Canada Gst Rebate Rental This guide provides information for landlords of new residential rental properties on how to apply for the GST HST new residential rental property rebate It includes instructions for completing Form GST524 GST HST New Residential Rental Property Rebate

On September 14 2023 the Prime Minister announced that the government will introduce legislation to enhance the Goods and Services Tax GST Rental Rebate on new purpose built rental housing to incentivize construction of much needed rental homes for Canadians The enhanced rebate will relieve builders of their obligation to pay the federal component of GST HST on newly constructed multi unit rental properties It will be available to eligible projects that begin construction after September 13 2023 and before January 1 2031 and complete construction by December 31 2035

Canada Gst Rebate Rental

Canada Gst Rebate Rental

https://sqicpa.com/wp-content/uploads/2018/09/GST-HST-Rebate-1-e1537821386125.png

Feds Temporary Boost To GST Rebate Will Help During High Inflation

https://www.nationalobserver.com/sites/nationalobserver.com/files/styles/article_header_xl/public/img/2022/09/14/e28716eec22252892070e8135bdaa05d7d100a22f1922e7264620b1091a4cdbb.jpg?itok=NK8tVZen

Top 5 Questions About The GST HST Housing Rebate

https://my-rebate.ca/wp-content/uploads/2021/03/shutterstock_745359235-1-768x509.jpg

The existing GST rental rebate has a phase out for qualifying residential units valued between 350k and 450k with no rebate available for units valued at 450k or more The bill would amend the Excise Tax Act to implement certain enhancements to the GST new residential rental property rebate GST rental rebate which Prime Minister Justin Trudeau announced on 14 September 2023 It also proposes changes to the Competition Act which focuses on the grocery sector

The draft legislation under Bill C 56 proposes changes to Section 256 2 of the Excise Tax Act to enhance the GST rental rebate on new purpose built rental housing including apartment buildings student housing and senior residences built specifically for long term rental accommodation Last year the Department of Finance announced a new enhanced GST rental property rebate for purpose built rental properties such as apartment buildings student housing and seniors residences

Download Canada Gst Rebate Rental

More picture related to Canada Gst Rebate Rental

HST New Rental Property Rebate Program HST Rebate For Landlords

https://www.stratosconsultants.ca/wp-content/uploads/bb-plugin/cache/HST-New-Rental-Property-Rebate-Program-1024x683-landscape.jpg

New Condo HST Rebates Sproule Associates

https://my-rebate.ca/wp-content/uploads/2022/09/34372240_new-condo-building-construction-in-progress_900x600.jpg

The 2022 GST Canada Rebate The Dark Truth Not Many Know

https://www.gatewaytax.ca/wp-content/uploads/2022/09/The-New-GST-Canada-Tax-Rebate-Featured-Image-1024x576.png

To help address a growing shortage of rental housing the Canadian government announced on September 14 2023 an enhancement to the Goods and Services Tax Rental Rebate GST Rental Rebate commonly referred to as the landlord s rebate An enhanced rebate is proposed to be available to landlords of new residential rental buildings as the federal government announces relief for the goods and services tax GST on the construction of purpose built rental housing

