Can You File Taxes While On Social Security Social Security Tax Amount Under 25 000 single or 32 000 joint filing No tax on your Social Security benefits Between 25 000 and 34 000 single or 32 000 and 44 000

You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and you and your spouse have combined income of more than 32 000 If you are married and file a separate return you probably will have to pay taxes on your benefits Views If you get Social Security you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes See Withholding Income Tax From Your Social Security Benefits for more information

Can You File Taxes While On Social Security

Can You File Taxes While On Social Security

https://stophavingaboringlife.com/wp-content/uploads/2020/11/tax-time-1536x1086.jpeg

How Much Money Can You Earn While On Social Security Disability Benefits

https://bestlearner.org/wp-content/uploads/2021/08/How-Much-Social-Security-Disability-Benefits-Can-You-Get.jpg

Can You File Taxes After The Deadline Banks

https://www.banks.com/wp-content/uploads/2022/04/can-you-file-taxes-after-the-deadline.jpg

Your Social Security benefit is taxable if you meet the following criteria Individuals with a combined income between 25 000 and 34 000 are taxed on 50 of their Social Security If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your Social Security benefits Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits

Your Social Security benefits may be taxable if one half of your Social Security benefits plus all of your other income is greater than the base amount of your filing status the base Social Security can potentially be subject to tax regardless of your age While you may have heard at some point that Social Security is no longer taxable after 70 or some other age this isn t the case In reality Social Security is taxed at any age if your income exceeds a certain level

Download Can You File Taxes While On Social Security

More picture related to Can You File Taxes While On Social Security

Can You File Taxes With No Income

https://taxsaversonline.com/wp-content/uploads/2022/07/Can-You-File-Taxes-With-No-Income-1.jpg

Can You File Taxes On SSI Disability Disability Help

https://www.disabilityhelp.org/wp-content/uploads/2022/03/Can-You-File-Taxes-On-SSI-Disability.jpg

Can You Own A Rental Property While Collecting Disability In 2024

https://www.amanica.com/wp-content/uploads/2021/09/social-security-card-with-cash-money-dollar-bills-FACR3LF-1024x683.jpg

