Can You Get Tax Deduction For Home Improvements However if you re a homeowner and you renovated or did some upgrades last year we have some good news for you You might be able to save some money on your taxes this year depending on the project Below we ll walk you through the basics about deducting home renovation and upgrade expenses

Home improvements are tax deductible if they meet the three qualifying criteria Betterment Amounts paid to repair something that will increase the value of the home or to add a feature that If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

Can You Get Tax Deduction For Home Improvements

Can You Get Tax Deduction For Home Improvements

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

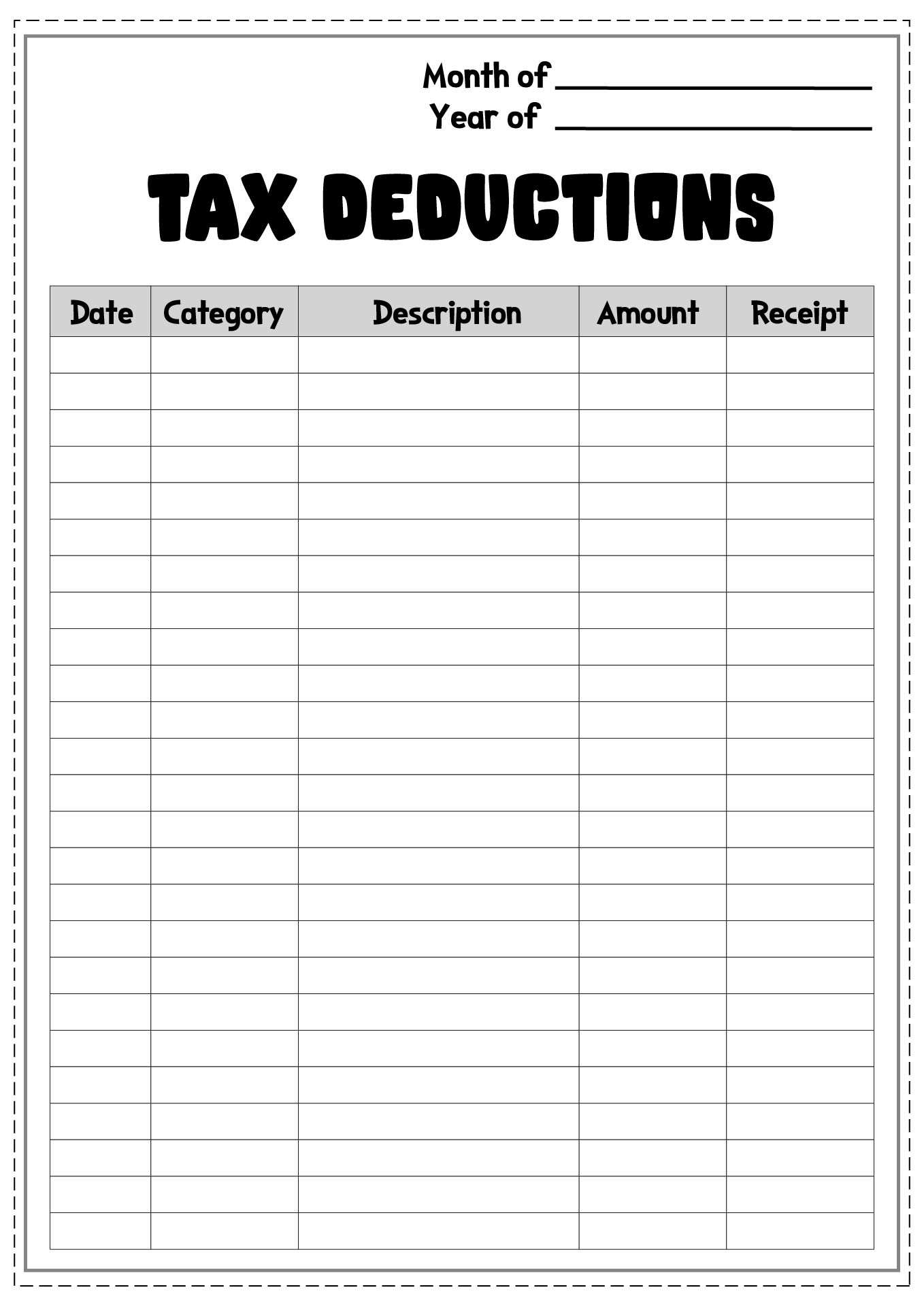

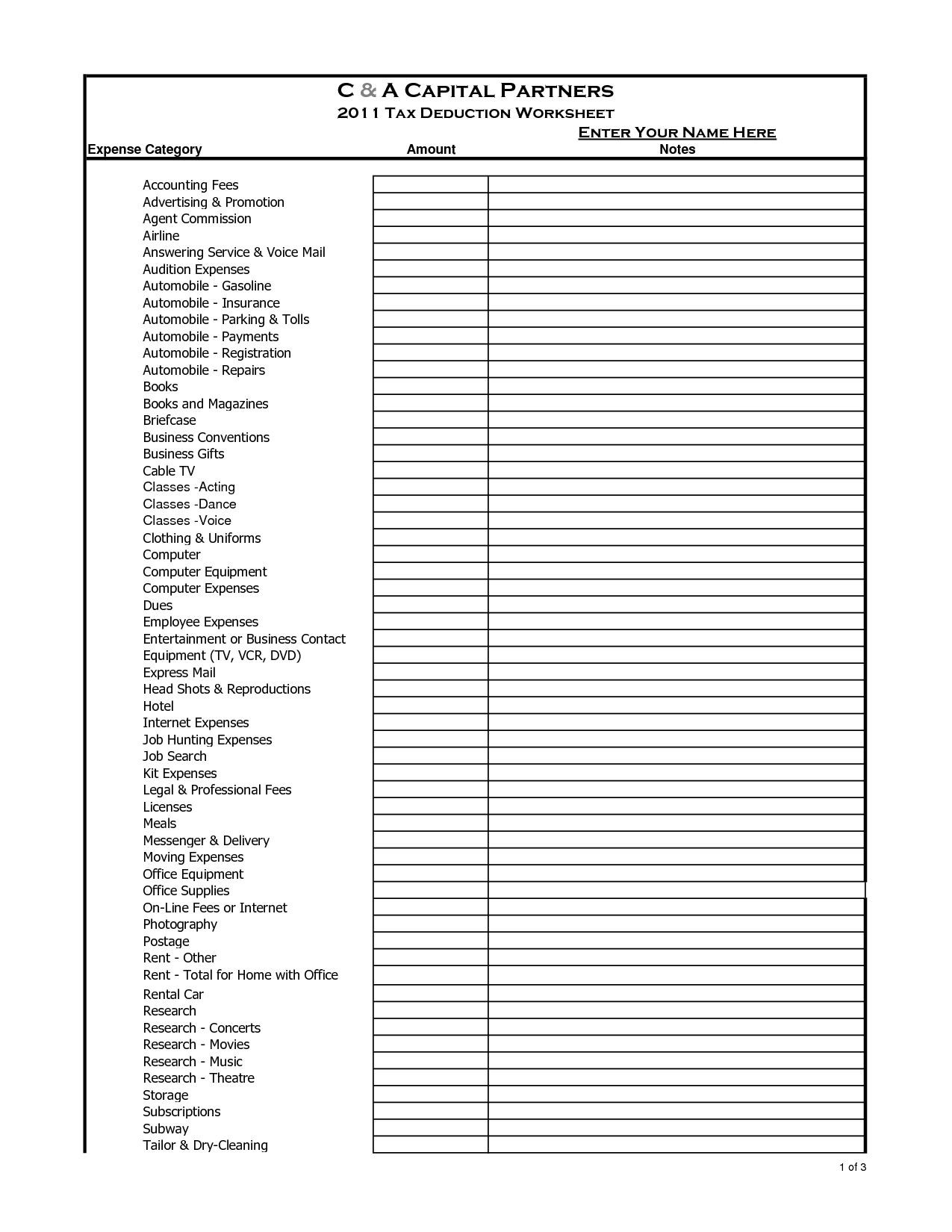

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

8 Tax Preparation Organizer Worksheet Worksheeto

https://www.worksheeto.com/postpic/2015/05/2015-itemized-tax-deduction-worksheet-printable_449272.png

The general rule is that home improvement is not tax deductible Many exceptions apply to the rule Several rules overlap and change yearly Always talk to a tax professional before digging These tax deductible home renovations can save you money in several ways Find out what you need to know to reap the best benefits

When you make a home improvement such as installing central air conditioning or replacing the roof you can t deduct the cost in the year you spend the money But if you keep track of those expenses they may help you Unfortunately most home improvements aren t deductible the year you make them But even if they aren t currently deductible they ll eventually have a tax benefit when you sell your home

Download Can You Get Tax Deduction For Home Improvements

More picture related to Can You Get Tax Deduction For Home Improvements

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Tax Savings Deductions Under Chapter VI A Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2023/03/03105750/FigJam-Basics-1-1024x870.jpg

10 Most Common Small Business Tax Deductions Infographic

https://triplogmileage.com/wp-content/uploads/2018/08/rev02-01-min-33-min.jpg

