Car Fuel Allowance Tax Exemption Section Check the exact requirements and check how much can be paid to you in tax free kilometre allowances and per diems Decision of the Tax Administration on tax exempt allowances for travel expenses 2024 Decision of the Tax Administration on tax exempt allowances for travel expenses 2023

17 rowsSections Maximum Deduction year Remarks Section 80C There can be no tax exemption on the fuel and driver salary reimbursement if the car is used only for personal purposes In other words the entire amount paid to you for fuel and driver salary will be taxable even if you submit bills

Car Fuel Allowance Tax Exemption Section

Car Fuel Allowance Tax Exemption Section

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

John Paul O Shea Fuel Allowance Expansion Update John Paul O Shea

https://johnpauloshea.ie/wp-content/uploads/2022/12/Fuel-Allowance-2023-2.jpg

Car Allowance Tax Exemption 2023

https://reef.org.au/wp-content/uploads/EG_2022_Winter_Pic6_Blog.jpg

Home Central Board of Direct Taxes Government of India The fuel allowance received by employees is subject to certain tax exemptions under section 10 The government has set a maximum limit of 2400 per month It means for an employee who has a taxable salary 2400 of the monthly salary is non taxable if the employer chooses to offer fuel allowance

Claiming Car Mileage Allowance Claiming car mileage allowance is a common source of head scratching how do you figure out what is eligible Other questions you ll be wondering will likely include Section 149 Where fuel is provided for a car the benefit of which is taxed in accordance with Chapters 11 and 12 company cars a fuel benefit charge will normally apply to tax

Download Car Fuel Allowance Tax Exemption Section

More picture related to Car Fuel Allowance Tax Exemption Section

Is The Risk Allowance Given To CRPF Employees Comes Under Section 10 14

https://qph.cf2.quoracdn.net/main-qimg-ed4ae02c5decd725eeeb274a38353f04-lq

Car Allowance Exemption U s 10 I Financialcontrol in

https://financialcontrol.in/wp-content/uploads/2018/04/car-allowance-income-tax-liability.jpg

All You Need To Know On Exempted Income In Income Tax Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/04/income-exempted.png

Travelling allowance petrol allowance toll rate up to RM6 000 annually Parking allowance Meal allowance Child care allowance of up to RM2 400 annually Subsidies on interest for housing education car loans Full exemption if up to RM300 000 loan The question raised is car allowance income tax liability There are some of the facts or points you must understand regarding Tax Exemption on Car Allowances or fuel reimbursement policy We will drive deep to clear and understand all the stuff about car allowance and its taxation

You purchased a new car in April 2023 for 24 500 and used it 60 for business Based on your business usage the total cost of your car that qualifies for the section 179 deduction is 14 700 24 500 cost 60 0 60 business use But see Limit on total section 179 special depreciation allowance and depreciation deduction discussed later Car maintenance allowance If the employer owned car is used by the employee and the employer reimburses driver s salary insurance maintenance and fuel expenses the taxable value will be Rs 2 700 per month car with engine capacity up to 1 600 cc or Rs 3 300 per month car with engine capacity more than 1 600cc

Fuel Allowance Form 2 Free Templates In PDF Word Excel Download

https://www.formsbirds.com/formimg/fuel-allowance-form/1666/fuel-allowance-form-michigan-d1.png

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

https://www.vero.fi/en/individuals/vehicles/...

Check the exact requirements and check how much can be paid to you in tax free kilometre allowances and per diems Decision of the Tax Administration on tax exempt allowances for travel expenses 2024 Decision of the Tax Administration on tax exempt allowances for travel expenses 2023

https://taxguru.in/income-tax/list-allowances...

17 rowsSections Maximum Deduction year Remarks Section 80C

Free Mileage Reimbursement Form 2022 IRS Rates PDF Word EForms

Fuel Allowance Form 2 Free Templates In PDF Word Excel Download

Section 10 Of Income Tax Act Deductions And Allowances

House Rent Allowance HRA Exemption Section 10 13A Income Tax CA Club

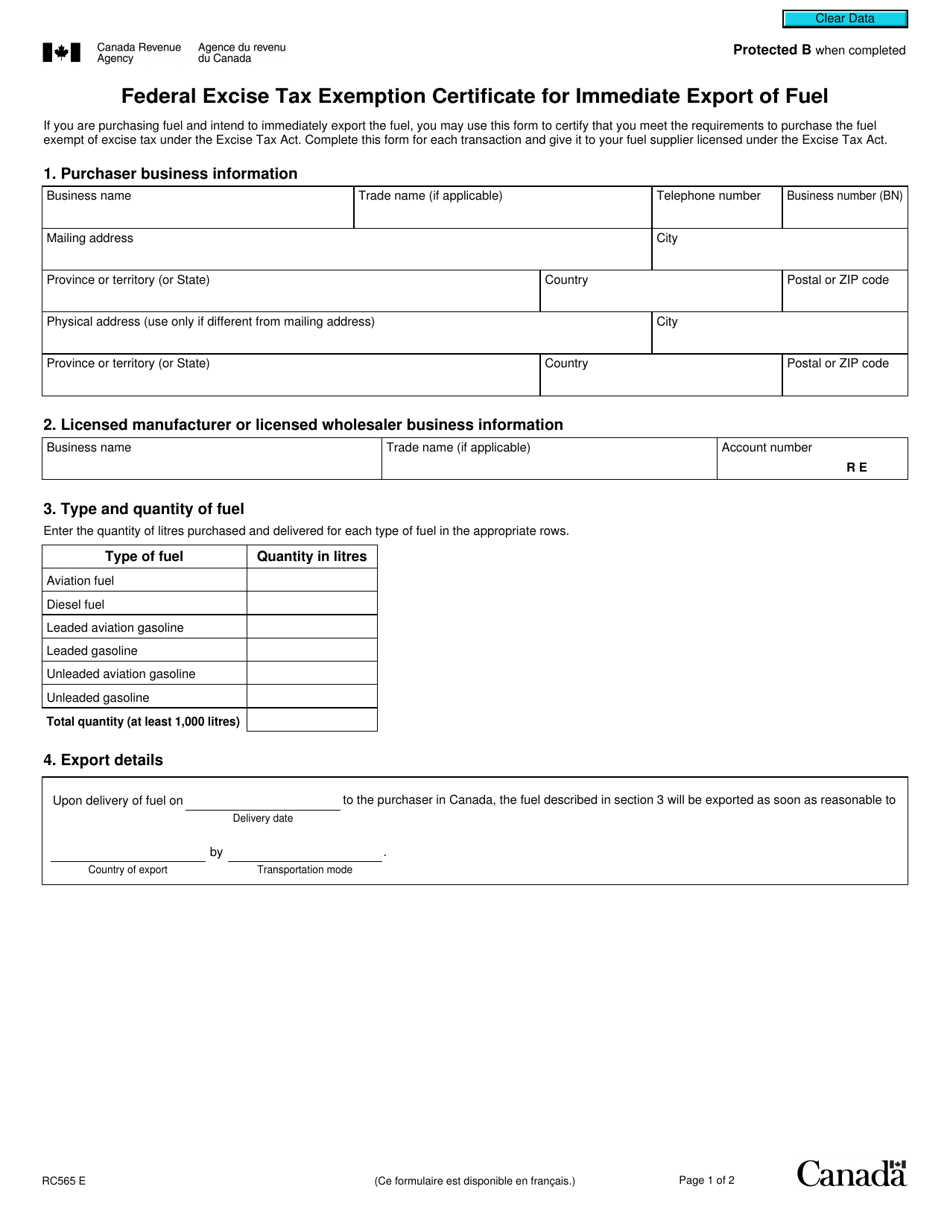

Form RC565 Fill Out Sign Online And Download Fillable PDF Canada

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

Explore Our Image Of Car Allowance Agreement Template For Free In 2020

Car Allowance Taxable In Malaysia JorgefvSullivan

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

Car Fuel Allowance Tax Exemption Section - Taxable Amount All Expenses 10 of actual cost Hire charges Driver s Salary No benefit can be availed by the employee in this regard The amount reimbursed will be mentioned in the pay slip and can be taxed according to the applicable income tax slab