Car Loan Rebate In Income Tax Web Are such deductions also available when you take a Car Loan Let us have a look Tax benefits on Car Loans Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST

Web Although car loan tax benefits exist they re not available for everyone Read on to know who can claim benefits on their car loan When you opt for an education loan or a home Web 9 juil 2019 nbsp 0183 32 Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to purchase an electric car

Car Loan Rebate In Income Tax

Car Loan Rebate In Income Tax

https://cbsnews1.cbsistatic.com/hub/i/r/2018/07/26/79e045b8-e83c-4fa1-b49a-93538a90aa6f/thumbnail/620x440/ea8746b1fb1a59c4853393af1da01206/car-loan-rates.png#

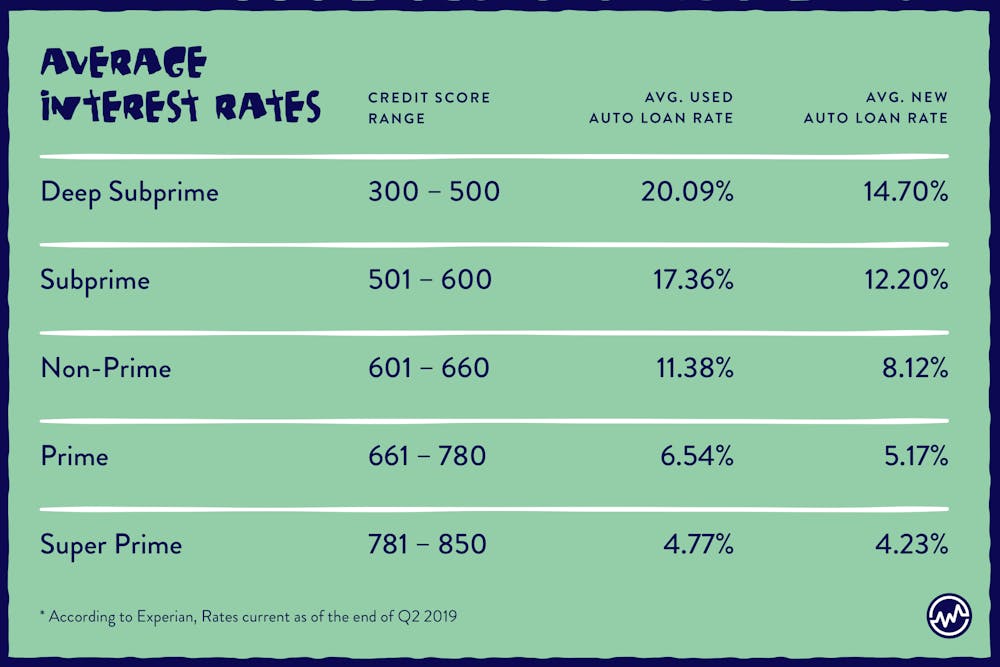

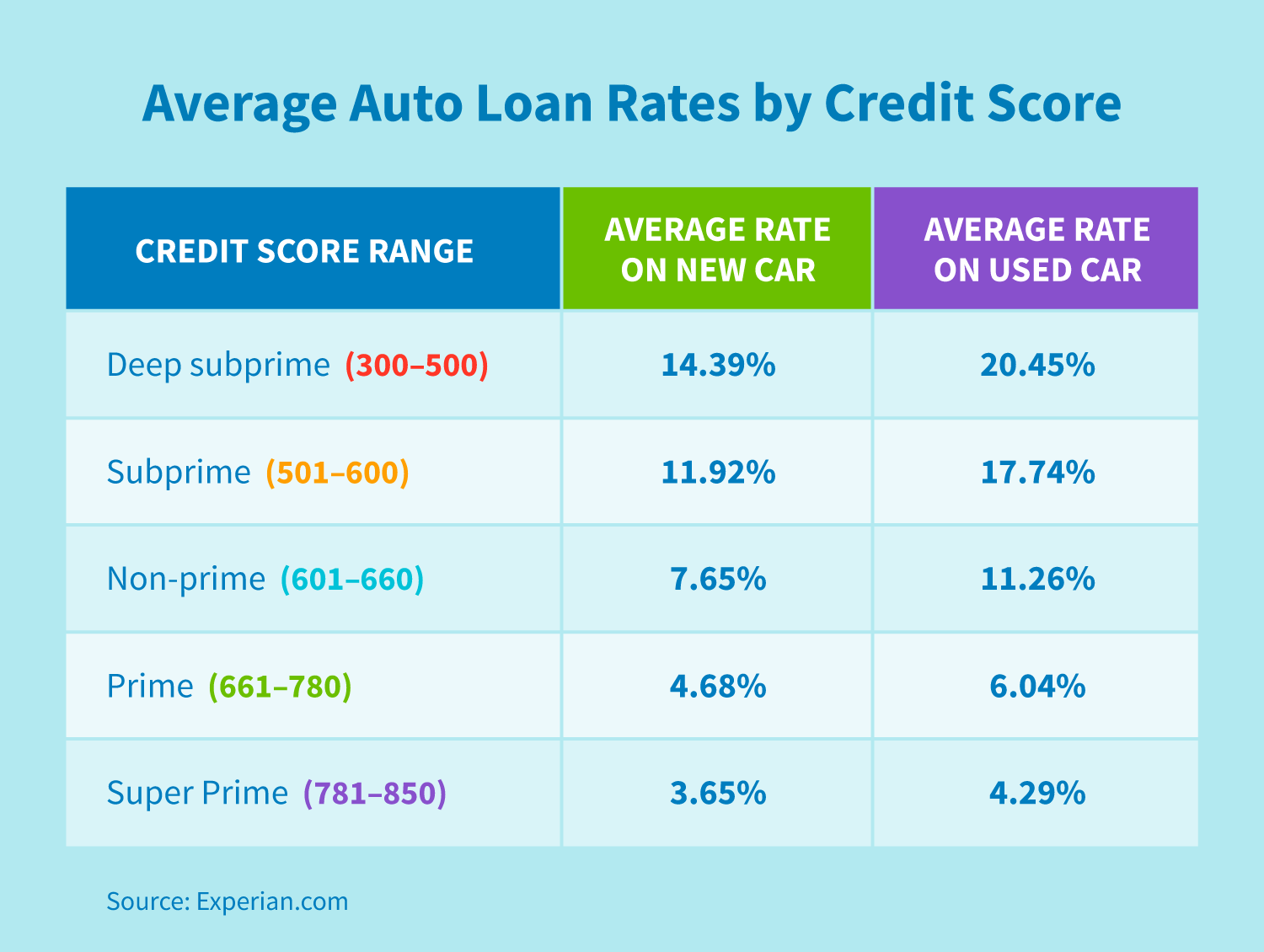

Average Auto Loan Rates Credit Repair

https://www.creditrepair.com/content/dam/credit-repair/assets/images/seo-articles/auto-loan-rate/average-auto-loan-rates.png

How To Get Out Of A Car Loan WealthFit

https://images.prismic.io/wealthfit-staging/feefe710-e9b9-47b3-bb79-96218fc4d13d_02-Good+and+Bad+Interest+Rates.png?auto=compress,format&rect=0,0,3838,2560&w=1000&h=667&w=1772

Web Can you use your Car Loan to save on tax Yes a Car Loan can help you save on tax if you are a self employed professional or business owner and use the car for business Web 16 sept 2022 nbsp 0183 32 To get a tax rebate on car loan you have to list the car loan interest paid as a business expense For this you can request your lender to issue an interest

