Car Loan Interest Deduction If you pay 1 000 in interest on your car loan annually this means you can only claim a 500 deduction On the other hand if the car is used entirely for business purposes the full amount

You can t deduct your car loan principal payments on your taxes but if you re self employed and you re financing a car you use for work all or a portion of the auto loan interest may be tax deductible The amount you can deduct will depend on how many miles you drive for business vs personal use Typically deducting car loan interest is not allowed But there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense

Car Loan Interest Deduction

Car Loan Interest Deduction

http://blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-20131.jpg

TransUnion Auto Loan Terms Lengthen As Interest Rates Rise ILL Cals

https://www.wardsauto.com/sites/wardsauto.com/files/Auto loan Getty 2.jpg

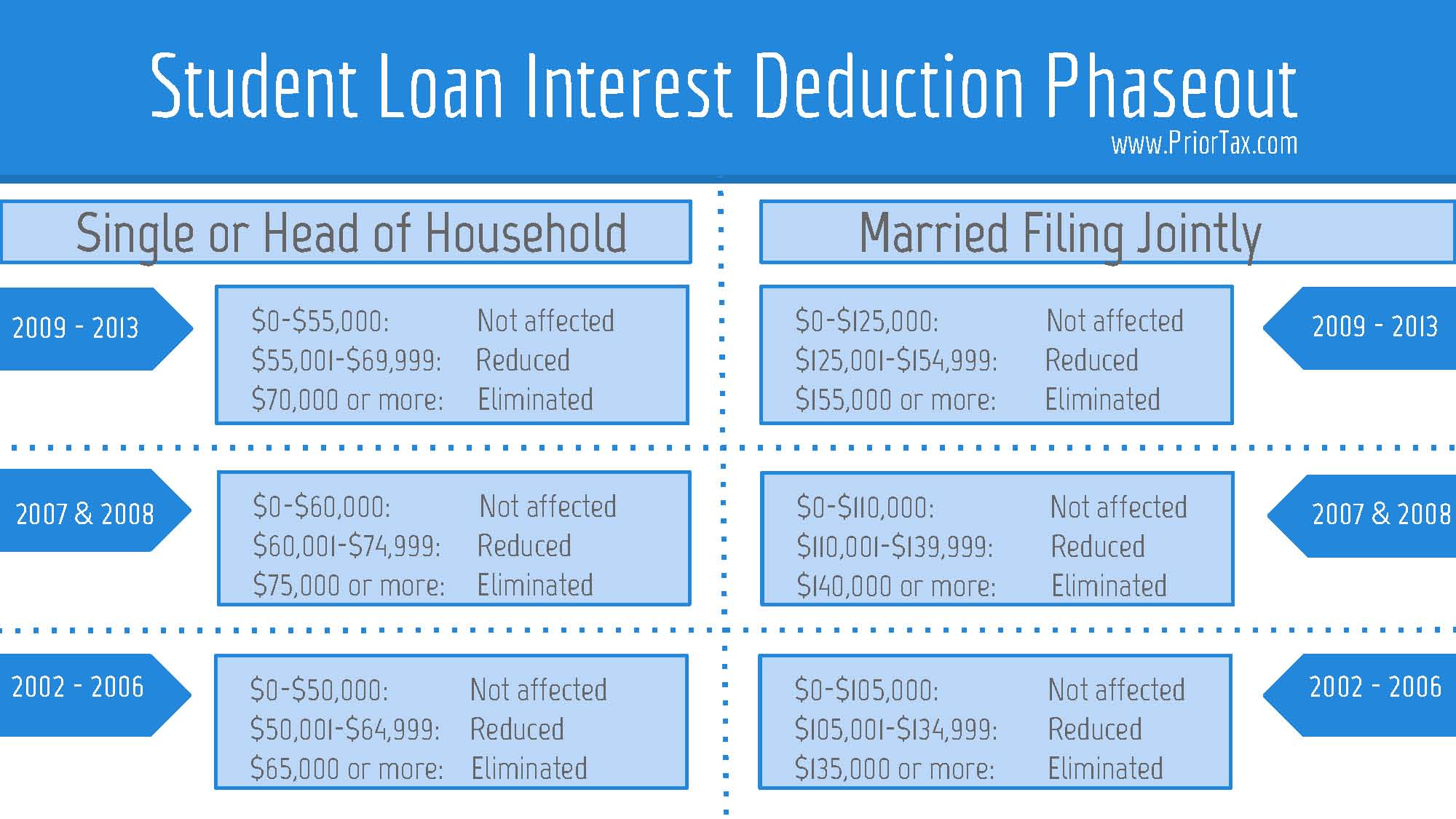

Student Loan Interest Deduction Who s Eligible And How To Apply For A

https://phantom-marca.unidadeditorial.es/b9d9e750c88f4c28889d6c6e55172bb0/resize/1320/f/jpg/assets/multimedia/imagenes/2022/03/23/16480644606624.jpg

Section 80EEB has been introduced allowing a deduction for interest paid on loan taken for the purchase of electric vehicles A deduction for interest payments up to Rs 1 50 000 is available under Section 80EEB Read to know more Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction When you prepay interest you must allocate the interest over the tax years to which the interest applies

Car loan interest is deductible in certain situations where you use your vehicle for business purposes Owning a car that you use some or all of the time for your business can provide tax Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of interest are tax deductible

Download Car Loan Interest Deduction

More picture related to Car Loan Interest Deduction

Claiming The Student Loan Interest Deduction

https://www.taxdefensenetwork.com/wp-content/uploads/2022/04/student-loan-interest-deduction-worksheet-1-2048x1352.jpg

How To Get The Interest Deduction On Your Student Loan

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2021/12/0/0/Credible-student-loan-interest-deduction-iStock-thumbnail-1170448087.jpg?ve=1&tl=1

Electric Vehicle Loan Interest 80EEB HRWorks User Guide HRWorks

https://docs.hinote.in/download/attachments/852352/80EEB-Image1.png?version=1&modificationDate=1661256598454&api=v2

You re already paying a lot of money on your car loan so why not get some extra money back Unfortunately most people cannot take advantage of writing off car payment interest on their taxes This deduction usually applies only to those who are self employed or own their own business Deduct your self employed car expenses on Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship or Schedule F Form 1040 Profit or Loss From Farming if you re a farmer

You can deduct the interest paid on an auto loan as a business expense using one of two methods the expense method or the standard mileage deduction when you file your taxes But writing off car loan interest as a business expense isn t as easy as just deciding you want to start itemizing your tax return when you file Claiming Car Loan tax benefits is easy as long as you are actually using the car for legitimate business purposes For claiming the benefit at the time of filing tax returns include the loan interest paid in a year in the business expenses column

Mortgage Interest Tax Deduction What Is It How Is It Used

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Mortgage Interest Deduction On Your Taxes What It Is Who Qualifies

https://image.cnbcfm.com/api/v1/image/107059537-1652287238617-gettyimages-1024531896-2018-05-1100-06-57bradius8smoothing4-edit.jpeg?v=1704303235&w=1920&h=1080

https://www.bankrate.com/loans/auto-loans/car-loan...

If you pay 1 000 in interest on your car loan annually this means you can only claim a 500 deduction On the other hand if the car is used entirely for business purposes the full amount

https://lanterncredit.com/auto-loans/is-car-interest-tax-deductible

You can t deduct your car loan principal payments on your taxes but if you re self employed and you re financing a car you use for work all or a portion of the auto loan interest may be tax deductible The amount you can deduct will depend on how many miles you drive for business vs personal use

Home Loan Interest Deduction Procedure To Claim HomeCapital

Mortgage Interest Tax Deduction What Is It How Is It Used

HOME LOAN INTEREST CERTIFICATE For FY 2021 22 PDF Loans Interest

Student Loan Interest Deduction What You Need To Know

Is The Mortgage Interest Deduction In Play B Logics

Mortgage Interest Is Often Deductible When You Can Take The Mortgage

Mortgage Interest Is Often Deductible When You Can Take The Mortgage

33 Mortgage Interest Statement 2021 MasraMathieu

Deducting Mortgage Interest On Your Tax Return What To Know Kiplinger

Does A Car Loan Build Your Credit Score Lexington Law

Car Loan Interest Deduction - The answer to is car loan interest tax deductible is normally no But you can deduct these costs from your income tax if it s a business car It can also be a vehicle you use for both personal and business purposes but you need to account for the usage