Canadian Income Tax Rates Corporate investment income tax rates 2023 Rates represent calendar year rates unless indicated otherwise For taxation years ending after 2015 the refundable additional Part I tax on investment income earned by a CCPC is 10 67 and the resulting federal rate applicable to investment income earned by a CCPC is 38 67

The low income tax reduction is clawed back for income in excess of 15 000 until the reduction is eliminated resulting in an additional 5 of provincial tax on income between 15 001 and 21 000 The federal basic personal amount comprises two elements the base amount 13 521 for 2023 and an additional amount 1 479 for 2023 0 00 7 50 12 50 15 25 18 00 19 00 20 66 21 16 21 66 23 50 24 00 The tax rates reflect budget proposals and news releases to June 1 2023 Where the tax is determined under the alternative minimum tax provisions AMT the above table is not applicable AMT may be applicable where the tax otherwise payable is less

Canadian Income Tax Rates

Canadian Income Tax Rates

https://www.taxfilingcpa.com/wp-content/uploads/2021/08/canada-income-tax-rate.jpg

Doing Your Taxes Myths Reality Checks And How Soon To Send Them

https://www.savespendsplurge.com/wp-content/uploads/Canada-Ontario-Federal-Provincial-Income-Tax-Brackets.png

2014 Canadian Income Tax For A 50 000 Salary Financial Diffraction

https://i.pinimg.com/736x/2b/41/46/2b4146f13f7850b3bfb35a0e90733870--tax-rate-income-tax.jpg

0 00 7 50 12 75 13 75 16 50 19 25 20 25 21 91 23 75 The tax rates reflect budget proposals and news releases to January 15 2023 Where the tax is determined under the alternative minimum tax provisions AMT the above table is not applicable AMT may be applicable where the tax otherwise payable is less than the tax The low income tax reduction is clawed back on income in excess of 23 179 until the reduction is eliminated resulting in an additional 3 56 of provincial tax on income between 23 180 and 37 814 The federal basic personal amount comprises two elements the base amount 13 520 for 2023 and an additional amount 1 480 for 2023

In accordance with its 2015 16 budget Quebec is gradually reducing the general corporate income tax rate from 11 9 to 11 5 over four years effective 1 January of each year beginning in 2017 and based on the following schedule 2017 11 8 2018 11 7 2019 11 6 and 2020 11 5 0 00 15 00 20 00 24 00 25 75 221 709 and up 41 279 27 56 The tax rates reflect budget proposals and news releases to January 15 2022 Where the tax is determined under the minimum tax provisions the above table is not applicable Alternative minimum tax AMT and Quebec minimum tax QMT may be applicable

Download Canadian Income Tax Rates

More picture related to Canadian Income Tax Rates

-1625833913635.png)

Canadian Tax Rates

https://d1ac9zce9817ms.cloudfront.net/images/Income Tax Rates (1)-1625833913635.png

Doing Your Taxes Myths Reality Checks And How Soon To Send Them

https://www.savespendsplurge.com/wp-content/uploads/Canada-Ontario-Income-Taxes-Combined-Chart-up-to-100000-600x188.png

Canadian Income Tax Rates For 2023 TNT Accounting Services

https://tntbooks.ca/wp-content/uploads/2019/05/gettyimages-155156722.jpg

The low income tax reduction is clawed back on income in excess of 20 698 until the reduction is eliminated resulting in an additional 3 56 of provincial tax on income between 20 699 and 34 556 The basic personal amount is comprised of two basic elements the existing personal amount 12 298 for 2020 and an additional amount Corporate investment income tax rates 2022 Rates represent calendar year rates unless indicated otherwise For taxation years ending after 2015 the refundable additional Part I tax on investment income earned by a CCPC is 10 67 and the resulting federal rate applicable to investment income earned by a CCPC is 38 67

[desc-10] [desc-11]

Canadian Income Tax Rates For Individuals Current And Previous Years

https://i.pinimg.com/originals/3a/6b/f0/3a6bf0260e11f29be38b428438b47907.jpg

Table Of Canadian Income Tax Rates PDF

https://imgv2-2-f.scribdassets.com/img/document/45087871/original/7102a407e9/1701482093?v=1

https://assets.ey.com/.../2023/ey-tax-rates-corporate-inves…

Corporate investment income tax rates 2023 Rates represent calendar year rates unless indicated otherwise For taxation years ending after 2015 the refundable additional Part I tax on investment income earned by a CCPC is 10 67 and the resulting federal rate applicable to investment income earned by a CCPC is 38 67

https://assets.ey.com/.../tax-calculators/2023/ey-tax-rates-…

The low income tax reduction is clawed back for income in excess of 15 000 until the reduction is eliminated resulting in an additional 5 of provincial tax on income between 15 001 and 21 000 The federal basic personal amount comprises two elements the base amount 13 521 for 2023 and an additional amount 1 479 for 2023

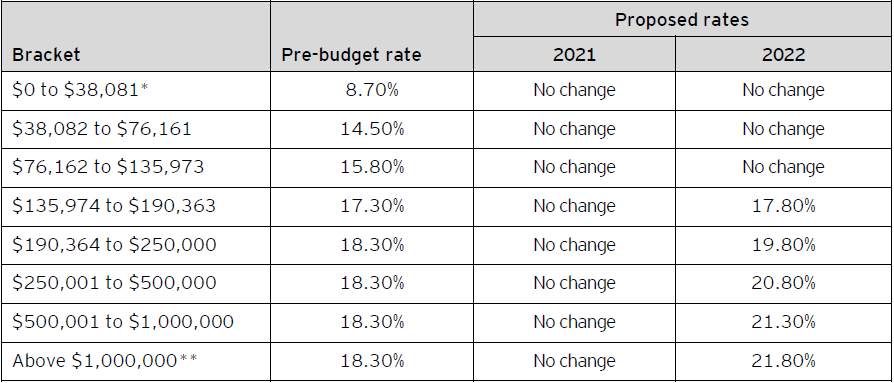

Changes In Canadian Income Tax Rates For Individuals

Canadian Income Tax Rates For Individuals Current And Previous Years

Things To Know About Canadian Income Tax Rates Foreign Policy

2020 Versus 2021 Tax Brackets Bulkwest

The Daily Effective Tax Rates And High Income Canadians 2016

Canadian Income Tax Rates 2005 Download Table

Canadian Income Tax Rates 2005 Download Table

In Canada 42 Of The Average Pay For People Who Make Over 100 000 Goes

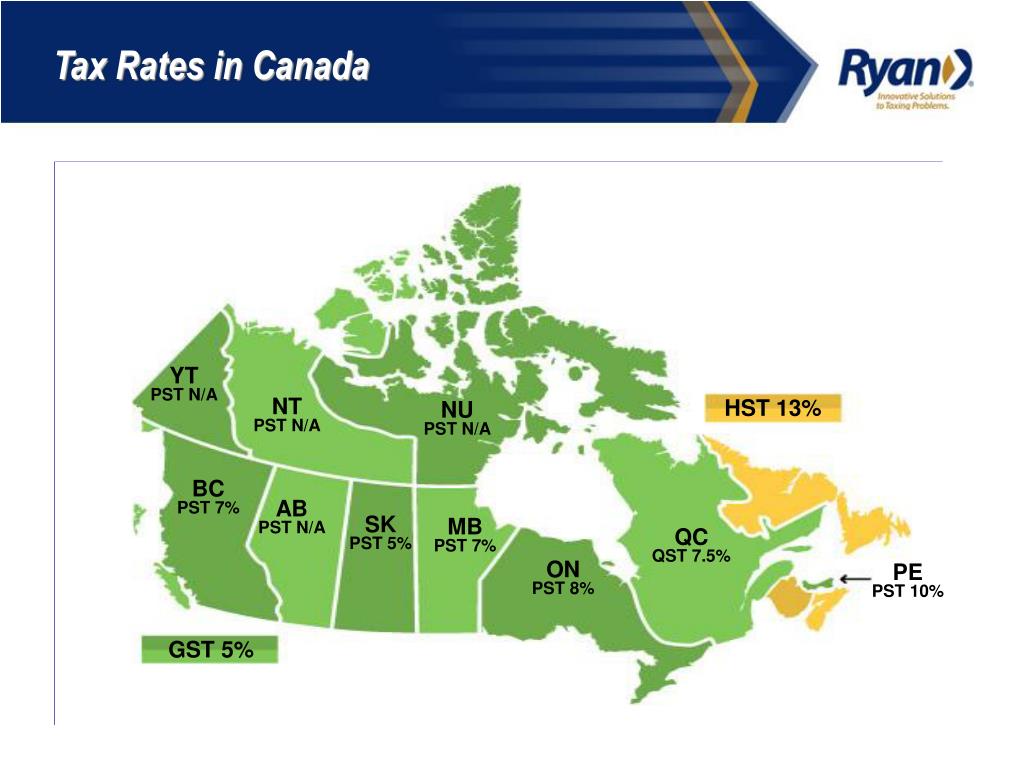

PPT Canadian Sales Taxes On Cross Border Transactions PowerPoint

Are You Ready Greater Fool Authored By Garth Turner The Troubled

Canadian Income Tax Rates - 0 00 15 00 20 00 24 00 25 75 221 709 and up 41 279 27 56 The tax rates reflect budget proposals and news releases to January 15 2022 Where the tax is determined under the minimum tax provisions the above table is not applicable Alternative minimum tax AMT and Quebec minimum tax QMT may be applicable