Thanks to the 2022 Inflation Reduction Act if you decide to make changes to your home to improve its energy efficiency chances are you will qualify for tax credits which work differently than a deduction within the next tax year You can receive potential tax deductions on improvements that make your home more energy efficient or meet medical needs Tax deductions may also be available to improve your home office space or maintain your rental property

Home improvements that qualify as capital improvements are tax deductible but not until you sell your home Home improvements on a personal residence are generally not tax deductible for federal income taxes However installing energy efficient equipment may qualify you for a tax credit and

7 Home Improvement Tax Deductions For Your House YouTube

https://i.ytimg.com/vi/6T3kvwk4Mtw/maxresdefault.jpg

Tax Deductions Template For Freelancers Google Sheets

https://lh3.googleusercontent.com/yYHiXPtBf2g0Mdr1epAGPvgKGG04ZKfex6W7-yeFJ1praIsZucsJpjEmqDKKOA4rGvpcaAAZEWePNA=w1200-h630-p

https://www.realsimple.com/are-home-renovations...

However if you re a homeowner and you renovated or did some upgrades last year we have some good news for you You might be able to save some money on your taxes this year depending on the project Below we ll walk you through the basics about deducting home renovation and upgrade expenses

https://www.investopedia.com/are-home-improvements...

Home improvements are tax deductible if they meet the three qualifying criteria Betterment Amounts paid to repair something that will increase the value of the home or to add a feature that

Self Employed Business Tax Deduction Sheet A Success Of Your Business

7 Home Improvement Tax Deductions For Your House YouTube

Tax Deductions And Credits For First Time Homeowners

Real Estate Expense Tracking Spreadsheet With Regard To Realtor Expense

Deduction Vs Tax Exemption Vs Tax Rebate 2021 What Is Tax Deduction

Income Tax Deductions For The FY 2019 20 ComparePolicy

Income Tax Deductions For The FY 2019 20 ComparePolicy

What Can I Deduct Freelance Tax Deductions Flowchart Rags To Reasonable

Standard Deduction For 2021 22 Standard Deduction 2021

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Small

Can You Get Tax Deduction For Home Improvements - There are multiple tax deductible home improvements you can undertake That new bedroom might just increase your refund In this article we ll show you what kinds of home improvements you can deduct from your taxes