Web Taxable Profits 77 00 000 As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit which in turn reduces the Income Tax to be Web The Australian government recently announced tax rebates of up to 150 000 on vehicles purchased for business use by small business owners You may qualify for this instant tax write off if you meet certain

Download Car Loan Rebate In Income Tax

More picture related to Car Loan Rebate In Income Tax

How To Get The Best Rate For Auto Loans In 2023 AUTAOKA

https://i.pinimg.com/736x/4a/c4/35/4ac435606f0dd11911da664af27ac82c.jpg

https://res.cloudinary.com/yourmechanic/image/upload/dpr_auto,f_auto,q_auto/v1/article_images/3_How_to_Compare_Car_Loan_Rates_calculator

Auto Finance Calculator With Tax And Trade Businesser

https://cdn.vertex42.com/Calculators/Images/auto-loan-payment-calculator_large.gif

Web 28 oct 2022 nbsp 0183 32 You can take tax benefit deduction of up to Rs 1 5 lacs per annum on interest payment towards a car loan subject to following conditions The loan is taken to Web 15 mai 2019 nbsp 0183 32 Yes you read that right Much like the education and home loan car loan benefits in income tax While cars purchased for personal use may not have car loan

Web In fact loans also help in reducing your taxable income However there are only specific types of loans that are eligible for tax exemption Those who have availed often have Web If you took out a car loan to purchase a vehicle for commuting and personal use only then the car loan interest on it is not tax deductible What kinds of interest are tax

