Canadian Income Tax Rates 2023 Verkko 1 The personal amount for 2023 and 2024 is increased federally and for Yukon for 2024 from 14 156 to 15 705 for taxpayers with net income line 23600 of 173 205 or less For incomes above this threshold the additional amount of 1 549 is reduced until it becomes zero at net income of 246 752

Verkko Federal and Provincial Territorial Income Tax Rates and Brackets for 2023 Current as of September 30 2023 Verkko 1 maalisk 2023 nbsp 0183 32 In 2023 Canada s federal tax brackets increased by 6 3 to account for inflation Here are the tax brackets for 2023 as outlined by the CRA Any Canadians earning less than 53 359 in

Canadian Income Tax Rates 2023

Canadian Income Tax Rates 2023

https://sk-ca.icalculator.com/img/og/SK-CA/80.png

Canadian Income Tax Rates For 2023 TNT Accounting Services

https://tntbooks.ca/wp-content/uploads/2019/05/gettyimages-155156722.jpg

17 932k Salary After Tax In Alberta CA Tax 2024

https://ab-ca.icalculator.com/img/og/AB-CA/448.png

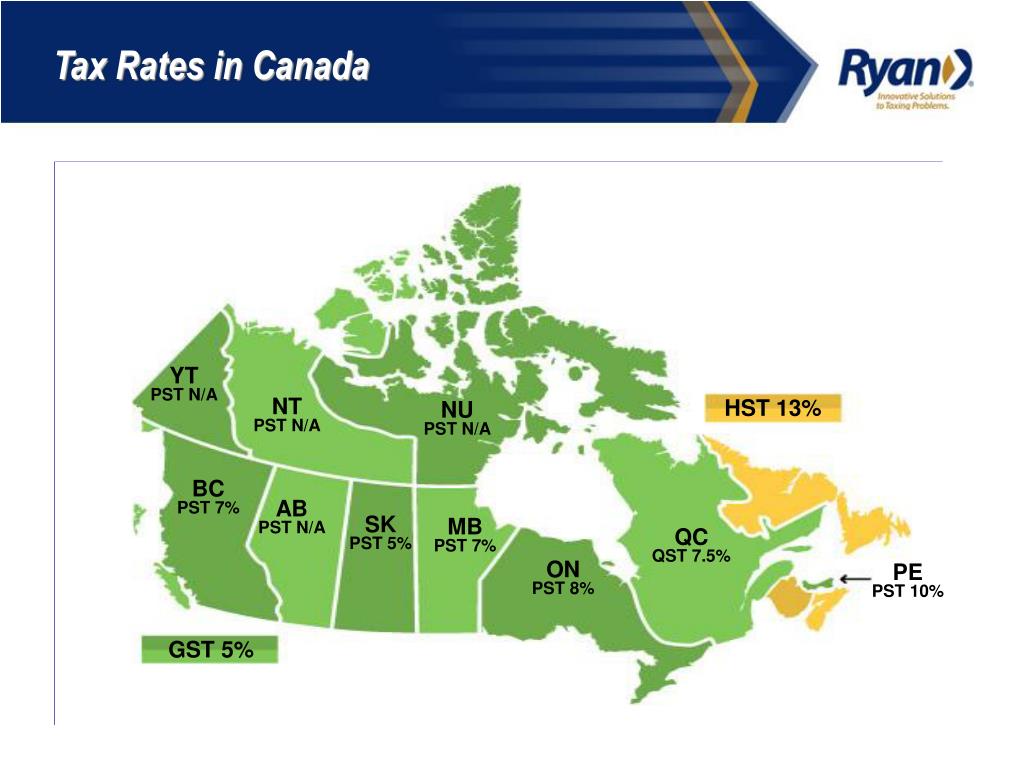

Verkko 2023 federal tax bracket rates 15 up to 53 359 of taxable income 20 5 between 53 359 and 106 717 26 between 106 717 and 165 430 29 between 165 430 up to 235 675 33 on any amount taxable income exceeding 235 675 2023 tax bracket rates by province Alberta 10 up to 142 292 12 between 142 292 and Verkko 15 jouluk 2023 nbsp 0183 32 The following table shows the top 2023 provincial territorial tax rates and surtaxes The provincial territorial tax rates are applicable starting at the taxable income levels shown below Surtax rates apply to provincial tax above the surtax thresholds shown Notes

Verkko 25 marrask 2023 nbsp 0183 32 The following are the provincial territorial tax rates for 2023 in addition to federal tax according to the CRA Province Territory Tax Rate British Columbia 5 06 on the first 45 654 of taxable income 7 7 on taxable income over 45 654 up to 91 310 10 5 on taxable income over 91 310 up to 104 835 Verkko 28 jouluk 2023 nbsp 0183 32 Ontario s lowest combined federal and provincial bracket now applies to those with taxable income of 51 446 or less compared with 49 231 in 2023 and this tranche of income continues to be taxed at 20 The top bracket now applies to those with taxable income over 246 752 versus 235 675 last year and is taxed at 53 5

Download Canadian Income Tax Rates 2023

More picture related to Canadian Income Tax Rates 2023

2023 Federal Tax Rates Cra Printable Forms Free Online

https://filingtaxes.ca/wp-content/uploads/2021/12/Screenshot_2.png

12k Salary After Tax Example CA Tax 2024

https://nl-ca.icalculator.com/img/og/CA/144.png

85k Salary Effective Tax Rate V s Marginal Tax Rate PH Tax 2024

https://ph.icalculator.com/img/og/PH/100.png

Verkko 2023 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory The calculator reflects known rates as of June 1 2023 Verkko Data source Data were taken from the individual income tax and benefit returns filed for the 2021 tax year These statistics contain information from initial assessments up to the cut off date of January 28 2023

Verkko 21 helmik 2023 nbsp 0183 32 Canada Revenue Agency Millions of Canadians file their income tax and benefit returns every year For the 2022 tax filing season Canadians filed approximately 31 million returns and 92 of them were filed electronically Also there were over 17 million refunds processed resulting in a total amount of 37 billion Verkko Calculate your tax bill and marginal tax rates for 2023 Skip to content Skip to footer Today s issues Insights Industries Services About us Careers Search Menu Today s issues Preparing for the tidal wave of Canadian tax changes 2024 Canadian ESG Reporting Insights Findings from the 2024 Global Digital Trust Insights Menu

1340 25k Salary After Tax Example CA Tax 2024

https://pe-ca.icalculator.com/img/og/PE-CA/152.png

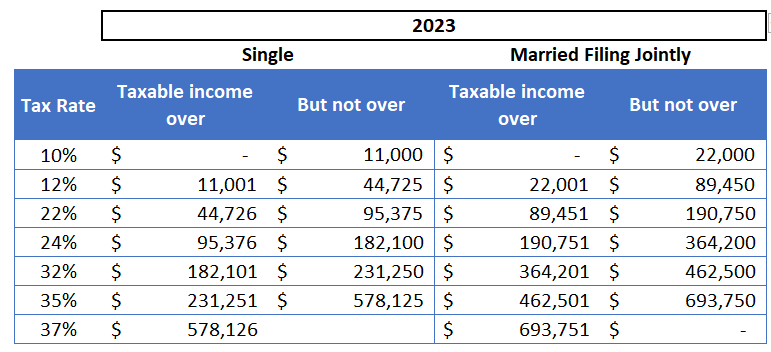

2023 IRS Contribution Limits And Tax Rates

https://darrowwealthmanagement.com/wp-content/uploads/2022/10/2023-Income-Tax-Rates.png

https://www.taxtips.ca/taxrates/canada.htm

Verkko 1 The personal amount for 2023 and 2024 is increased federally and for Yukon for 2024 from 14 156 to 15 705 for taxpayers with net income line 23600 of 173 205 or less For incomes above this threshold the additional amount of 1 549 is reduced until it becomes zero at net income of 246 752

https://kpmg.com/ca/en/home/services/tax/tax-facts/canadian-personal...

Verkko Federal and Provincial Territorial Income Tax Rates and Brackets for 2023 Current as of September 30 2023

25k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

1340 25k Salary After Tax Example CA Tax 2024

18 66k Salary After Tax Example CA Tax 2024

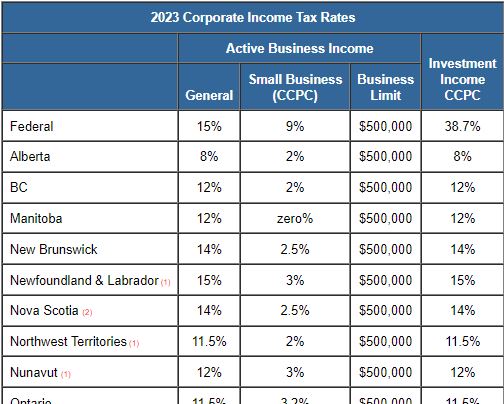

TaxTips ca Business 2023 Corporate Income Tax Rates

Canadian Income Tax Rates For Individuals Current And Previous Years

Ca Tax Brackets Chart Jokeragri

Ca Tax Brackets Chart Jokeragri

Canadian Tax Rates Www vrogue co

Canadian Income Tax Rates For Individuals

Individual Tax Rate Tax Rates Income Tax Rates For Resident

Canadian Income Tax Rates 2023 - Verkko The latest 2023 tax rate card puts the most up to date marginal tax rates and tax brackets by taxable income source non refundable tax credits and much more all in one place This reference card is designed to help you and your clients with tax planning for the 2023 calendar year Included in this piece are tables for combined federal and