Car Mileage Rate 2022 Nz The tier one rates reflect an overall increase in vehicle running costs largely due to fuel costs The table of rates for the 2022 income year The Tier Two rate is for running costs only Use the Tier Two rate for the business portion of any travel over

There are 3 ways to do this keeping a logbook claiming 25 of the vehicle s running costs or adding up the actual costs We publish the kilometre rates after each tax year ends on 31 March We usually publish the rates for the tax year just ended by May If your The 2022 2023 kilometre rates have been published Skip to main content FamilyBoost claims You can claim FamilyBoost in myIR from 1 October for the 1 July 30 September quarter

Car Mileage Rate 2022 Nz

Car Mileage Rate 2022 Nz

https://ledgergurus.com/wp-content/uploads/2022/06/Mileage-scaled.jpg

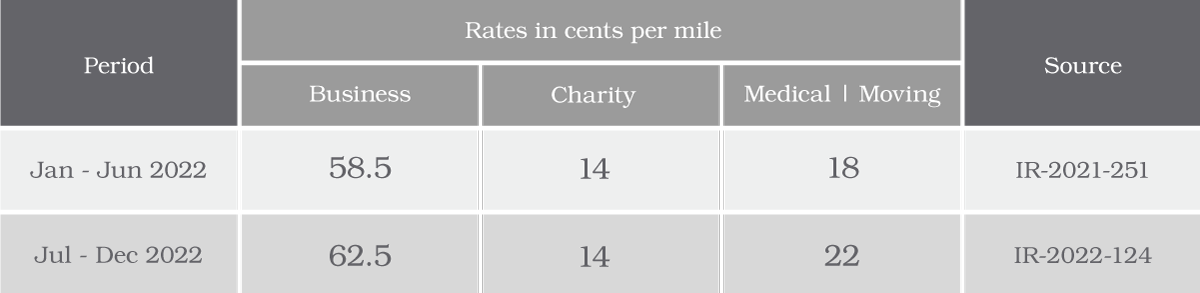

New Mileage Reimbursement Rate For 2022 Henry Ford College

https://www.hfcc.edu/sites/hfcmain/files/newsroom/photos/2021-0107-mileage_reimbursement_rate_2022.jpg

IRS Increases Standard Mileage Rates For Remainder Of 2022 Maillie LLP

https://www.maillie.com/wp-content/uploads/2022/06/IRS-Increases-Mileage-Rates-e1655293795151.jpg

The Tier 1 rates recognise the fixed and variable costs of running a vehicle and can be used for the first 3 500km of business travel or the business portion of the first 14 000km of total travel in the vehicle The 2022 2023 allowance rate is 95 cents per business km for petrol diesel hybrid and electric vehicles After 14 000 km the rates are lower and differ depending on vehicle type For petrol and diesel 34

Given the large increases in fuel prices in 2022 some employees may try to push employers to provide a higher reimbursement By way of contrast the tier 1 rate for petrol and diesel vehicles was NZD 0 79 in 2021 and NZD 0 82 in 2020 when the Kilometre rates for the business use of vehicles for the 2022 income year is now 0 83 cents for petrol or diesel hybrid and electric cars The rates set out below apply for the 2021 2022 income year for business motor vehicle expenditure claims

