Car Loan Income Tax Rebate Web Read on to know who can claim benefits on their car loan When you opt for an education loan or a home loan you avail of certain tax benefits and get tax exemptions from

Web 16 sept 2022 nbsp 0183 32 To get a tax rebate on car loan you have to list the car loan interest paid as a business expense For this you can request your lender to issue an interest Web Read about tax benefits of a car loan for self employed individuals in this guide before claiming it You can claim your car loan interest amount as business expenses amp save

Car Loan Income Tax Rebate

Car Loan Income Tax Rebate

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

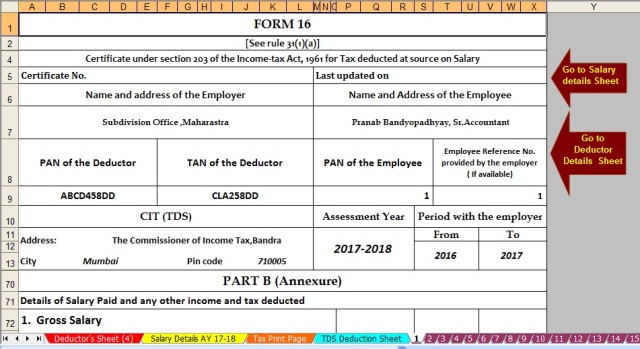

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Auto Loan Rebate Financing Comparison Calculator

https://www.carpaymentcalculator.net/images/rebate-check.jpg

Web 8 mars 2023 nbsp 0183 32 If you pay 1 000 in interest on your car loan annually you can only claim a 500 deduction If on the other hand the car is used entirely for business purposes then the full amount of Web Il y a 1 jour nbsp 0183 32 Lower income buyers could get up to 12 000 California is eliminating its popular electric car rebate program which often runs out of money and has long

Web 21 oct 2022 nbsp 0183 32 How to get an auto rebate Unlike 0 percent financing car rebates don t have any set criteria If you pick a model and trim with a rebate you qualify Search manufacturer deals on new cars Web 7 mars 2023 nbsp 0183 32 3 ways to use your tax refund to pay for a car There are a few ways you can fund a tax return car purchase Depending on your current financial situation determine which route is best for you

Download Car Loan Income Tax Rebate

More picture related to Car Loan Income Tax Rebate

The Florida Hybrid Car Rebate Save Money And Help The Environment

https://cdn.osvehicle.com/do_hybrid_cars_get_a_tax_rebate.png

Income Tax

https://images.dailynews360.com/fit-in/636x386/dnn-upload/images/2020/11/21/image-1605979376.jpg

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

https://vakilsearch.com/advice/wp-content/uploads/2019/07/Income-tax-rebate-under-Section-87A.jpg

Web 11 avr 2023 nbsp 0183 32 If you use your car for business is it better to sign a new car lease or buy it outright Find out what can deduct and how to decide Web While tax deductions can save you money refinancing your auto loan first might make more sense If your interest rate is high it pays to look into refinancing possibilities You can

Web 30 juil 2023 nbsp 0183 32 Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to purchase an electric car Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Quick Reference Page From My Fav Budgeting Book References Page

https://i.pinimg.com/originals/2a/88/cc/2a88ccbb0a34b0be650797c063fb1277.jpg

https://www.idfcfirstbank.com/finfirst-blogs/car-loan/tax-benefits-on-car-loan

Web Read on to know who can claim benefits on their car loan When you opt for an education loan or a home loan you avail of certain tax benefits and get tax exemptions from

https://www.tatacapital.com/.../income-tax-benefits-on-car-loan

Web 16 sept 2022 nbsp 0183 32 To get a tax rebate on car loan you have to list the car loan interest paid as a business expense For this you can request your lender to issue an interest

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

2007 Tax Rebate Tax Deduction Rebates

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Tax Rebate Under Section 87A Investor Guruji Tax Planning

How To Calculate Tax Rebate On Home Loan Grizzbye

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

The Benefits Of An Interest Rate Calculator For Car Loan Funaya Park

Pin On Tigri

Income Tax Rebate Hike Rs 5000 Under Section 87A With Automated

Car Loan Income Tax Rebate - Web 7 mars 2023 nbsp 0183 32 3 ways to use your tax refund to pay for a car There are a few ways you can fund a tax return car purchase Depending on your current financial situation determine which route is best for you