Capital Gains Tax Rebate Web 27 janv 2023 nbsp 0183 32 New way to obtain a capital gains tax refund by Rebecca Cave HMRC has introduced a mechanism to allow initial overpayments of capital gains tax CGT to

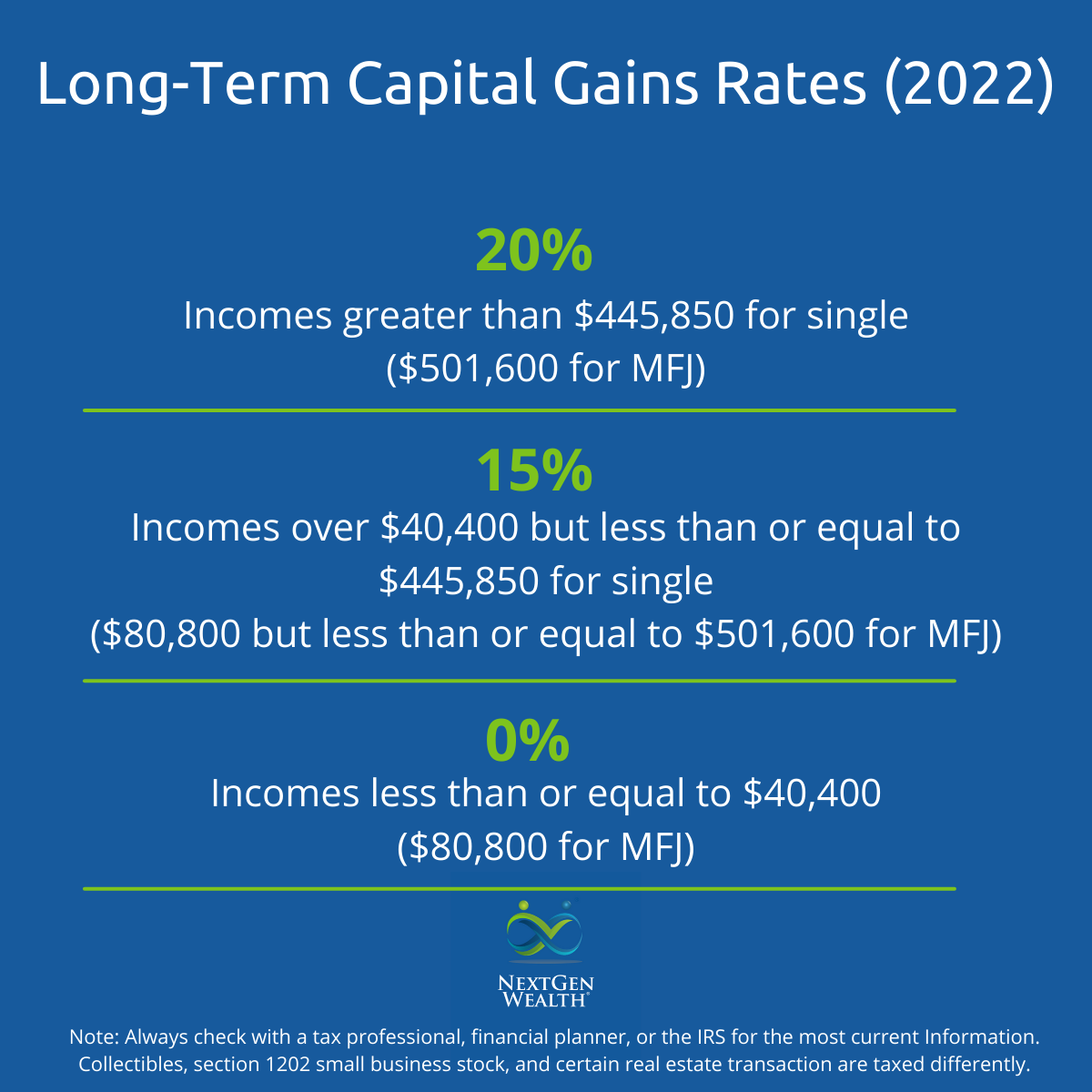

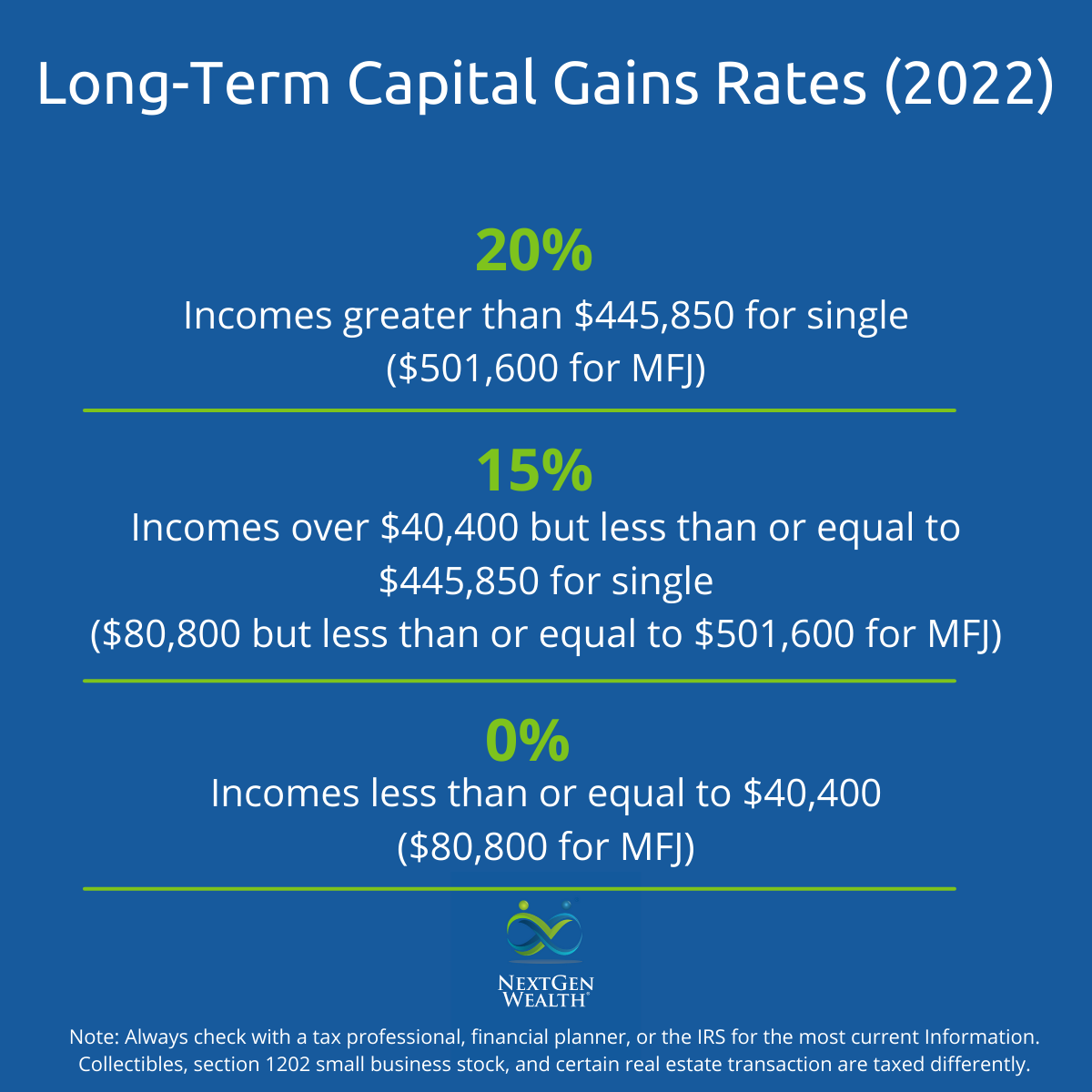

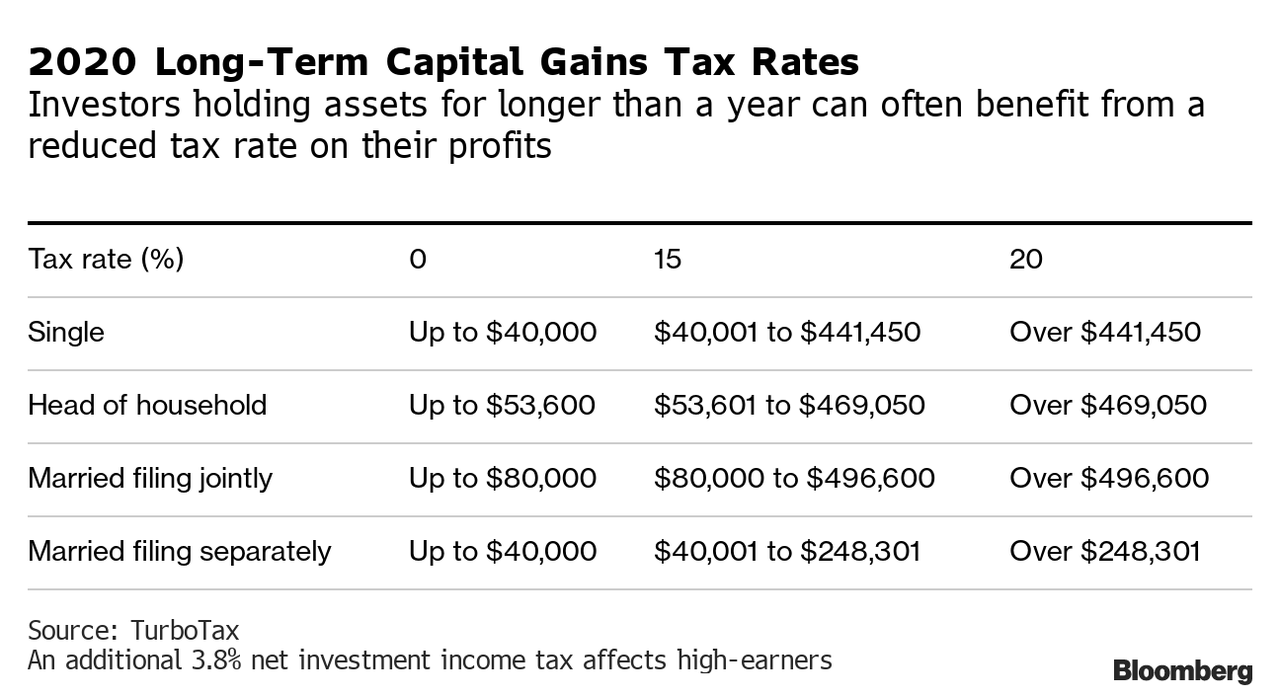

Web 24 f 233 vr 2018 nbsp 0183 32 The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year Capital gains taxes on assets held for a year or less correspond to ordinary Web 15 nov 2022 nbsp 0183 32 Long term capital gains taxes are paid when you ve held an asset for more than one year and short term capital gains apply to profits from an asset you ve held for

