Canada Tax Deductions For Home Business Business tax fees licences and dues You can deduct any annual licence fees and some business taxes you incur to run your business You can also deduct

Explore the tax deductions available for home based businesses in Canada to help you maximize profitability and reduce taxable income Can I get tax deductions If you re using your home as your primary place of business and not conducting business somewhere else on top of that then you re

Canada Tax Deductions For Home Business

Canada Tax Deductions For Home Business

https://db-excel.com/wp-content/uploads/2019/09/spreadsheet-for-tax-expenses-then-rental-property-tax-768x994.jpg

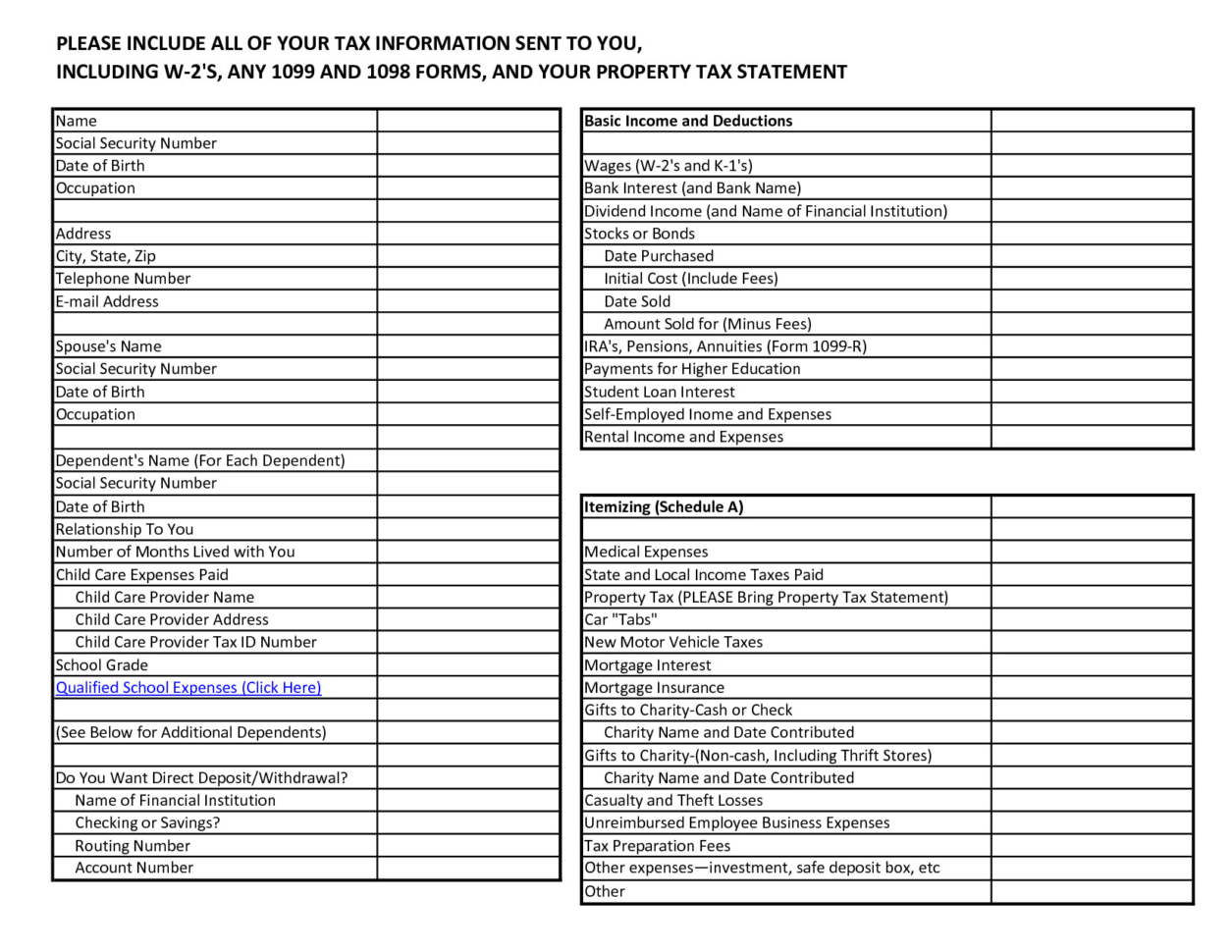

Printable Itemized Deductions Worksheet

https://www.pdffiller.com/preview/391/382/391382225/large.png

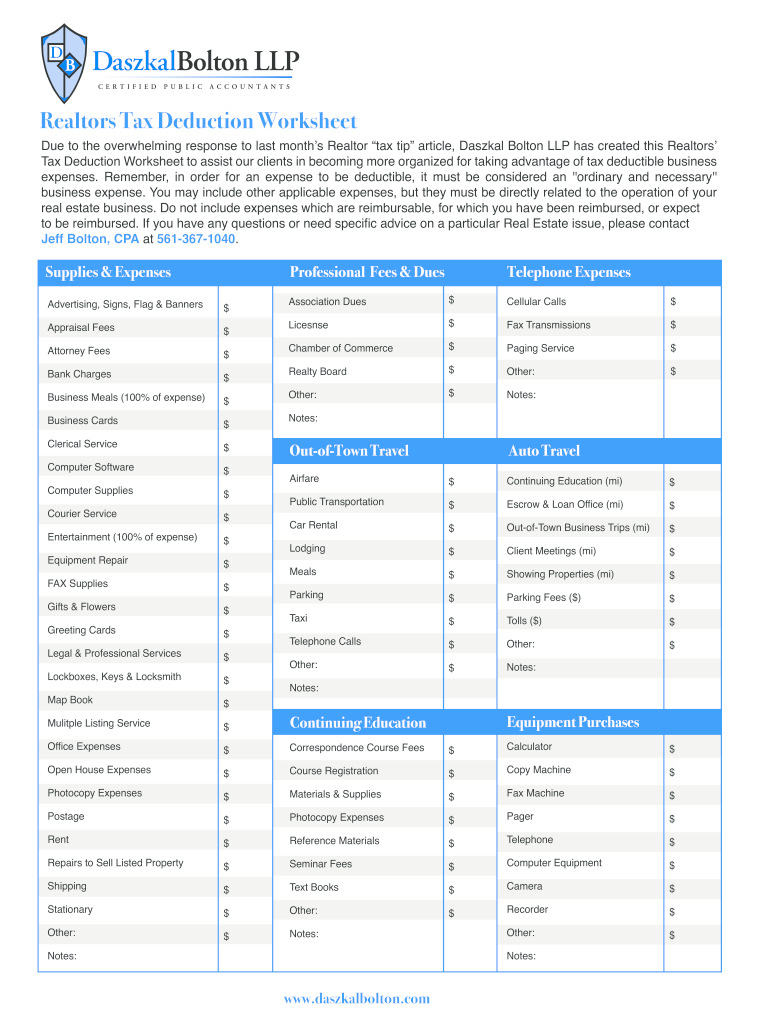

Possible Tax Deductions Worksheet

http://db-excel.com/wp-content/uploads/2019/01/1099-expense-spreadsheet-in-business-tax-deductions-worksheet-inspirational-50-unique-business-1255x970.png

The Canada Revenue Agency CRA allows you to deduct expenses for the business use of your home if it is your main place of business or if you use the space to earn your business income Here s For over a year many Canadians have worked from home due to the pandemic lockdowns But if you worked from home because you run a home based

Canadian home based business owners may be eligible for tax deductions that can lower their taxable income Understanding the specific criteria and Are you fully self employed and working out of your home or are you an employee who works from home at the request or offering of your employer In both

Download Canada Tax Deductions For Home Business

More picture related to Canada Tax Deductions For Home Business

The Best Category Of All Small Categories Ideas Blog Sport Global News

https://i.pinimg.com/736x/30/a9/78/30a978df70e08068f97de9f1005aea7c.jpg

Photographer Tax Deduction Worksheet

https://www.signnow.com/preview/100/284/100284604/large.png

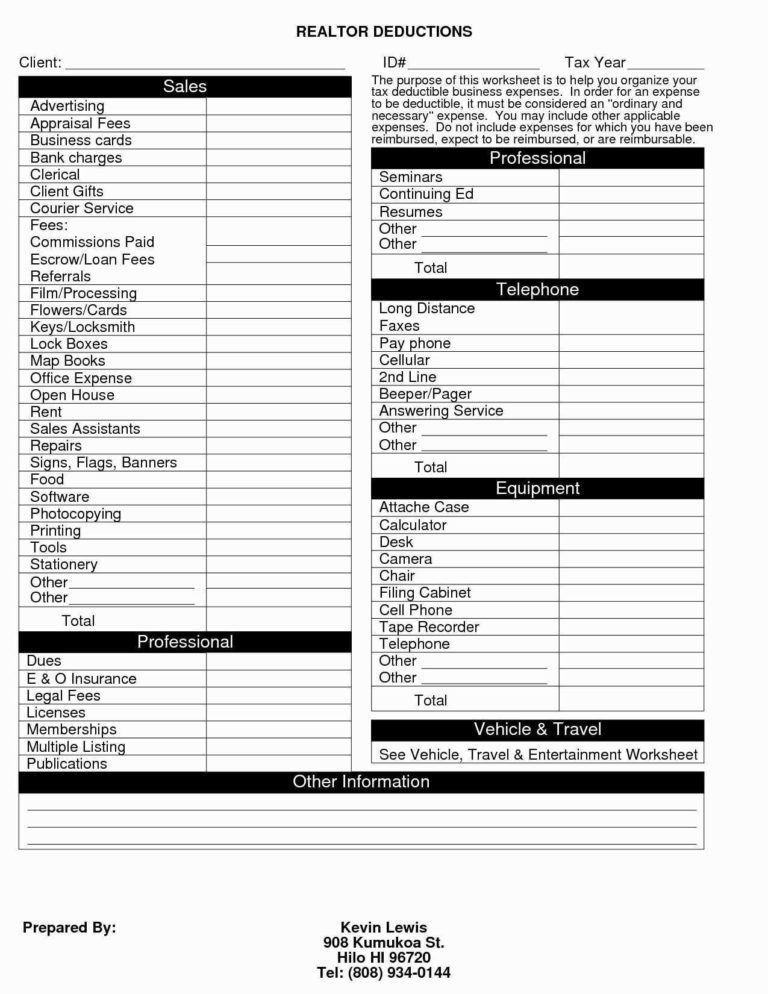

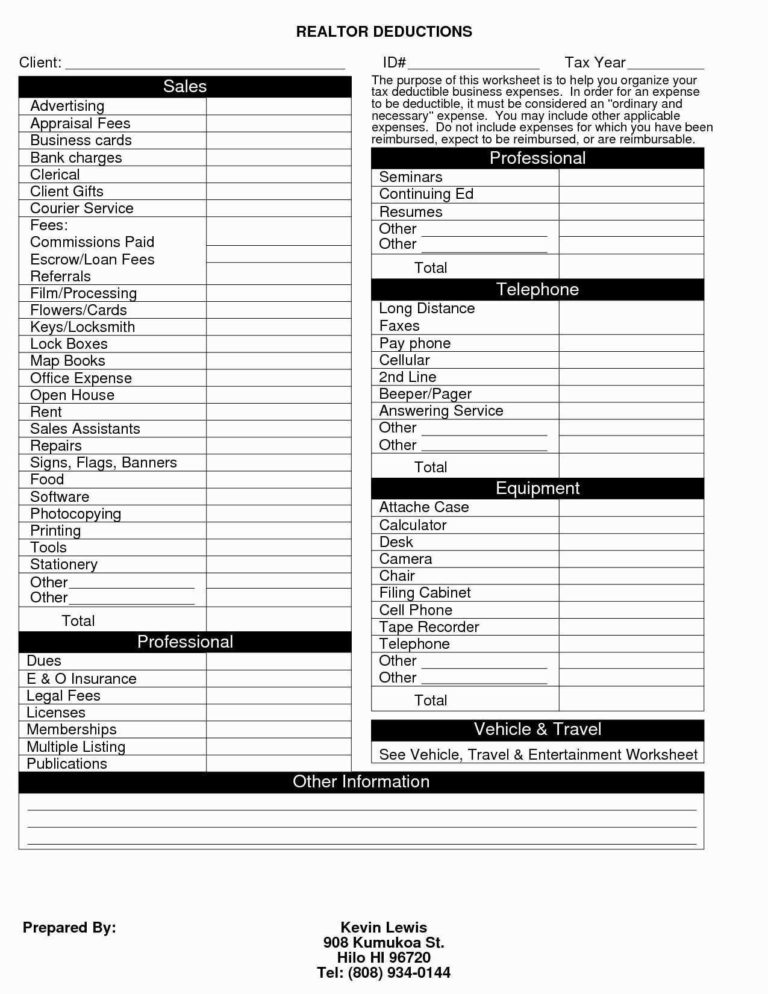

Real Estate Agent Tax Deductions Worksheet

https://i.pinimg.com/originals/16/16/86/161686673757e7aaf5dba85fa41be0ed.jpg

Common Small Business Tax Deductions Business Use of Home If you operate your business from a room in your home you may be eligible to claim part of your home Dec 11 2023 Operating a business from home in Canada mirrors the tax obligations of traditional businesses with regard to income taxes Provided you have earnings to

That means you are able to deduct 20 of many home expenses as home office expenses on your tax return You can deduct some expenses for heat electricity insurance Expenses for heat electricity insurance maintenance mortgage interest and property taxes are tax deductible For home offices utility tax deductions must be

![]()

Real Estate Agent Commission Spreadsheet With Realtor Expense Tracking

https://db-excel.com/wp-content/uploads/2019/01/real-estate-agent-commission-spreadsheet-with-realtor-expense-tracking-spreadsheet-fresh-tax-deduction-cheat-sheet-768x994.png

Excel Tax Deduction Template

https://newdocer.cache.wpscdn.com/photo/20191025/a893d00e6a764d2f9dbbb7838baa295d.jpg

https://www.canada.ca/en/revenue-agency/services...

Business tax fees licences and dues You can deduct any annual licence fees and some business taxes you incur to run your business You can also deduct

https://homebusinessmag.com/money/taxing-times/top...

Explore the tax deductions available for home based businesses in Canada to help you maximize profitability and reduce taxable income

Self Employed Tax Prep Checklist Download 2022 TurboTax Canada Tips

Real Estate Agent Commission Spreadsheet With Realtor Expense Tracking

10 Small Business Tax Deductions Worksheet Worksheets Decoomo

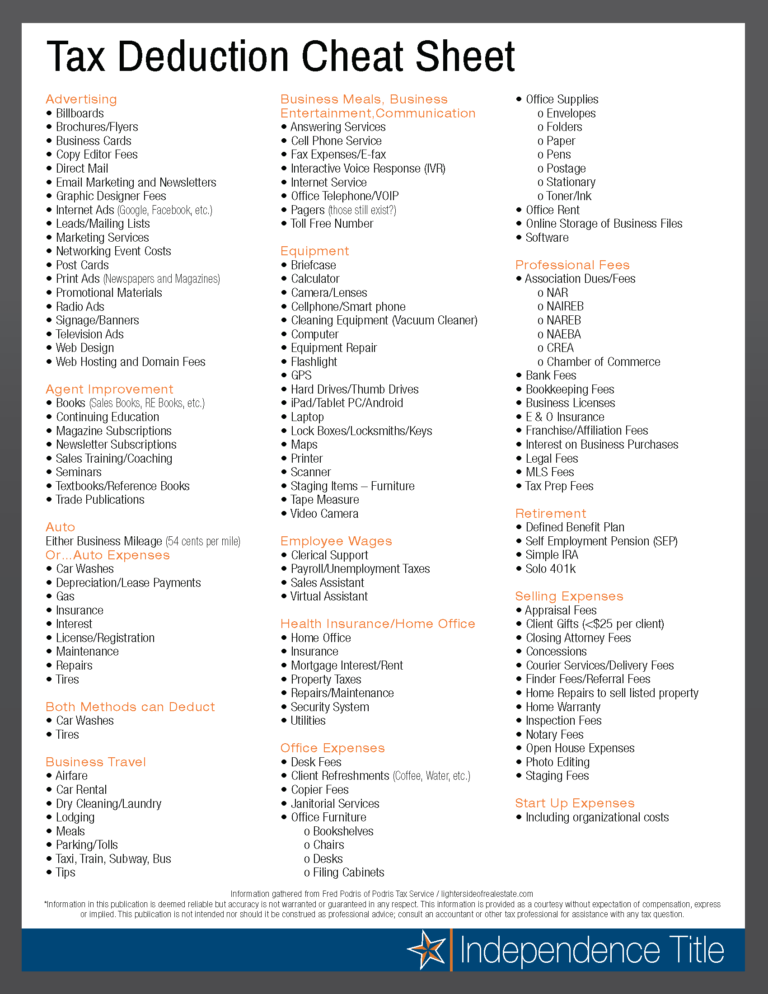

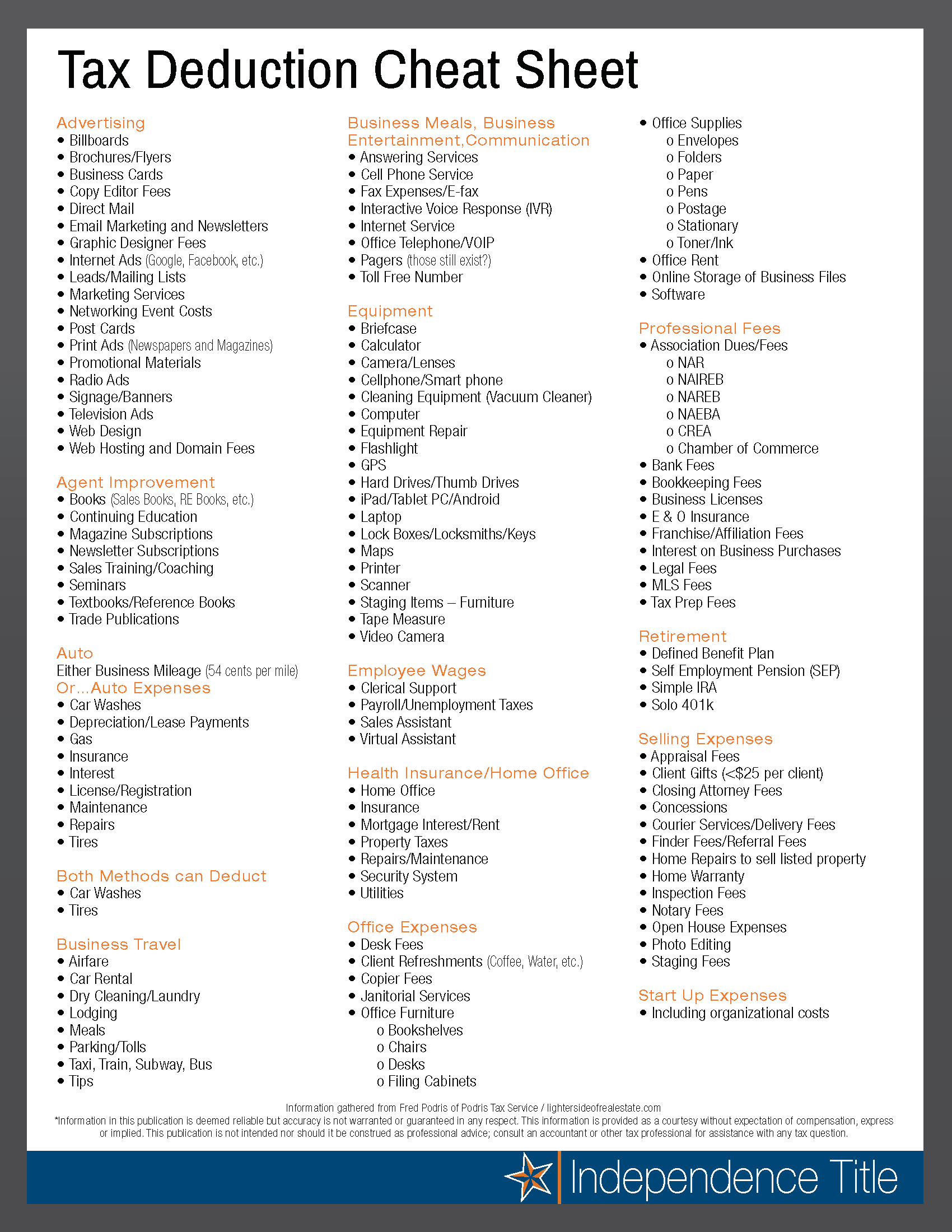

Tax Deduction Cheat Sheet For Real Estate Agents Db excel

Itemized Deductions List Fill Out Sign Online DocHub

List Of Tax Deductions For Self Employed

List Of Tax Deductions For Self Employed

Tax Deduction Spreadsheet Throughout Tax Deduction Cheat Sheet For Real

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Free Tax Preparation Worksheets

Canada Tax Deductions For Home Business - If your home office qualifies for the tax deduction you can claim a portion of your household expenses For example if your home office takes up 10 percent of