Car Mileage Tax Rebate Web How much is a mileage tax rebate worth The value of your claim depends on whether you pay income tax at a rate of 20 40 or 45 A mileage tax rebate example using

Web 9 juin 2023 nbsp 0183 32 The employee can therefore claim tax relief on 163 4 875 the maximum tax free payment available less 163 1 725 amount employer pays 163 3 150 If employees pay tax at the basic rate they can claim a refund Web Mileage allowance rebate works by reducing your taxable pay based the total number of business miles travelled in the year multiplied by specific Approved Mileage Rates by

Car Mileage Tax Rebate

Car Mileage Tax Rebate

https://i.pinimg.com/originals/89/1b/0a/891b0ad37c9259795ebb74fa88dbb1e0.png

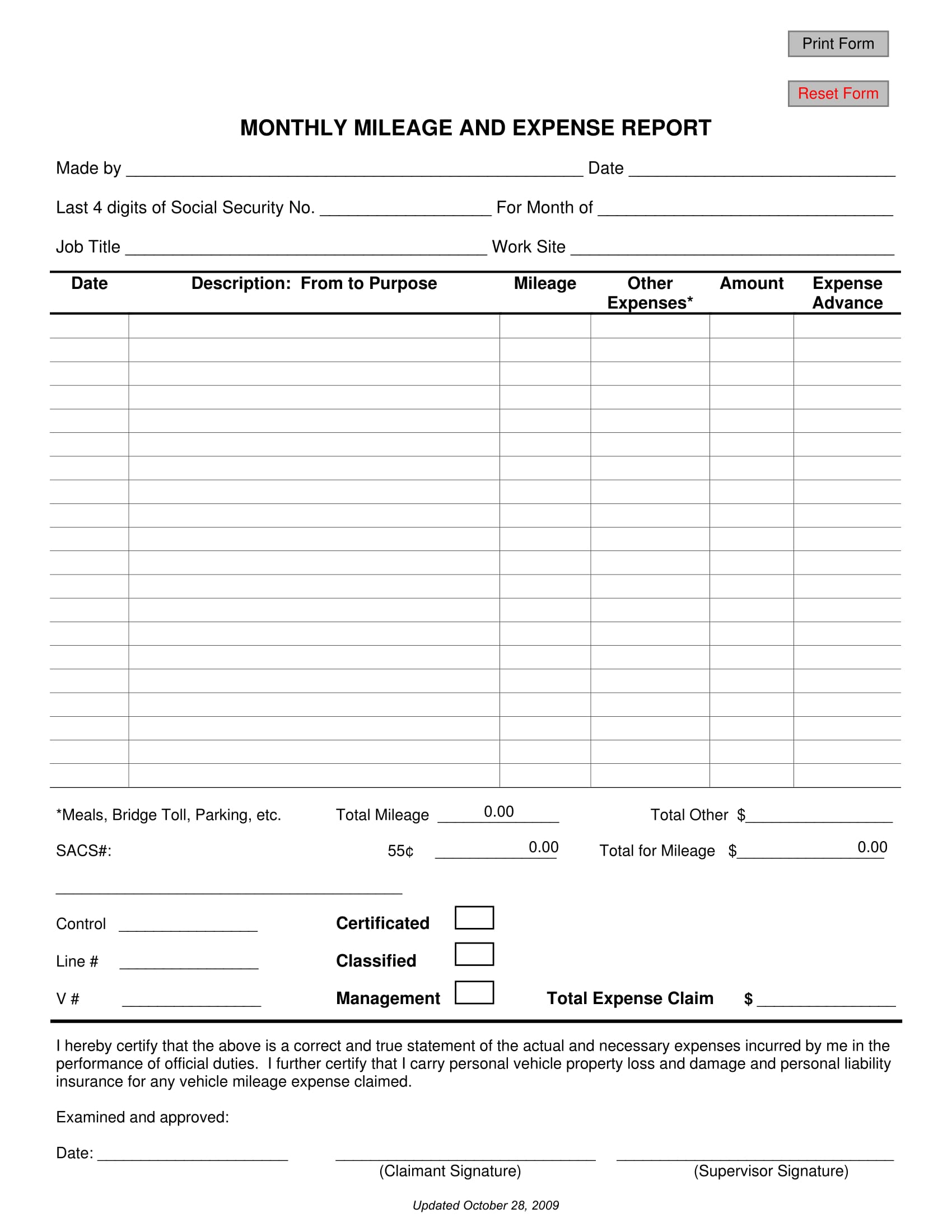

Printable Mileage Reimbursement Form Linaschnaufer

https://i.pinimg.com/originals/a2/21/dd/a221dd2079224ff2b3d7cb54c554ca72.jpg

2014 Form OR 735 9002 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/100/53/100053412/large.png

