Canadian Clean Energy Investment Tax Credit Introducing a 15 percent refundable Clean Electricity Investment Tax Credit for eligible investments in technologies that are required for the generation and storage

The Clean Technology ITC would provide a 30 refundable tax credit for investments in eligible property acquired and available for use on or after March 28 Carbon Capture Utilization and Storage investment tax credit Clean Technology investment tax credit Clean Hydrogen investment tax credit and

Canadian Clean Energy Investment Tax Credit

/cloudfront-us-east-1.images.arcpublishing.com/tgam/CDDVSAYVBFLUXB7R5U6JF4JSOI.jpg)

Canadian Clean Energy Investment Tax Credit

https://www.theglobeandmail.com/resizer/9a4nCcXuqDAup9exT6_u70qLmQc=/1200x807/filters:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/tgam/CDDVSAYVBFLUXB7R5U6JF4JSOI.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Clean Technology Investment Tax Credit The Clean Technology ITC is aimed at supporting investment in low emitting energy generation and storage Tel 1 604 806 7705 Serene Cheung Director SR ED and Government Incentives PwC Canada Tel 1 403 509 7461 On November 21 2023 the federal

The government lined up a 30 refundable tax credit incentive for investment in machinery and equipment used to manufacture clean energy project components and extract relevant critical minerals The CH Tax Credit is a refundable tax credit claimed at the following rates based on assessed carbon intensity CI of the hydrogen that is produced measured in kg of

