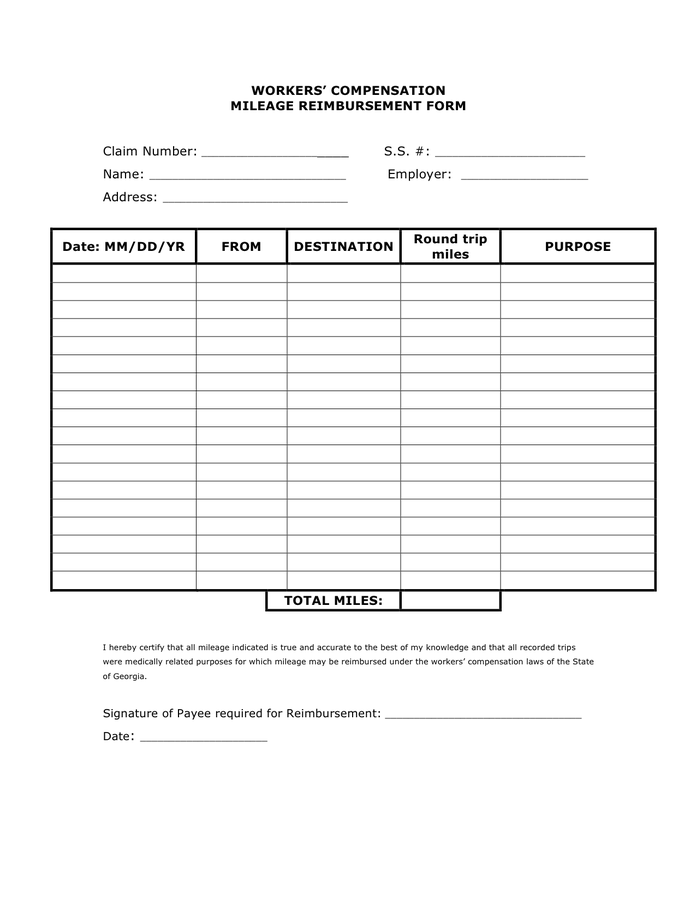

Workers Comp Mileage Reimbursement Form IRS Mileage Rate 2021

Workers Comp Mileage Reimbursement Form IRS Mileage Rate 2021

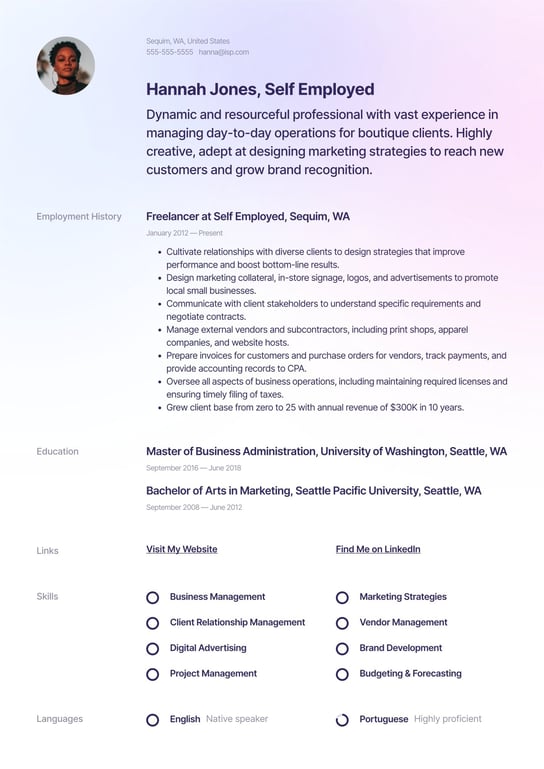

Self employed Resume Examples Writing Tips 2024 Free Guide

Thanks for picking to explore our internet site. We seriously hope your experience surpasses your assumptions, and that you find all the details and resources about Can You Deduct Mileage To And From Work If Self Employed that you are seeking. Our dedication is to supply an user-friendly and informative platform, so do not hesitate to navigate via our pages easily.