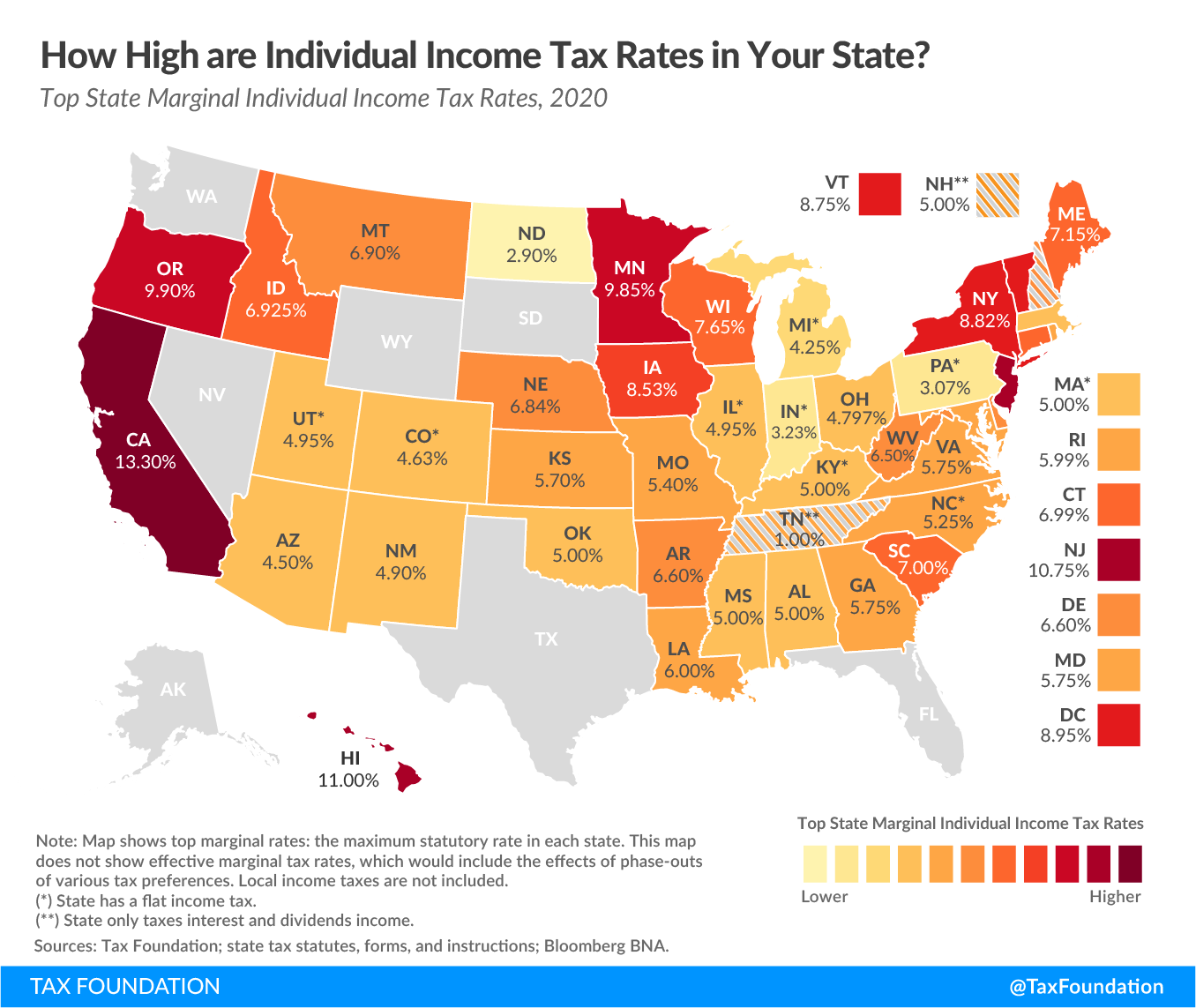

Can You Deduct State Taxes From Federal Income Tax State and local income taxes are deductible when you re calculating your regular federal income tax but they re not deductible when you re calculating the AMT The IRS has slammed the door on paying

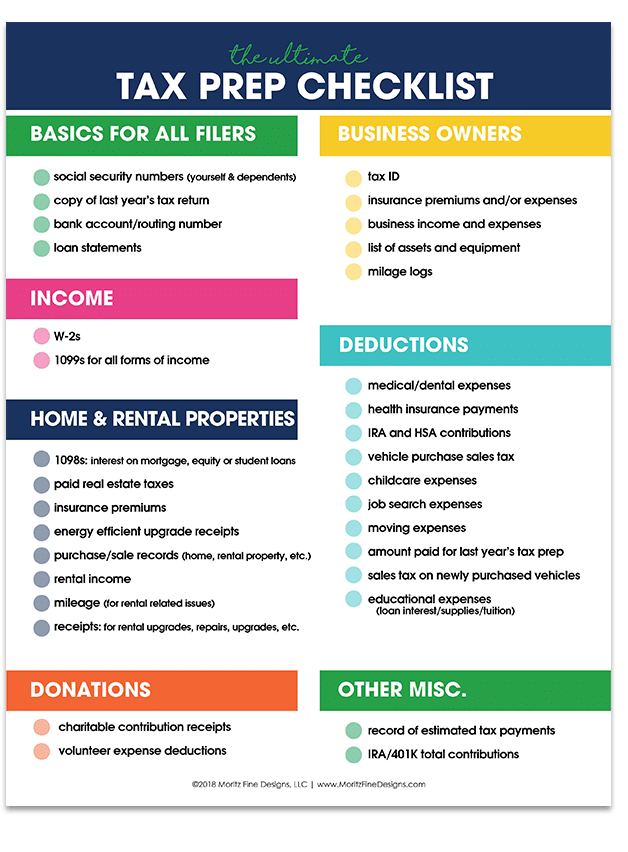

The state and local tax deduction allows you to deduct up to 10 000 of your state and local property taxes as well as your state income or sales taxes Wait wait hold up state income or sales The U S has a multitiered income tax system under which taxes are imposed by federal state and sometimes local governments Federal and state income taxes are similar in that

Can You Deduct State Taxes From Federal Income Tax

Can You Deduct State Taxes From Federal Income Tax

https://standard-deduction.com/wp-content/uploads/2020/10/2020-state-individual-income-tax-rates-and-brackets-tax.png

New York State Taxes What You Need To Know Russell Investments

https://russellinvestments.com/-/media/images/us/blogs/images/kuharicny_july19_1.jpg?la=en&hash=EAFF36450E83624757D71C655AB69D67CECD684B

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Irs

https://i.pinimg.com/736x/62/3b/c7/623bc7e4a3e0ecafff9074f3a6657381--irs-tax-property-tax.jpg

Only five of the 41 states that impose a tax on income allow taxpayers to claim a deduction for their federal income taxes These states are Alabama Iowa You might be able to get a federal deduction for state or local income taxes you paid in 2023 even if they were for an earlier tax year To get this deduction you ll need to

Taxpayers who itemize deductions on their federal income tax returns can deduct state and local real estate and personal property taxes as well as either income taxes or general sales taxes The Tax Cuts and Jobs Act The SALT tax deduction allows taxpayers who itemize to deduct certain state and local taxes to reduce their federally taxable income by as much as 10 000 The deduction is for people

Download Can You Deduct State Taxes From Federal Income Tax

More picture related to Can You Deduct State Taxes From Federal Income Tax

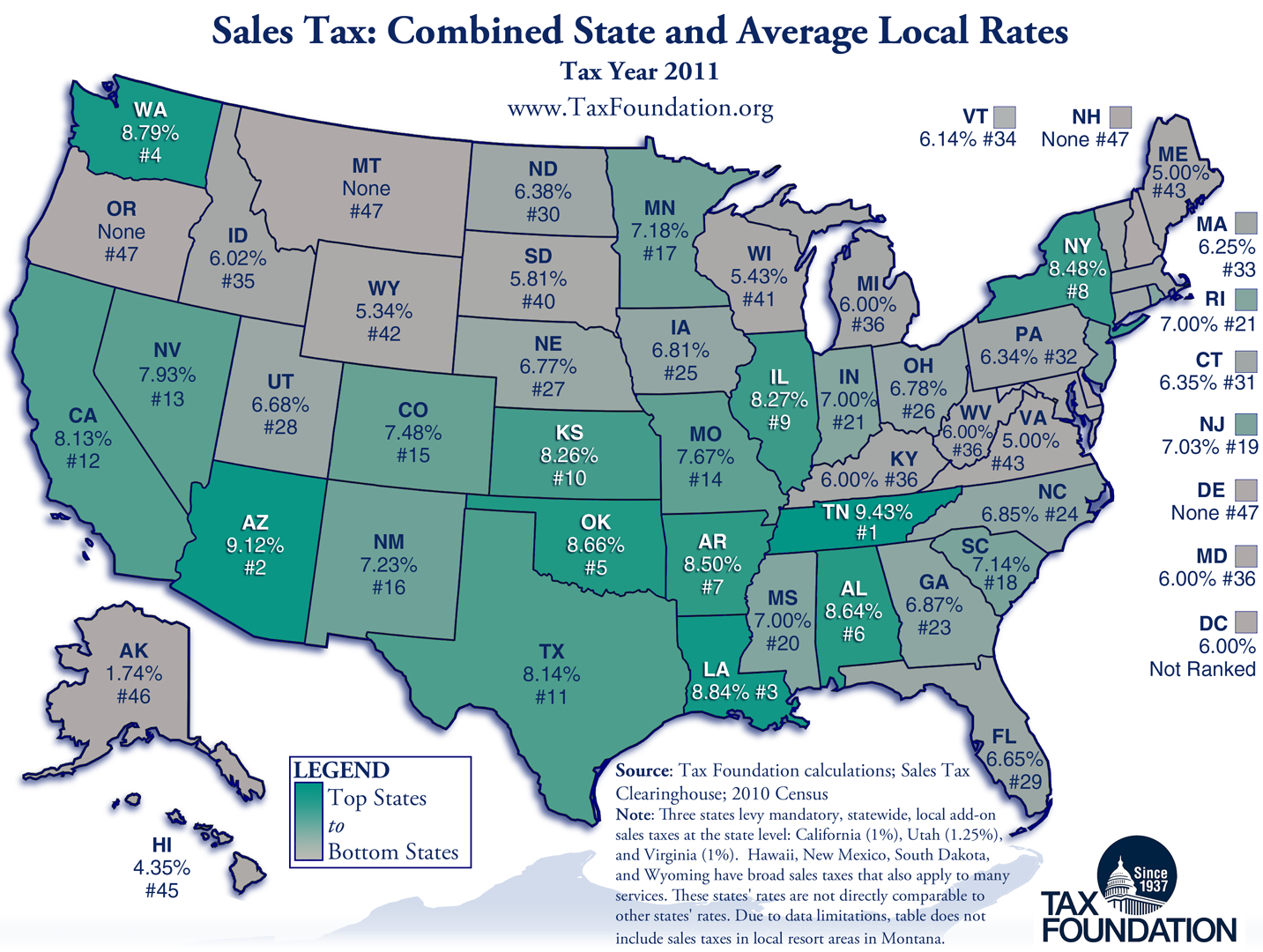

Can You Deduct State Sales Tax From Federal Income Tax Tax Walls

https://www.taxpolicycenter.org/sites/default/files/styles/original_optimized/public/6.3.1_-_figure_1.png?itok=yMlBI0MV

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

http://4.bp.blogspot.com/-4cLQaqI0jYM/TkmIL611lAI/AAAAAAAAPlc/z5MYhmcnqd0/s1600/taxrate.jpg

Visualizing Taxes By State

https://cdn.howmuch.net/articles/133_Income-tax-567b.jpg

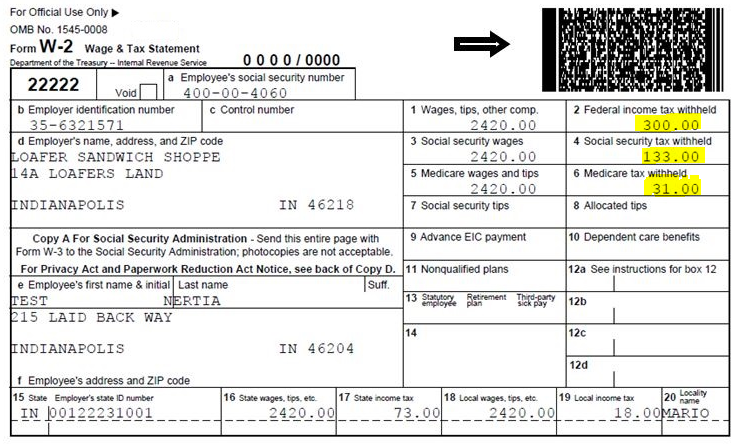

You can deduct all state income tax payments you make during the year for tax years before 2018 Beginning in 2018 the deduction limit is 10 000 which includes the withholding By application of the general rules regarding the timing of the state tax deduction many taxpayers were receiving a one time double state tax deduction on their federal income

As a general rule taxpayers who choose the standard deduction on their federal income tax returns do not owe federal income tax on state tax refunds The The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes This deduction is a below the line tax deduction

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Small

https://i.pinimg.com/originals/e2/0f/81/e20f81a96f10e2dc77a5e25a448ba22c.jpg

29000 A Year Is How Much A Month After Taxes New Update

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

https://www.thebalancemoney.com/stat…

State and local income taxes are deductible when you re calculating your regular federal income tax but they re not deductible when you re calculating the AMT The IRS has slammed the door on paying

https://www.ramseysolutions.com/taxes/…

The state and local tax deduction allows you to deduct up to 10 000 of your state and local property taxes as well as your state income or sales taxes Wait wait hold up state income or sales

Ranking State And Local Sales Taxes Tax Foundation Texas Sales Tax

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Small

W2 Withholding Calculator Tax Withholding Estimator 2021

Tax Form Checklist 2023 Printable Forms Free Online

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

Federal Tax Withheld Tax Rate 2021 Federal Withholding Tables 2021

Federal Tax Withheld Tax Rate 2021 Federal Withholding Tables 2021

How Do You Deduct State Taxes From Federal Taxes Tax Walls

10 Things To Know About Property Taxes Property Tax Federal Income

Pin On Save Money With Us The Financial Gym

Can You Deduct State Taxes From Federal Income Tax - If you itemize deductions you can deduct state and local taxes you paid during the year These taxes can include state and local income taxes or state and local sales taxes