Web 8 avr 2022 nbsp 0183 32 HMRC approved mileage rate for cars and vans is set at 163 0 45 per mile when driven under 10 000 miles per year If the vehicle is used for more the employee receives 163 0 25 per mile above that 10 000 Web Mileage Allowance Payments 480 Appendix 3 Work out the appropriate percentage for company car benefits 480 Appendix 2 Check how much tax relief you can claim for

Web HMRC won t automatically give you a mileage tax rebate for your travel so you have to claim it back which can be worth 163 3 000 on average when you claim with RIFT Here s a Web 27 janv 2023 nbsp 0183 32 What are the two mileage rates for 2022 For the 2022 tax year you re looking at two mileage rates for business use A rate of 58 5 cents a mile applies to travel from January through June

Download Car Mileage Tax Rebate

More picture related to Car Mileage Tax Rebate

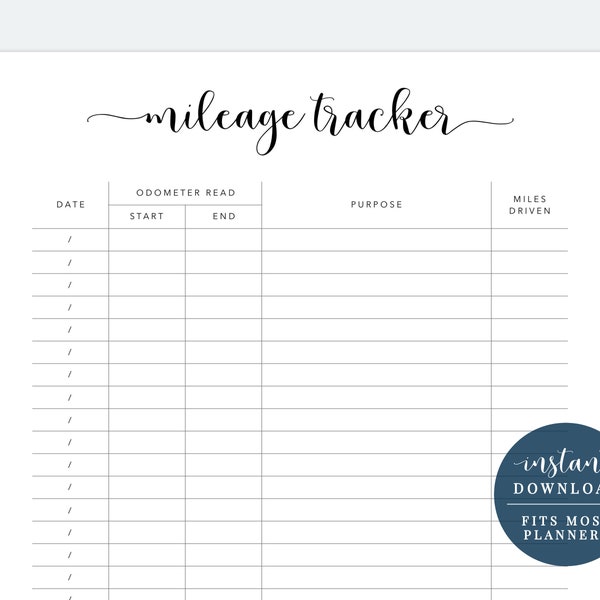

Tax Deductions Printable Editable Vehicle Mileage Expense Log

https://i.pinimg.com/originals/23/e9/f6/23e9f63f799cd37e3fe85648b4659daf.jpg

![]()

