Car Manufacturer Rebate Include Sale Tax In California Web 17 ao 251 t 2022 nbsp 0183 32 California s rebate program imposes income caps for buyers 135 000 for single filers and 200 000 for joint filers and the state rebate amount varies based

Web The rebates received either directly from the manufacturer or from the wholesaler are not subject to tax since they are tied to the retailer s wholesale purchases of the products Web If you accept manufacturer coupons amounts paid by manufacturers to reimburse you for the value of the manufacturer s coupons are included in your total taxable sales when

Car Manufacturer Rebate Include Sale Tax In California

Car Manufacturer Rebate Include Sale Tax In California

https://www.logistis.us/wp-content/uploads/2020/07/Screen-Shot-2020-07-20-at-2.37.18-PM-1024x1013.png

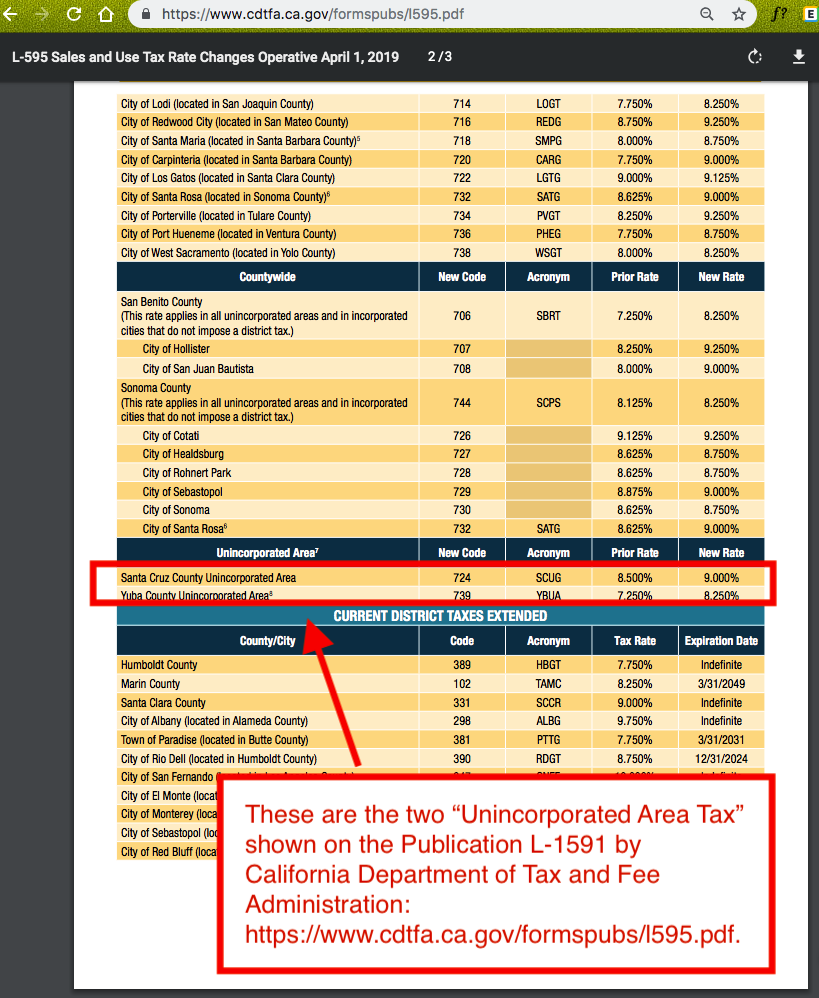

CDTFA 95 California Sales And Use Tax Rates By County And City CDTFA

https://www.pdffiller.com/preview/625/104/625104045/large.png

What Car Manufacturer Has The Best Rebates Right Now 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2023/05/new-car-manufacturer-rebates-2022-carrebate-3.jpg