Download Canadian Clean Energy Investment Tax Credit

More picture related to Canadian Clean Energy Investment Tax Credit

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work

https://www.eesi.org/images/content/IRA.tax_.credits_.png

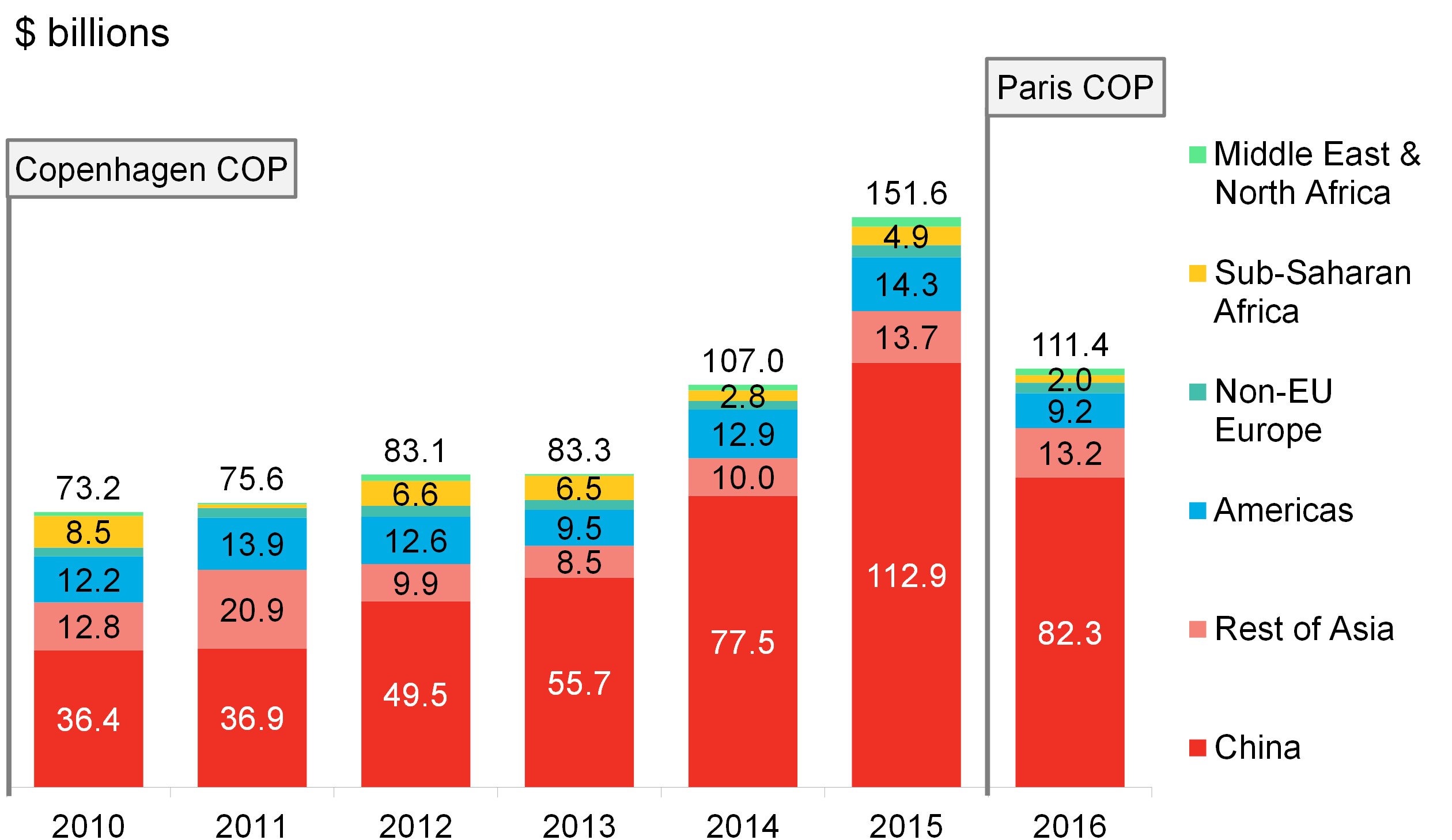

Why Canada s Clean Energy Investment Plummeted In 2016 National Observer

https://www.nationalobserver.com/sites/nationalobserver.com/files/img/2017/02/03/screen_shot_2017-02-03_at_10.45.35_am.png

Clean Energy Credit Overview In Inflation Reduction Act

https://mossadamsproduction.blob.core.windows.net/cmsstorage/mossadams/media/images/insights/2022/08/22-rne-1155_alert_clean_energy_smsi.jpg

Clean electricity will power Canada s future economy In its 2023 budget the federal government made a historic commitment to support the build out of the bigger cleaner smarter grids required to Freeland made good on that promise introducing an investment tax credit of up to 30 per cent for renewable electricity systems industrial electric vehicles energy storage systems and

The Canadian government s recently released 2022 Fall Economic Statement introduces investment tax credits ITC for clean technologies and clean hydrogen that will help to spur the Canada s recent 2022 Fall Economic Statement has proposed an investment tax credit of up to 30 percent for investments in clean energy

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Tax Mitigation Solar International Legacy Solutions

https://internationallegacysolutions.com/wp-content/uploads/2023/03/iStock-1350734924-mono-scaled.jpg

/cloudfront-us-east-1.images.arcpublishing.com/tgam/CDDVSAYVBFLUXB7R5U6JF4JSOI.jpg?w=186)

https://www.canada.ca/en/environment-climate...

Introducing a 15 percent refundable Clean Electricity Investment Tax Credit for eligible investments in technologies that are required for the generation and storage

https://www.fasken.com/en/knowledge/2023/12/canada...

The Clean Technology ITC would provide a 30 refundable tax credit for investments in eligible property acquired and available for use on or after March 28

International Energy Agency On Twitter While Global Clean Energy

Federal Solar Tax Credit What It Is How To Claim It For 2024

Canadian Government Consulting On Clean Hydrogen And Labour Conditions

Canadian Investment Tax Credits For Clean Technologies And Clean

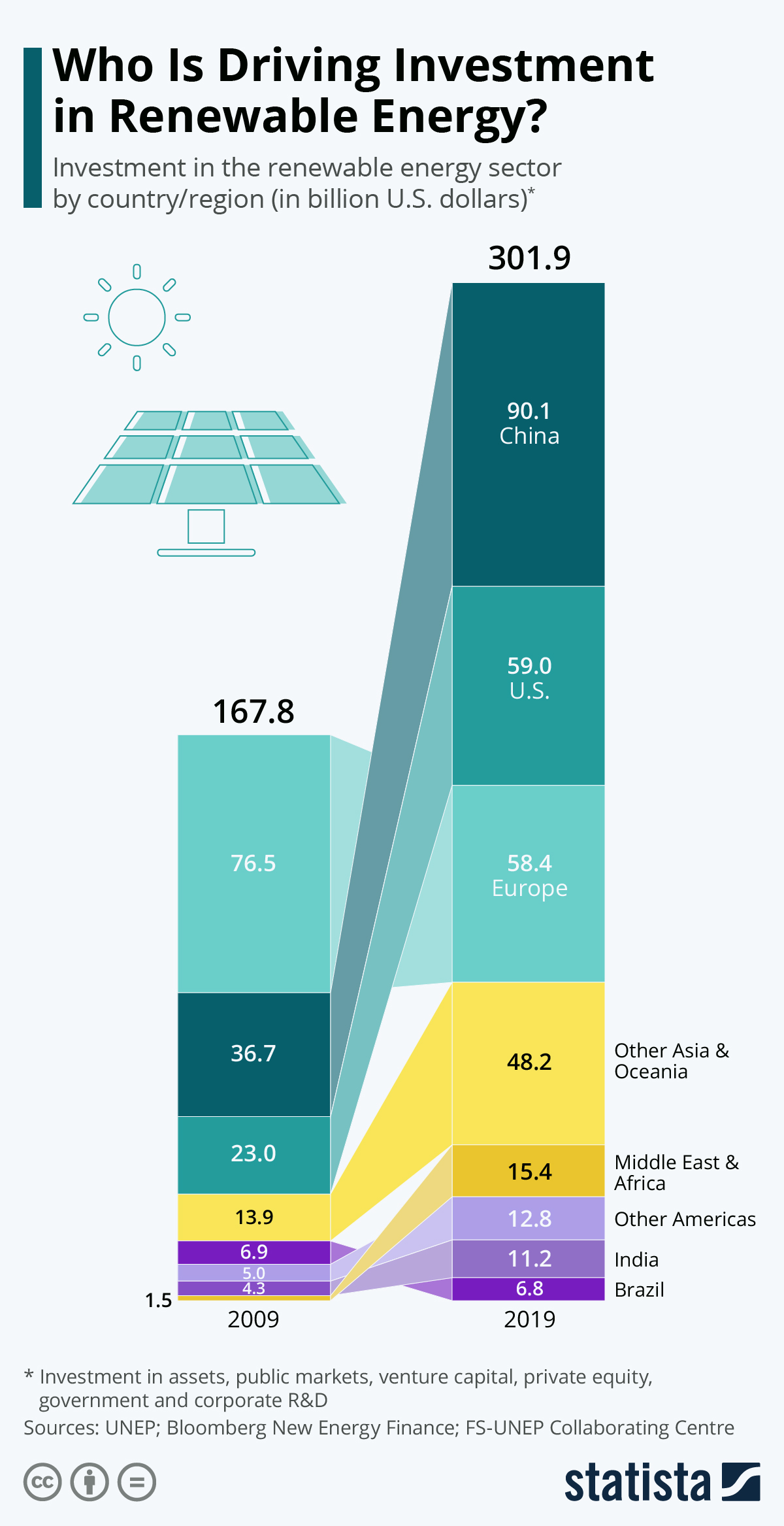

Chart Who Is Driving Investment In Renewable Energy Statista

2023 Residential Clean Energy Credit Guide ReVision Energy

2023 Residential Clean Energy Credit Guide ReVision Energy

Is There An Energy Tax Credit For 2023 Facts You Didn T Know

Emerging Markets Clean Energy Investment Climatescope 2017

Federal Tax Credit ITC For Solar Energy Gets Extended

Canadian Clean Energy Investment Tax Credit - The government lined up a 30 refundable tax credit incentive for investment in machinery and equipment used to manufacture clean energy project components and extract relevant critical minerals