Canada Tax Return Form T691 Complete Form T691 to calculate your claim for minimum tax carryover and enter the result on line 40427 of your return If you are filing electronically keep your Form T691 for your

If you reported or claimed any of the following on your return you ll need to complete form T691 to determine whether you ll need to pay minimum tax Taxable capital gain Loss You ve won extra paperwork aka Form T691 see link above In 2023 and previous years the AMT is and has been a flat 15 on adjusted taxable income with a standard

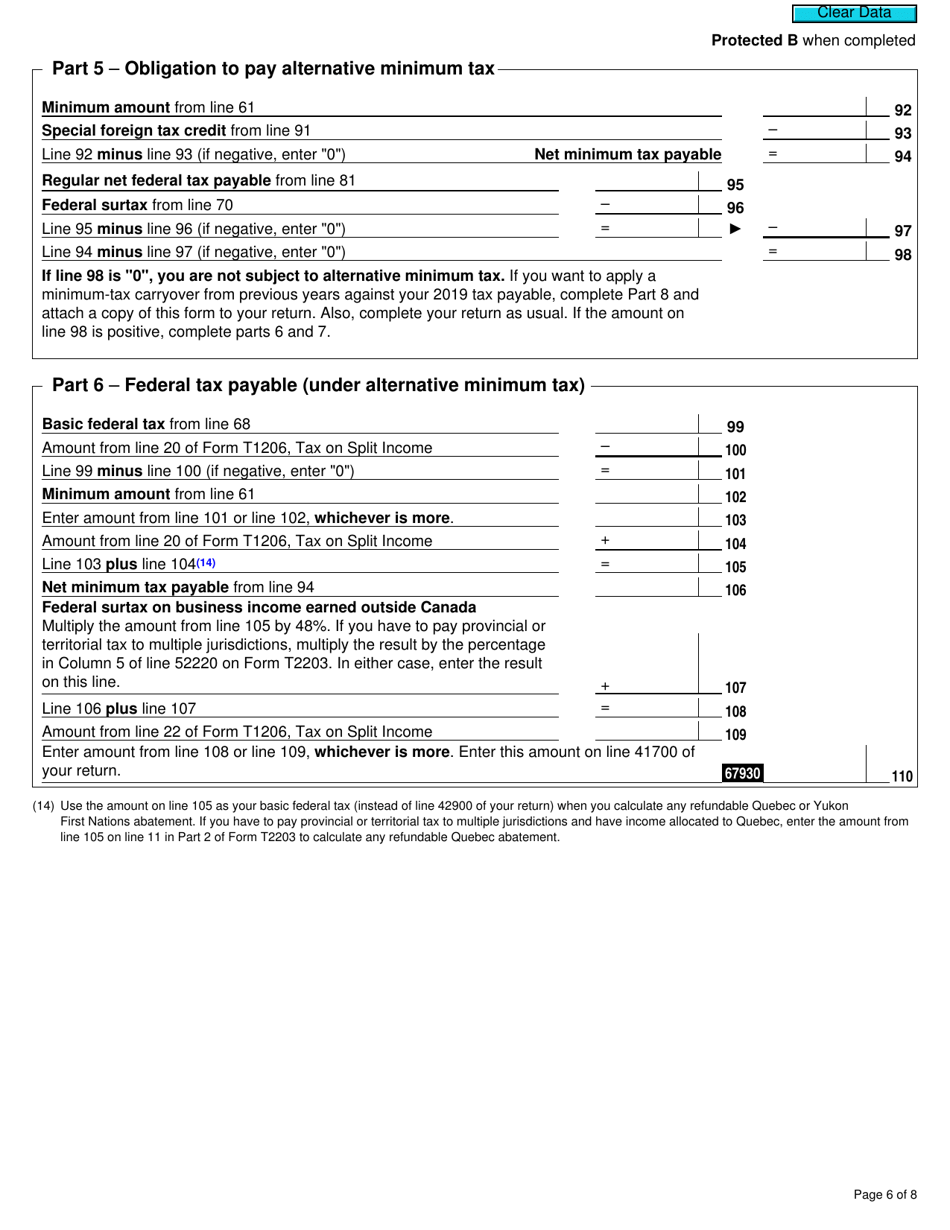

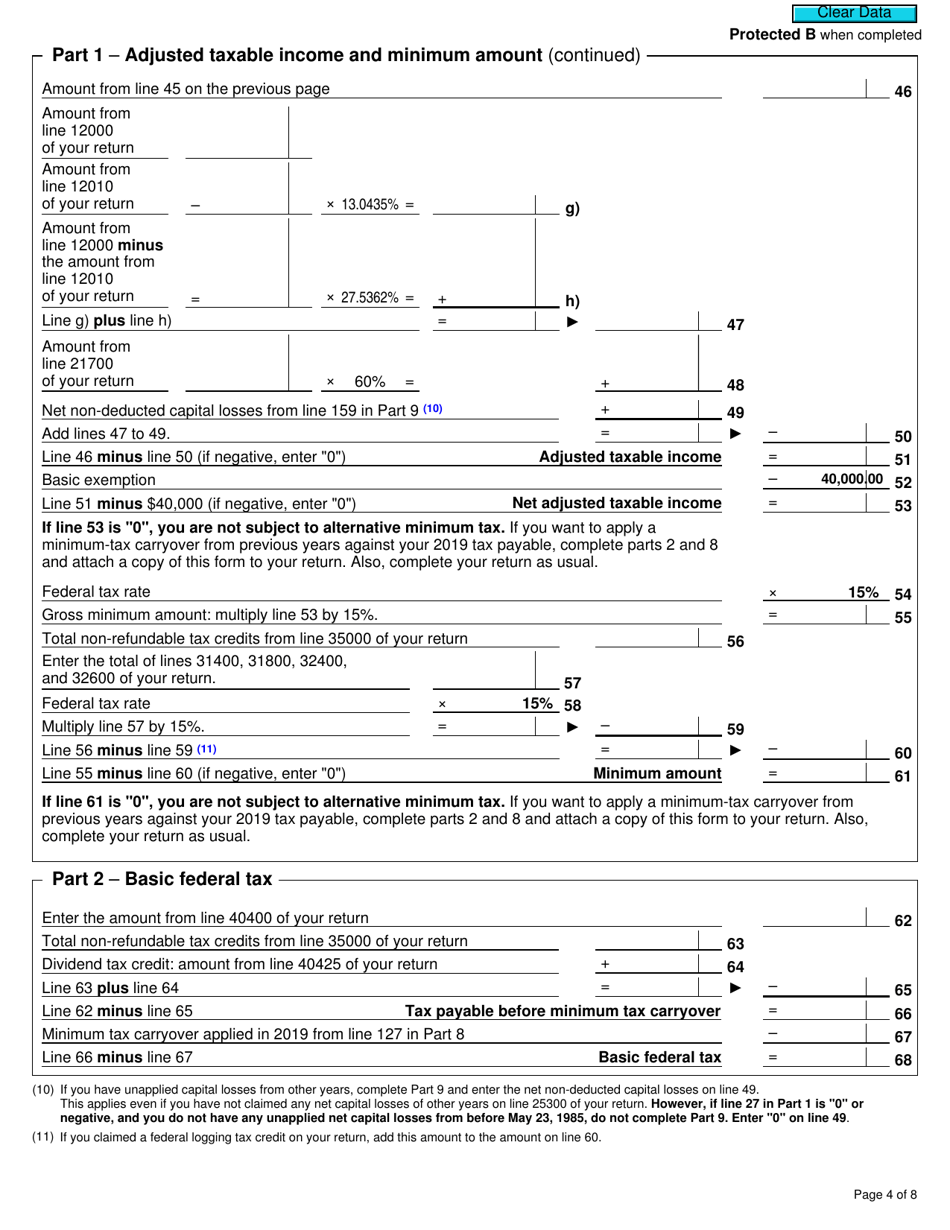

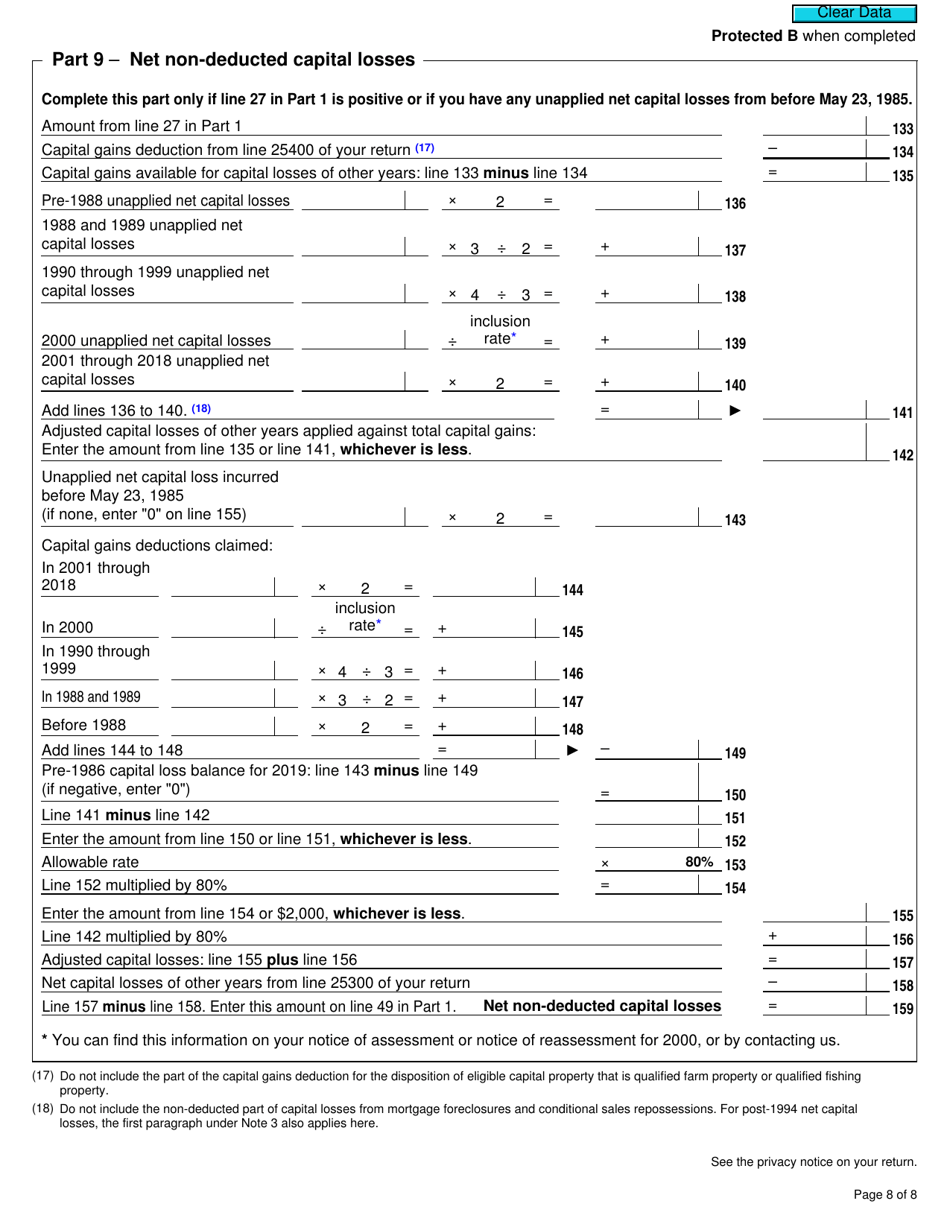

