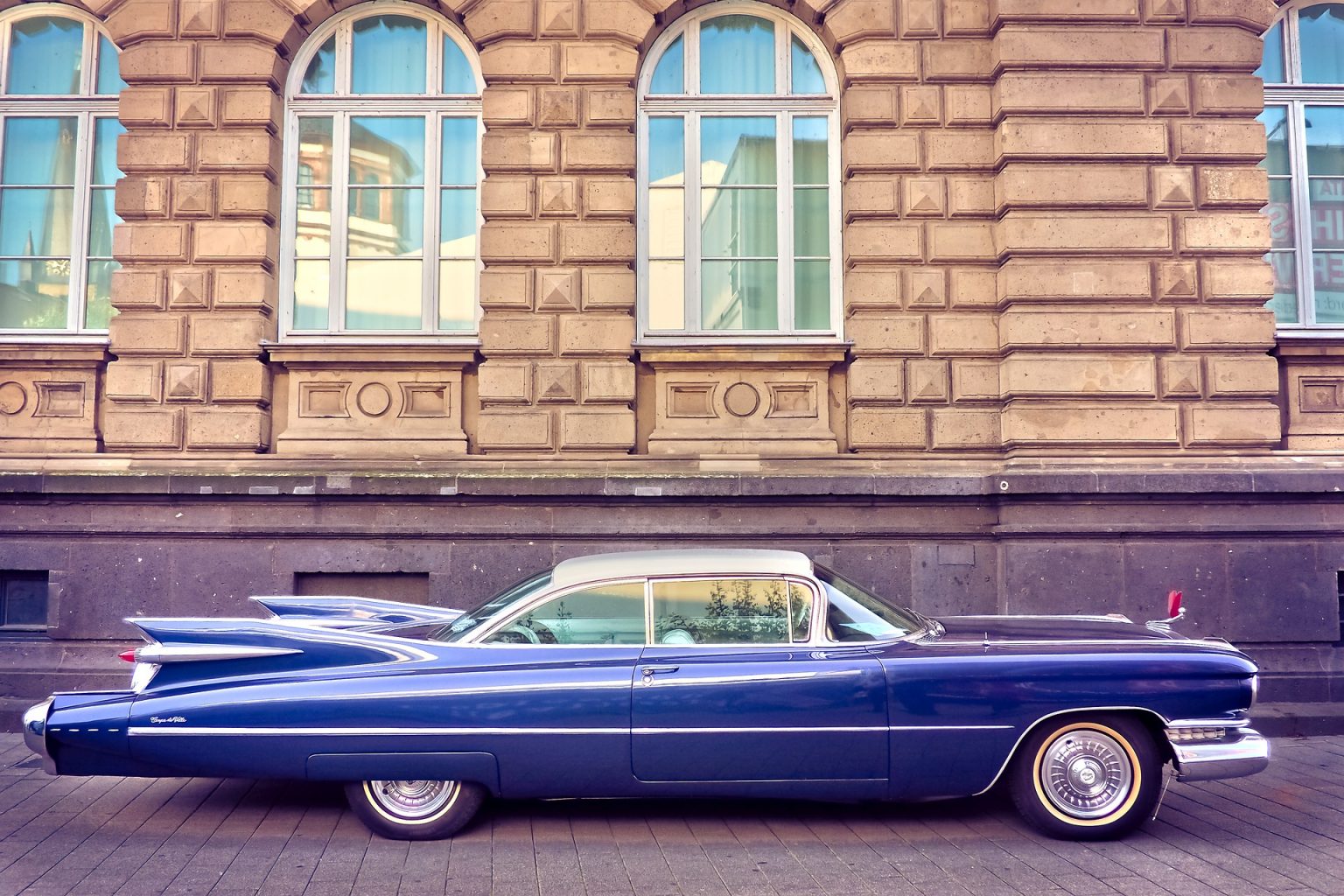

Car Donation Tax Deduction Amount Learn how to check out the charity the value of your vehicle and your responsibilities as a donor Find out the rules and limits for deducting your vehicle contribution based on the charity s use of the vehicle

Donating a vehicle to a charity is a great way to give back to your favorite organization and may also allow you to receive a tax deduction When you donate a qualified vehicle valued at more than 500 the organization Learn how to claim a tax deduction on your car donation to Habitat based on the selling price or fair market value of your vehicle Find out how to calculate your vehicle s value what documentation to receive

Car Donation Tax Deduction Amount

Car Donation Tax Deduction Amount

https://www.humanecars.org/wp-content/uploads/tax-deduction-note.jpg

Car Donation Tax Deduction Tax Benefits Of Donating A Car

https://www.goodwillcardonation.org/wp-content/uploads/2016/06/auto-goodwill-car-donation--1536x1024.jpg

Car Donation Tax Deduction Goodwill Car Donations

https://www.goodwillcardonation.org/wp-content/uploads/2020/07/Tax-Documents-1024x683.jpg