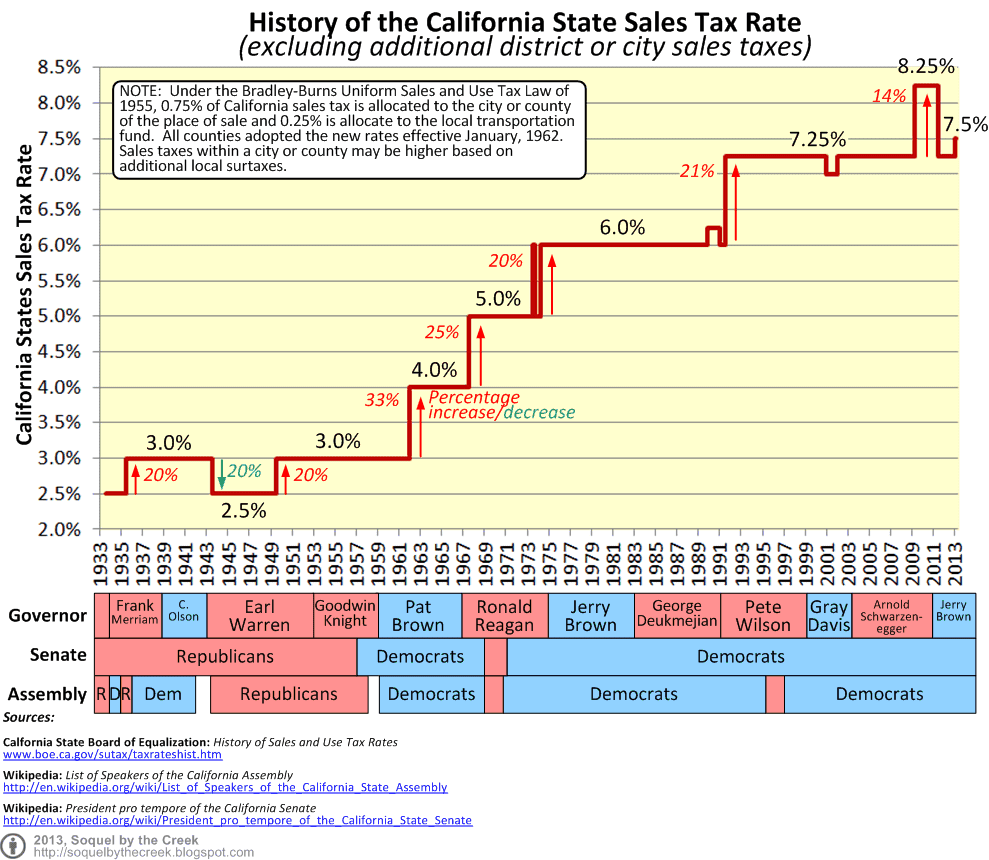

Web Geoff Cudd Sales tax can add hundreds or even thousands of dollars to a new car purchase For that reason many people wonder how they can avoid paying car sales Web California Sales Tax on Car Purchases According to the Sales Tax Handbook the California sales tax for vehicles is 7 5 percent Of this 1 25 percent goes to the

Web 16 avr 2022 nbsp 0183 32 Car dealers should be mindful of the requirements for reimbursement of sales tax when passing the cost of sales tax to the customer e g itemizing the sales tax portion on the bill or other proof Web Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales For example a 1 000 cash rebate may be offered on a