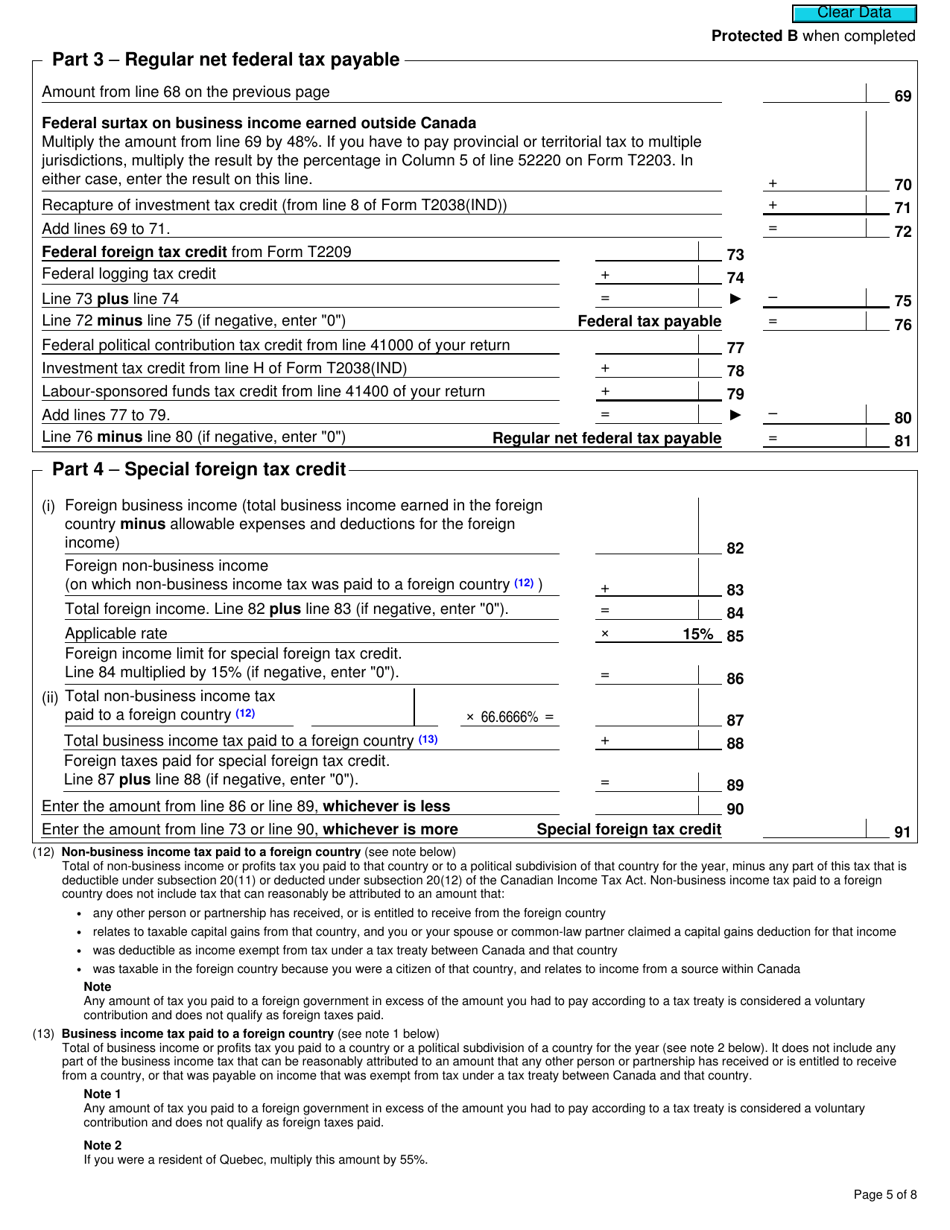

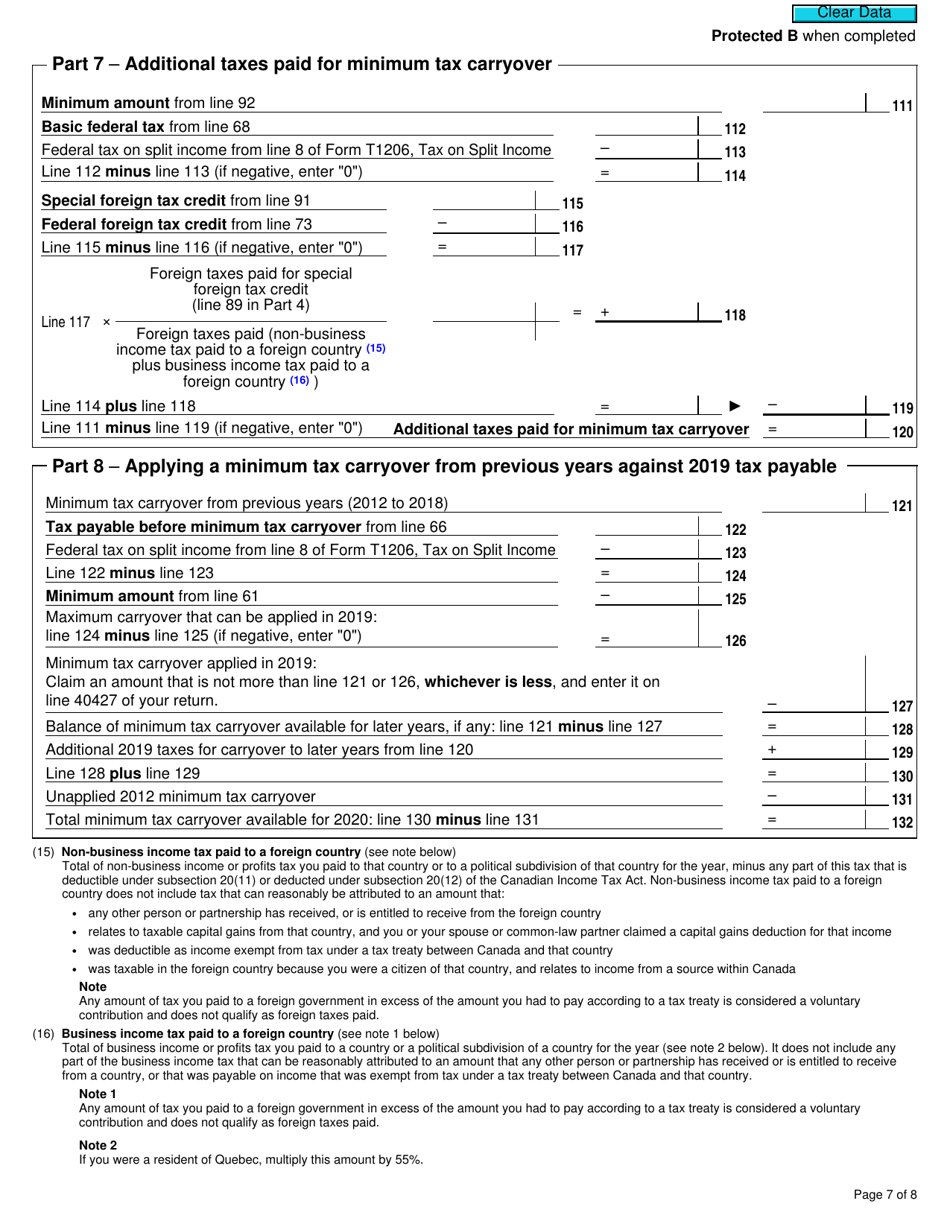

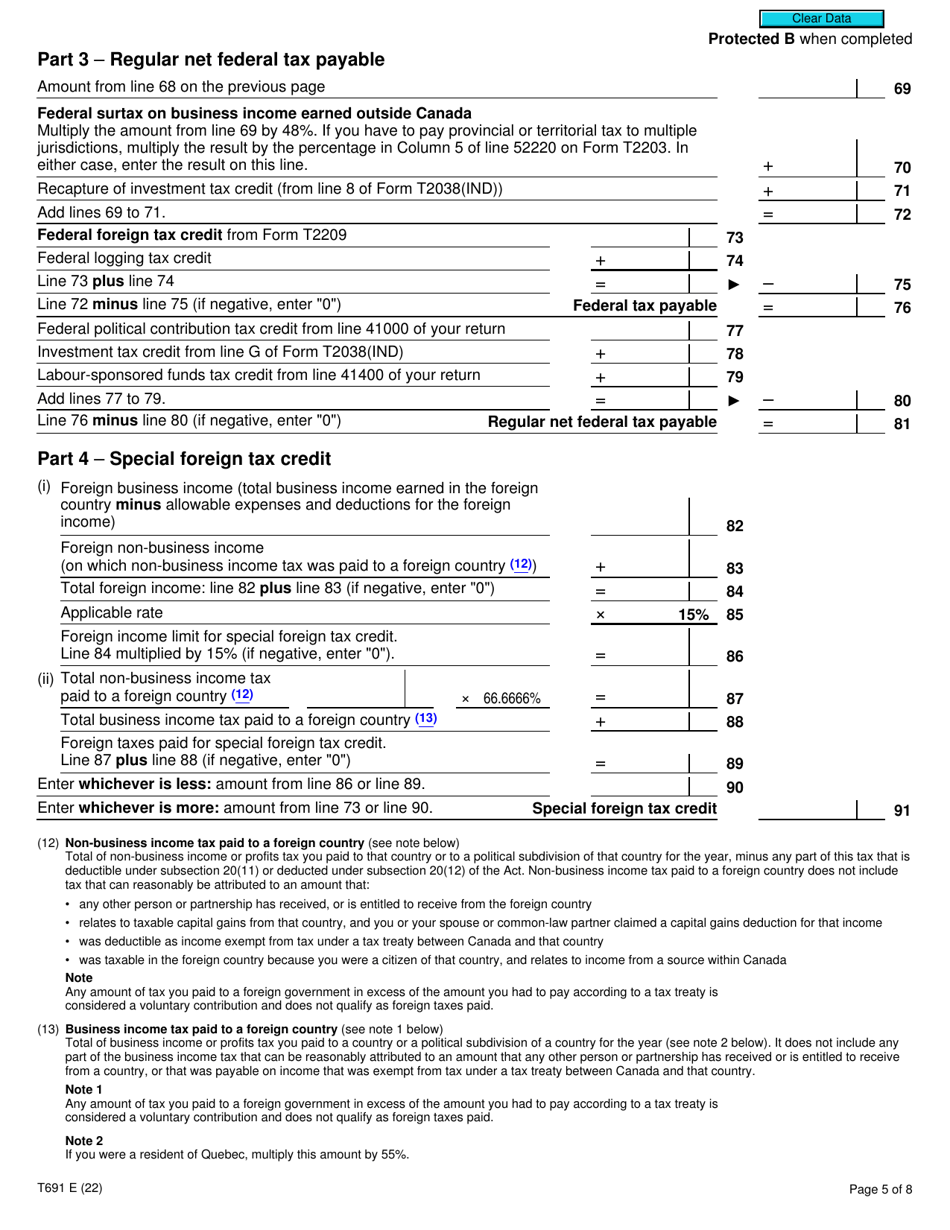

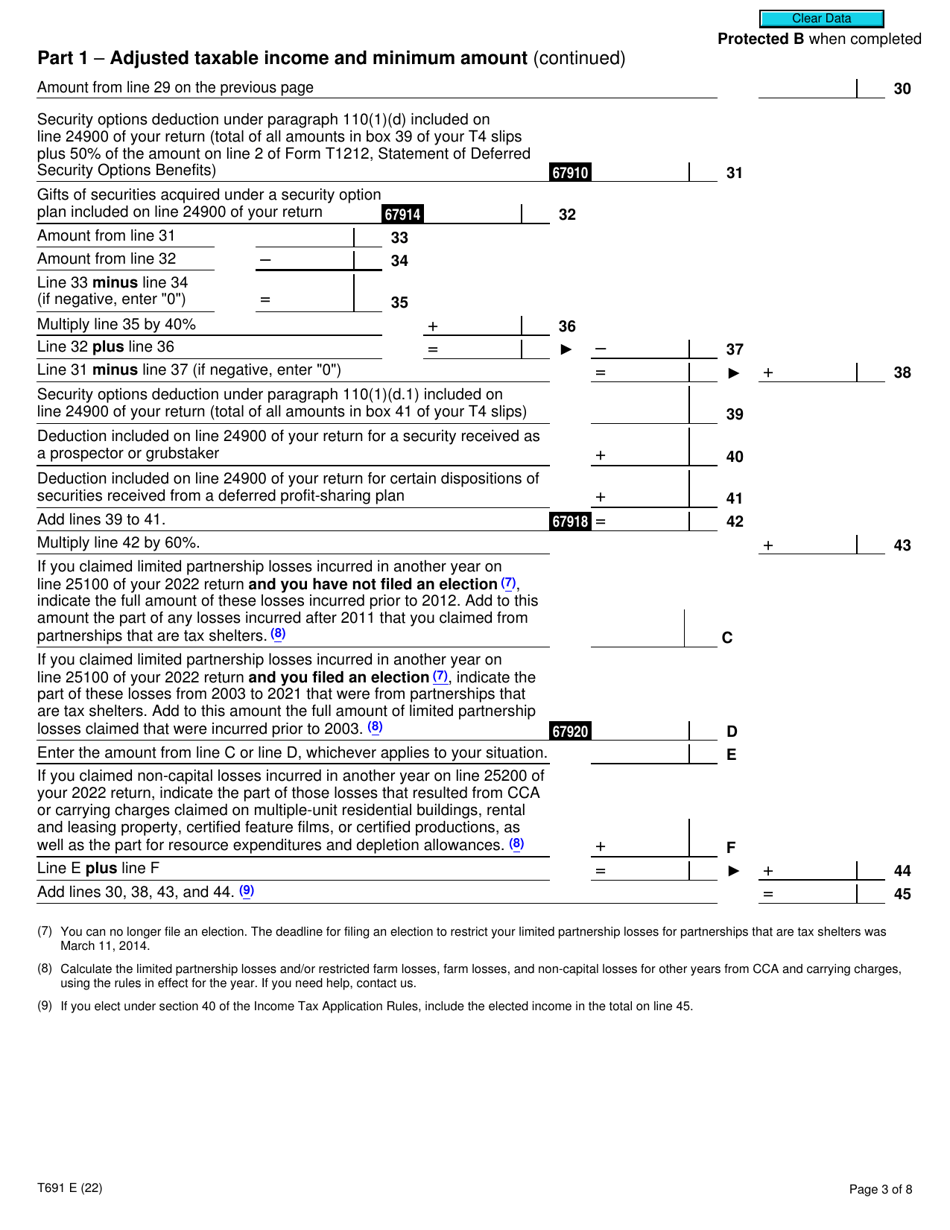

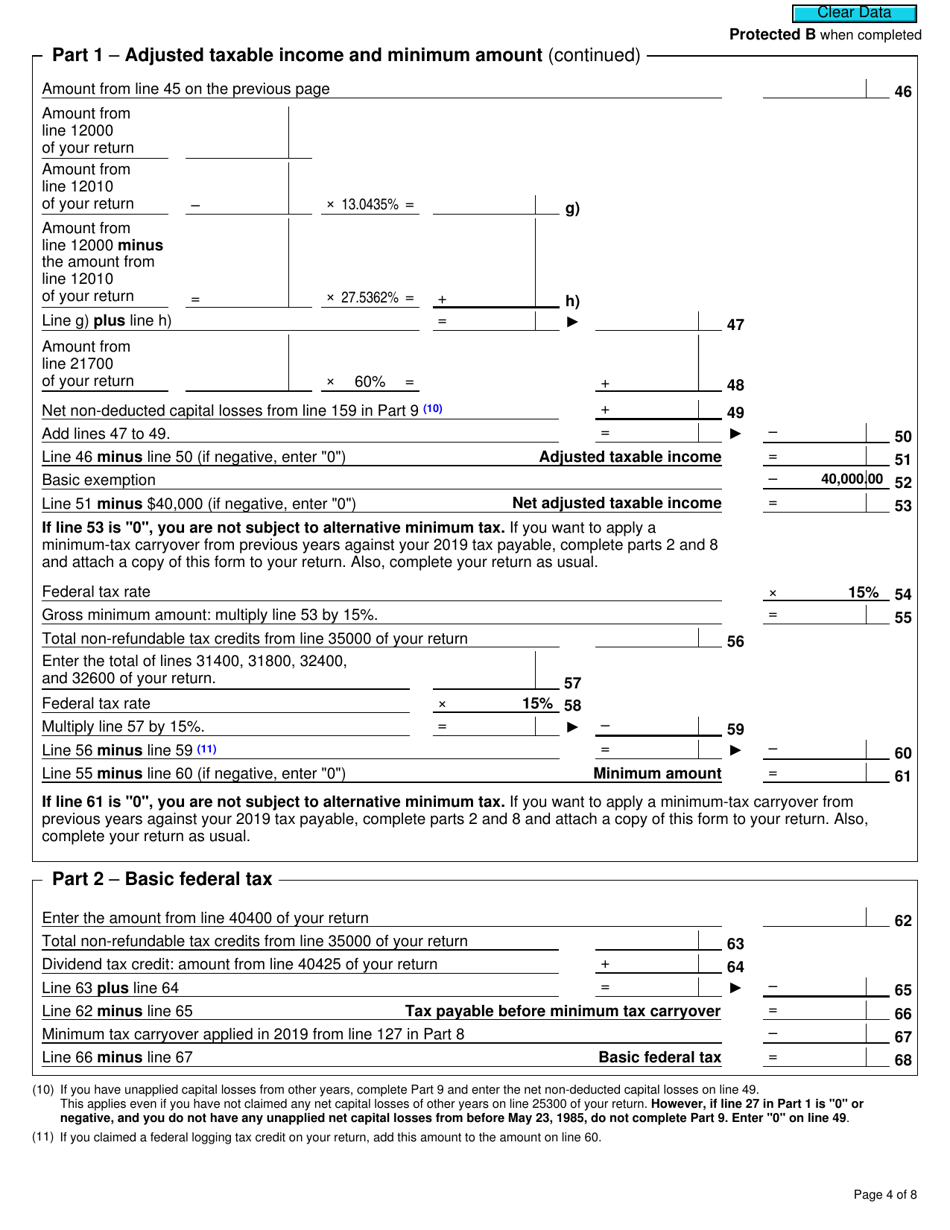

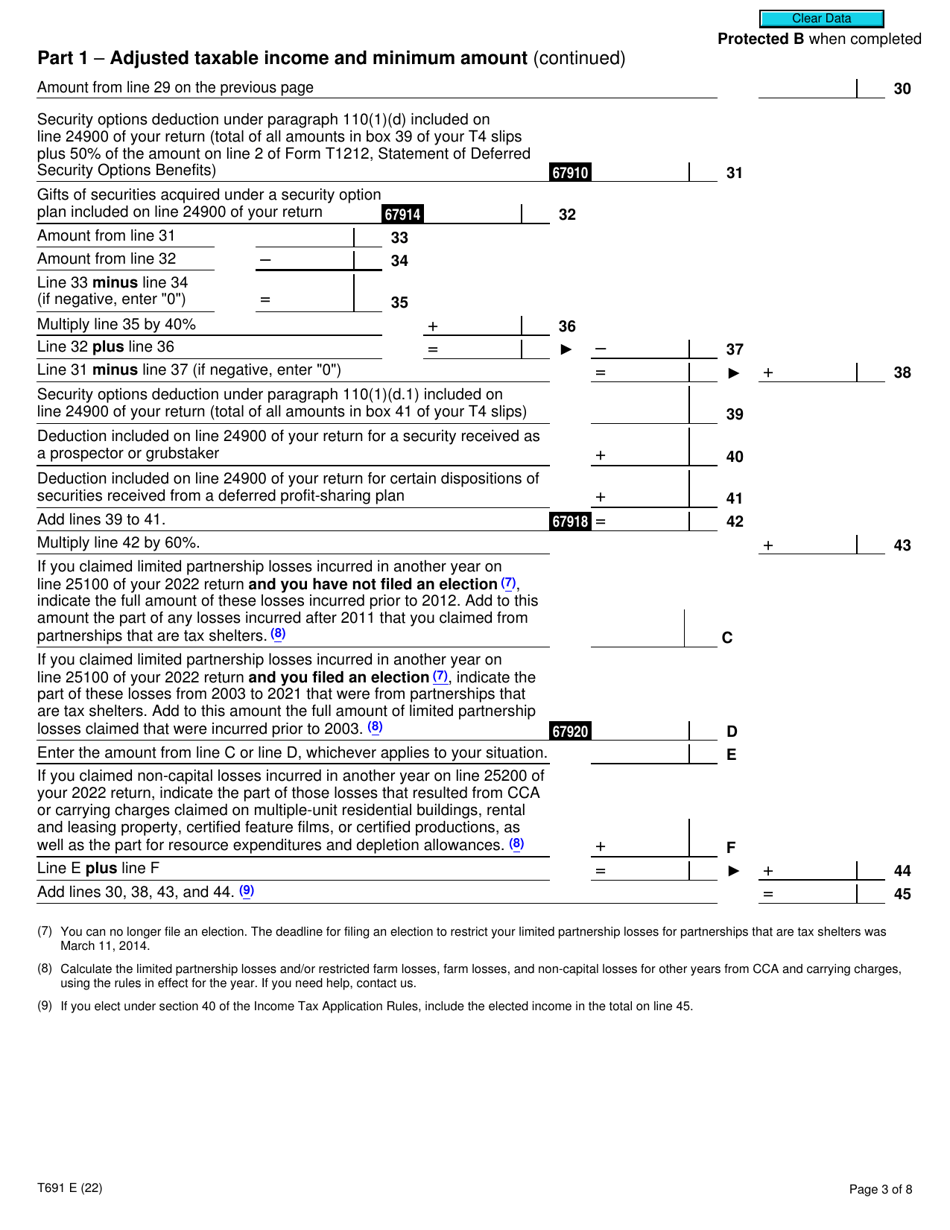

Canada Tax Return Form T691

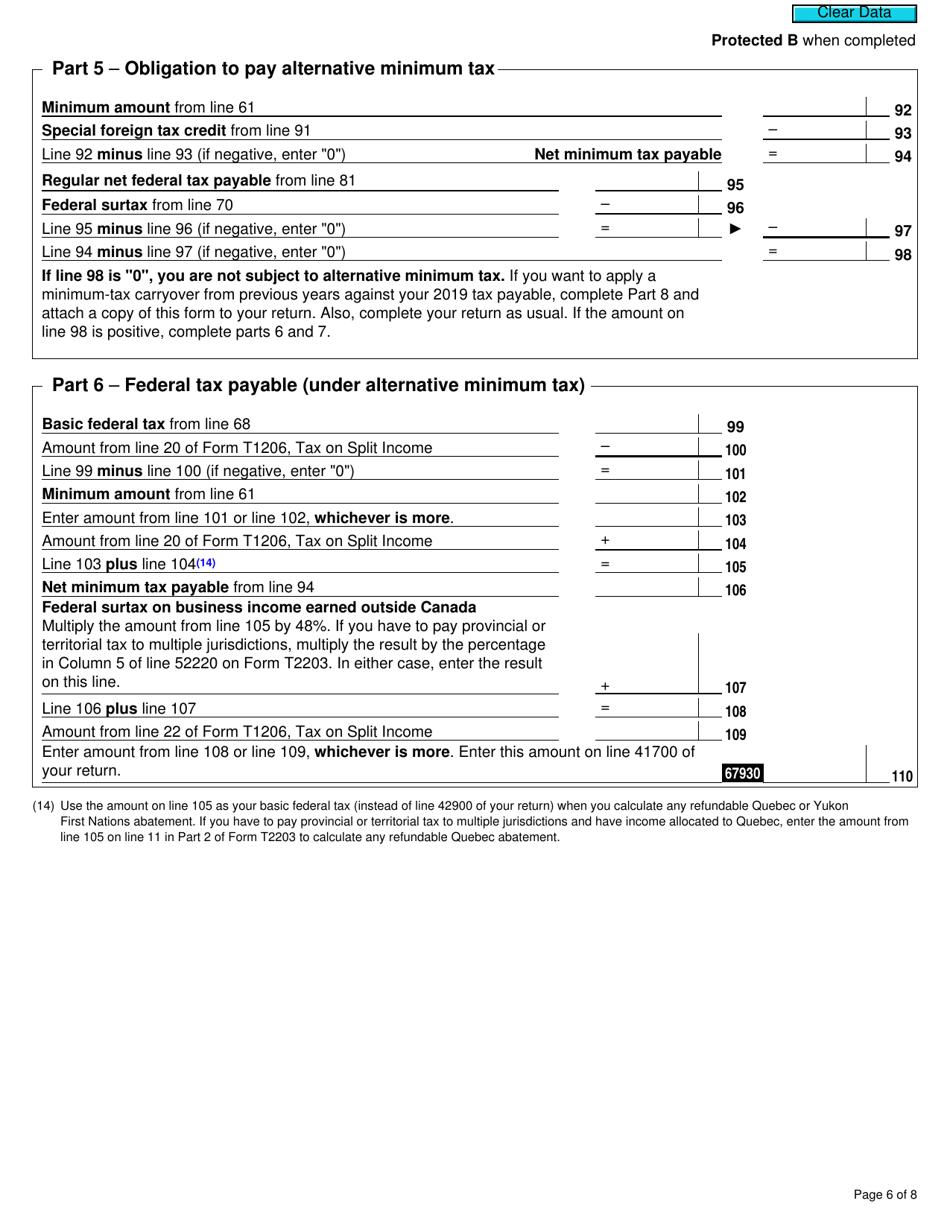

Canada Tax Return Form T691

https://data.templateroller.com/pdf_docs_html/2066/20664/2066451/page_6_thumb_950.png

Form T691 2019 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2066/20664/2066451/page_4_thumb_950.png

Form T691 2019 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2066/20664/2066451/page_8_thumb_950.png

AMT is calculated on Form T691 Alternative Minimum Tax for individuals or T3 Schedule 12 Minimum Tax for trusts by Reporting normal taxable income Taxable Income on AMT is calculated on Form T691 Alternative Minimum Tax for individuals or T3 Schedule 12 Minimum Tax for trusts by Reporting normal taxable income Taxable Income on

Alternative Minimum Tax Use this form to calculate your federal tax payable under alternative minimum tax for 2021 If you are completing a return for atrust use T3 Using Form T691 your taxable income from calculation A is adjusted for certain items and multiplied by 15 to obtain the tax owing under the AMT method Calculation B You

Download Canada Tax Return Form T691

More picture related to Canada Tax Return Form T691

Form T691 2019 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2066/20664/2066451/page_5_thumb_950.png

Form T691 2019 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2066/20664/2066451/page_7_thumb_950.png

Form T691 Download Fillable PDF Or Fill Online Alternative Minimum Tax

https://data.templateroller.com/pdf_docs_html/2626/26263/2626374/page_5_thumb_950.png

Download Fillable Form T691 In Pdf The Latest Version Applicable For 2024 Fill Out The Alternative Minimum Tax Canada Online And Print It Out For Free Form T691 Is The alternative minimum tax or AMT is exactly as it sounds it is an alternative method to calculate the income tax you owe in Canada This tax is often applicable when you have claimed a preferential tax deduction

An individual must use this form to calculate the federal tax payable for the taxation year under alternative minimum tax He or she must complete Parts 1 2 and 8 if he or she Enter your inclusion rate for 2000 on Form CARRY Carry Forwards from last year worksheet You can find this rate on line 16 in Part 4 of your Schedule 3 for 2000 or on

Form T691 Download Fillable PDF Or Fill Online Alternative Minimum Tax

https://data.templateroller.com/pdf_docs_html/2626/26263/2626374/page_3_thumb_950.png

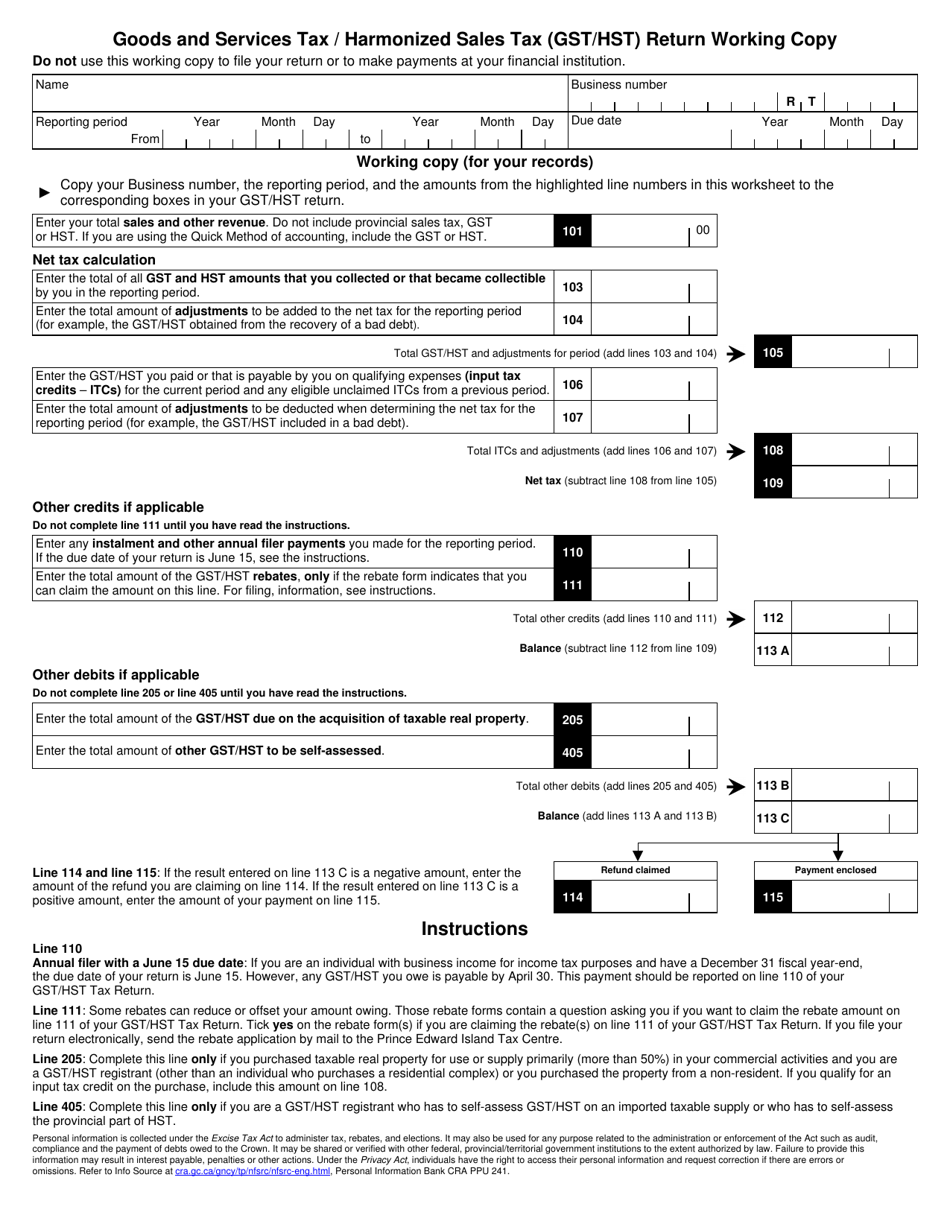

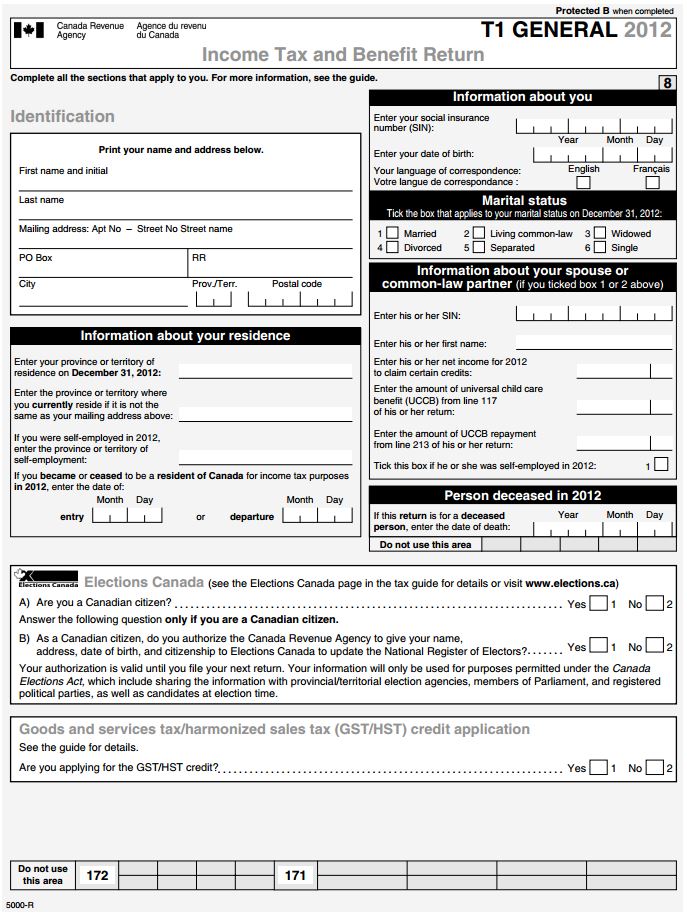

Canada Goods And Services Tax Harmonized Sales Tax Gst Hst Return

https://data.templateroller.com/pdf_docs_html/2108/21087/2108767/goods-and-services-tax-harmonized-sales-tax-gst-hst-return-working-copy-canada_print_big.png

https://www.canada.ca/en/revenue-agency/services/...

Complete Form T691 to calculate your claim for minimum tax carryover and enter the result on line 40427 of your return If you are filing electronically keep your Form T691 for your

https://support.hrblock.ca/en-ca/Content/Other/...

If you reported or claimed any of the following on your return you ll need to complete form T691 to determine whether you ll need to pay minimum tax Taxable capital gain Loss

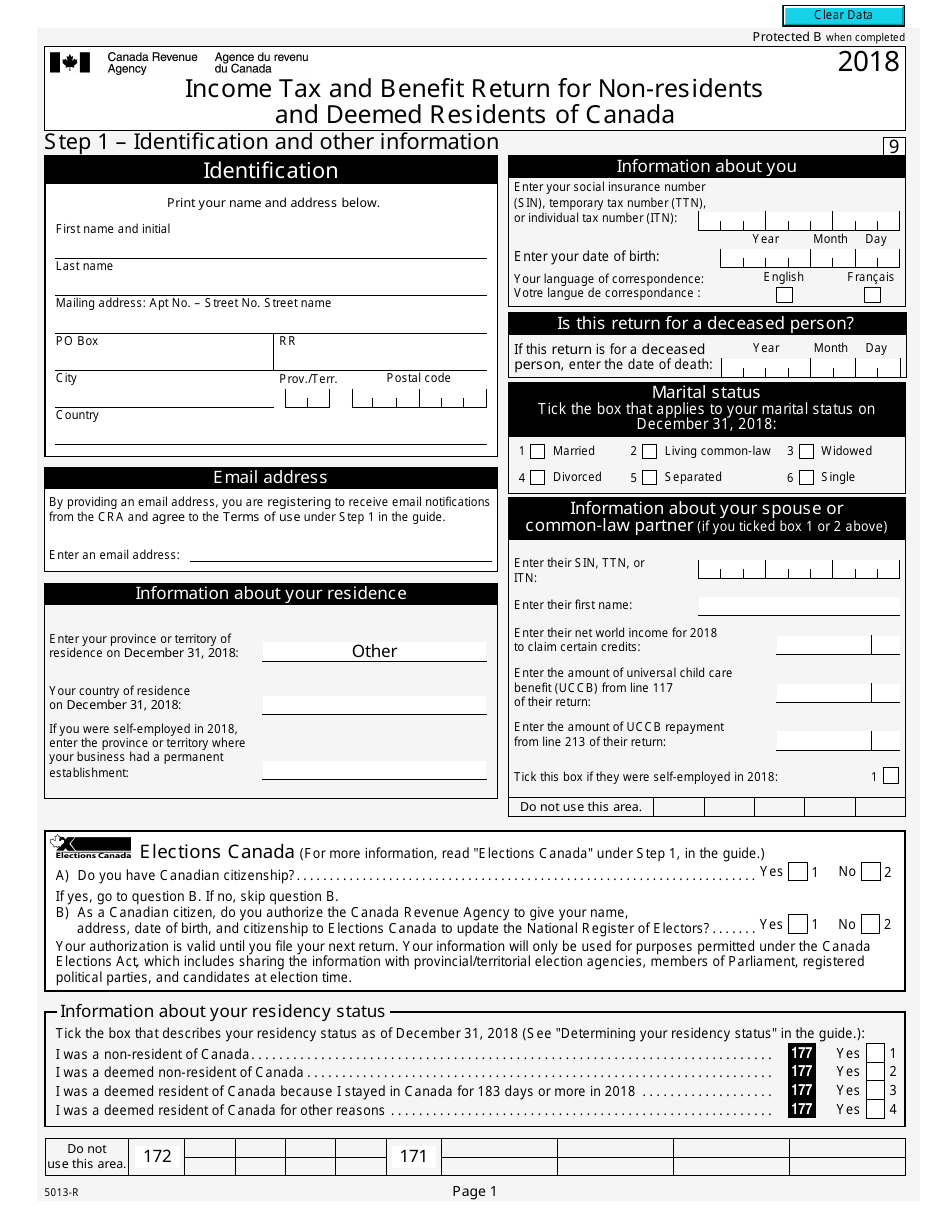

Tax Return Canada Tax Return

Form T691 Download Fillable PDF Or Fill Online Alternative Minimum Tax

Free Canada Forms PDF Template Form Download

T661 Fill Out Sign Online DocHub

2023 Canadian Income Tax Return Forms Printable Forms Free Online

2019 2023 Form Canada T3 RET E Fill Online Printable Fillable Blank

2019 2023 Form Canada T3 RET E Fill Online Printable Fillable Blank

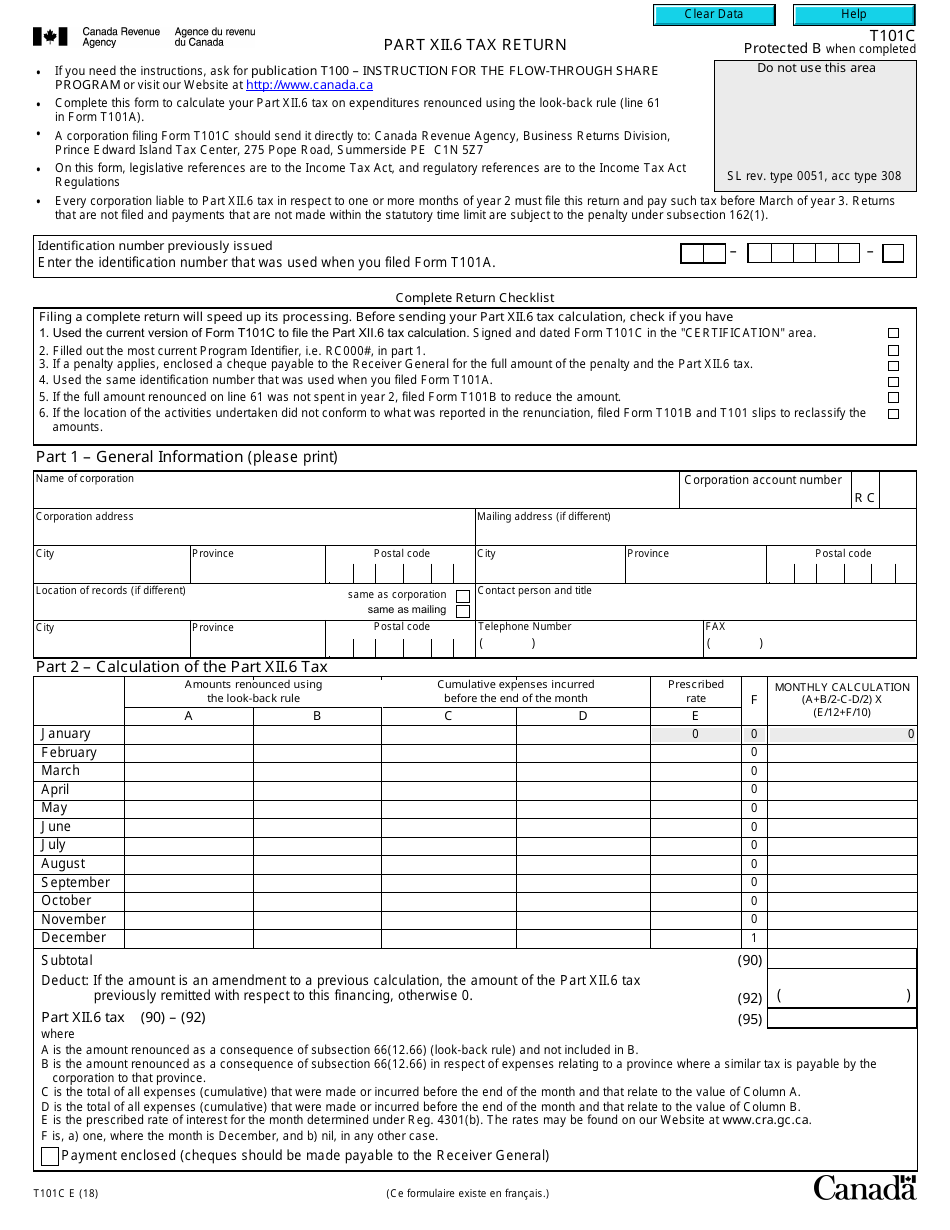

