Can You Get A Tax Write Off For Home Improvements Most home improvements aren t tax deductible but the IRS does specify situations in which you can write off expenses as you improve your home Here are

Home improvements and taxes When you make a home improvement such as installing central air conditioning or replacing the roof you can t deduct the cost Home improvements are tax deductible if they meet the three qualifying criteria Betterment Amounts paid to repair something that will increase the value of the

Can You Get A Tax Write Off For Home Improvements

Can You Get A Tax Write Off For Home Improvements

https://bestlettertemplate.com/wp-content/uploads/2020/10/Tax-Clearance-Letter-1086x1536.png

Small Business Tax Deductions Tax Deductible Business Expenses

https://www.communitytax.com/wp-content/uploads/2019/04/Small-Business-Tax-Deductions-1.png

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Small

https://i.pinimg.com/originals/e2/0f/81/e20f81a96f10e2dc77a5e25a448ba22c.jpg

Most home improvements aren t tax deductible but there are a few exceptions you should know about before tax season comes around The rules on home If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements

Updated on January 18 2023 Reviewed by David Kindness Fact checked by J R Duren You typically can t deduct home improvements but a few updates come with tax The general rule is that home improvement is not tax deductible Many exceptions apply to the rule Several rules overlap and change yearly Always talk to a

Download Can You Get A Tax Write Off For Home Improvements

More picture related to Can You Get A Tax Write Off For Home Improvements

7 Insanely Awesome Write Offs That Solopreneurs Need To Know

https://i.pinimg.com/736x/23/c8/d8/23c8d85659ab66be4e967a6fa6ecb315.jpg

Hairstylist Tax Write Offs Checklist For 2024 Zolmi

https://zolmi.com/assets/img/com/sticky/tax-deductions-checklist-for-hairstylists.png

Small Business Bookkeeping Small Business Tax Startup Business Plan

https://i.pinimg.com/originals/85/2b/9c/852b9c217ad1122b0bd8d12f2d36175e.png

Renovation of a home is not generally an expense that can be deducted from your federal taxes but there are a number of ways that you can use home renovations and You can t deduct the cost of home improvements These costs are nondeductible personal expenses But home improvements do have a tax benefit They can help reduce the

As we said home improvements can t be written off like say tax preparation fees or medical expenses although later we ll see how medical expenses might lead to home improvement deductions One way you Home improvements on a personal residence are generally not tax deductible for federal income taxes However installing energy efficient equipment may

What Can I Write Off On My Taxes Business Tax Deductions Tax Write

https://i.pinimg.com/736x/7b/c1/62/7bc1625611a14e807cd121199d0cb313.jpg

Tax Deductions Write Offs To Save You Money Financial Gym

https://images.squarespace-cdn.com/content/v1/5a1efe26914e6b83e9456629/1582581779280-IL3MNWGKUNKHXL5A4790/TFG_IG-post_7-Tax-Deductions-You-Shouldn't-Miss.jpg

https://realestate.usnews.com/real-estate/articles/...

Most home improvements aren t tax deductible but the IRS does specify situations in which you can write off expenses as you improve your home Here are

https://turbotax.intuit.com/tax-tips/home...

Home improvements and taxes When you make a home improvement such as installing central air conditioning or replacing the roof you can t deduct the cost