Download Car Manufacturer Rebate Include Sale Tax In California

More picture related to Car Manufacturer Rebate Include Sale Tax In California

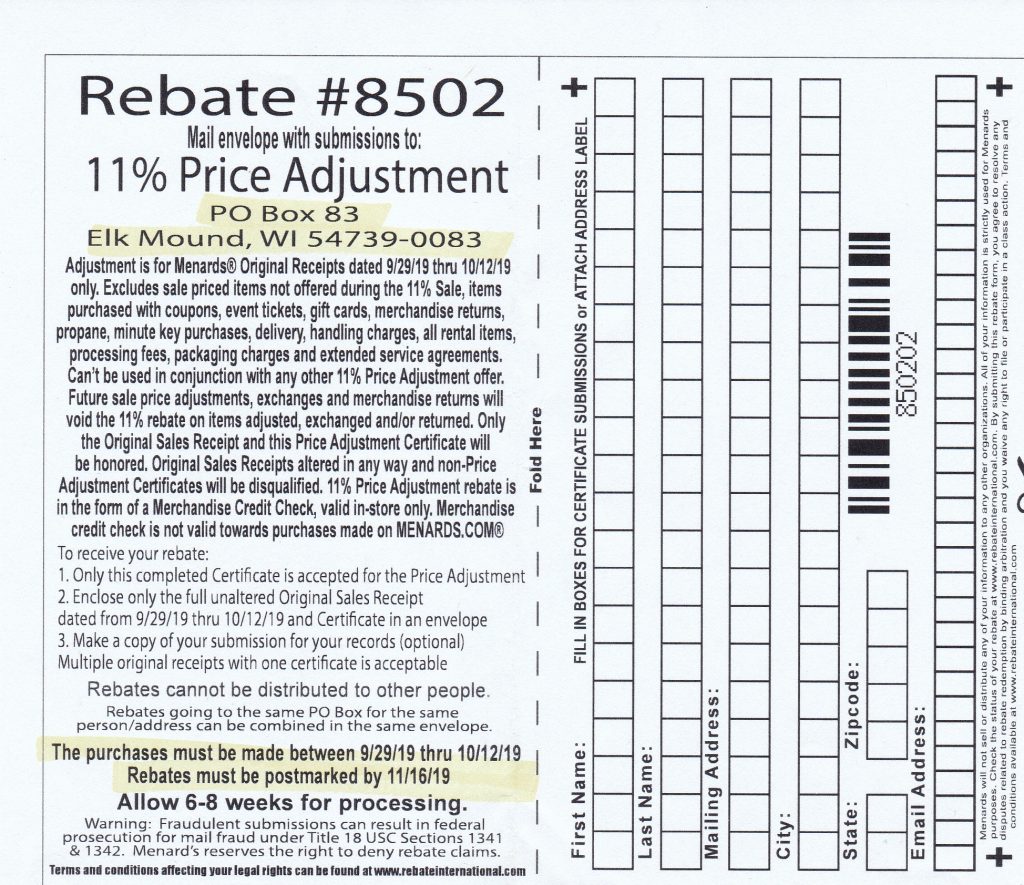

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

http://struggleville.net/wp-content/uploads/2019/10/MenardsPriceAdjustmentRebate8502-1024x885.jpg

Salesx Tax In Ca Vancouverbezy

https://cdn.gobankingrates.com/wp-content/uploads/2017/04/171108_GBR_SalesTax_1920x1080-_ea3b4bb5-e0f9-4662-9961-7c0580cb1520_.jpg

Car Sales Tax In California 2016 Car Sale And Rentals

https://files.taxfoundation.org/20170203100842/LOST-01.png

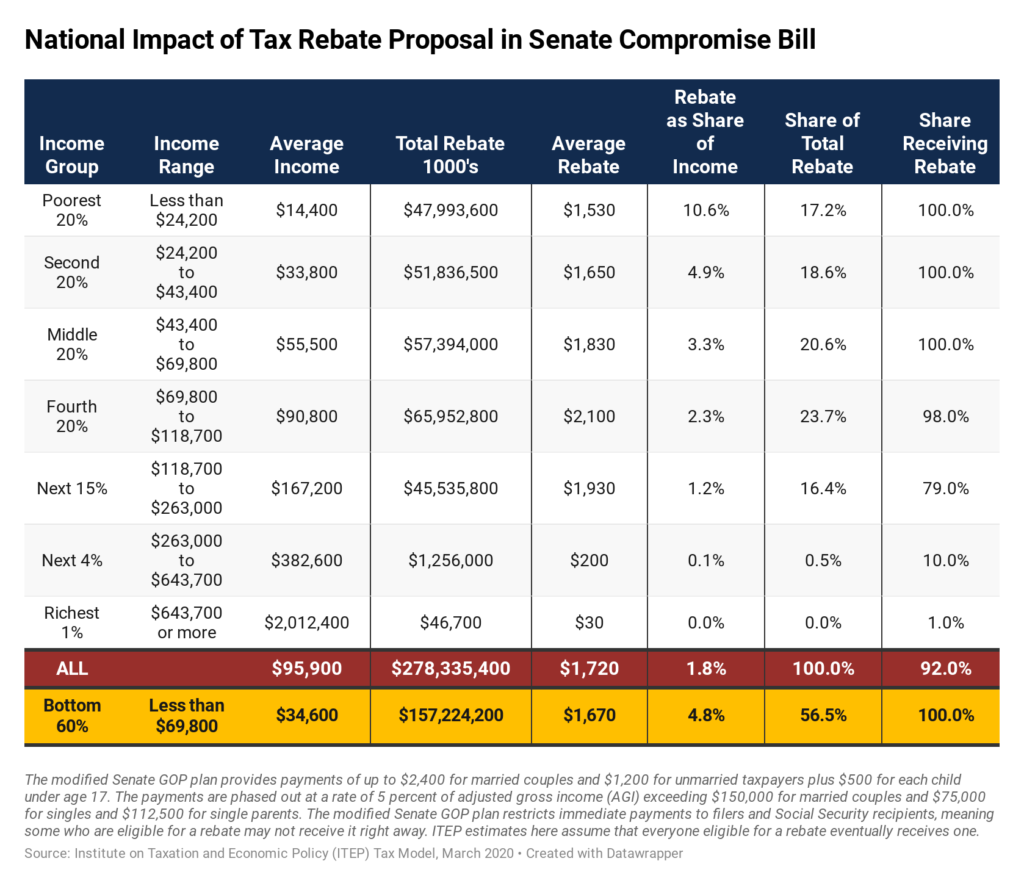

Web 30 juin 2022 nbsp 0183 32 Under the tax rebate plan households making as much as 75 000 for individuals or 150 000 for joint filers would receive 350 per taxpayer plus an additional Web 26 janv 2023 nbsp 0183 32 For Battery Electric Vehicles BEVs the rebate offered is worth 2 000 Additionally an increase of 5 500 formerly 2 500 for 2022 can be added to the

