Can You Get Tax Deduction For Working From Home One of the bigger tax deductions you can take if you work from home as an independent contractor is the home office deduction To take this deduction you ll need to

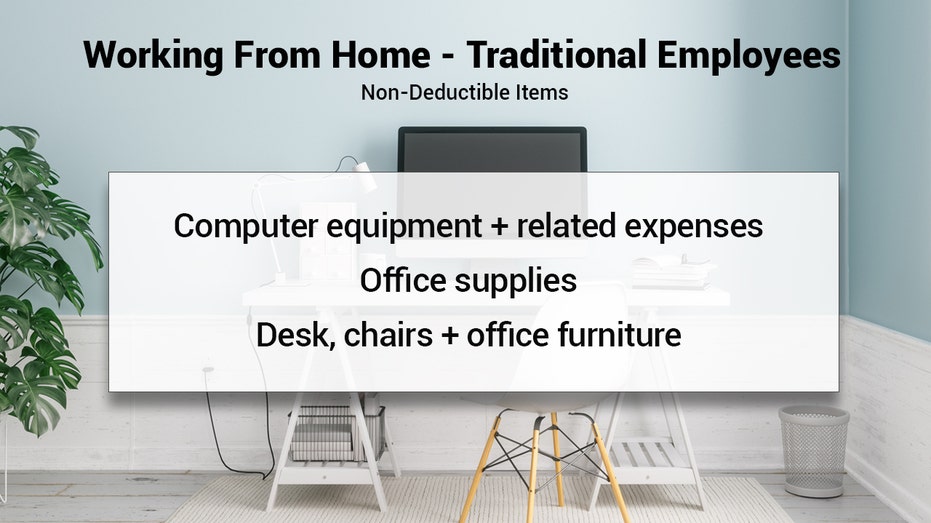

Employees who work from home can no longer claim tax deductions for their unreimbursed employee expenses or home office costs on their federal tax return Prior to the If you re a regular employee working from home you can t deduct any of your related expenses on your tax return In the past you could claim an itemized deduction for

Can You Get Tax Deduction For Working From Home

Can You Get Tax Deduction For Working From Home

https://www.fastcapital360.com/wp-content/uploads/2021/02/homeDeduction.jpg

Can You Get A Tax Deduction For Working From Home YouTube

https://i.ytimg.com/vi/7mwHL9ktMIw/maxresdefault.jpg

Home Office Tax Deduction Still Available Just Not For COVID displaced

https://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e2026bde880761200c-800wi