Download Car Mileage Rate 2022 Nz

More picture related to Car Mileage Rate 2022 Nz

Medical Mileage Rate 2022 Discover Claims

https://www.discoverclaims.com/img/medical-mileage-rate-2022-calculator.jpg

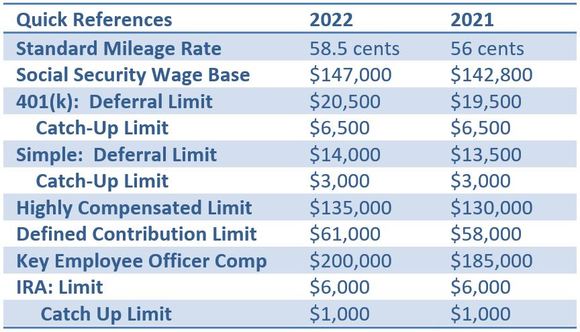

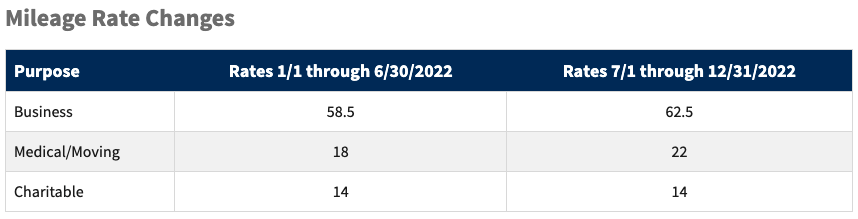

IRS Increases Standard Mileage Rates Starting July 1 2022 Stinson

https://jdsupra-html-images.s3-us-west-1.amazonaws.com/2cc30a4d-edf6-4797-b367-9df3694291f8-Picture6.png

New IRS Standard Mileage Rates In 2022 MileageWise 2023

https://www.mileagewise.com/wp-content/uploads/2021/12/.irs-standard-mileage-rate-2022.jpeg

The rates set out below apply for the 2022 2023 income year for business motor vehicle expenditure claims The tier one rates reflect an overall increase in vehicle running costs largely due to fuel costs In respect of the kilometre rate method the Commissioner will set rates by reference to industry figures that represent the average cost of using average motor vehicles

The rates set out below apply for the 2021 2022 income year for business motor vehicle expenditure claims The tier one rates reflect an overall increase in vehicle running costs largely due to fuel costs The AA s running costs report highlights car running costs compares petrol vs diesel can help you find ways to save on car costs Get the report today

Mileage Rate Changes 2022 CPA Nerds

https://www.cpanerds.com/app/uploads/2022/06/Mileage-Rate-Changes.png

New 2022 IRS Standard Mileage Rate Virginia CPA Firm

https://keitercpa.com/wp-content/uploads/mileage-rates-gas-1024x683.jpg

https://www.taxtechnical.ird.govt.nz/operational...

The tier one rates reflect an overall increase in vehicle running costs largely due to fuel costs The table of rates for the 2022 income year The Tier Two rate is for running costs only Use the Tier Two rate for the business portion of any travel over

https://www.ird.govt.nz/.../claiming-vehicle-expenses

There are 3 ways to do this keeping a logbook claiming 25 of the vehicle s running costs or adding up the actual costs We publish the kilometre rates after each tax year ends on 31 March We usually publish the rates for the tax year just ended by May If your

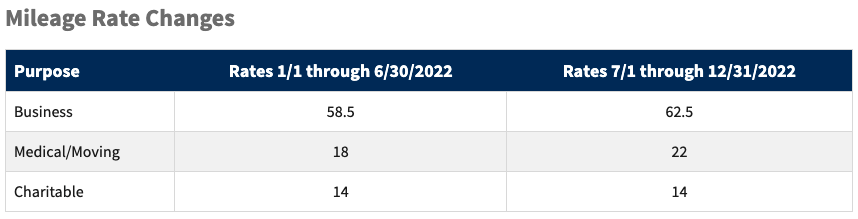

Mileage Rates For 2022 and Other Quick Reference Numbers LSWG CPAs

Mileage Rate Changes 2022 CPA Nerds

2022 Standard Mileage Rates Increase Board Of Retirement

Updated Standard Mileage Rate 2022

Florida Mileage Rate For 2022 And What It Means For You

Standard Mileage Rates For 2022 Elite Business Solutions

Standard Mileage Rates For 2022 Elite Business Solutions

IRS Announces Standard Mileage Rate Change Effective July 1 2022

IRS Raises Business Mileage Rate For 2022 Hardge Connection

Standard Mileage Rates For 2022 New York Society Of Tax Accountants

Car Mileage Rate 2022 Nz - Given the large increases in fuel prices in 2022 some employees may try to push employers to provide a higher reimbursement By way of contrast the tier 1 rate for petrol and diesel vehicles was NZD 0 79 in 2021 and NZD 0 82 in 2020 when the