Web 19 oct 2022 nbsp 0183 32 When Must Manufacturers Collect Sales Tax from Customers As a manufacturer you will collect applicable state and local sales tax on the gross receipt Web Southern California Edison SCE customers who purchase or lease an electric vehicle can apply for a rebate of up to 1000 through the Clean Fuel Reward Program Make sure

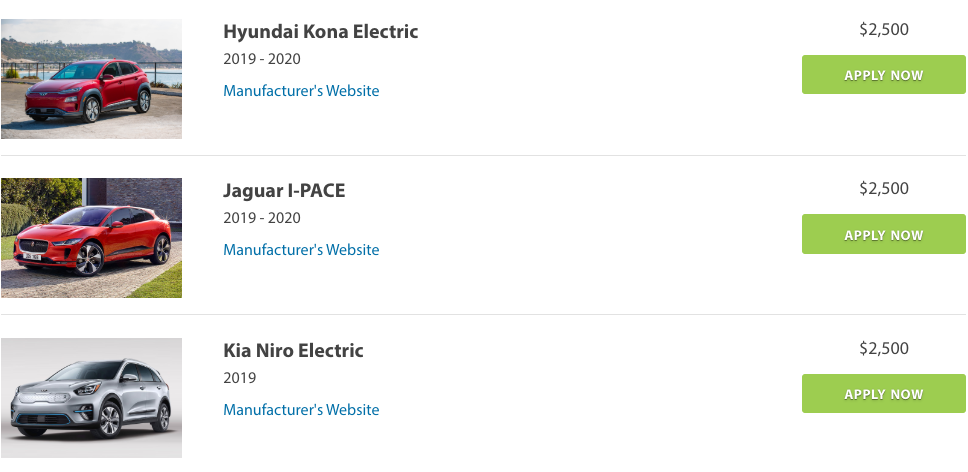

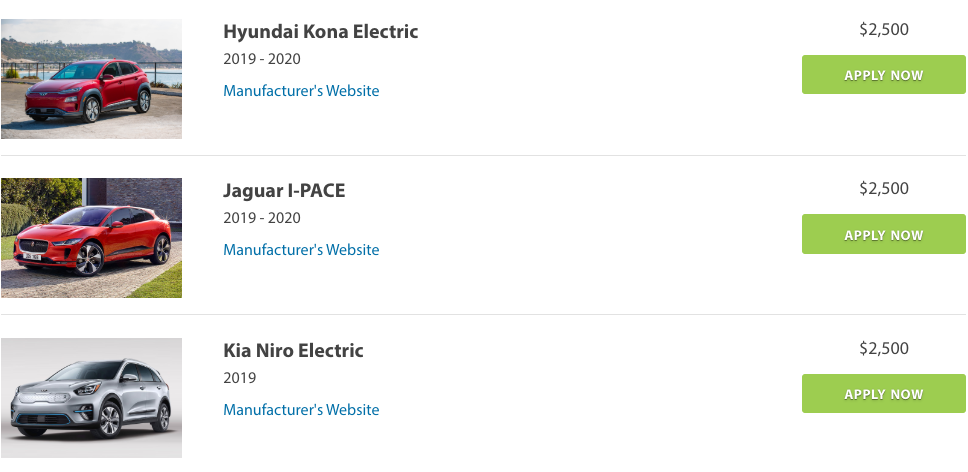

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/california-s-ev-rebate-changes-a-good-model-for-the-federal-ev-tax-3.png

Top 16 How To Collect Sales Tax In California In 2022 G u y

https://cdn2.howtostartanllc.com/images/tax/sales-tax/california-sales-tax.jpg

https://www.latimes.com/business/story/2022-08-17/what-car-buyers...

Web 17 ao 251 t 2022 nbsp 0183 32 California s rebate program imposes income caps for buyers 135 000 for single filers and 200 000 for joint filers and the state rebate amount varies based

https://www.cdtfa.ca.gov/lawguides/vol1/sutr/1671-1.html

Web The rebates received either directly from the manufacturer or from the wholesaler are not subject to tax since they are tied to the retailer s wholesale purchases of the products

Taxes On New Car Rebates Tennessee 2023 Carrebate

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

How To Calculate California Unincorporated Area Sales Tax

New Car Manufacturer Rebates 2022 Carrebate

Creekside Chat February 2013

Electric Car Rebates Canada 2021

Electric Car Rebates Canada 2021

Ultimate California Sales Tax Guide Zamp

Salesx Tax In Ca Rentalladeg

What Is Car Sales Tax In California Cuterose

Car Manufacturer Rebate Include Sale Tax In California - Web California Sales Tax on Car Purchases According to the Sales Tax Handbook the California sales tax for vehicles is 7 5 percent Of this 1 25 percent goes to the