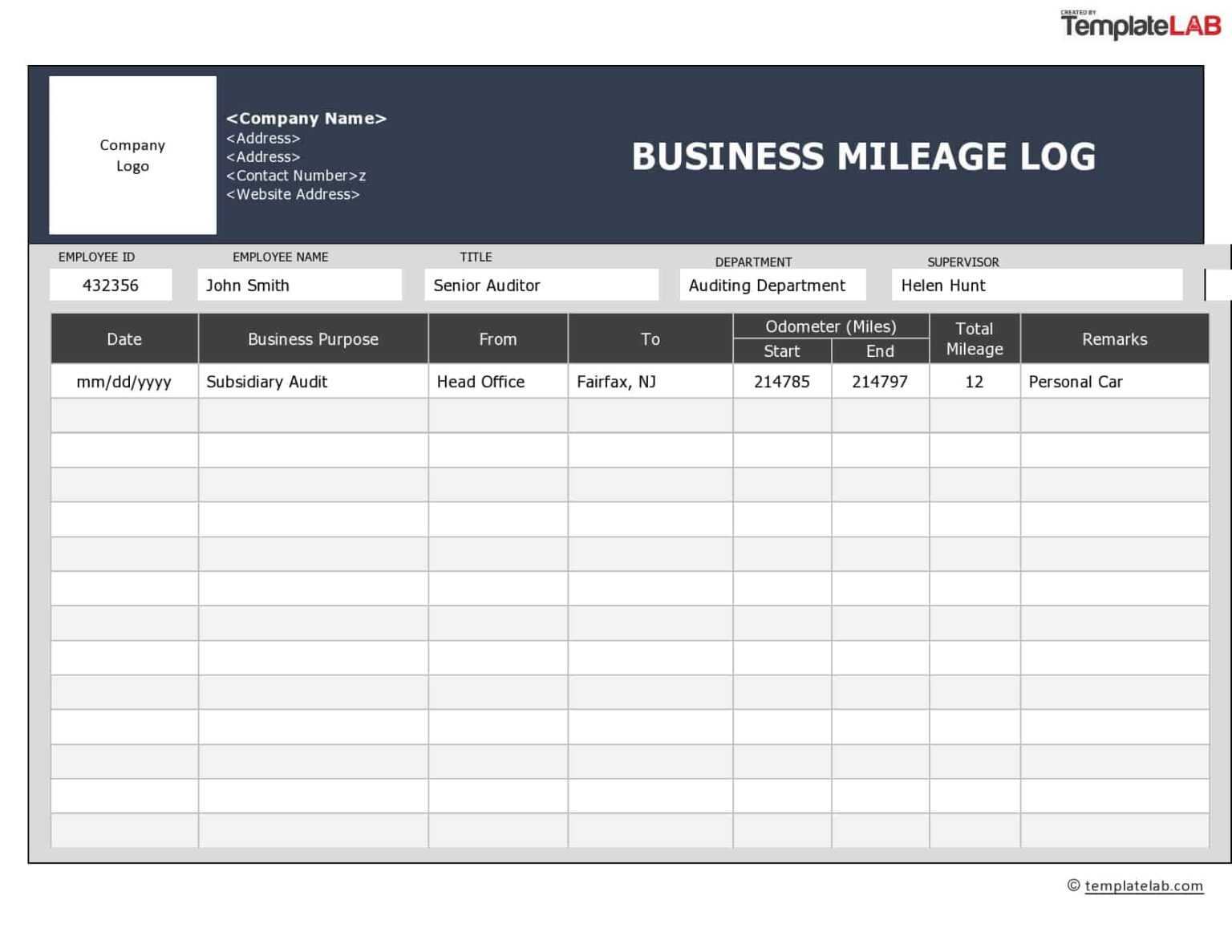

25 Printable Irs Mileage Tracking Templates Gofar In Mileage Report

https://pray.gelorailmu.com/wp-content/uploads/2020/01/25-printable-irs-mileage-tracking-templates-gofar-in-mileage-report-template-2048x1448.jpg