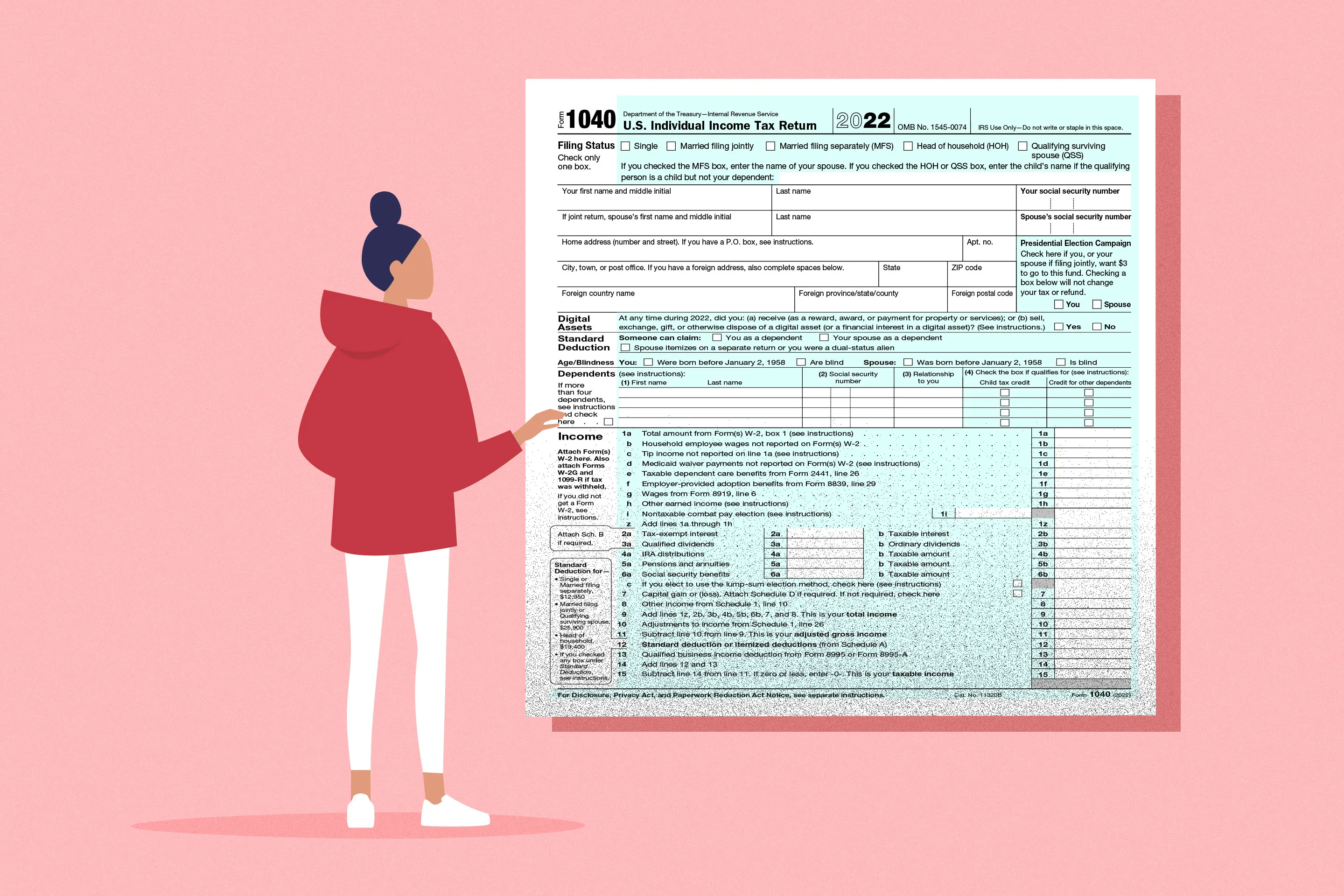

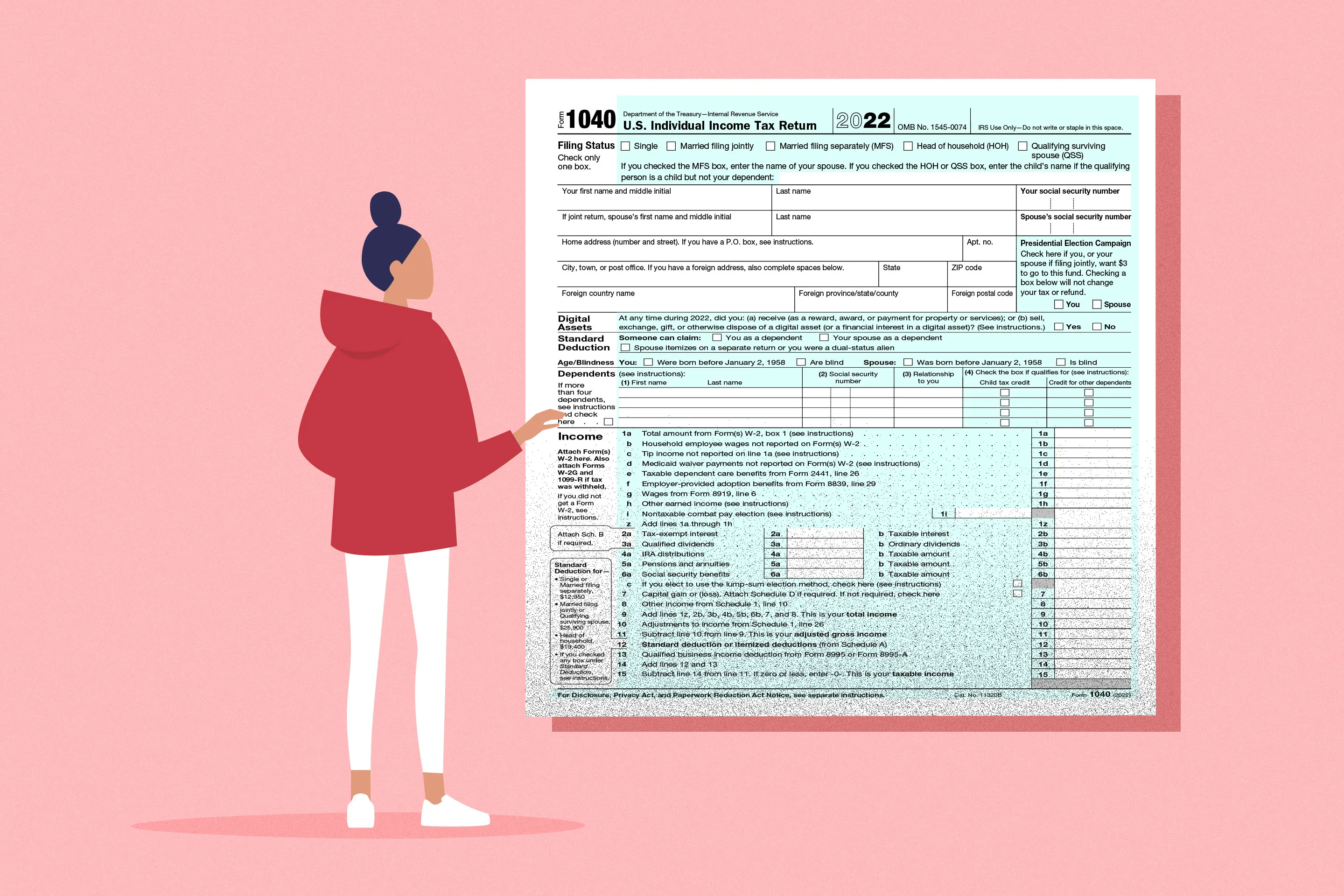

They don t include supplemental security income SSI payments which aren t taxable The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA 1099 Social Security Benefit Statement and you report that amount on line 6a of Form 1040 U S Individual Income If you are single Head of Household Qualifying Widow er or Married Filing Separately didn t live with spouse you can report up to 25 000 of income half of your SSDI benefits plus other income before needing to pay taxes on your SSDI benefits

Here are seven things Social Security recipients present and future should know about taxation of benefits 1 Income matters age doesn t Contrary to another common misperception you don t stop paying taxes on your Social Security when you reach a certain age Income and income alone dictates whether you owe federal taxes Yes it s possible to avoid paying taxes on your Social Security income but it requires some careful maneuvering While avoiding taxes on your monthly benefit check may sound like a

When Can You File Taxes In 2023 Kiplinger

https://cdn.mos.cms.futurecdn.net/PHP7biN7KEiSfwdGWncXxK.jpg

2022 Standard Deduction Amounts Are Now Available Bankruptcy L Lawyers

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

https://www.kiplinger.com/taxes/social-security-income-taxes

Social Security Tax Amount Under 25 000 single or 32 000 joint filing No tax on your Social Security benefits Between 25 000 and 34 000 single or 32 000 and 44 000

https://faq.ssa.gov/en-US/Topic/article/KA-02471

You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and you and your spouse have combined income of more than 32 000 If you are married and file a separate return you probably will have to pay taxes on your benefits