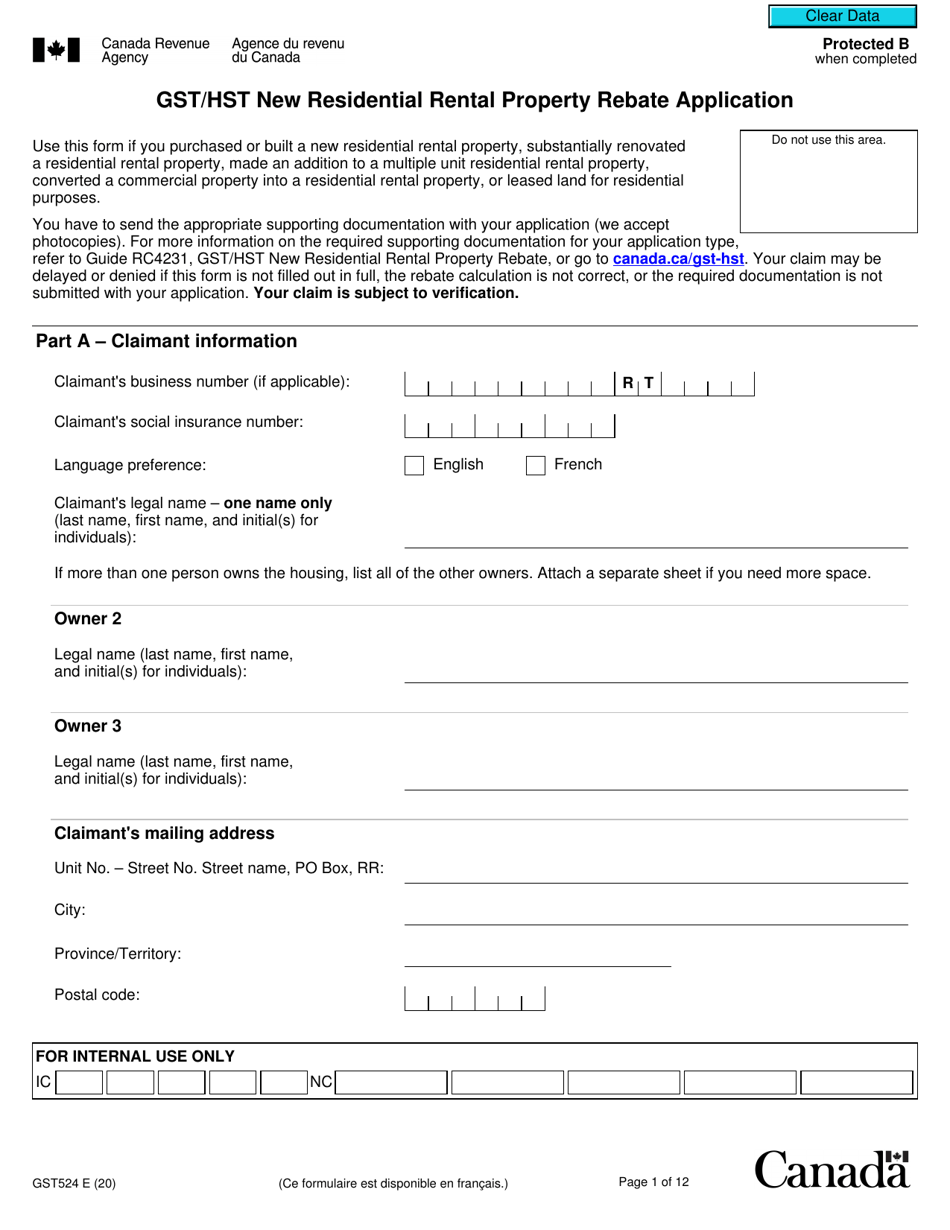

The Government of Canada is providing a 100 rebate of the Goods and Services Tax GST or the federal portion of the Harmonized Sales Tax HST on new purpose built rental housing PBRH All applicants must complete Form GST524 GST HST New Residential Rental Property Rebate Application Depending on the specific situation under which you qualify you may need to complete additional forms and applications

![]()

Claiming The New Residential Rental Property Rebate 2022 TurboTax

https://bclgcommunity.com/037ec6b5/https/09b942/turbotax.intuit.ca/tips/images/rawpixel-1053187-unsplash-683x470.jpg

HST Rebate Calculator GST HST Rebate Experts Sproule Associates

https://www.my-rebate.ca/wp-content/uploads/2020/08/Hero-Image-3-1024x683.jpg

https://www.canada.ca › en › revenue-agency › services › ...

This guide provides information for landlords of new residential rental properties on how to apply for the GST HST new residential rental property rebate It includes instructions for completing Form GST524 GST HST New Residential Rental Property Rebate

https://www.canada.ca › en › department-finance › news › ...

On September 14 2023 the Prime Minister announced that the government will introduce legislation to enhance the Goods and Services Tax GST Rental Rebate on new purpose built rental housing to incentivize construction of much needed rental homes for Canadians

What Is The GST HST New Housing Rebate Rental Rebate And How To Receive

Claiming The New Residential Rental Property Rebate 2022 TurboTax

Canadians Eligible For GST Credit Expected To Receive grocery Rebate

HST Rebate For New Condo New Rental Property Purchase

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

Liberals To Hike GST Rebate Rental Allowances But Announcement Delayed

Liberals To Hike GST Rebate Rental Allowances But Announcement Delayed

New Home HST GST Rebate By Nadene Milnes Issuu

The HST GST Rebate And One s Primary Place Of Residence

Canada s Enhanced GST Rental Rebate Program REMI Network

Canada Gst Rebate Rental - The Department of Finance originally announced GST relief on new residential rental construction on September 14 2023 The core legislation relating to the enhanced GST rebate came as part of Bill C 56 which received Royal Assent on December 15 2023