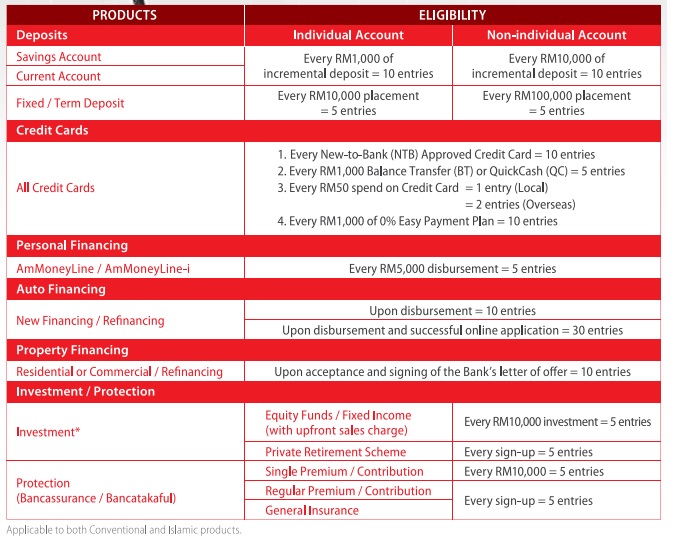

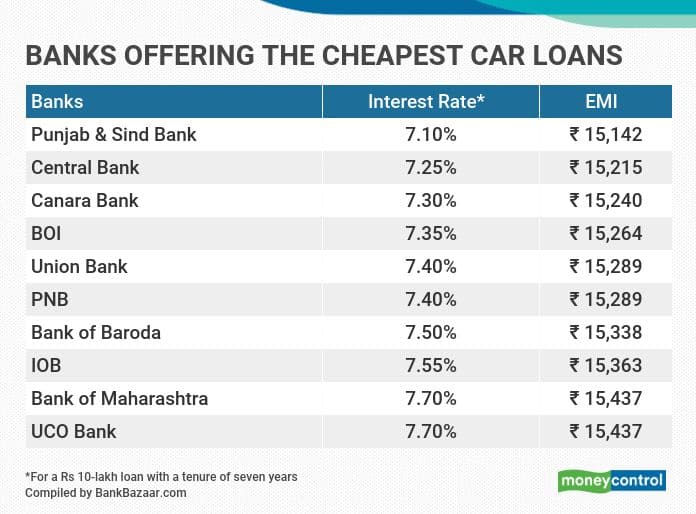

Car Loan Tax Rebate India Web Are such deductions also available when you take a Car Loan Let us have a look Tax benefits on Car Loans Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST

Web Read about tax benefits of a car loan for self employed individuals in this guide before claiming it You can claim your car loan interest amount as business expenses amp save Web You can claim tax benefits only on interest You can only claim car loan tax benefits on the interest and not the principal amount For instance assume you are a business owner