Form T101C Download Fillable PDF Or Fill Online Part XII 6 Tax Return

2020 2023 Form Canada T2 Corporation Income Tax Return Fill Online

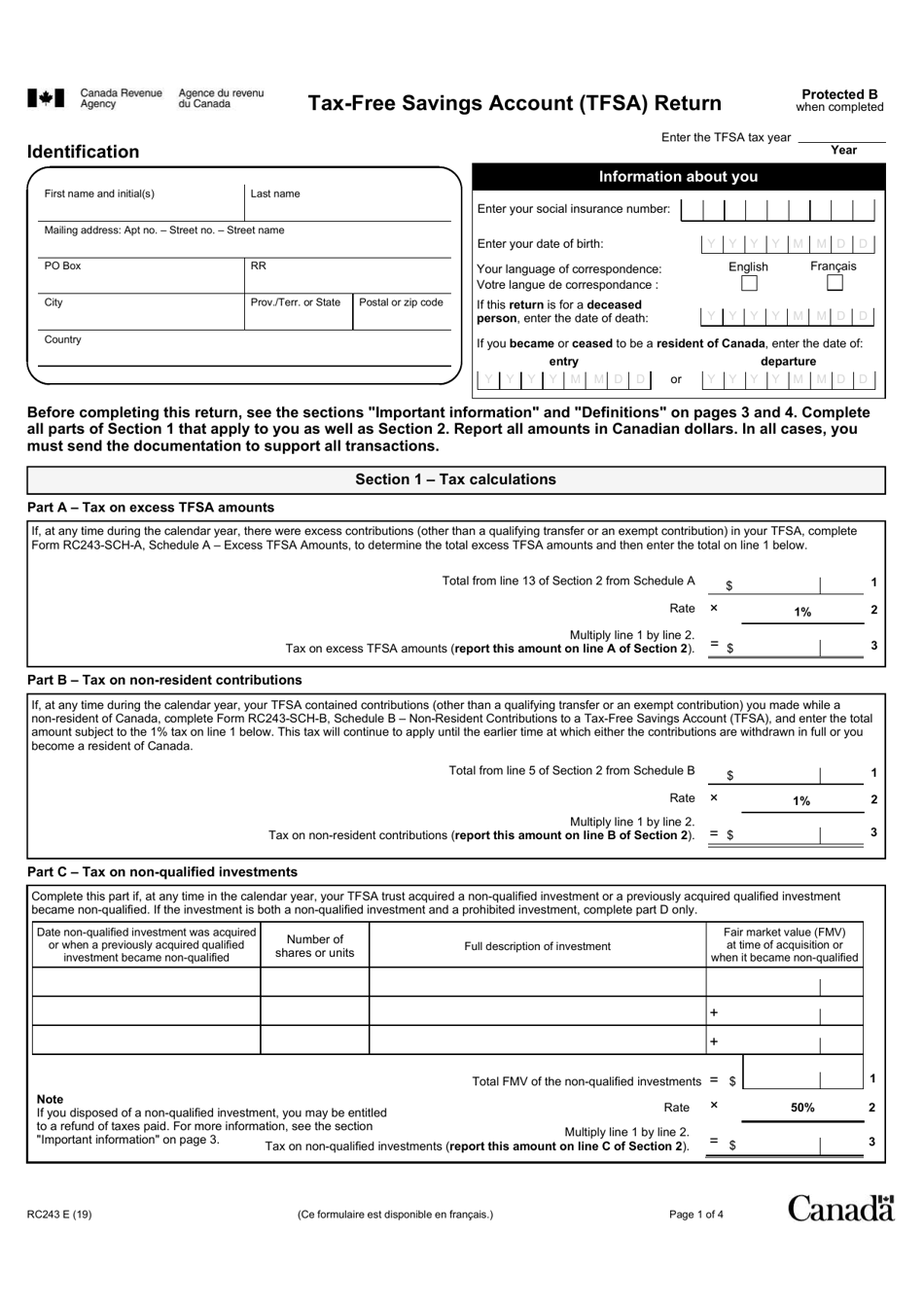

Form RC243 Fill Out Sign Online And Download Fillable PDF Canada

Canada Tax Return Form T691 - Therefore complete Form T691 Alternative Minimum Tax You also may have to complete Form 428 or Form T2203 Provincial and Territorial Taxes for Multiple Jurisdictions to