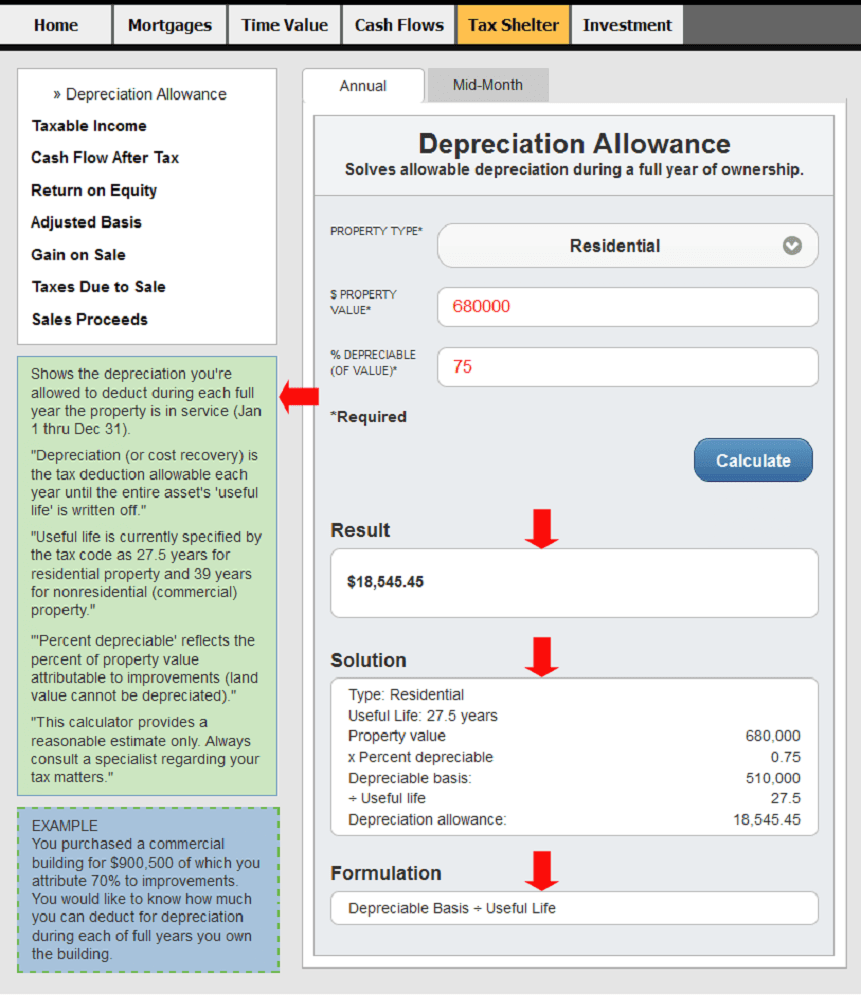

Car Allowance Tax Rebate Calculator 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/62-online-real-estate-calculators-proapod-re-calculator.png

Web The average mileage expenses rebate made with RIFT Tax Refunds is worth 163 3 000 Many people don t realise that it s not something HMRC will automatically give back to you you Web Mileage Allowance Claim Back Tax on Company Car and Fuel Tax Rebates Tax Rebates Tax Rebates Calculator Tax rebates amp tax refunds Travel and Mileage Military Tax

Web From tax year 2011 to 2012 onwards First 10 000 business miles in the tax year Each business mile over 10 000 in the tax year Cars and vans 45p 25p Motor cycles 24p Web 21 mars 2023 nbsp 0183 32 Edited by Colin Hogan March 21 2023 at 12 30 p m How to Claim a Mileage Tax Deduction You need to know the rules for claiming mileage on your taxes

