Car Insurance Tax Form Vehicle data and tax payment By typing in a registration number or a vehicle identification number you can check the technical and vehicle tax data of any vehicle entered in the

You must submit this tax return when you apply for vehicle registration or when you enter a motor vehicle into taxable service in Finland for the first time The Submit a declaration of use and report the car tax Submit a declaration of use and file a car tax return if you are taking the vehicle into taxable use before registering it in

Car Insurance Tax Form

Car Insurance Tax Form

https://thumbs.dreamstime.com/b/car-insurance-auto-claim-document-count-property-tax-form-vehicle-vector-illustration-229142266.jpg

5 Things Your Accountant Wishes You Knew About Owning A Home Filing

https://i.pinimg.com/originals/4c/9c/70/4c9c7048997bbeb1f91747edd3b1b1c5.jpg

2290 Price TaxExcise IRS Authorized Electronic Filing Service

https://blog.taxexcise.com/wp-content/uploads/2022/06/2.jpg

Car insurance is tax deductible as part of a list of expenses for certain individuals Generally people who are self employed can deduct car Pay or cancel vehicle tax register your vehicle off road book or check an MOT insurance

How to deduct your car insurance on your tax forms If you are self employed including as a rideshare driver you will file a Schedule C tax form which If you work for an employer but still use your own vehicle for business you can fill out Form 2106 These forms allow for reporting of auto insurance premiums and deductibles as a business

Download Car Insurance Tax Form

More picture related to Car Insurance Tax Form

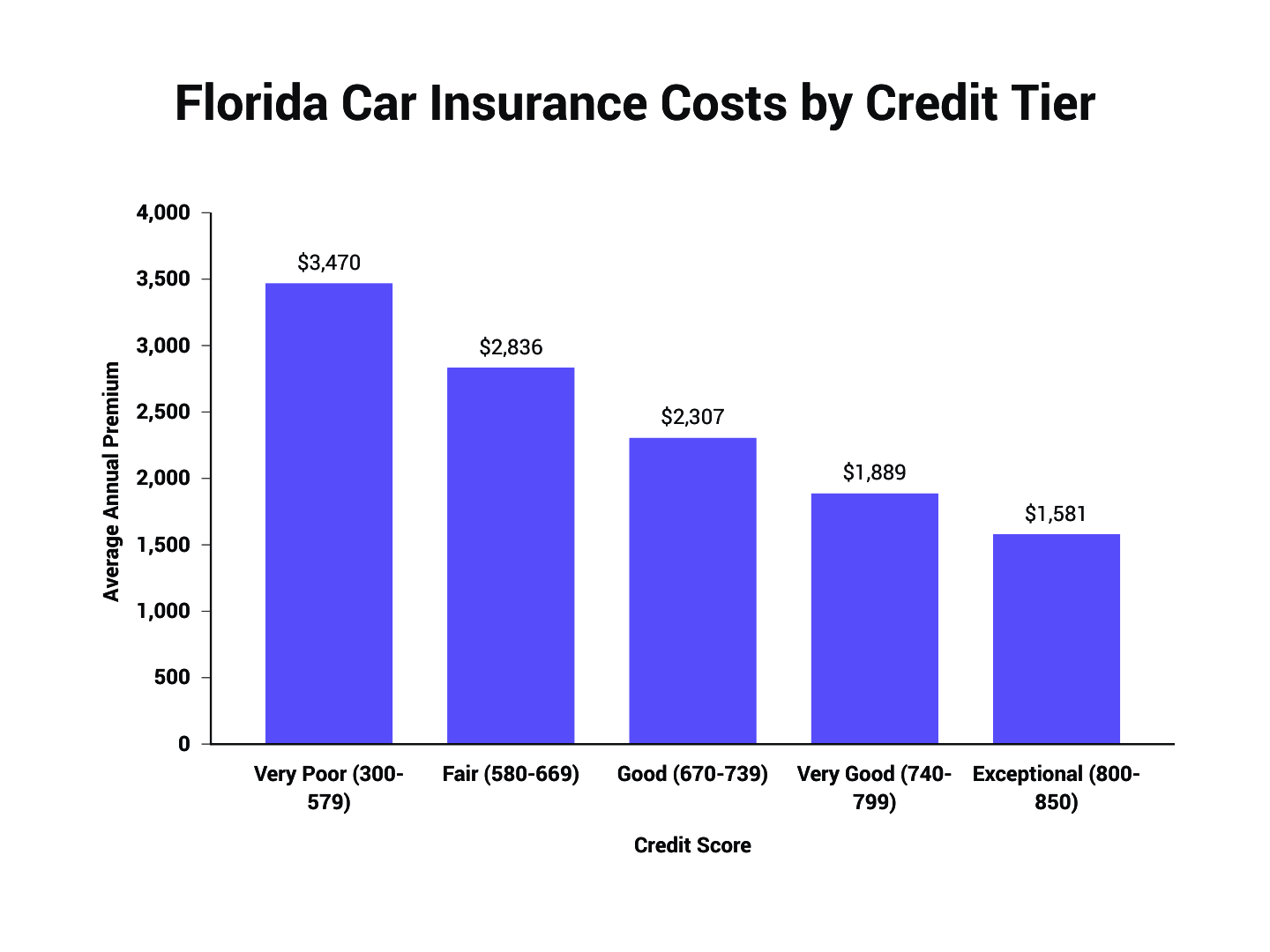

How Much Is Car Insurance A Month 2022 Insure Can Be Fun For

https://www.forbes.com/advisor/wp-content/uploads/2022/02/comparison-of-auto-insurance-complaint-levels.png