Capital Gains Tax Rebate

Capital Gains Tax Rebate

https://i2.wp.com/blog.commonwealth.com/hs-fs/hubfs/Images_Blog/Understanding the Capital Gains Tax - Chart.png?width=1854&name=Understanding the Capital Gains Tax - Chart.png

Can Capital Gains Push Me Into A Higher Tax Bracket

https://www.nextgen-wealth.com/images/blogImages/Long-Term-Capital-Gains-Tax-Brackets-2022-.png

Long Term Capital Gain Tax Rate For Ay 2022 23 Latest News Update

https://i.pinimg.com/originals/57/a2/27/57a2275bd156a3432290afc7b164dfb2.png

Web 22 d 233 c 2022 nbsp 0183 32 For 2022 long term capital gains tax rate varies between 0 for individuals earning up to 41 675 44 625 for 2023 and 20 for single filers making more than Web 22 f 233 vr 2023 nbsp 0183 32 26 64 Events that trigger a disposal include a sale donation exchange loss death and emigration The following are some of the specific exclusions R2 million

Web Your taxable income is 82 050 85 000 10 000 12 950 putting you in the 22 tax bracket for 2022 However you don t pay 22 on all your income only income over Web 2 mai 2023 nbsp 0183 32 Section 87A rebate is available under the old and the new tax regime Rebate against various tax liabilities Section 87A rebate can be claimed against tax liabilities on Normal income which is taxed at the