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

What Can I Write Off On My Taxes Business Tax Deductions Tax Write

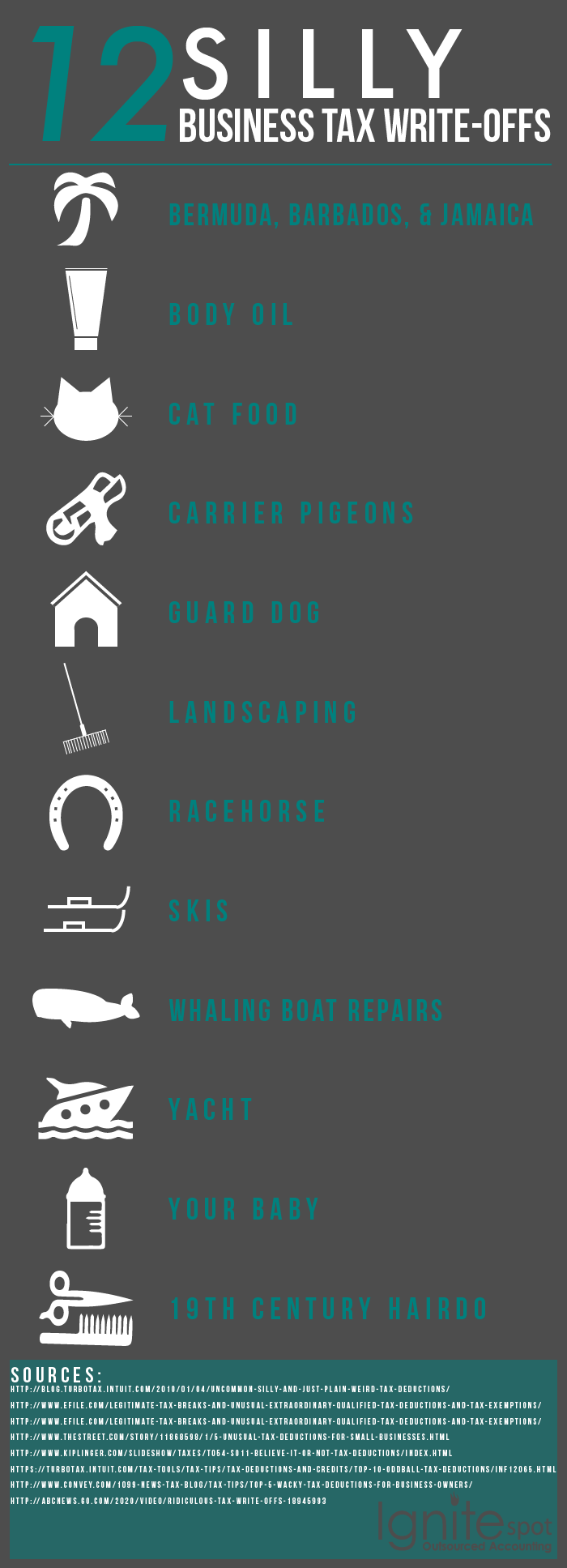

12 Silly Tax Write Offs That Actually Happened infographic

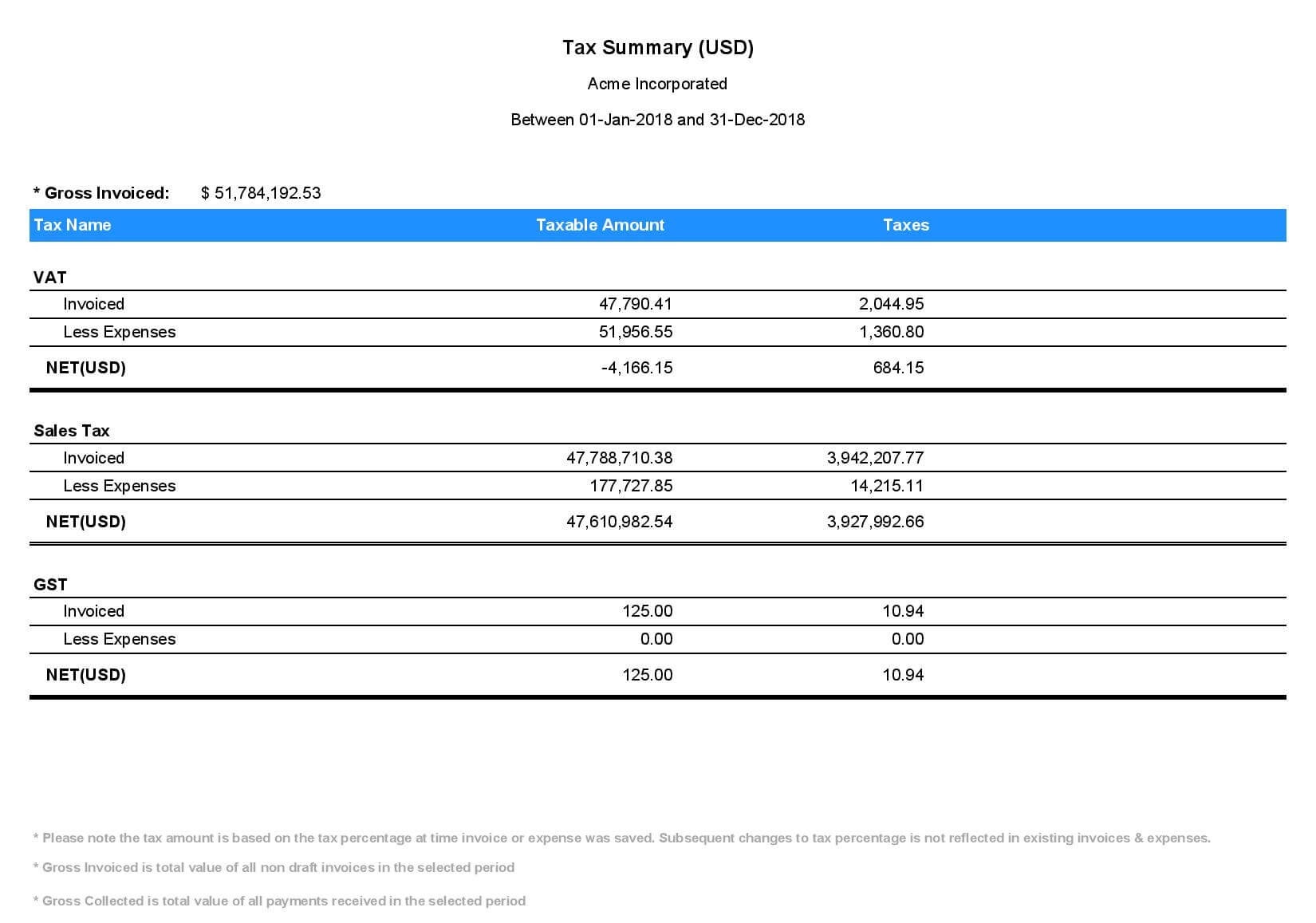

Tax Summary Report Avaza Support

Pin On Stuff

Business Tax Deductions Worksheet Business Tax Deductions Small

Business Tax Deductions Worksheet Business Tax Deductions Small

