Canada Corporate Tax Rate As a general rule corporations resident in Canada are subject to Canadian corporate income tax CIT on worldwide income Non resident corporations are subject to CIT on income derived from carrying on a business in Canada and on capital gains arising upon the disposition of taxable Canadian property see Capital gains in the

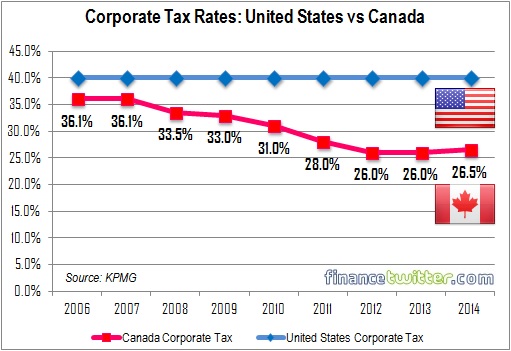

Federal and Provincial Territorial Tax Rates for Income Earned by a General Corporation 2024 and 2025 Current as of March 31 2024 Canadian corporate tax rates range from 26 5 to 31 similar to the USA s combined federal and state rates which average around 27 What are the tax benefits for small businesses in Canada A corporation s tax rate depends on its revenue operating location business structure and income sources

Canada Corporate Tax Rate

Canada Corporate Tax Rate

https://www.taxtips.ca/smallbusiness/corporatetax/corporate-tax-rates-2019.jpg

Canada Corporate Tax Rate 1981 2020 Data 2021 2022 Forecast

https://d3fy651gv2fhd3.cloudfront.net/charts/canada-corporate-tax-rate.png?s=cancorptax&v=202012212300V20200908

Canadian Tax Rates Www vrogue co

https://www.mondaq.com/images/article_images/452684.jpg

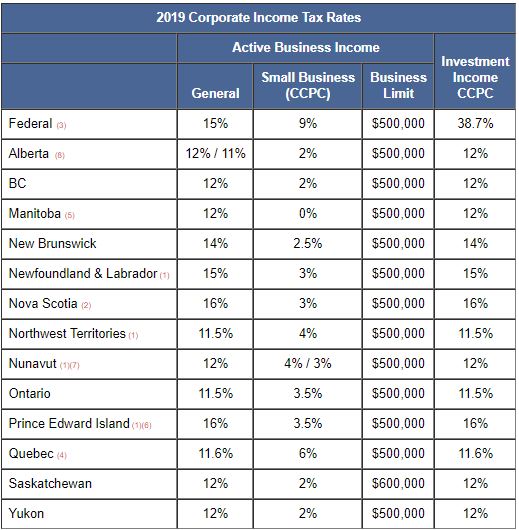

The rates shown are nominal tax rates as at April 16 2024 Add federal and provincial territorial rates to get a combined rate Rate and amount changes are set out in the notes and should be prorated for taxation years Corporation tax rates Get federal provincial or territorial rates and learn when to apply the lower or higher rate Provincial and territorial corporation tax What s new for corporations reporting tax and claiming credits and related forms and publications Federal tax credits Federal income tax credits you may be eligible to claim

In general the SBD is calculated based on the least of three amounts active business income earned in Canada taxable income and the small business income threshold 6 A general tax rate reduction is available on qualifying income The following table shows the general and small business corporate income tax rates federally and for each province and territory for 2022 The small business rates are the applicable rates after deducting the small business deduction SBD which is available to Canadian controlled private corporations CCPCs

