Car Lease Tax Benefits India INR 4 47 600 Out of this Rs 4 80 000 is your car lease amount and another Rs 39600 is allocated towards car maintenance insurance fuel and driver

At the end of the four years you would ve spent Rs 22 70 160 But leasing means you get a tax benefit of up to 30 Car leasing option can save more tax than auto loan income tax deduction When compared to an auto loan a company leased car works out to be a far better

Car Lease Tax Benefits India

Car Lease Tax Benefits India

https://static.toiimg.com/thumb/msid-79383655,width-1070,height-580,imgsize-119730,resizemode-75,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

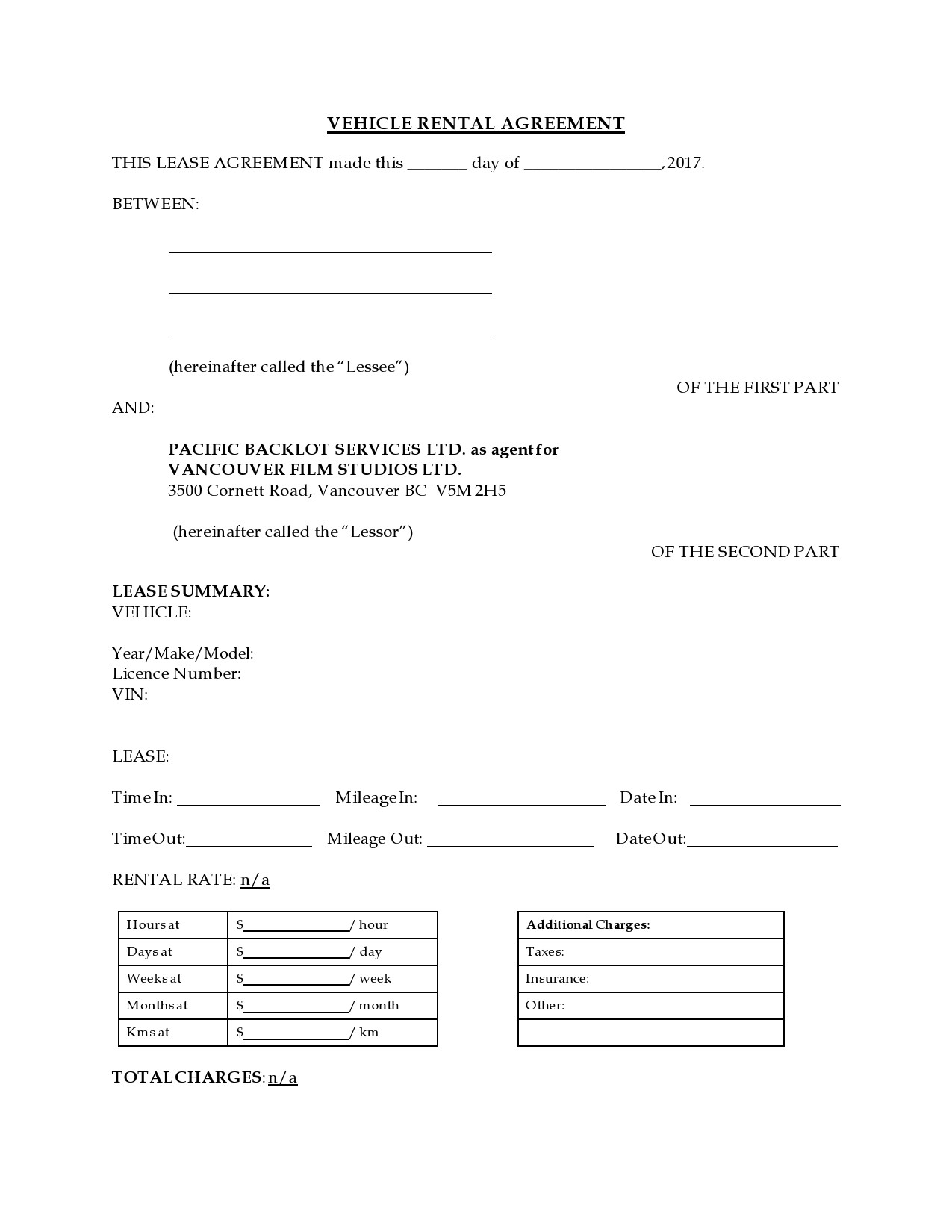

Editable Vehicle Rental Lease Agreement Car Rental Agreement Lease

https://i.etsystatic.com/24665948/r/il/dfd8e1/3719616726/il_1080xN.3719616726_r79t.jpg

Financing Equipment Lease Tax Benefits In Canada Filing Taxes

https://filingtaxes.ca/wp-content/uploads/2021/12/photo-1619379104040-5c22149c734d-768x577.jpg

97 rowsBenefits A Allowances 1 10 13A House Rent Allowance Sec 10 13A As the lease amount is deducted from the pre tax salary the employee stands to save up to 30 in taxes As opposed to a car loan that comes with hefty down

Help Support Car leasing is alternative way to finance your car in India and picking up traction faster than ever all due to its long list of benefits and savings Unlock tax benefits with a corporate car lease policy Explore how opting for a salary linked car leasing model provided by your employer can significantly reduce

Download Car Lease Tax Benefits India

More picture related to Car Lease Tax Benefits India

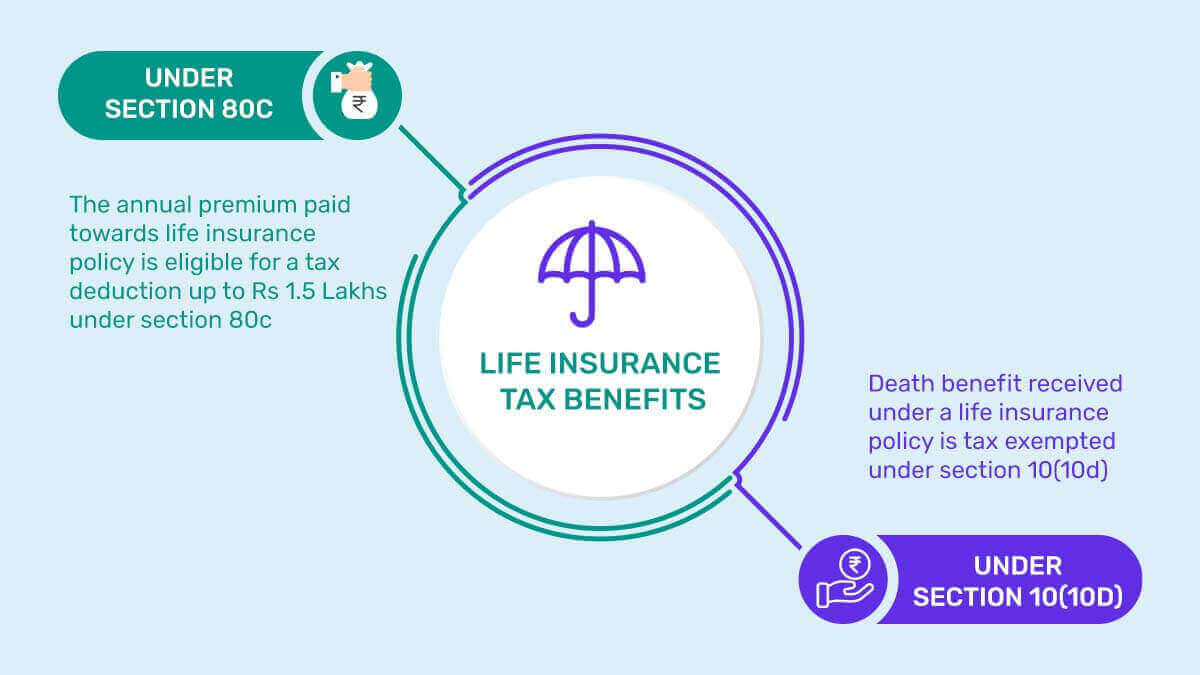

Life Insurance Tax Benefits In India 2023 PolicyBachat

https://www.policybachat.com/ArticlesImages/1165.jpg

Used Car Lease Affordable Car Leasing 2020

https://www.automotivereconditioningfranchise.com/wp-content/uploads/2020/12/can-you-lease-a-car-and-then-buy-it.jpg

The Fees And Taxes Involved In Car Leasing Complete Guide

https://belowinvoice.com/wp-content/uploads/2020/03/car-lease-tax-featured-image-1200x799.jpg

1 No Down Payment Needed The car you obtain is financed by a leasing company So as a lessee you do not need to pay any down payment amount while Tax deductions on such leases will help bring down the cost of a vehicle by at least 20 40 Car leasing allows an individual to use a vehicle for a specified duration by paying rentals

Benefits of ClearTax Lease Calculator The ClearTax Lease Calculator shows you the effective interest rate and the monthly payments You get to understand the benefits of a The EMI you have to pay towards the car loan will depend on the rate of interest decided by the bank Your eligibility for the loan will depend on your income

Free Car Rental Agreement Template To Help You Win More Clients

https://signaturely.com/wp-content/uploads/2023/02/car-rental-agreement-template-1.png

Canadian Equipment Lease Tax Benefits Thomcat Leasing Blog

https://thomcatleasing.ca/wp-content/uploads/2020/02/cash-in-on-canadian-equipment-lease-tax-benefits.jpg

https://blog.saginfotech.com/income-tax-benefits-car-lease-employer-india

INR 4 47 600 Out of this Rs 4 80 000 is your car lease amount and another Rs 39600 is allocated towards car maintenance insurance fuel and driver

https://timesofindia.indiatimes.com/business/india...

At the end of the four years you would ve spent Rs 22 70 160 But leasing means you get a tax benefit of up to 30

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Free Car Rental Agreement Template To Help You Win More Clients

Car Lease Tax Deduction Hmrc Jeraldine Will

Downloadable Printable Car Rental Agreement Form

Car Lease Tax Deduction Calculator Have A Large Ejournal Lightbox

Analysing Tax Deductions In India And Exemptions On Life Insurance

Analysing Tax Deductions In India And Exemptions On Life Insurance

Is Your Car Lease A Tax Write Off A Guide For Freelancers

AUTO LEASE TAX BENEFITS Explained By DON DIAMOND YouTube

Car Lease Tax Write Offs Secrets Revealed YouTube

Car Lease Tax Benefits India - Unlock tax benefits with a corporate car lease policy Explore how opting for a salary linked car leasing model provided by your employer can significantly reduce