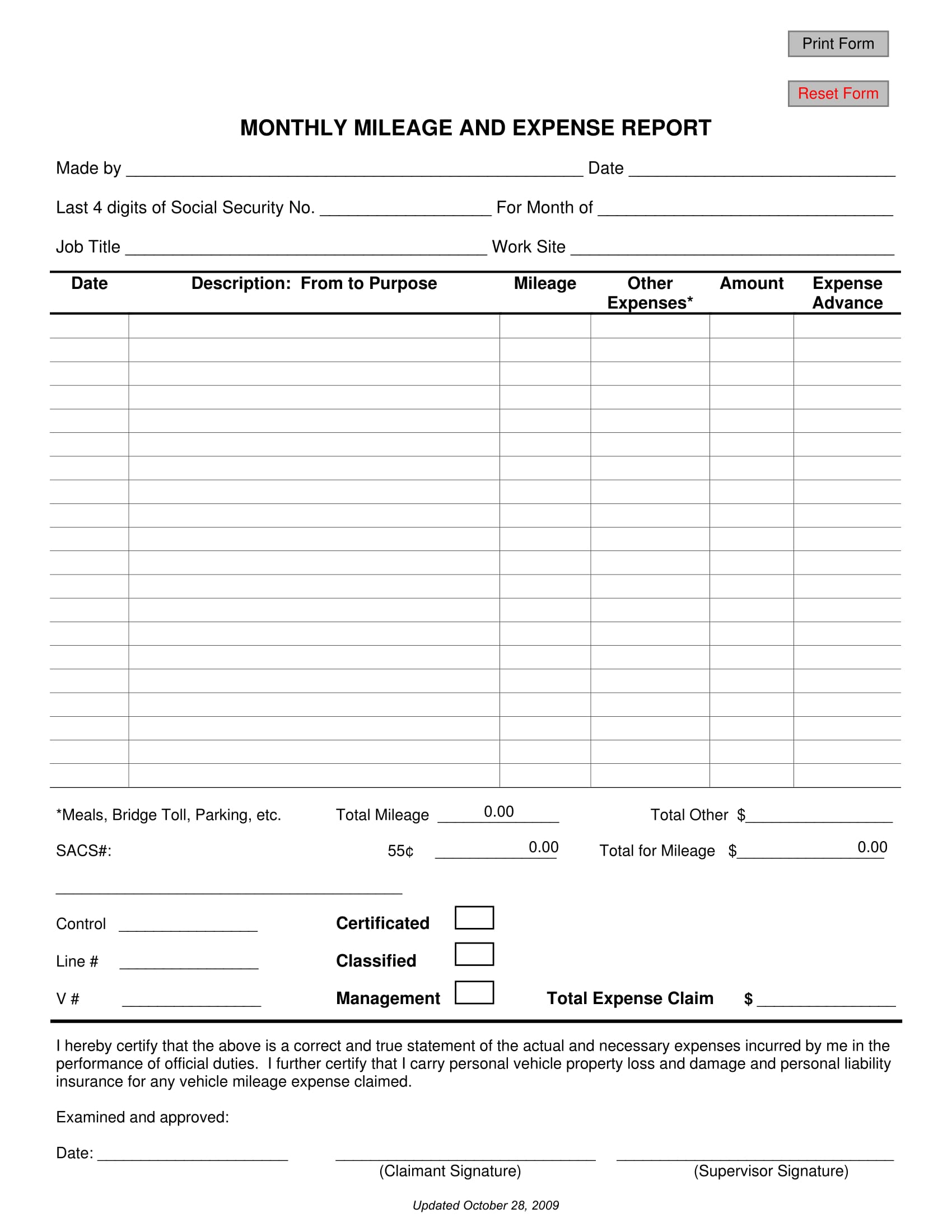

FREE 5 Mileage Report Forms In MS Word PDF Excel

https://images.sampleforms.com/wp-content/uploads/2018/01/Monthly-Mileage-and-Expense-Report-Form-1.jpg