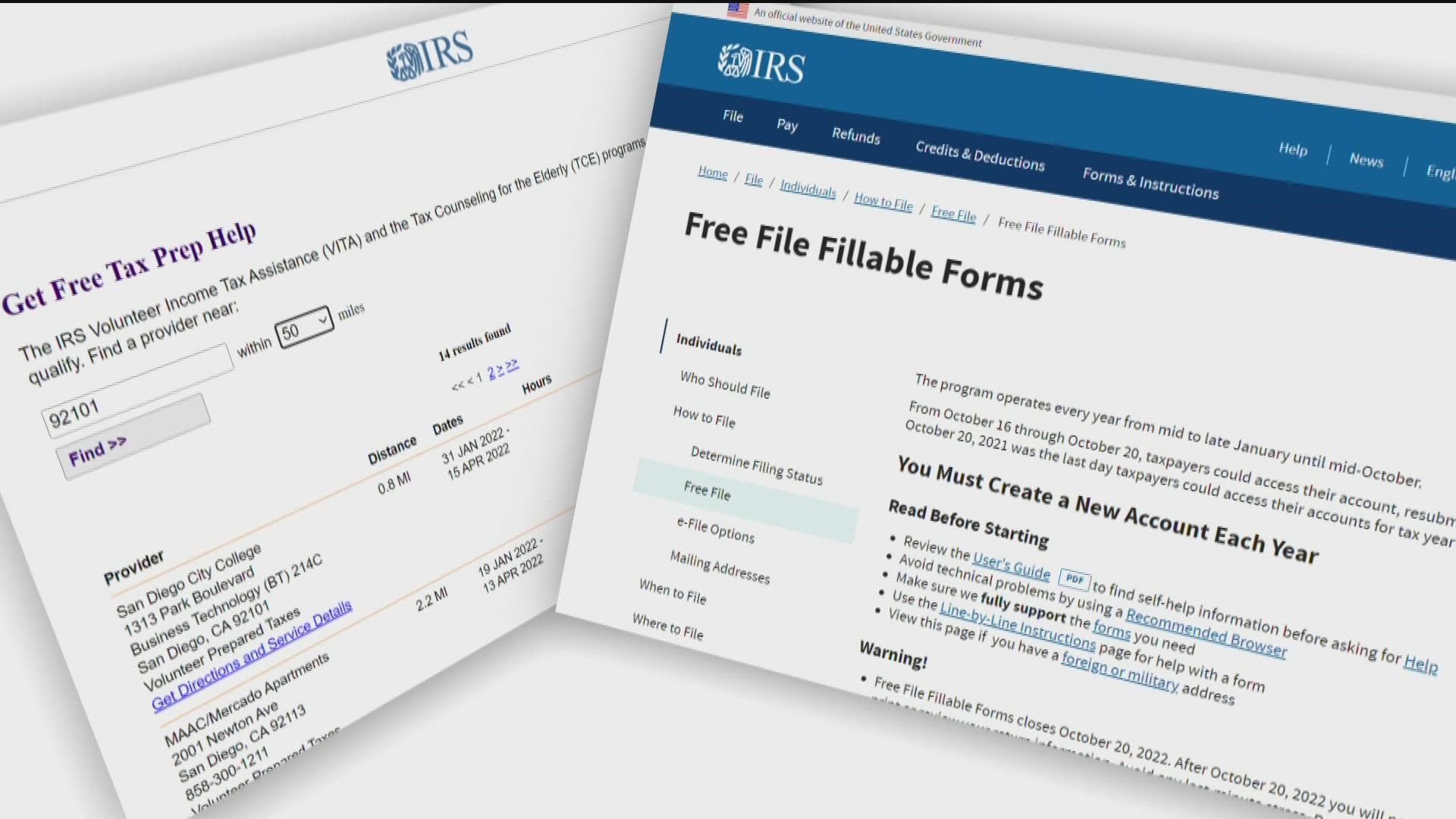

How To File Your Taxes Online For Free This 2022 Tax Season Cbs8

When Can You File Taxes In 2023 Kiplinger

Can You File Your Taxes In The US Without A Social Security Number

6 Benefits Of Filing Your Taxes Early You Need To Know Sheffield

Quarterly Estimated Taxes Due Dates Penalties Cerebral Tax Advisors

How To File An Extension For State Taxes In California

