Canadian Carbon Tax Rebate 2024 2024 01 12 On January 15 2024 people living in provinces where the federal fuel charge applies will receive their first pollution pricing rebate of the year through direct bank deposit or by cheque This means a family of four will receive a pollution price rebate called the Climate Action Incentive payment in the following amounts

CAI payments for 2023 24 will be disbursed as follows Residents of Alberta Manitoba Ontario and Saskatchewan will receive four equal quarterly payments April 2023 July 2023 October 2023 and January 2024 as these provinces are already covered by the federal price on pollution Since the federal fuel charge will only come into effect as The rebates are given to Canadians every three months In October the federal government changed the program for rural Canadians increasing the top up rate from 10 to 20 per cent of the baseline

Canadian Carbon Tax Rebate 2024

Canadian Carbon Tax Rebate 2024

http://www.driveaxis.ca/img/blog/content/Banner-understanding-the-canadian-carbon-tax-rebate.png

Carbon Tax Rebate Available To Alberta Farmers Fulcrum Group Chartered Professional

https://www.fulcrumgroup.ca/wp-content/uploads/2022/03/fulcrum-group-accountant-grande-prairie-carbon-tax-rebate-farmers.png

Canadian Carbon Tax

https://earthwiseradio.org/wp-content/uploads/2016/11/alberta.jpg

For the 2023 2024 payment period RC4215 E Rev 07 23 If you get your T1 refund by direct deposit you will also get your CAIP by direct deposit For tax information by telephone use the CRA s automated service TIPS by calling 1 800 267 6999 Teletypewriter TTY users If you use a TTY for a hearing or speech impairment call 1 Ontarians eligible for the rebate will receive rebates of 122 with an additional 61 for a second adult in the family and 30 50 for each child A family of four in Ontario according to the

What you should know about Canada s first carbon pricing rebates for 2024 In Canada the policy collects a federal carbon tax to pay the cost of carbon emissions Then residents receive quarterly rebates to offset that cost and to encourage them to make energy efficiency investments Fil Canadian employment rates remain high To be eligible for the CAIP you need to be a Canadian resident for tax purposes at the start of the month in which the payment will be issued e g on April 1 for an April payment You must be

Download Canadian Carbon Tax Rebate 2024

More picture related to Canadian Carbon Tax Rebate 2024

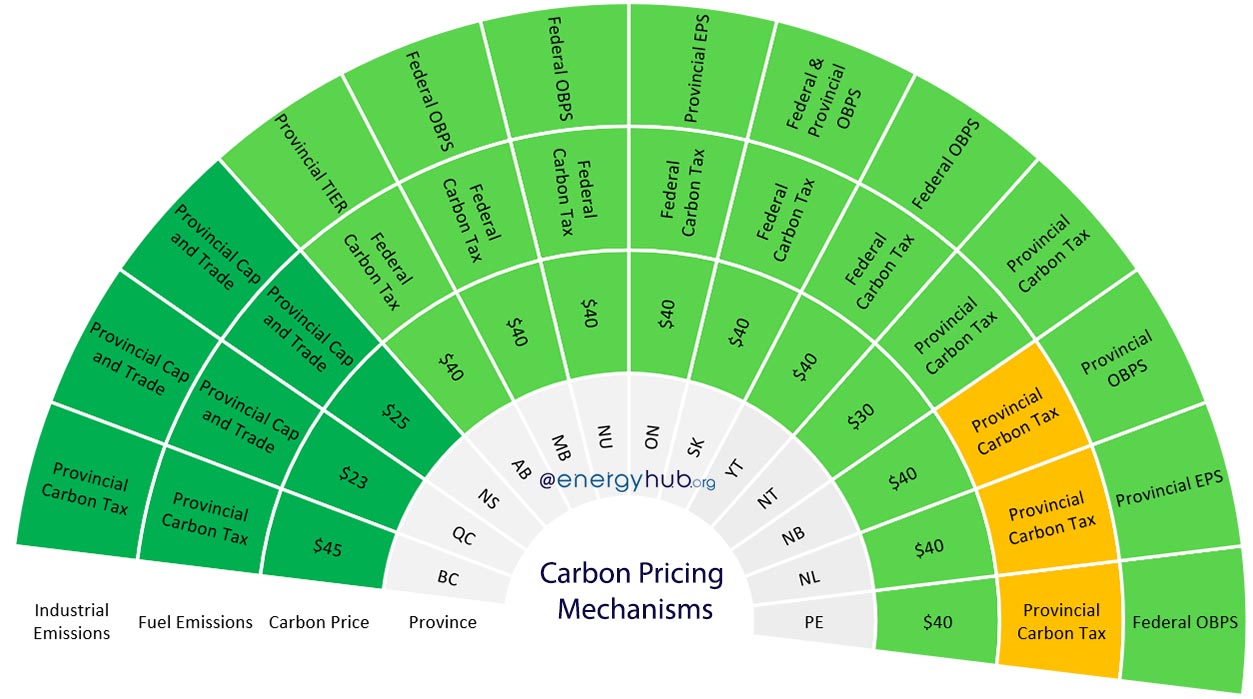

Canadian Carbon Pricing Mechanisms Updated 2020

http://www.energyhub.org/wp-content/uploads/Carbon-Pricing-in-Canada.jpg

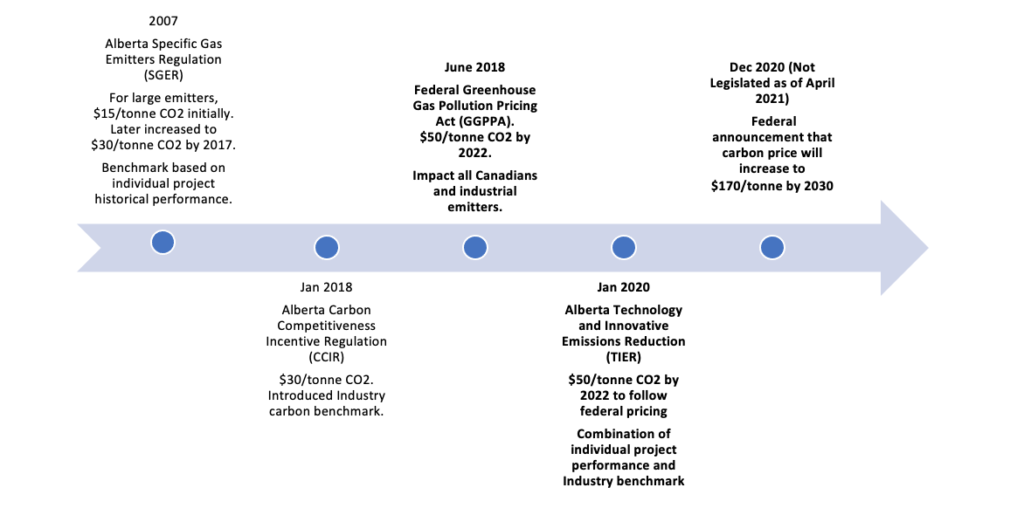

Canadian Carbon Tax Impacts Carbon Capture Utilization And Storage CCUS Environmental

https://boereport.com/wp-content/uploads/2021/08/Graphic-3-1024x515.png

Updated Canadian Carbon Tax Rebate CAI Deposit Marble Financial

https://mymarble.ca/wp-content/uploads/2023/04/MicrosoftTeams-image-149.png

The Canadian government recently sent out carbon tax rebates for January 2024 See how much you can expect to receive Starting on Jan 15 2024 eligible Canadians will receive their first carbon The rebate called the Climate Action Incentive payment is given to people living in provinces where the carbon tax is applied Eligible Canadians will receive their first carbon pricing rebate of 2024 from the federal government on Monday

The carbon tax rate is set to increase by 15 per tonne annually rising next to 80 per tonne on April 1 2024 Rebates will also increase as the tax rate increases How this app works The carbon tax takes a substantial leap on Saturday Christopher Katsarov The Canadian Press Canada s national carbon price saw its largest hike yet on Saturday when it jumped from 50 per tonne

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will Hurt Less Globalnews ca

https://globalnews.ca/wp-content/uploads/2019/05/infogfx_carbon_tax_comparison_1.jpg?quality=85&strip=all&w=1200

France Cut Its Carbon Tax After Deadly Riots Here s How It Compares To Canada s National

https://globalnews.ca/wp-content/uploads/2018/12/raw_36up_carbon-tax-france-canada-1-e1543981084695.jpg?quality=70&strip=all

https://www.canada.ca/en/environment-climate-change/news/2024/01/eligible-canadian-residents-to-receive-their-first-pollution-pricing-rebate-of-the-year.html

2024 01 12 On January 15 2024 people living in provinces where the federal fuel charge applies will receive their first pollution pricing rebate of the year through direct bank deposit or by cheque This means a family of four will receive a pollution price rebate called the Climate Action Incentive payment in the following amounts

https://www.canada.ca/en/department-finance/news/2022/11/climate-action-incentive-payment-amounts-for-2023-24.html

CAI payments for 2023 24 will be disbursed as follows Residents of Alberta Manitoba Ontario and Saskatchewan will receive four equal quarterly payments April 2023 July 2023 October 2023 and January 2024 as these provinces are already covered by the federal price on pollution Since the federal fuel charge will only come into effect as

Carbon Taxes What Do They Mean For Your Business Folkestone Works

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will Hurt Less Globalnews ca

New Carbon Tax Rebate Payments Keep Climate Action Affordable For Canadians Clean Prosperity

Government Of Canada Clarifies Timelines For National Price On Carbon Pollution Pembina Institute

Breakthrough Strategic Transportation Solution Provider

Here s How To Claim Your Carbon Tax Refund From The Canadian Government

Here s How To Claim Your Carbon Tax Refund From The Canadian Government

Advisorsavvy Carbon Tax Rebate

How Do I Get My Carbon Tax Rebate In Ontario PRORFETY

Canada s Carbon Tax Has Anyone Even Done The Math YouTube

Canadian Carbon Tax Rebate 2024 - For the 2023 2024 payment period RC4215 E Rev 07 23 If you get your T1 refund by direct deposit you will also get your CAIP by direct deposit For tax information by telephone use the CRA s automated service TIPS by calling 1 800 267 6999 Teletypewriter TTY users If you use a TTY for a hearing or speech impairment call 1