Download Canada Corporate Tax Rate

More picture related to Canada Corporate Tax Rate

Canada s Corporate Tax Cuts Prompt Companies To Hoard Cash Not Hire

https://s-i.huffpost.com/gen/477531/CANADA-CORPORATE-TAX-RATE.jpg

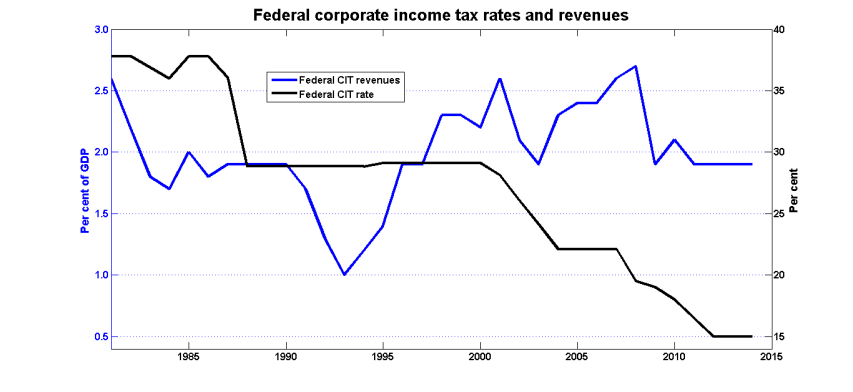

CANADIAN CORPORATE INCOME TAX RATE VS REVENUE AS OF GDP BASED ON

https://www.researchgate.net/profile/Jack_Mintz/publication/256049106/figure/download/fig2/AS:669408762544131@1536610894602/CANADIAN-CORPORATE-INCOME-TAX-RATE-VS-REVENUE-AS-OF-GDP-BASED-ON-STATISTICS-CANADA.png

Canada Corporate Tax Rate 2024 Take profit

https://img.take-profit.org/graphs/indicators/corporate-tax-rate/corporate-tax-rate-canada.png

Information for individuals and businesses on rates such as federal and provincial territorial tax rates prescribed interest rates EI rates corporation tax rates excise tax rates and more The general corporate tax rate on business income the net tax rate after the general tax reduction is 15 For Canadian Controlled Private Corporations CCPCs s eligible Small Business Deduction SBD the net tax rate 9 as of January 1 2019

[desc-10] [desc-11]

TaxTips ca Business 2022 Corporate Income Tax Rates

https://www.taxtips.ca/smallbusiness/corporatetax/corporate-tax-rates-2022.jpg

The Winnipeg RAG Review Brian Pallister Slickest NDP Foe In A Decade

http://2.bp.blogspot.com/-QBVKCALrcKQ/UANwj7cmvLI/AAAAAAAAAa0/PAnqaFqCNRU/s1600/Provincial+Corporate+Tax+Rates.jpg

https://taxsummaries.pwc.com/canada/corporate/...

As a general rule corporations resident in Canada are subject to Canadian corporate income tax CIT on worldwide income Non resident corporations are subject to CIT on income derived from carrying on a business in Canada and on capital gains arising upon the disposition of taxable Canadian property see Capital gains in the

https://kpmg.com/ca/en/home/services/tax/tax-facts/...

Federal and Provincial Territorial Tax Rates for Income Earned by a General Corporation 2024 and 2025 Current as of March 31 2024

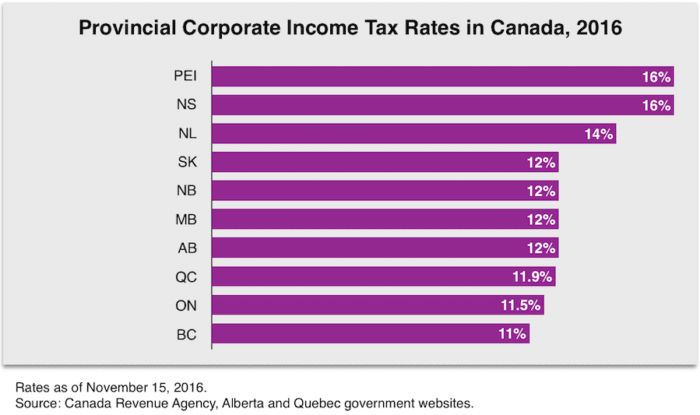

August 2015 Quotulatiousness

TaxTips ca Business 2022 Corporate Income Tax Rates

BC Tax Commission Focuses On Business And Not The Rest Of Us Policy Note

2021 Provincial Tax Rates Frontier Centre For Public Policy

Corporate Taxes Low Rates High Revenues In Canada Downsizing The

Canada Corporate Tax Rate Forecast

Canada Corporate Tax Rate Forecast

Corporate Tax Definition And Meaning Market Business News

2023 Corporate Tax Rates And Small Business Tax Rates In Canada

Here re The Reasons For The Burger King Tim Hortons Combo Deal It s

Canada Corporate Tax Rate - [desc-14]