How To File An Extension For State Taxes In California

How Much Can I Earn While On Social Security

Social Security Income Limit What Counts As Income YouTube

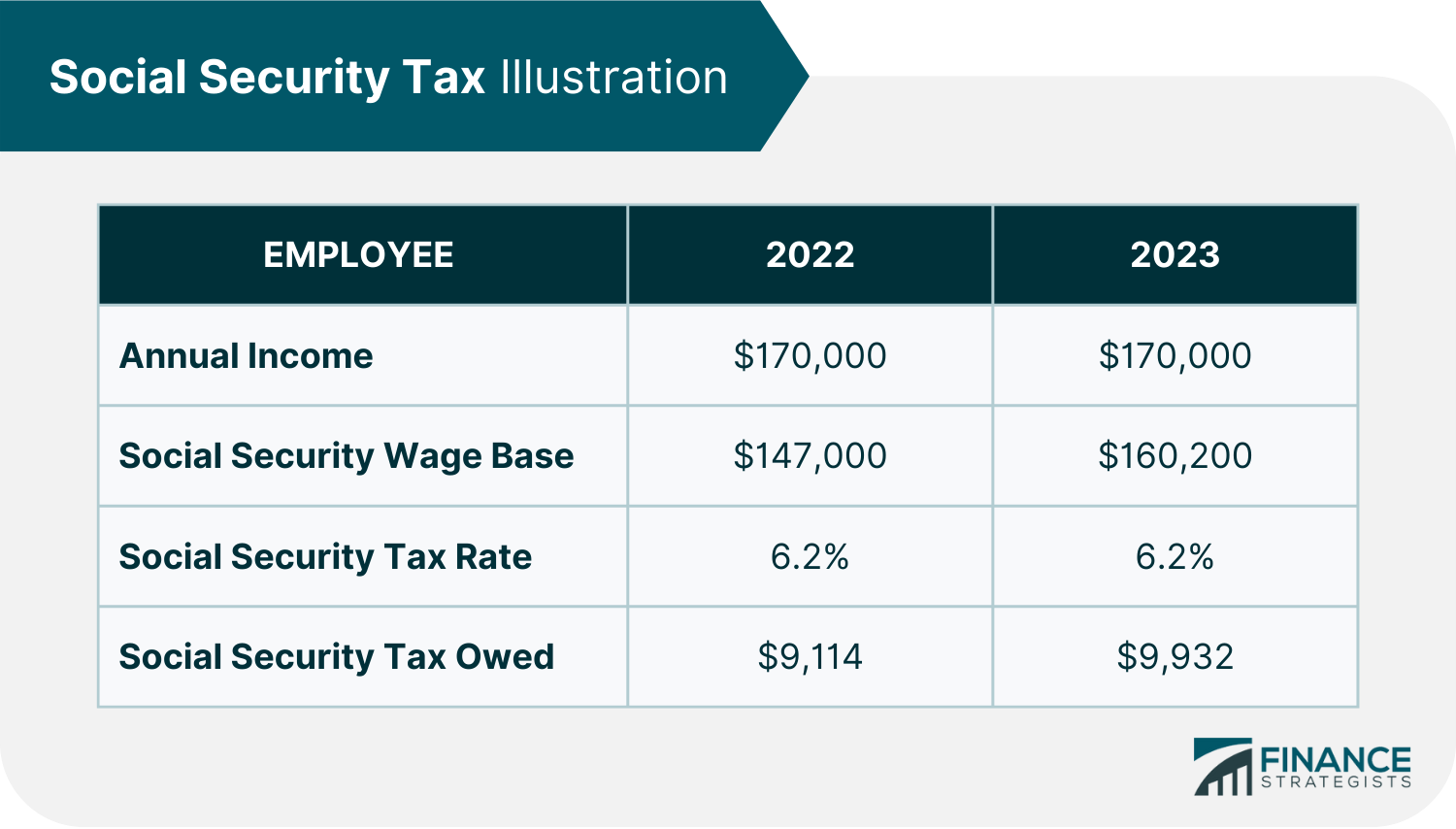

Social Security Tax Definition How It Works Exemptions And Tax Limits

Can You File Taxes While On Social Security - If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your Social Security benefits Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits