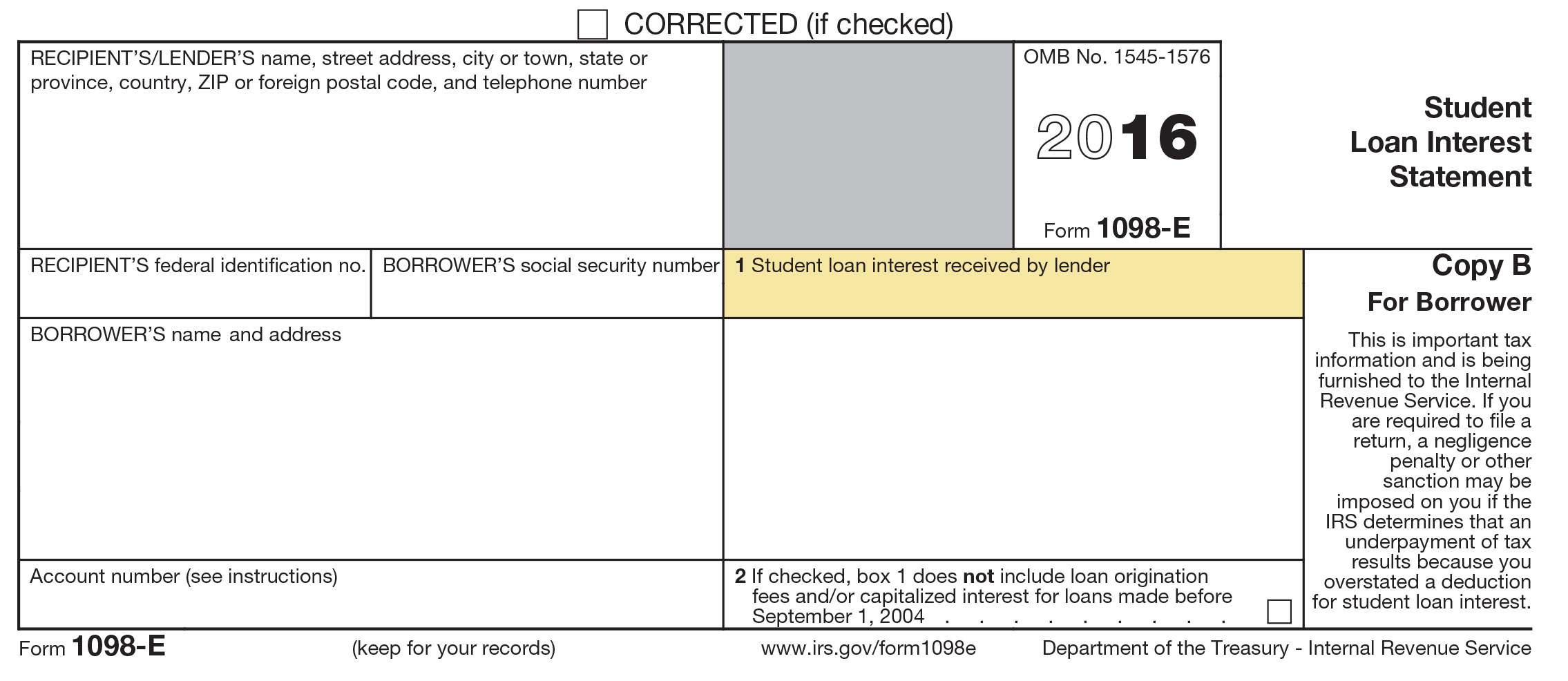

Can You Deduct Student Loan Payments On Taxes You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a

You can deduct that interest on your taxes but the entire student loan payment amount is not tax deductible For example say you have a 29 000 student In 2023 if your MAGI is below 75 000 for single filers or 150 000 for married filing jointly you can claim the full student loan tax deduction if certain

Can You Deduct Student Loan Payments On Taxes

Can You Deduct Student Loan Payments On Taxes

https://i2.wp.com/thedailycpa.com/wp-content/uploads/2017/06/36858563_xl.jpg?fit=3831%2C2554&ssl=1

Can You Deduct Property Taxes With A Standard Deduction

https://www.realized1031.com/hubfs/propertytaxes-1295797018.jpg#keepProtocol

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

I think you re a little confused You don t have to be a student to deduct loan interest You ve graduated most likely making your loan payments you can deduct it But as this says no more than 2500 a The student loan interest tax deduction is for students and their parents who are repaying federal student financial aid It s the above the line adjustment to your AGI if you have paid interest to a qualified

Student Loan Interest Deduction income limit Outside of the above requirements the biggest determining factor in whether you can deduct your student The amount you can deduct is limited each year You can only deduct the interest on student loans you actually used to pay

Download Can You Deduct Student Loan Payments On Taxes

More picture related to Can You Deduct Student Loan Payments On Taxes

Can You Deduct Business Loans On Taxes

https://www.unsecuredfinance.co.nz/wp-content/uploads/2020/02/business-loan-deductions.jpg

Student Loan Interest Can You Deduct It On Your Tax Return BMG CPAs

https://bmgcpas.com/wp-content/uploads/2020/05/6.10.2020.jpg

HOW TO DEDUCT STUDENT LOAN INTEREST ON YOUR TAXES 1098 E Blog

https://content.accfs.com/wp-content/uploads/2019/02/1098_Blog.jpg

Yes Student Loans Can Impact Your Taxes Here s How Janet Berry Johnson Contributor Reviewed By Doug Whiteman editor Updated Nov 10 2022 There are a few options for deducting student loan interest and student loan payments on your federal income tax returns including the student loan interest

This interview will help you determine if you can deduct the interest you paid on a student or educational loan Information you ll need Filing status Basic Feb 3 2023 at 10 27 a m Getty Images Depending on your filing status and household income you might qualify for tax deductions Higher education costs have been on the

Are Student Loan Payments Tax Deductible

https://images.ctfassets.net/h1t3y2jud9xn/1sNksspbZMnIog9uuyDQFf/1856a78569450818009306d5da7ae168/image4.png

Student Loan Payment Pause What To Expect

https://imageio.forbes.com/specials-images/imageserve/1210427901/0x0.jpg?format=jpg&crop=5040,2835,x0,y69,safe&width=1200

https://www.irs.gov/taxtopics/tc456

You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a

https://www.nerdwallet.com/article/loans/student...

You can deduct that interest on your taxes but the entire student loan payment amount is not tax deductible For example say you have a 29 000 student

Remember To Deduct Student Loan Interest On Your Taxes IonTuition

Are Student Loan Payments Tax Deductible

Tax Tip 2016 Deduct Student Loan Interest Paid By Your Parents YouTube

Student Loan Payment Resumption Set To Test U S Economy

Can I Deduct My Student Loan Interest Student Loan Interest Student

Are Professional Conferences Tax Deductible

Are Professional Conferences Tax Deductible

11 Tax Deductions You Can Claim Without Itemizing

Can You Deduct Student Loan Interest From Your Taxes CBS News

College Kid Tax Guide How To Deduct Student Loan Interest college

Can You Deduct Student Loan Payments On Taxes - Student Loan Interest Deduction income limit Outside of the above requirements the biggest determining factor in whether you can deduct your student