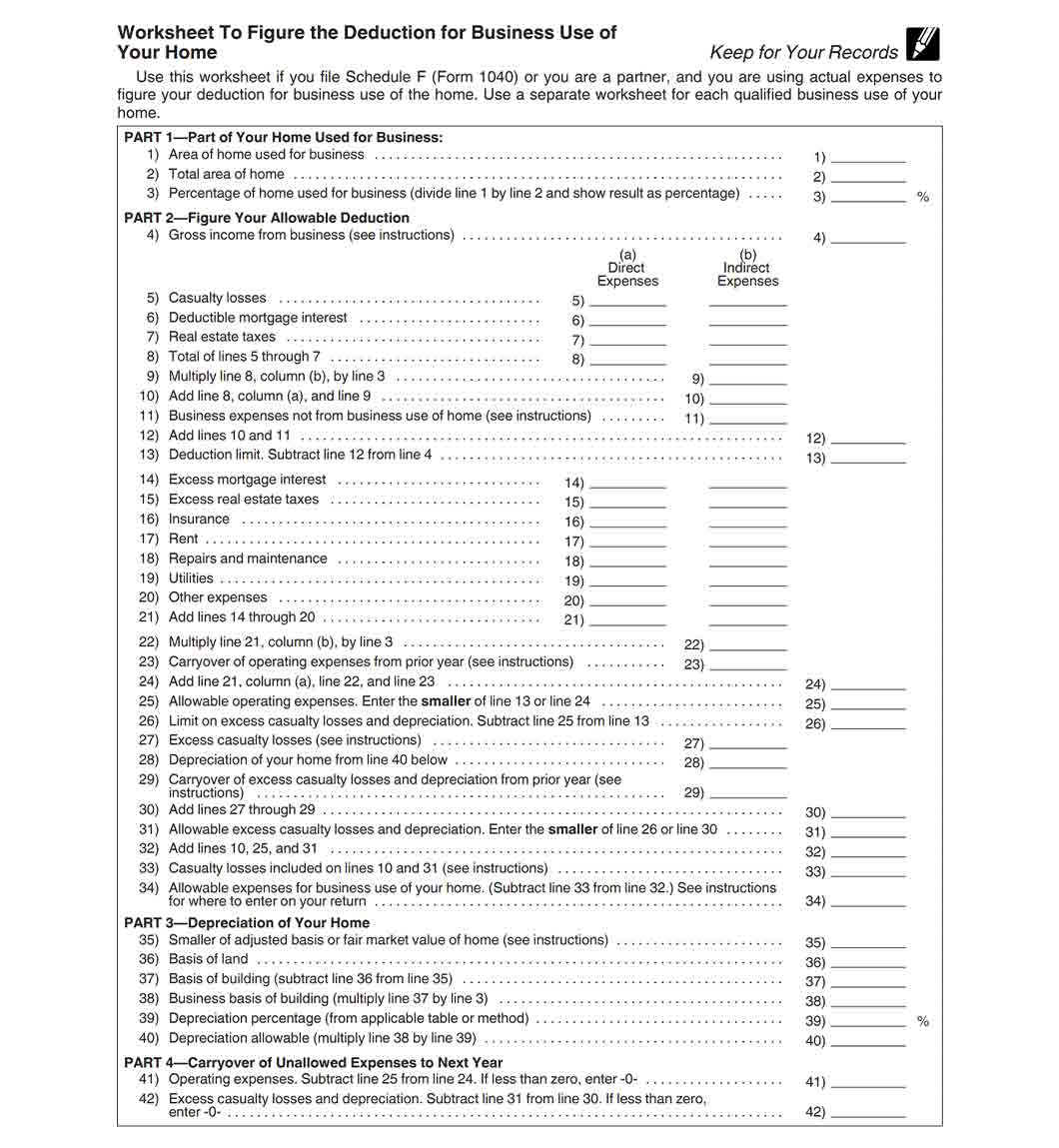

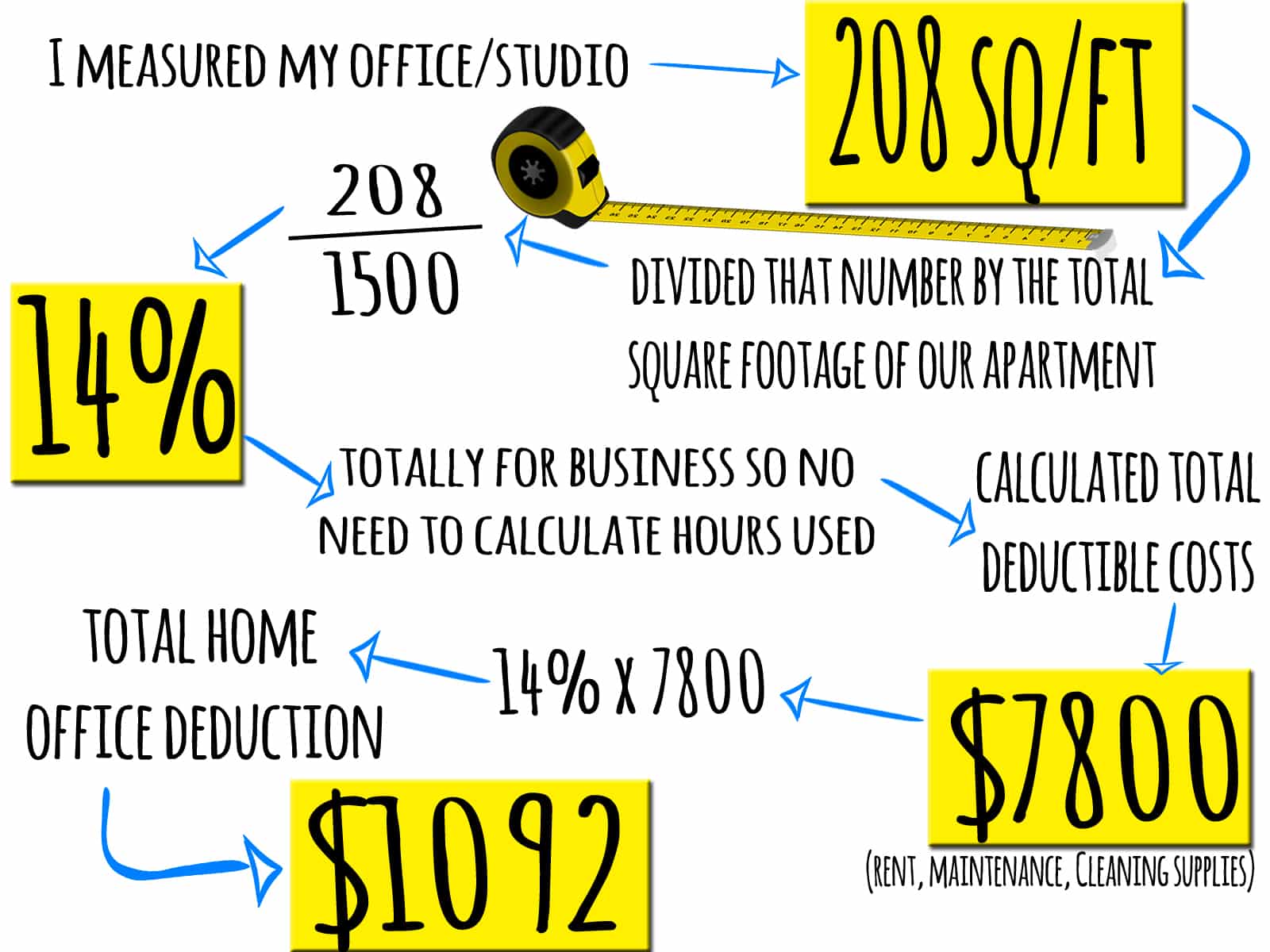

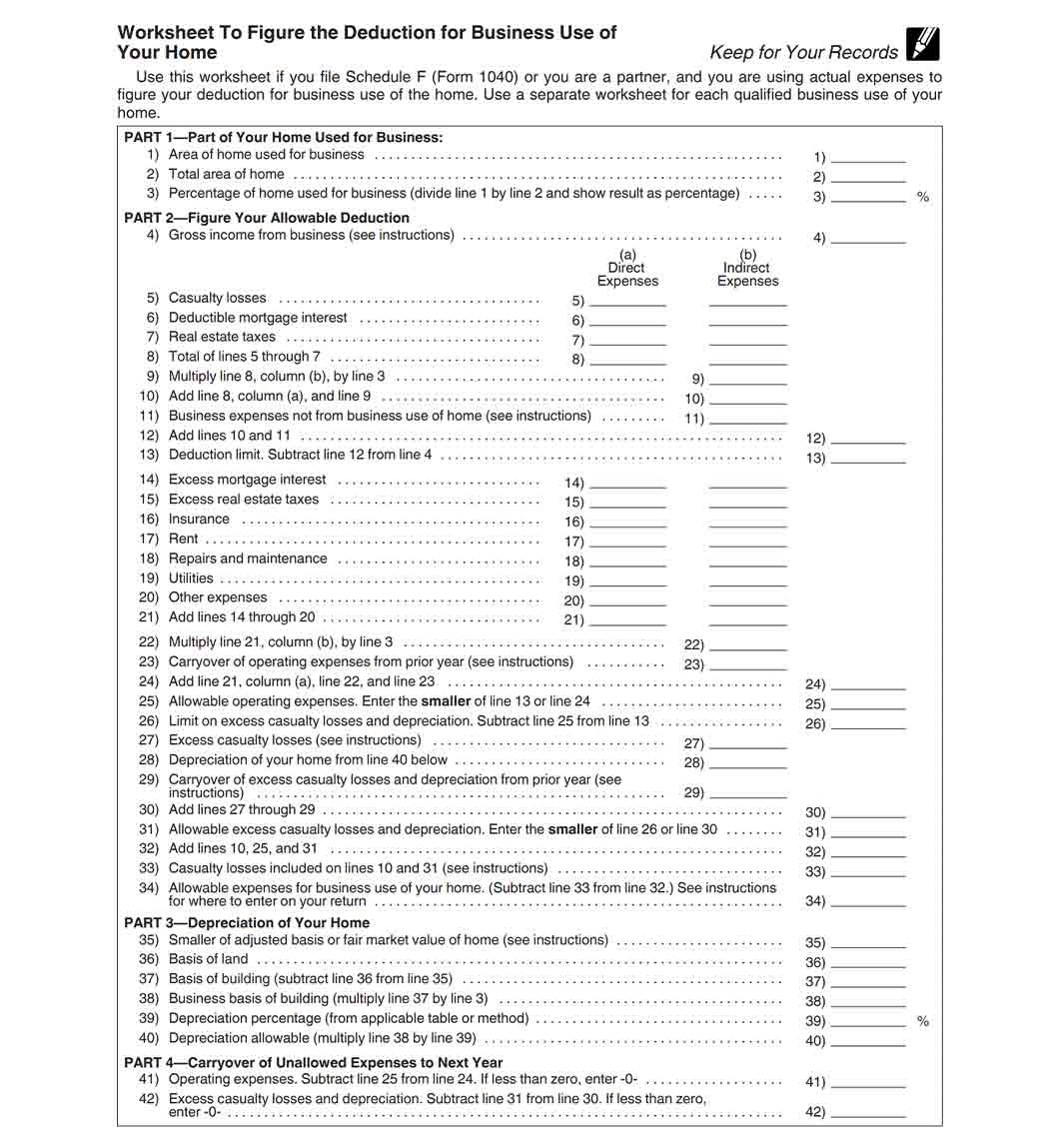

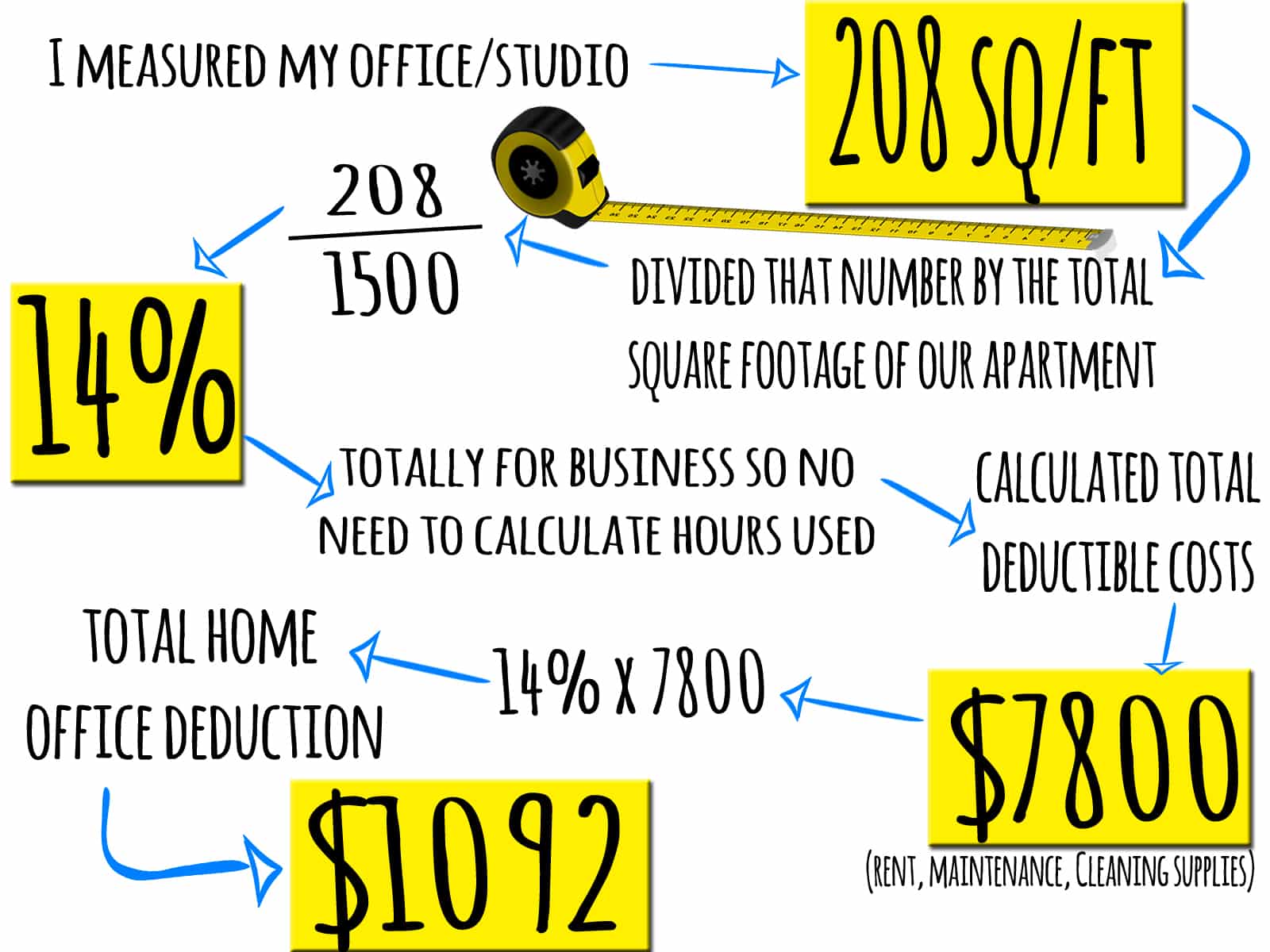

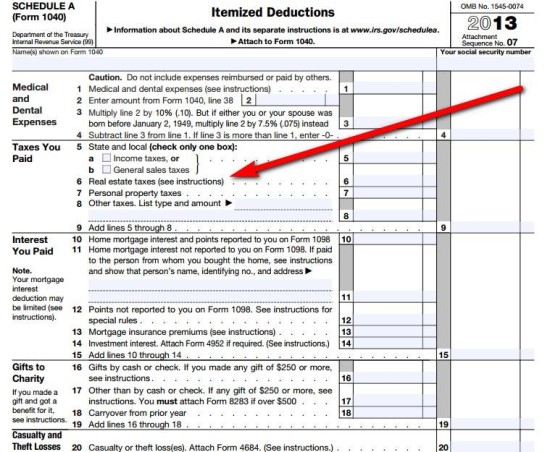

You can deduct mortgage interest taxes maintenance and repairs insurance utilities and other expenses You can use Form 8829 to figure out the expenses you can deduct To claim the home office deduction in 2021 taxpayers must exclusively and regularly use part of their home or a separate structure on their property as their primary place of business

Although you can t take federal tax deductions for work from home expenses if you are an employee some states have enacted their own laws requiring employers to reimburse employees for necessary business If you worked from home in 2022 you may be wondering if you qualify for the home office deduction which offers a tax break for part of your home expenses