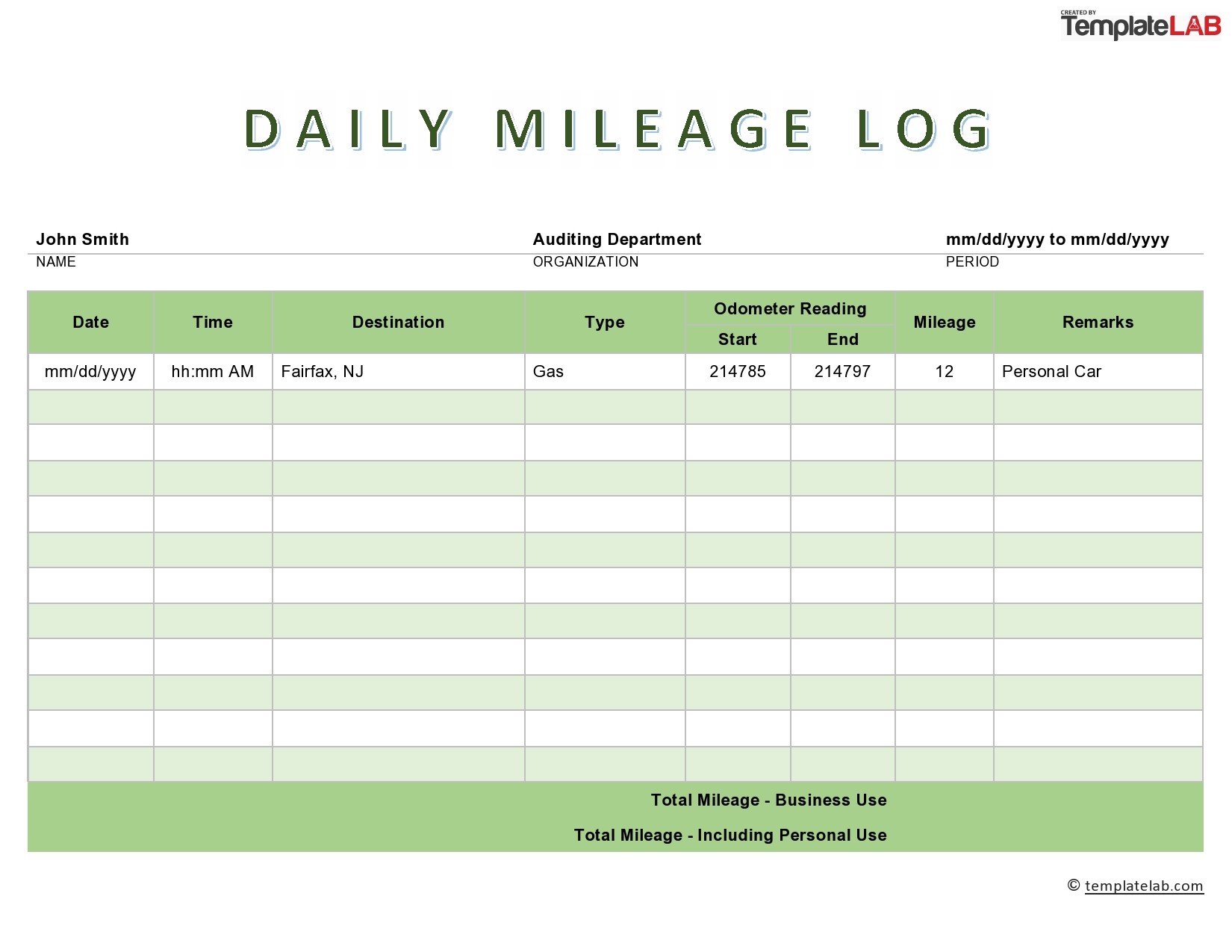

Vehicle Mileage Log Book Track Your And Gas Tnk skr jp

https://templatelab.com/wp-content/uploads/2020/02/Daily-Mileage-Log-TemplateLab.com_.jpg

https://www.taxrebateservices.co.uk/tax-guides/mileage-allowance...

Web How much is a mileage tax rebate worth The value of your claim depends on whether you pay income tax at a rate of 20 40 or 45 A mileage tax rebate example using

https://www.gosimpletax.com/blog/car-allowa…

Web 9 juin 2023 nbsp 0183 32 The employee can therefore claim tax relief on 163 4 875 the maximum tax free payment available less 163 1 725 amount employer pays 163 3 150 If employees pay tax at the basic rate they can claim a refund