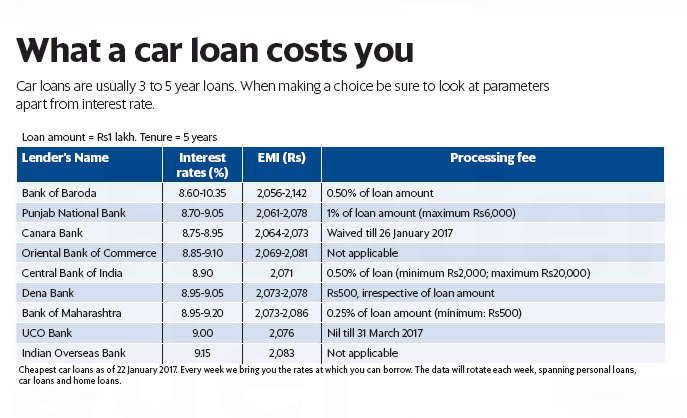

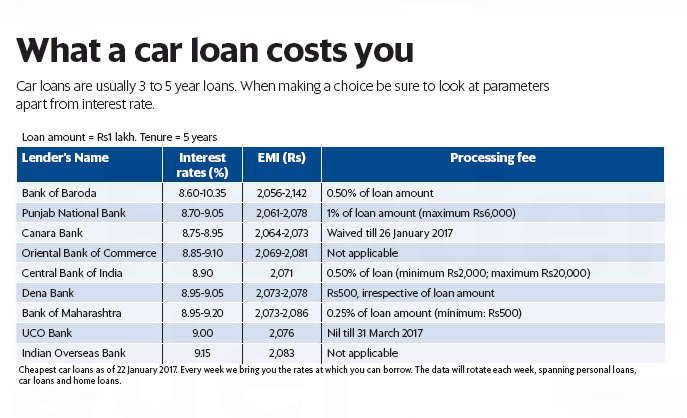

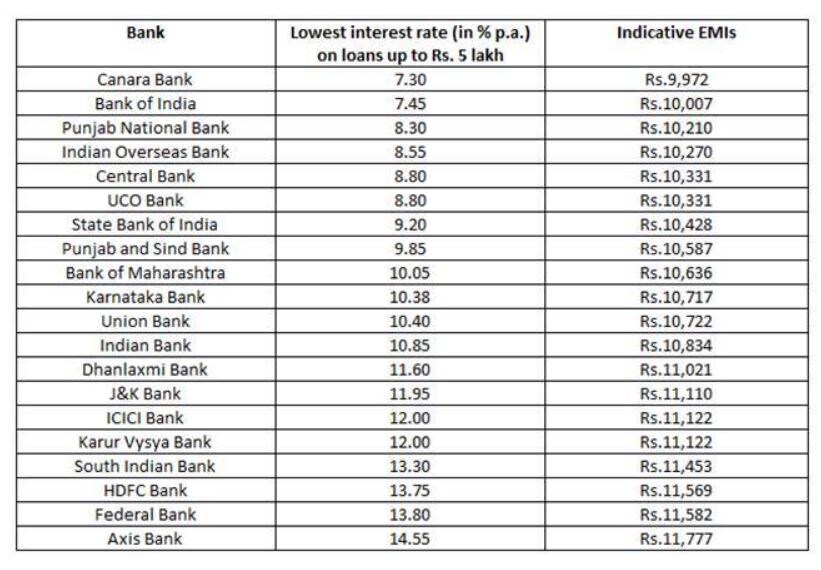

Money Musingz Personal Finance Blog Car Loan Rates 24 01 2017

https://moneymusingz.in/wp-content/uploads/2017/01/CarLoans240102017.png

Best Used Car Loans In India 2021 ValueChampion India

https://res.cloudinary.com/valuechampion/image/upload/c_limit,dpr_1.0,f_auto,h_1600,q_auto,w_1600/v1/india_carloans_usedrates_02

https://www.icicibank.com/blogs/car-loan/car …

Web Are such deductions also available when you take a Car Loan Let us have a look Tax benefits on Car Loans Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST

https://www.idfcfirstbank.com/finfirst-blogs/car-loan/tax-benefits-on-car-loan

Web Although car loan tax benefits exist they re not available for everyone Read on to know who can claim benefits on their car loan When you opt for an education loan or a home

DEDUCTION UNDER SECTION 80C TO 80U PDF

Money Musingz Personal Finance Blog Car Loan Rates 24 01 2017

90 Security Agreement Template Page 2 Free To Edit Download Print

What Does It Mean To Have A Car Loan Rate Of 3 14

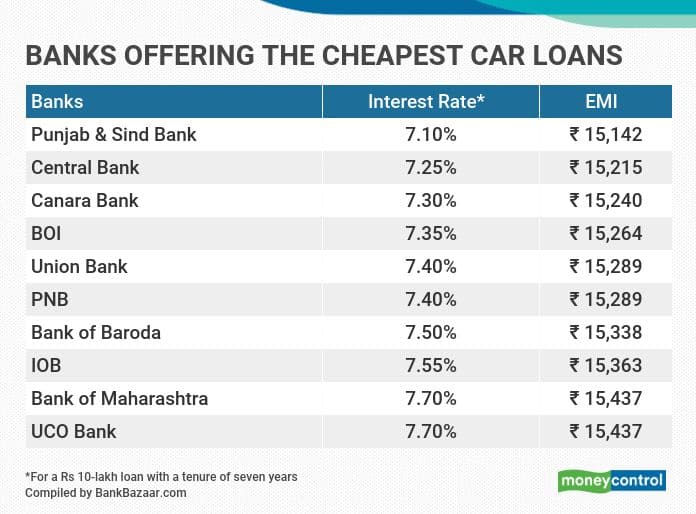

Car Loan Interest Rates In India 2019 Stats Facts Droom

Auto Loans Rates What Seem For Isn t Going To An Car Loans Telegraph

Auto Loans Rates What Seem For Isn t Going To An Car Loans Telegraph

Car Loan

Average Auto Loan Interest Rates Facts And Figures Aromanist

Columbia Asia Hospital Cheras

Car Loan Rebate In Income Tax - Web Taxable Profits 77 00 000 As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit which in turn reduces the Income Tax to be