Car Loan Tax Rebate India

Car Loan Tax Rebate India

https://i.pinimg.com/originals/3f/f6/74/3ff6741dc3a1544e2b830a1ab072a7a3.png

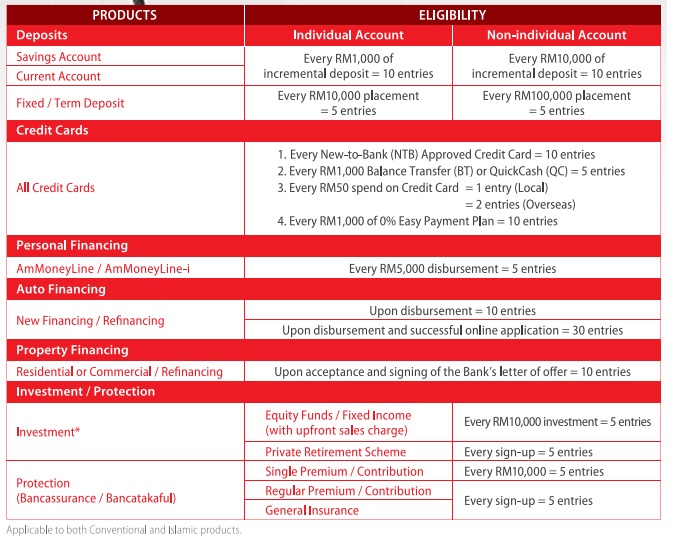

Calculate Car Loan Interest Malaysia Car Loan Calculator With Rebate

http://www.personalloan.com.my/wp-content/uploads/2014/01/ambank-a-newme.jpg

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Web 15 mai 2019 nbsp 0183 32 How does tax rebate on car loan work For example you own a business and have taken a loan for a car for your business For this you take a loan of Rs15 lakh Web 18 d 233 c 2021 nbsp 0183 32 When paying off an EV loan a total tax exemption of up to Rs 1 50 000 is available under section 80EEB This tax break is applicable for both four wheeler and two wheeler electric vehicle purchases

Web 16 sept 2022 nbsp 0183 32 And how can you claim a tax rebate on a car loan Here s all you need to know Vehicle loan tax exemption As mentioned above borrowers applying for home Web 9 sept 2020 nbsp 0183 32 Axis Bank New Car Loans come with a host of features like 100 on road price financing comfortable tenure and Axis eDGE Reward points etc Axis Bank s Pre owned Car Loan offers up to 85 funding of

Download Car Loan Tax Rebate India

More picture related to Car Loan Tax Rebate India

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

https://res.cloudinary.com/yourmechanic/image/upload/dpr_auto,f_auto,q_auto/v1/article_images/3_How_to_Compare_Car_Loan_Rates_calculator

Toyota New Car Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/toyota-fortuner-car-the-undisputed-leader-ad-times-of-india-mumba.png

Web Tax Benefits on Loans There are different tax rebates for different loans These range from education loans home loans car loans and personal loans Some loans do not Web Tax Savings Calculator Switching to EVs is not only cost effective but they also have tax advantages in India The government created a new section that includes tax benefits

Web The section is applicable to individual taxpayers and offers a tax deduction of up to 1 5 lakhs on the interest component of a car loan taken to buy an EV An EV Loan can be Web 19 f 233 vr 2023 nbsp 0183 32 The 80EEB is a section of the Income Tax Act specially curated for electric vehicle buyers who avail of vehicle loans to purchase an EV This section allows an

SPECIAL TAX REBATES CONCESSIONS ON BUYING NEW CAR IN INDIA YouTube

https://i.ytimg.com/vi/ukkcKxOa2h8/maxresdefault.jpg

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

https://4.bp.blogspot.com/-ygld82QNGGs/Xd_7fFpO9WI/AAAAAAAAJBU/w2H37lRhli4Tk4pgjN-Ra8So_O_t_RJ-wCK4BGAYYCw/s1600/slab_rate_%25281%2529-20190201043639.png

https://www.icicibank.com/blogs/car-loan/car …

Web Are such deductions also available when you take a Car Loan Let us have a look Tax benefits on Car Loans Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST

https://www.hdfcbank.com/.../borrow/tax-benefits-on-car-loan

Web Read about tax benefits of a car loan for self employed individuals in this guide before claiming it You can claim your car loan interest amount as business expenses amp save

Tax Rebates Under Indian Income Tax Act Invest Internals

SPECIAL TAX REBATES CONCESSIONS ON BUYING NEW CAR IN INDIA YouTube

Delhi Govt Gives Nod To Proposal To Offer Rebate On Road Tax For

Latest Income Tax Slab Rates FY 2019 20 AY 2020 21 Budget 2019

Tax Rebates On New Cars 2023 Carrebate

Columbia Asia Hospital Cheras

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

How Do I Calculate Actua Cost Of Auto Loan

Car Loan Tax Rebate India - Web 22 avr 2022 nbsp 0183 32 Do you know that you can avail tax deduction on loan taken for purchase of electric vehicle under section 80EEB on Income Tax Act Learn here the eligibilty criteria