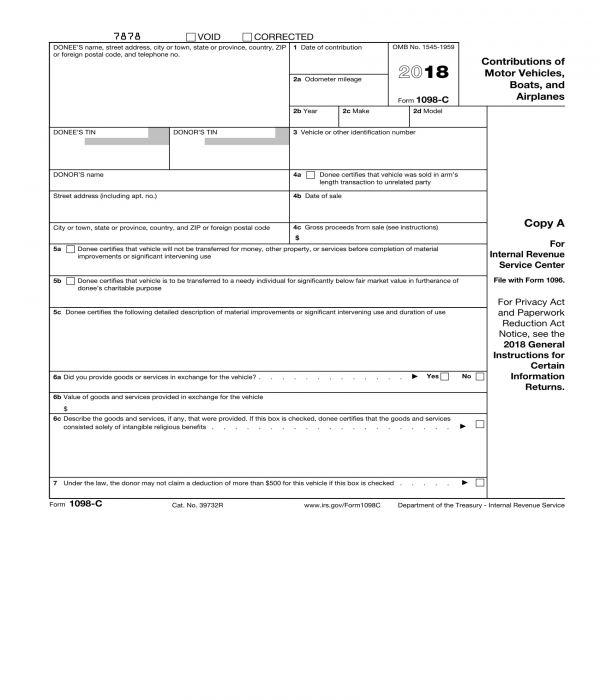

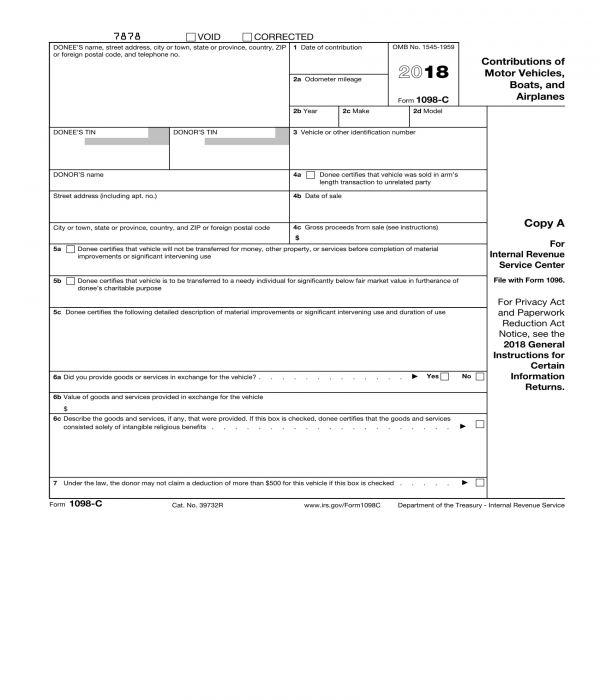

Typically you ll receive a written receipt that tells you how much the car sold for and this is the amount you should use as a tax deduction On the other hand there are a few cases Donors may claim a deduction of the vehicle s fair market value under the following circumstances The charity makes a significant intervening use of the vehicle such as using it to deliver meals on wheels

Learn how to get the maximum tax benefit from donating your car or vehicle to charity in 2024 Find out the IRS rules forms and tips for claiming your car donation tax deduction Learn how to deduct the value of your car donation from your income tax depending on whether you itemize or take the standard deduction Find out how to determine the fair market value of your car

Download Car Donation Tax Deduction Amount

More picture related to Car Donation Tax Deduction Amount

How Does Donating A Car Affect Taxes

https://www.donateforcharity.com/wp-content/uploads/2013/10/irs-car-donation-tax-deduction-e1381639923844.jpg

Maximize Your Impact The Ultimate Guide To Car Donation And Tax

https://www.u-pull-it.com/wp-content/uploads/2023/07/BEST-CHARITIES-FOR-CAR-DONATION-TAX-DEDUCTION.jpg

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Your deduction for a donated car boat or airplane is generally limited to the gross proceeds from its sale by the qualified organization This rule applies if the claimed value of the donated vehicle is more than 500 In certain Learn how to claim a tax deduction for donating your car to a qualified charity such as Rawhide Youth Services Find out the IRS rules on FMV documentation and best practices for car donation

In this comprehensive guide we will delve into the intricacies of car donations for tax deductions providing you with valuable insights to make informed decisions and potentially benefit from tax incentives while supporting a worthy cause How much do you get for donating a car If your donated car sells for under 500 you are allowed to claim the fair market value of your car up to 500 If your donated cars sells for more than 500 you are allowed to claim the precise dollar amount that your car was

FREE 6 Car Donation Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2018/07/Car-Donation-Tax-Form.jpg

Donate Car For Tax Credit 2016 Car Donation Tax Deduction How To Get

https://3.bp.blogspot.com/-I2ZnysVTsCw/V0MFtS_ztYI/AAAAAAAAAAY/Aq_AEm6A9LE47-HnrHKpziRJSvLjgVpYwCLcB/s1600/tax.jpg

https://www.irs.gov/pub/irs-pdf/p4303.pdf

Learn how to check out the charity the value of your vehicle and your responsibilities as a donor Find out the rules and limits for deducting your vehicle contribution based on the charity s use of the vehicle

https://www.hrblock.com/.../1098-c-ve…

Donating a vehicle to a charity is a great way to give back to your favorite organization and may also allow you to receive a tax deduction When you donate a qualified vehicle valued at more than 500 the organization

How Do I Estimate The Value Of My Donated Car For My Tax Deduction

FREE 6 Car Donation Forms In PDF MS Word

Donate Car For Tax Deduction Tax Deductions Donate Car Deduction

We Have Cash And Are Looking To Buy One Or Two Properties This Month In

What Is My Car Donation s Value Tax Deduction

Donate Your Car For A Tax Deduction

Donate Your Car For A Tax Deduction

Car Donation Tax Deduction Goodwill Car Donations

How To Donate Car In Maryland Car Donation Tax Deduction Donate Car

Vehicle Donation Receipt Template

Car Donation Tax Deduction Amount - Learn how to deduct the value of your car donation from your income tax depending on whether you itemize or take the standard deduction Find out how to determine the fair market value of your car