Can You Still Claim Tax Relief For Working From Home 2022 From the current tax year 2022 23 onwards employees who are eligible can still make a claim for tax relief for working from home The claim can be made in self assessment SA returns online or on a paper P87 form

You cannot claim tax relief if you choose to work from home This includes if your employment contract lets you work from home some or all of the time you work from home Can I still claim for working from home tax relief in 2022 23 tax year Some workers will be able to claim for the current tax year

Can You Still Claim Tax Relief For Working From Home 2022

Can You Still Claim Tax Relief For Working From Home 2022

https://www.backhouse-solicitors.co.uk/wp-content/uploads/2020/11/work_from_home-768x512.jpg

Company Tax Relief 2023 Malaysia Printable Forms Free Online

https://ringgitplus.com/en/blog/wp-content/uploads/2022/03/income-tax_everything-you-should-claim_ya2021.jpg

Working From Home Tax Relief 2022 23 Changes The Home Office Life

http://static1.squarespace.com/static/606e11b80b94173f33b2dd54/606f255609b92746009634b3/62950166c46ed1075c738fbc/1668168302180/unsplash-image-RahFim8GkXk.jpg?format=1500w

While you can still claim for the prior two tax years for this tax year the one that started 6 April 2022 and likely for future tax years HMRC says you can t claim tax relief if the only reason you re required to work from home With millions of people back in the office for at least part of the week experts say you can now claim tax relief for working from home only if you meet strict conditions

Yes you can backdate your claim for up to 4 years which is helpful if you began working from home back in March 2020 and didn t made a claim at the time even if you are no longer eligible under the new rules 5 April 2025 Deadline to claim for the 2020 21 tax year working from home tax relief 5 April 2026 Published 13 May 2021 HM Revenue and Customs HMRC is accepting tax relief claims for working from home due to coronavirus during 2021 to 2022 More than 550 000 employed workers have

Download Can You Still Claim Tax Relief For Working From Home 2022

More picture related to Can You Still Claim Tax Relief For Working From Home 2022

Can You Still Claim ERTC In 2022 Find Out At This CARES Act Assistance

https://www.dailymoss.com/wp-content/uploads/2022/03/can-you-still-claim-ertc-in-2022-find-out-at-this-cares-act-assistance-service-6220f2ea8fe80.jpeg

Working From Home Tax Claim Eyre Co Accountants

https://eyreandco.co.uk/wp-content/uploads/2020/09/a5316bab-7433-464b-a509-93fcce073f04.jpg

Malaysia Personal Income Tax Relief 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjM81nSzJ2QiCATWboDACN2BpfNmw-0Wf5BApuHi91cjON32r6XUxhruNbA8f0o3K_H_4oIf1B4xQE6D0tInpJ7fFjXuaqCtw3-786N9ouUQ8nKcW7kxtIy0bZOmw2wXtBmRb63A-pQjcxK9mCdSvqTGiUvUxaePn9JkzlCVQKv7Gj0EukB_pdXpC10/s1585/Individual_Tax_Relief_2021.jpg

The easement that allows tax relief to be claimed for the whole tax year if someone is eligible to claim extra costs for working from home for any time during the year are to remain in place for 2022 23 HMRC expects significantly fewer claims however as the tests have not been relaxed Employees who have either returned to working in an office since early April or are preparing for their return can still claim the working from home tax relief and benefit from the

How to Claim Work From Home Deductions Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions Also work from home expenses can only be written off Employees who work from home can no longer claim tax deductions for their unreimbursed employee expenses or home office costs on their federal tax return Prior to the 2018 tax reform employees could claim

Can You Claim The Home Office Tax Deduction If Ve Been Working Remotely

https://images.mktw.net/im-300624?width=700&height=466

List Of Personal Tax Relief And Incentives In Malaysia 2023

https://iqiglobal.com/blog/wp-content/uploads/2023/01/tax-relief.webp

https://www.icaew.com/insights/tax-news/2023/jan...

From the current tax year 2022 23 onwards employees who are eligible can still make a claim for tax relief for working from home The claim can be made in self assessment SA returns online or on a paper P87 form

https://www.gov.uk/tax-relief-for-employees/working-at-home

You cannot claim tax relief if you choose to work from home This includes if your employment contract lets you work from home some or all of the time you work from home

Work From Home Tax Relief Scheme How It Works For 2021 22

Can You Claim The Home Office Tax Deduction If Ve Been Working Remotely

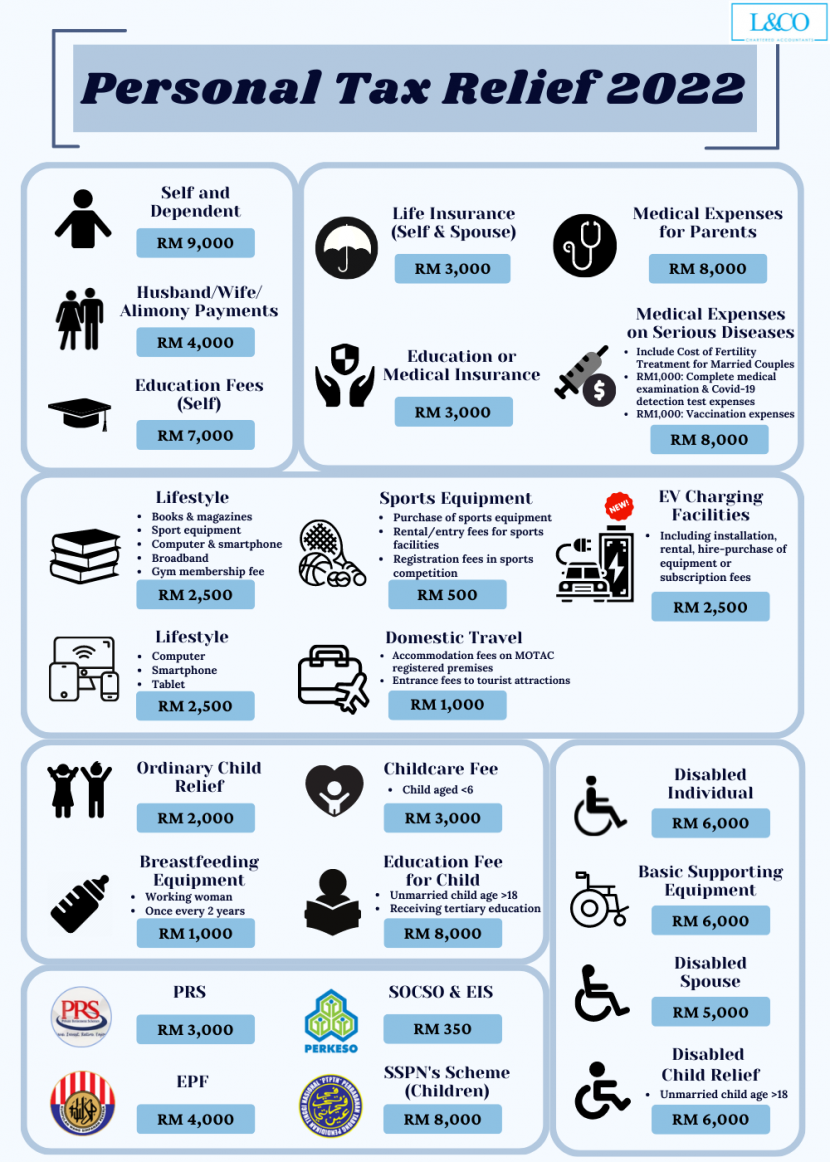

Personal Tax Relief 2022 L Co Accountants

A Guide To Maximize Your Income Tax Filing In 2022

Don t Miss Out On The Working from home Tax Relief The Money Edit

Can You Still Claim Tax Relief For Working From Home Which News

Can You Still Claim Tax Relief For Working From Home Which News

List Of LHDN s Income Tax Relief For E Filing 2021 YA 2020

Personal Tax Relief 2022 L Co Accountants

List Of Personal Tax Relief And Incentives In Malaysia 2023

Can You Still Claim Tax Relief For Working From Home 2022 - You can claim tax relief if you have been working at home over the past 12 months because of Covid Photograph mapodile Getty Images Consumer champions Tax Working from home