Download Can You Get Tax Deduction For Working From Home

More picture related to Can You Get Tax Deduction For Working From Home

When Is Working From Home A Tax Deduction TL DR Accounting

https://www.tldraccounting.com/wp-content/uploads/2019/05/When-is-Working-from-Home-a-Tax-Deduction_.png

Working From Home Due To Covid 19 Can You Claim A Home Office Tax

https://ratebeat.com/wp-content/uploads/2021/03/WFH-DUE-TO-COVID-19-CAN-YOU-CLAIM-A-HOME-OFFICE-TAX-DEDUCTION.png

There s A Tax Deduction For People Working From Home But It Won t

https://www.businessinsider.in/photo/76988439/theres-a-tax-deduction-for-people-working-from-home-but-it-wont-apply-to-most-remote-workers-during-the-pandemic.jpg?imgsize=194410

Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage It depends The biggest WFH tax deduction is arguably the home office deduction and according to CNBC most employees aren t eligible for it though you may qualify as a

The home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business Your home can be a house The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes To claim the home office deduction on their 2021 tax return taxpayers

Freelancer Taxes How To Deduct Your Home Office Rags To Reasonable

https://www.ragstoreasonable.com/wp-content/uploads/2016/04/Home-Office-Deduction-1.jpg

Home Office Tax Deduction What Can I Deduct Working From Home

https://melmagazine.com/wp-content/uploads/2020/04/How_Much_Of_Home_Office_Can_I_Write_Off_Taxes.jpg

https://www.ramseysolutions.com/taxes/work-from-home-tax-deductions

One of the bigger tax deductions you can take if you work from home as an independent contractor is the home office deduction To take this deduction you ll need to

https://turbotax.intuit.com/tax-tips/jobs-and...

Employees who work from home can no longer claim tax deductions for their unreimbursed employee expenses or home office costs on their federal tax return Prior to the

Can You Take A Tax Deduction For Working From Home Wallpaper

Freelancer Taxes How To Deduct Your Home Office Rags To Reasonable

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Small

Home Office Tax Deductions Calculator 2019 Microsoft Excel Spreadshe

May Sheets Home Office Deduction Simplified Method Worksheet 2018

Can You Take A Tax Deduction For Working From Home Wallpaper

Can You Take A Tax Deduction For Working From Home Wallpaper

Can You Get Tax Back If You Work From Home TAXIRIN

How To Deduct Property Taxes On IRS Tax Forms

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Can You Get Tax Deduction For Working From Home - Were you among the employees forced to work from home in 2021 TurboTax CPA Lisa Greene Lewis breaks down what is and isn t deductible for remote workers who are filing taxes