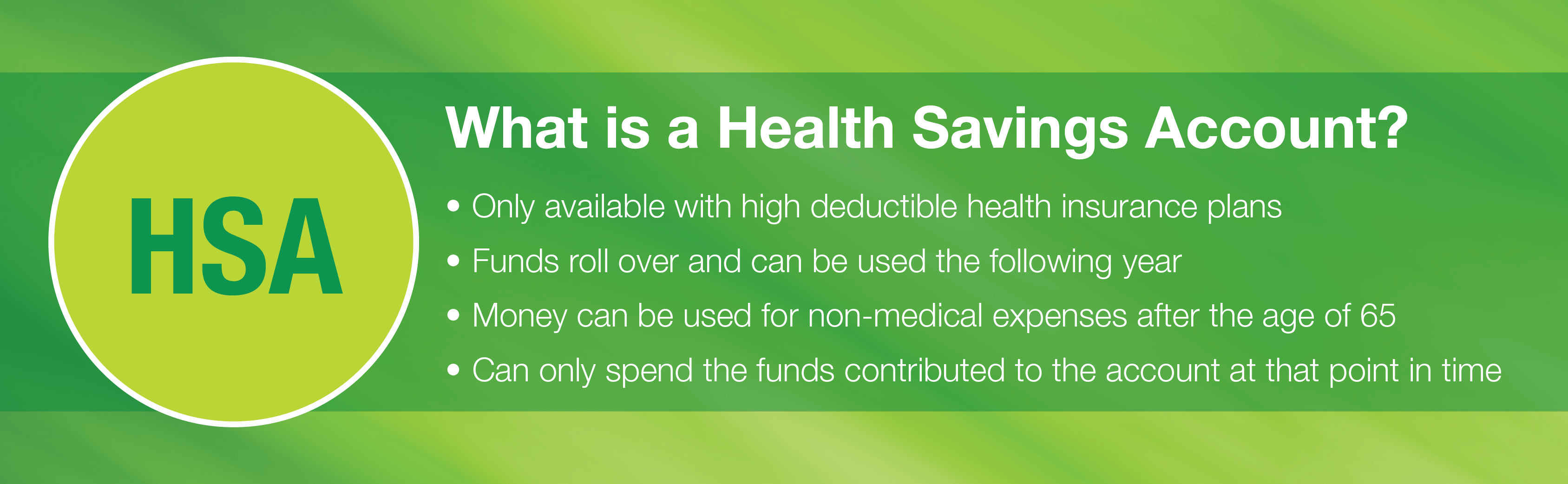

Can You Write Off Medical Expenses Paid With Hsa The IRS won t let you deduct medical expenses paid with HSA or MSA funds Those funds are already tax free and deducting them as medical expenses

Similarly any medical expenses paid from a flexible spending account a health savings account HSA or a health reimbursement arrangement aren t included in the itemized deduction for Expenses for medical care under section 213 of the Code also are eligible to be paid or reimbursed under an HSA FSA Archer MSA or HRA However if any

Can You Write Off Medical Expenses Paid With Hsa

/GettyImages-88305470-56fb095d5f9b5829867a30b3.jpg)

Can You Write Off Medical Expenses Paid With Hsa

https://www.verywellhealth.com/thmb/fAVfipbrUZcRFSKdHmy_9V5GwNI=/3899x2557/filters:fill(87E3EF,1)/GettyImages-88305470-56fb095d5f9b5829867a30b3.jpg

Written By Diane Kennedy CPA On July 19 2023

https://www.ustaxaid.com/wp-content/uploads/2023/07/1684488-1536x1024.jpg

Medigap Premiums Be Paid With HSA Medicare And Health Savings Accounts

https://centurymedicare.com/wp-content/uploads/2022/10/5ddc22e8c8721f89f484f263_bcg-HSA.jpg

To clarify an important point You can t do both as that would be double dipping the money in your HSA is already pre tax so if you use HSA funds to pay your medical Revenue Procedure 2021 45 November 10 2021 provides that for tax years beginning in 2022 the dollar limitation under section 125 i on voluntary employee salary reductions

You can only deduct your total medical expenses that exceed 7 5 of your adjusted gross income AGI For example if your AGI is 100 000 and you have Medical expenses can take a big bite out of your wallet But two special accounts the health savings account HSA and the health flexible spending account FSA can be good

Download Can You Write Off Medical Expenses Paid With Hsa

More picture related to Can You Write Off Medical Expenses Paid With Hsa

Medical Expenses Tax Back Get 20 Tax Back Today My Tax Rebate

https://www.mytaxrebate.ie/wp-content/uploads/2020/09/Medical-Expenses-Blog-Image-e1602500412593.png

5 Things To Know About Health Savings Accounts ThinkHealth

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

Can I Write Off Medical Expenses Canada Lead Chile

https://www.leadchile.cl/wp-content/uploads/2023/01/can-i-write-off-medical-expenses-canada.png

A Health Savings Account HSA can help you reduce your taxable income and you can use it to pay for or reimburse yourself for medical expenses Are you eligible for one If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental

But can you pay off that medical credit card debt using a tax advantaged medical savings account like an HSA or FSA In short yes but it s important to keep You can t write off any medical expenses or dental expenses that were reimbursed by insurance or paid for with funds from a health savings account HSA or

Medical Expense Deductions Flexible Spending Accounts Bethesda CPA

https://www.cbmcpa.com/wp-content/uploads/2022/05/Blog-Header-Medical-Costs-Can-I-Really-Get-a-Tax-Break-for-That.png

What s The Difference Between An HSA FSA And HRA Medical Health

https://i.pinimg.com/originals/aa/77/4b/aa774bbfaa51f1cf3e4e1c3926cd8443.jpg

/GettyImages-88305470-56fb095d5f9b5829867a30b3.jpg?w=186)

https://ttlc.intuit.com/turbotax-support/en-us/...

The IRS won t let you deduct medical expenses paid with HSA or MSA funds Those funds are already tax free and deducting them as medical expenses

https://www.thebalancemoney.com/med…

Similarly any medical expenses paid from a flexible spending account a health savings account HSA or a health reimbursement arrangement aren t included in the itemized deduction for

The Deductions You Can Claim Hra Tax Vrogue

Medical Expense Deductions Flexible Spending Accounts Bethesda CPA

E File Form 1099 SA 2022 File Form 1099 SA Online

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

What Is Fsa hra Eligible Health Care Expenses Judson Lister

Can I Write Off Medical Expenses Canada 27F Chilean Way

Write Off Health Expenses Whaaaat Kelowna Investment Brokerage

Write Off Health Expenses Whaaaat Kelowna Investment Brokerage

:max_bytes(150000):strip_icc()/rules-having-health-savings-account-hsa_final-58180fce30aa4fe8b278b4137e8ccb48.png)

Health Savings Account HSA Rules And Limits

Should I Itemize My Medical Expenses Or Use The Money In My HSA

HOW TO WRITE OFF MEDICAL EXPENSES AS BUSINESS DEDUCTION LEGITIMATELY

Can You Write Off Medical Expenses Paid With Hsa - You can only deduct your total medical expenses that exceed 7 5 of your adjusted gross income AGI For example if your AGI is 100 000 and you have