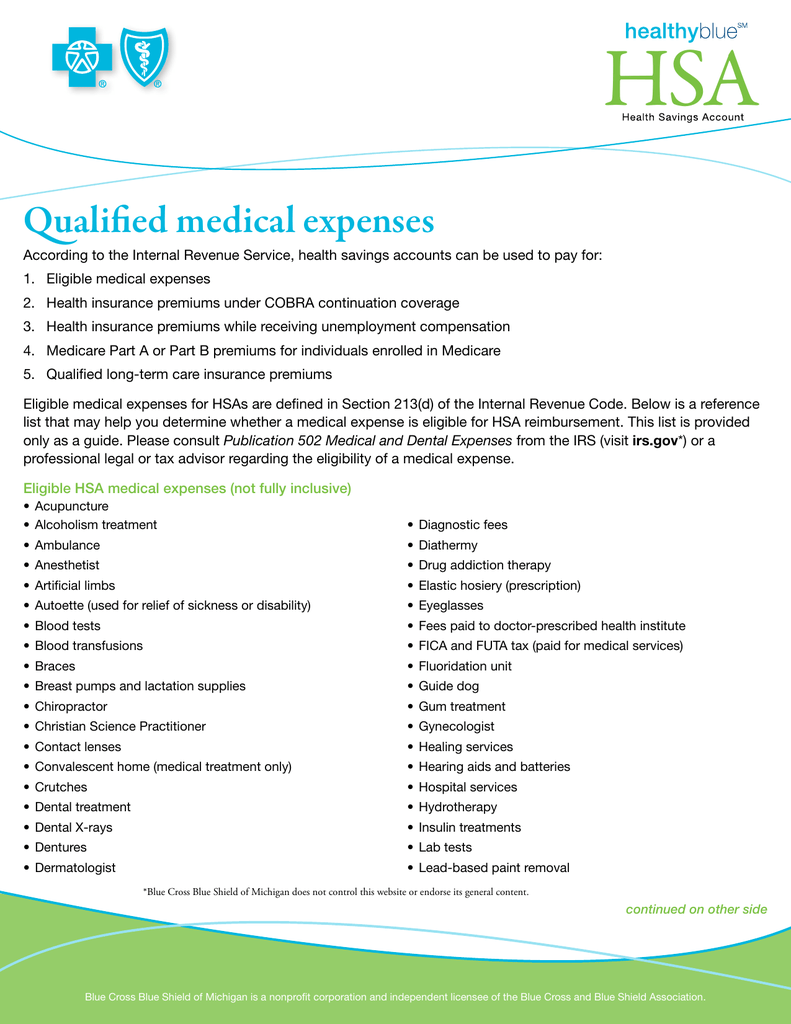

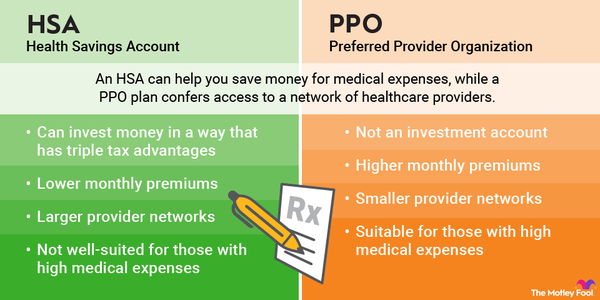

Can You Use Hsa To Pay For Medical Bills If you use a distribution from your HSA for qualified medical expenses you do not pay tax on the distribution but you have to report the distribution on Form 8889 There is nothing about the timing of contributions versus distributions

Generally you can t use your HSA to pay for expenses that don t meaningfully promote the proper function of the body or prevent or treat illness or disease Nutritional supplements Used in combination with a High Deductible Health Plan HDHP funds deposited in an HSA can go towards paying medical bills until the plan s deductible

Can You Use Hsa To Pay For Medical Bills

Can You Use Hsa To Pay For Medical Bills

https://excelmg.excel-medical.com/what_medical_expenses_can_i_use_my_hsa_for.png

What Is An HSA And Will It Change Under The New Health Bill ThinkHealth

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

Health Savings Account HSA Workest

https://www.zenefits.com/workest/wp-content/uploads/2022/12/HSA-e1677100040197.jpg

Your health savings account HSA can be used to pay for many medical expenses approved by the Internal Revenue Service This includes qualified health As long as the qualifying medical expense was made after the establishment of your HSA you can use your HSA to pay yourself back for your out of pocket

You also usually can t use HSA money to pay for health insurance premiums unless you meet certain criteria According to Optum Bank you re only qualified to use HSAs You can use your HSA to pay for healthcare costs such as emergency dental and vision expenses The CARES Act has expanded the list of HSA eligible

Download Can You Use Hsa To Pay For Medical Bills

More picture related to Can You Use Hsa To Pay For Medical Bills

What Is An HSA MotivHealth Insurance Company

https://www.motivhealth.com/wp-content/uploads/2019/10/how-an-HSA-works.jpg

Health Savings Account How It Works And How To Benefit In 2020

https://www.moneypeach.com/wp-content/uploads/2019/05/Health-Savings-Account-768x1152.png

HSA And FSA Accounts What You Need To Know Readers

https://www.readers.com/blog/wp-content/uploads/2018/10/[email protected]

Unfortunately you can t use your HSA to pay for your medical debt directly but there are ways you can use it indirectly Use your HSA to pay for qualified medical expenses and You can use the 1 200 you ve already saved to pay part of your bill then use your regular 100 contributions to the HSA to make monthly payments on your bill

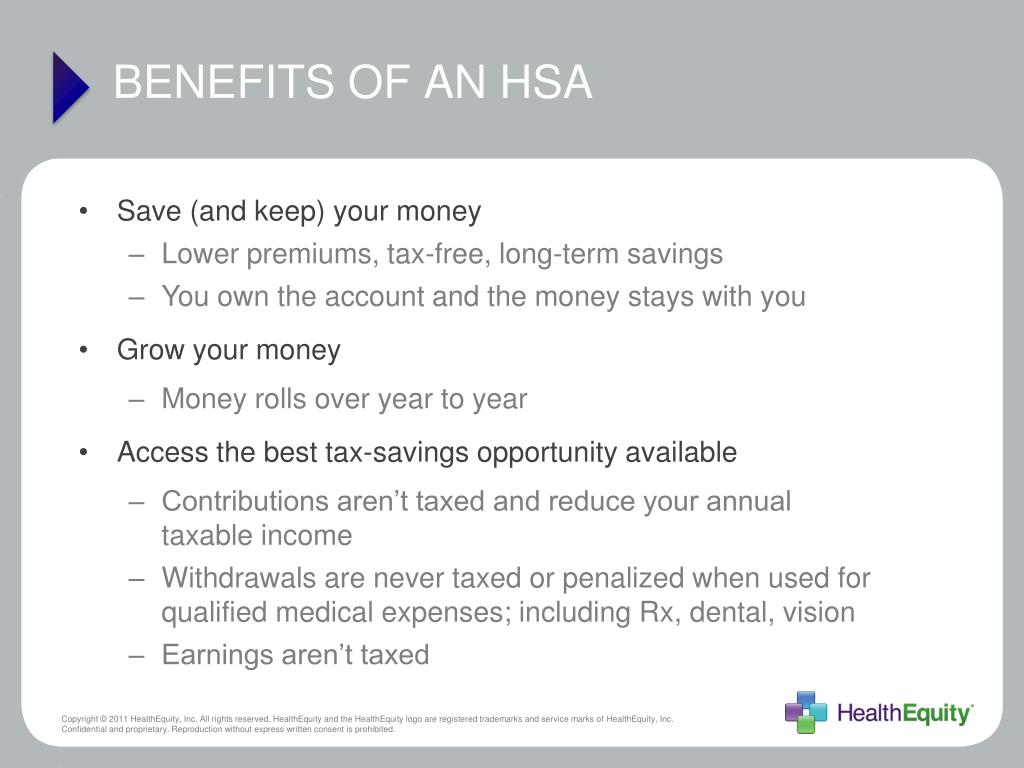

Your HSA funds can be used tax free to pay for qualified medical expenses In addition your HSA contributions earn tax free interest and carry over from year to year even if You can set aside pretax money in your HSA and then use it to pay for medical expenses such as deductibles or copayments Paying for medical care with

What Is An HSA How Does It Work The Difference Card

https://www.differencecard.com/wp-content/uploads/2021/08/03-How-Can-You-Use-HSA-Funds-Pinterest-476x1024.png

HSA Qualified Medical Expenses

https://s2.studylib.net/store/data/012820623_1-1132dc89d22ae76677bae033049228ca.png

https://money.stackexchange.com/questions/57190

If you use a distribution from your HSA for qualified medical expenses you do not pay tax on the distribution but you have to report the distribution on Form 8889 There is nothing about the timing of contributions versus distributions

https://communications.fidelity.com/pdf/wi/pay-with-hsa.pdf

Generally you can t use your HSA to pay for expenses that don t meaningfully promote the proper function of the body or prevent or treat illness or disease Nutritional supplements

How To Set Up Get The Most From A Health Savings Account HSA

What Is An HSA How Does It Work The Difference Card

Health Savings Accounts HSAs Explained The Motley Fool

Guide To HSA Withdrawal Rules Health Savings Accounts Lively

How Does An HSA Work The Ultimate HSA Guide Personal Finance Club

Can You Use An FSA Or HSA To Pay For Medical Cards And Cannabis

Can You Use An FSA Or HSA To Pay For Medical Cards And Cannabis

PPT Health Savings Accounts HSA Basics PowerPoint Presentation

Are You Healthy I HOPE You re Using An HSA Pacific Crest Management

Ask Bob Can I Rollover Money In My IRA Or 401 k To An HSA

Can You Use Hsa To Pay For Medical Bills - Your health savings account HSA can be used to pay for many medical expenses approved by the Internal Revenue Service This includes qualified health