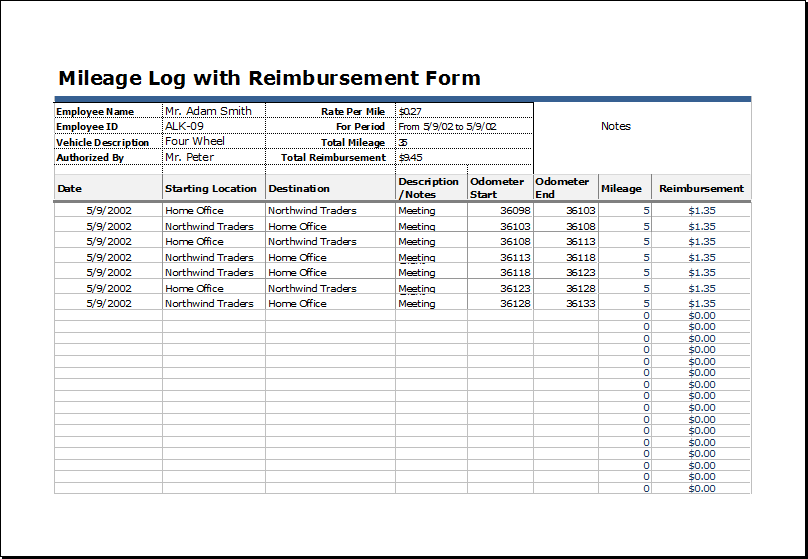

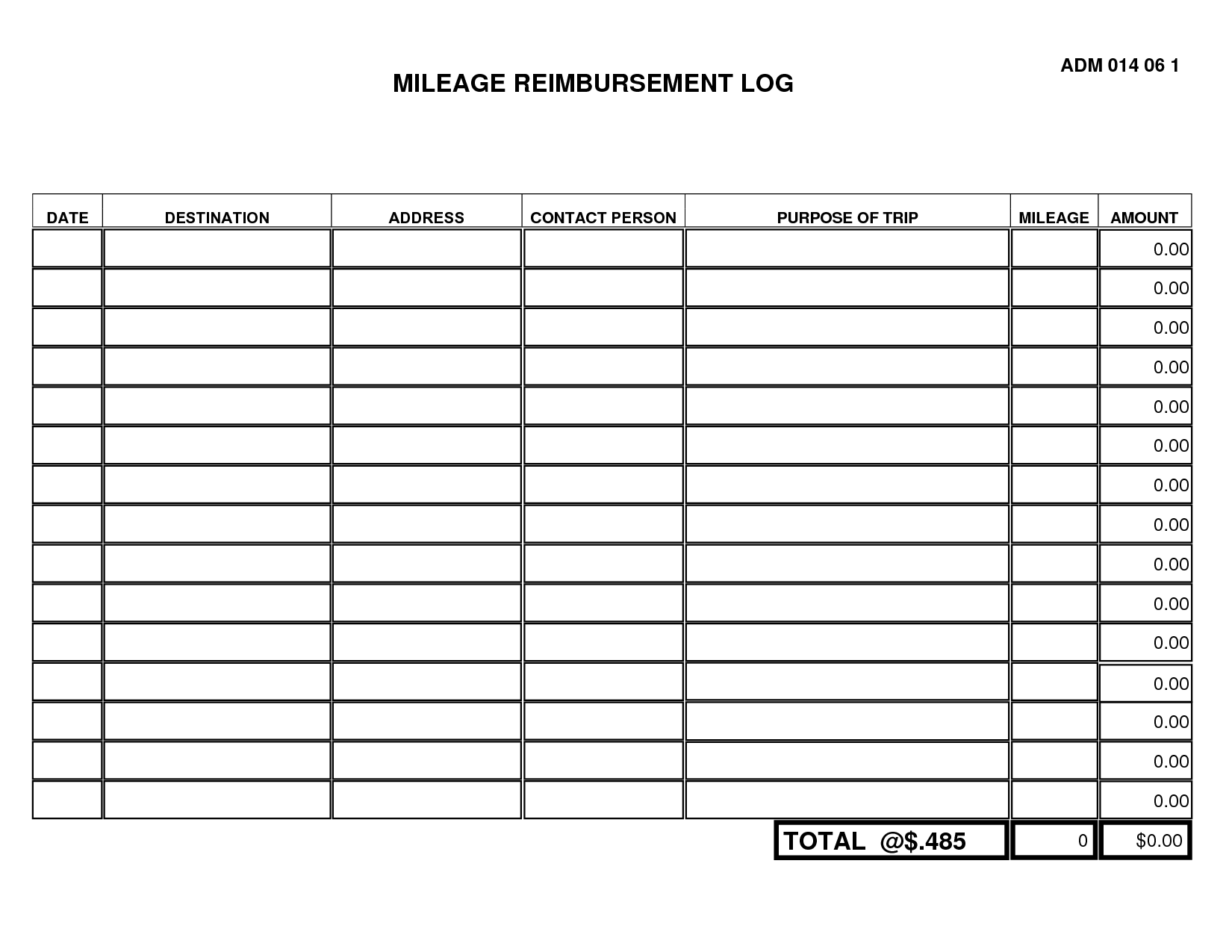

Vehicle Mileage Log With Reimbursement Form Word Excel Templates

FREE 5 Mileage Report Forms In MS Word PDF Excel

Mileage Report Template 7 TEMPLATES EXAMPLE TEMPLATES EXAMPLE

Tax Deduction Etsy

Mileage Report Template Professional Plan Templates

2019 Mileage Tax Deduction GPS Tracking GPS LEADERS

2019 Mileage Tax Deduction GPS Tracking GPS LEADERS

Mileage Invoice

Mileage Reimbursement Log Excel Templates

Mileage Log Template Free Excel PDF Versions IRS Compliant

Car Mileage Tax Rebate - Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed