Can You Write Off Mortgage Interest On Investment Property You can only deduct mortgage interest and repairs you make that restore the property to its original minimally functional condition You can t deduct capital investments like new buildings additions or renovations

In no necessary order we ll run through the various expenses that real estate investors can deduct Interest Financing interest incurred on loans credit lines and mortgages can be deducted These financing charges are related to the acquisition of properties Mortgage interest goes on Form 1098 Other interest expenses go on Mortgage interest is a popular rental property deduction You can usually deduct mortgage interest as a business expense for investment properties like a rental How to calculate rental mortgage interest Your mortgage company sends you an IRS Form 1098 each year showing how much you ve paid in interest throughout the year

Can You Write Off Mortgage Interest On Investment Property

Can You Write Off Mortgage Interest On Investment Property

https://armstrongadvisory.com/wp-content/uploads/2019/07/MortgageRateHeader-e1564147573470.jpeg

How Can You Write Off Mortgage Interest On Taxes

https://mortgagenewschannel.com/wp-content/uploads/2021/10/write-off-mortgage-interest-img.jpg

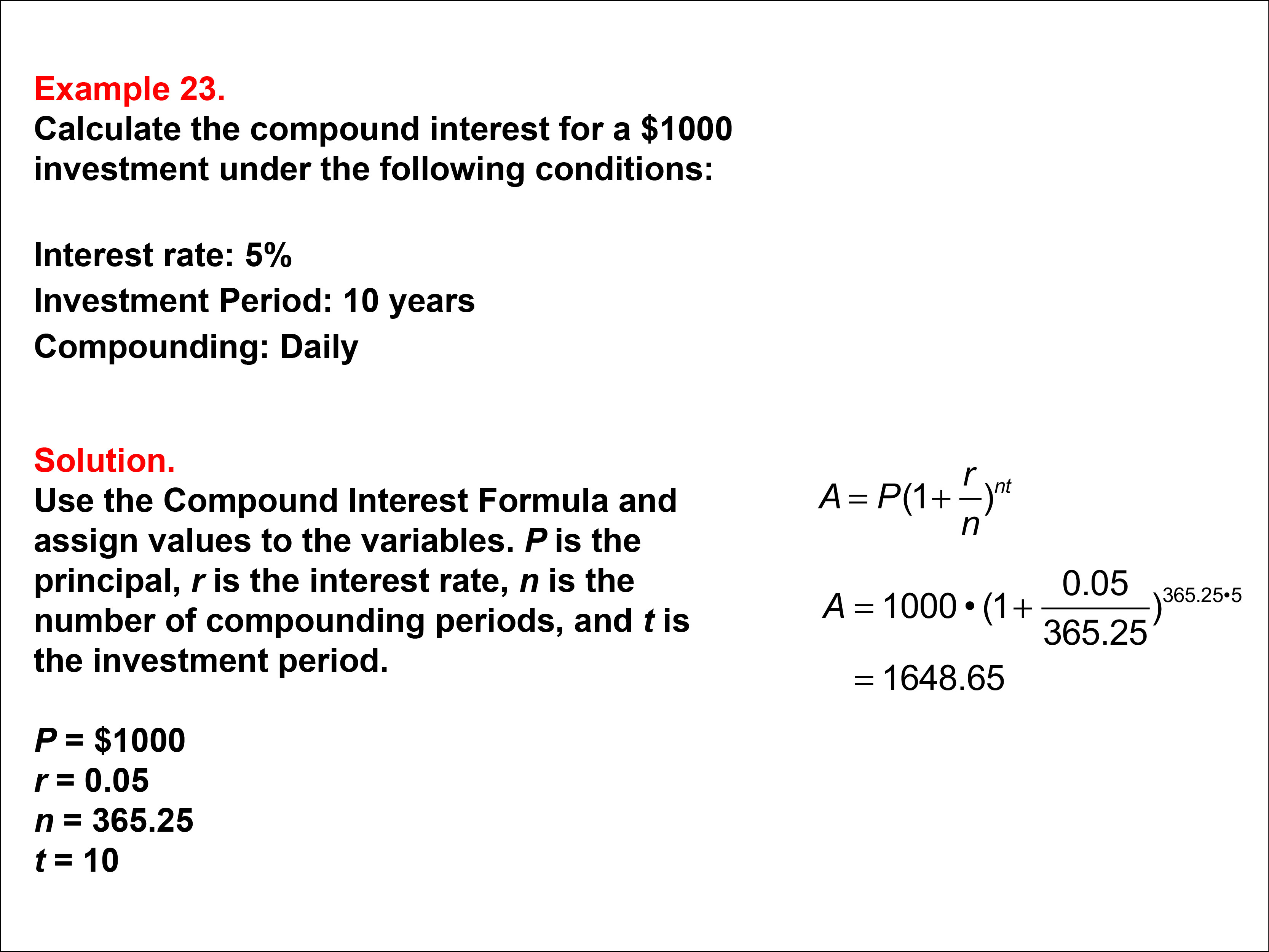

Student Tutorial Compound Interest Media4Math

https://www.media4math.com/sites/default/files/library_asset/images/CompoundInterest23.jpg

The interest on that loan is investment interest It wouldn t be deductible as mortgage interest because you didn t use the money to buy build or improve your home If you use only part of the borrowed money for investments you can deduct only a proportional amount of the interest you pay Back to the main question that most investors ask is if they can deduct mortgage interest on an investment property The simple answer is NO The mortgage interest deduction only applies to homeowners and rental properties provided they meet the requirements

What Deductions Can I Take as an Owner of Rental Property If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest property tax operating expenses depreciation and repairs You can deduct the If you did use all or part of any mortgage proceeds for business investment or other deductible activities the part of the interest on line 16 that is allocable to those activities can be deducted as business investment or other deductible expense subject to any limits that apply

Download Can You Write Off Mortgage Interest On Investment Property

More picture related to Can You Write Off Mortgage Interest On Investment Property

Hecht Group Mortgage Rates For Commercial Property In The United States

https://img.hechtgroup.com/what_are_the_fixed_mortgage_rates_on_commercial_property.jpg

How To Calculate Interest Using Apr Haiper

https://www.wikihow.com/images/6/6d/Calculate-Mortgage-Interest-Step-14.jpg

57 Can You Write Off Mortgage Interest On A Rental Property AidieAdebare

https://photos.zillowstatic.com/fp/58feafa3e8f5f3eb95b383ddddda14ed-cc_ft_1152.jpg

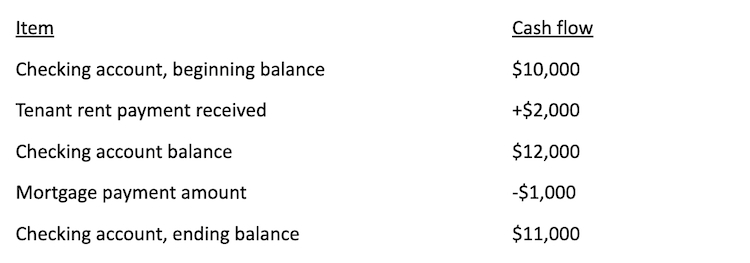

Written by Jeff Rohde Last updated on October 13 2021 The IRS allows real estate investors to offset rental income with closing costs unlike buying a personal residence While some closing costs on investment property can be written off right away others must be added to your property basis and expensed out as part of depreciation As a rental property investor you can deduct the interest part of your mortgage payment but not the principal payments because those are used to reduce the mortgage loan liability on the property balance sheet Each year your lender will issue a Form 1098 to report the interest paid on the loan throughout the year Mortgage Points

The answer is yes You can deduct mortgage interest on rental property as a business expense This can potentially reduce your taxable income and save you money on taxes To be eligible for the deduction the property must be held for income production and be available for rent In general yes You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home

5 Tips For Financing Investment Property TLOA Mortgage

https://tloamortgage.com/wp-content/uploads/2020/06/investment-property-loan-with-bad-credit-min-e1567016634203-scaled.jpg

Today s Best Mortgage Refinance Rates For October 2 2020 Money

https://img.money.com/2020/09/Mortgage-Rate-Oct-2.jpg?quality=85

https://www.zillow.com/learn/tax-on-investment-properties

You can only deduct mortgage interest and repairs you make that restore the property to its original minimally functional condition You can t deduct capital investments like new buildings additions or renovations

https://www.realized1031.com/blog/what-investment...

In no necessary order we ll run through the various expenses that real estate investors can deduct Interest Financing interest incurred on loans credit lines and mortgages can be deducted These financing charges are related to the acquisition of properties Mortgage interest goes on Form 1098 Other interest expenses go on

57 Can You Write Off Mortgage Interest On A Rental Property AidieAdebare

5 Tips For Financing Investment Property TLOA Mortgage

An infographic Of The Impact Of Interest Rate Increases Mortgage

Can I Write Off The Interest On A HELOC ThinkGlink

Weighing The Costs Of Property Taxes When Buying A Vacation Home

Compare Home Mortgage Interest Rates By Decade INFOGRAPHIC Denver

Compare Home Mortgage Interest Rates By Decade INFOGRAPHIC Denver

How To Claim Timeshare On Taxes Timeshare Release

The Chicago Real Estate Local Hello Mortgage Rates Are LOW Research

Mortgage Rates Jump Above 6 For First Time Since 2008 The New York Times

Can You Write Off Mortgage Interest On Investment Property - The mortgage interest deduction is a tax incentive for homeowners This itemized deduction allows homeowners to subtract mortgage interest from their taxable income lowering the amount of taxes they owe This deduction can also be taken on loans for second homes as long as it stays within IRS limits See What You Qualify For 0