Download Capital Gains Tax Rebate

More picture related to Capital Gains Tax Rebate

Long Term Vs Short Term Capital Gains Tax Ultimate Guide Ageras

https://assets-prod.ageras.com/assets/frontend/upload/resources/lt-capital-gains-tax-brackets.png

View 27 Capital Gains Tax Brackets Quoteqlaboratory

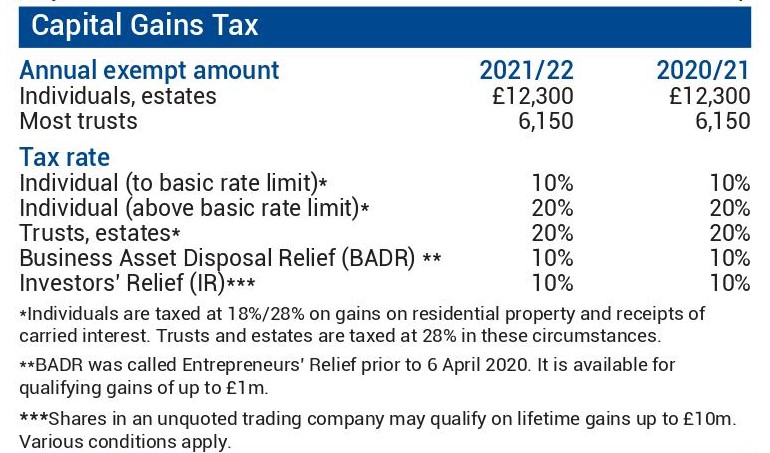

https://parkerhartley.co.uk/wp-content/uploads/2021/03/Capital-Gains-Tax-1.jpg

Arizona Capital Gains Tax Rate 2022 Latest News Update

https://i2.wp.com/itep.sfo2.digitaloceanspaces.com/0801-Figure-5-Capital-Gains-vs-Interest.jpg

Web 20 d 233 c 2021 nbsp 0183 32 Since your income including the gross long term capital gains does not exceed the threshold of five lakhs you are eligible to claim the rebate under Section Web 2 f 233 vr 2023 nbsp 0183 32 Under Section 54 the IncomeTax Act an individual or HUF selling a residential property can avail tax exemptions from Capital Gains if the capital gains are invested

Web Tax on income Accumulation and income shares Equalisation payments Tax on investment growth Calculating the gain Gains on accumulation units shares Gains on Web 25 oct 2022 nbsp 0183 32 A capital gain arises when you dispose of an asset on or after 1 October 2001 for proceeds that exceed its base cost The relevant legislation is contained in

20 Capital Gains Worksheet 2020

https://i.pinimg.com/736x/ae/e0/c1/aee0c124b354b5d72825eda9e7b58fbf.jpg

Georgie Quigley

https://darrowwealthmanagement.com/wp-content/uploads/2020/06/2022-Income-Tax-Brackets.png

https://www.accountingweb.co.uk/tax/personal-tax/new-way-to-obtain-a...

Web 27 janv 2023 nbsp 0183 32 New way to obtain a capital gains tax refund by Rebecca Cave HMRC has introduced a mechanism to allow initial overpayments of capital gains tax CGT to

https://www.nerdwallet.com/article/taxes/capital-gains-tax-rates

Web 24 f 233 vr 2018 nbsp 0183 32 The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year Capital gains taxes on assets held for a year or less correspond to ordinary

People Are Starting To Scramble 2020 s Newbie Traders Face A Lesson

20 Capital Gains Worksheet 2020

What Is The Capital Gains Tax Rate For 2022 2022 CGR

2023 Tax Brackets The Best Income To Live A Great Life

Pension Calculation Uk Offers Discounts Save 69 Jlcatj gob mx

Capital Gains Tax Calculator

Capital Gains Tax Calculator

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

Form 2438 Undistributed Capital Gains Tax Return 2013 Free Download

Long Term Capital Gain Tax Calculator For Ay 2020 21 In Excel Qatax

Capital Gains Tax Rebate - Web a person must simply declare capital gains and capital losses in the annual income tax return If the sum of a person s capital gain ors capital losses exceeds the annual