VIP Tax And Accounting Services

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100063526784064

Best Car Insurance Companies For Texans DrivingGuide Articles

https://www.drivingguide.com/wp-content/uploads/2019/01/best-car-insurance-for-texans.png

Renew or tax your vehicle for the first time using a reminder letter your log book or the green new keeper slip and how to tax if you do not have any documents You would include your auto costs as a business expense on Schedule C Profit or Loss From Business which must be filed with your Form 1040 tax return As with the itemized deduction you can

Fill out and file the appropriate forms with the IRS at tax time If you re not sure how to calculate your expenses talk to your tax professional to ensure you re compensated IRS Tax Topic on deductible car expenses such as mileage depreciation and recordkeeping requirements If you use your car only for business purposes you

Vehicle Insurance Belmont Car Rental And Tour

https://i0.wp.com/tciholiday.com/wp-content/uploads/2019/12/car-insurance-.png?fit=2055%2C1305&ssl=1

Freelance Accounting Personal Tax Services

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100057362743633

https://www.traficom.fi/en/services/vehicle-data-and-tax-payment

Vehicle data and tax payment By typing in a registration number or a vehicle identification number you can check the technical and vehicle tax data of any vehicle entered in the

https://www.vero.fi/.../1200e-car-tax-return

You must submit this tax return when you apply for vehicle registration or when you enter a motor vehicle into taxable service in Finland for the first time The

6 Types Of Car Insurance 2022

Vehicle Insurance Belmont Car Rental And Tour

What s The Average Cost Of Car Insurance In Florida For 2024 The Zebra

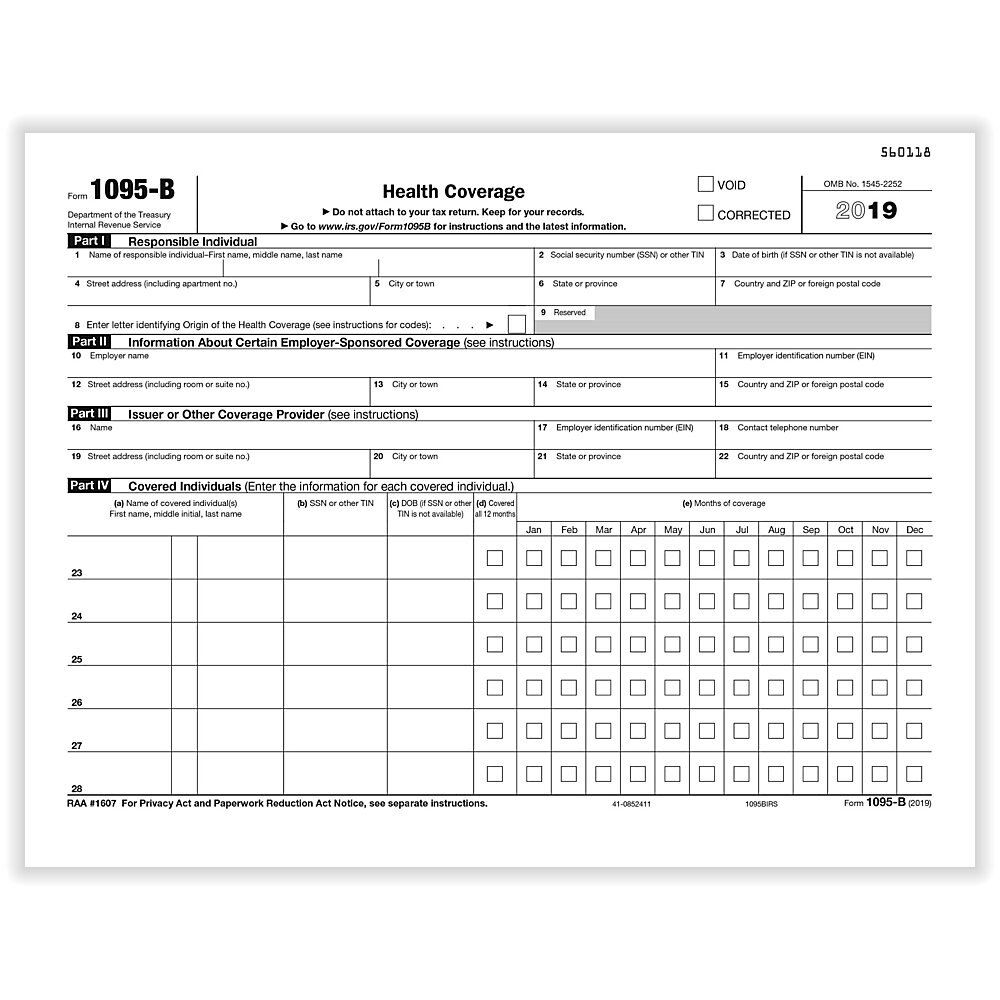

What Tax Forms Do I Need For Employee Health Insurance 2023

Tax Return Form Icons Correctly And Incorrectly Completed Tax Form

Car Insurance Uses Car Insurance Free Creative Commons F Flickr

Car Insurance Uses Car Insurance Free Creative Commons F Flickr

Car Insurance Prices By State Average Cost Of Car Insurance 2018

Can You Tax A Car Without Insurance Insure 2 Drive

Can You Pay Car Insurance With A Credit Card Insurance Navy Brokers

Car Insurance Tax Form - If you work for an employer but still use your own vehicle for business you can fill out Form 2106 These forms allow for reporting of auto insurance premiums and deductibles as a business