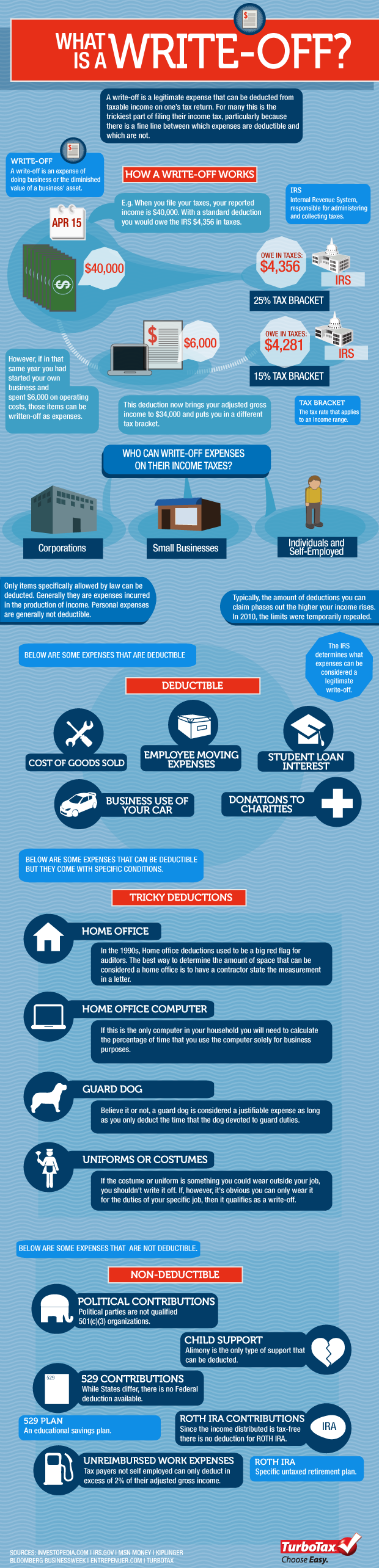

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

Printable Tax Deduction Cheat Sheet

What Is A Tax Write Off Tax Deductions Explained YouTube

Can You Get A Tax Write Off For Home Improvements - Broadly speaking no However there can be exceptions Home improvements can potentially reduce your tax burden such as capital improvements