Carbon Rebate Income Tax Web convex combinations of the following four rebate options for the carbon tax revenue i reduce the capital income tax ii reduce the level of the labor income tax iii increase

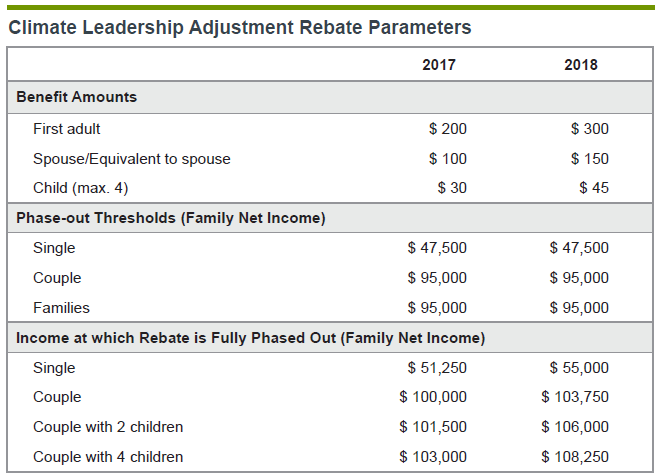

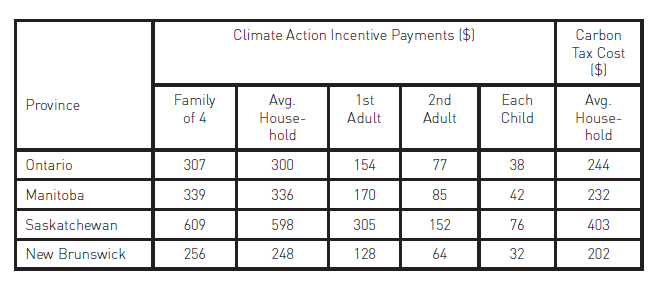

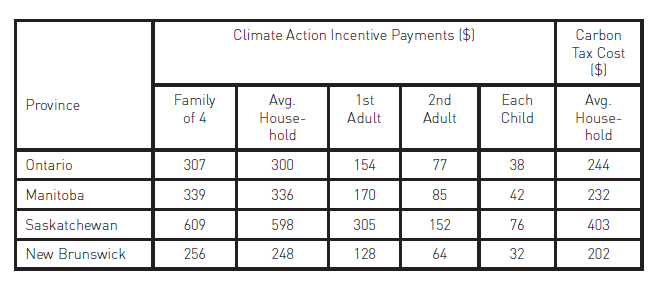

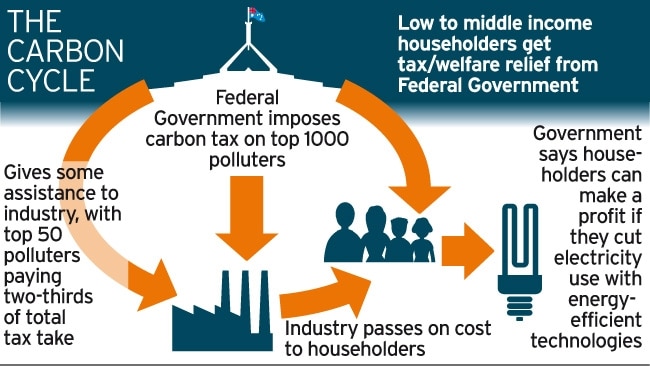

Web 23 oct 2018 nbsp 0183 32 The tax will start at 20 per tonne of emissions and grow by 10 a year until it hits 50 The second part of the tax will hit fuel companies in April 2019 Web 14 juil 2023 nbsp 0183 32 In Ontario an individual can expect 122 a spouse or common law partner 61 and 30 50 per child under 19 In

Carbon Rebate Income Tax

Carbon Rebate Income Tax

http://blogs.ubc.ca/smilelaura/files/2013/02/7492DA7E-1513-44D5-A29B-A6C91A01FDA5.png

A Tale Of 2 Taxes How Carbon Pricing And Revenue Rolls Out In Alberta

https://i.cbc.ca/1.4971762.1547067964!/fileImage/httpImage/image.jpg_gen/derivatives/original_620/climate-action.jpg

Taxing Canadians Patience Corporations Need To Pay Their Fair Share

https://i.cbc.ca/1.5078161.1553905061!/fileImage/httpImage/image.jpg_gen/derivatives/original_620/carbon-tax-costs-returns-manitoba.jpg

Web 7 juil 2023 nbsp 0183 32 It s been a year since the federal government started making climate action incentive payments CAIP also known as carbon tax rebates to residents of Alberta Saskatchewan Manitoba and Web If you are eligible for the climate action incentive payment and didn t claim it when you filed your income tax and benefit return it s not too late All you have to do is change your

Web 15 juil 2022 nbsp 0183 32 At a new rate of 50 per tonne of emissions this year s increase to the carbon tax amounts to a spike of 2 21 cents per litre of gasoline and 2 68 cents per litre Web 14 oct 2022 nbsp 0183 32 Total for 2022 23 186 208 275 270 Referred to as a qualified relation in the legislation Amounts do not reflect the 10 per cent supplement for residents of

Download Carbon Rebate Income Tax

More picture related to Carbon Rebate Income Tax

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will

https://globalnews.ca/wp-content/uploads/2019/05/infogfx_carbon_tax_comparison_1.jpg?quality=85&strip=all&w=1200

Alberta Budget 2016 How Much Is This Carbon Tax Going To Cost Me

https://globalnews.ca/wp-content/uploads/2016/04/budget2016-carbonrebate.png

What You Need To Know Federal Carbon Tax Takes Effect In Ont

https://i.cbc.ca/1.4875360.1540329689!/fileImage/httpImage/image.png_gen/derivatives/original_620/federal-government-s-carbon-tax-and-rebate-plan.png

Web 13 avr 2023 nbsp 0183 32 Quick facts Residents who have had their income tax and benefit returns assessed on or before March 24 2023 will receive their first quarterly payment in April Web 22 nov 2022 nbsp 0183 32 CAI payments for 2023 24 will be disbursed as follows Residents of Alberta Manitoba Ontario and Saskatchewan will receive four equal quarterly payments April

Web Climate action incentive payment The climate action incentive payment CAIP is a tax free amount paid to help individuals and families offset the cost of the federal pollution Web The Government of Canada has changed the payment method for the CAI from a refundable credit claimed annually on personal income tax returns to quarterly tax

FEDERAL CARBON TAX Costs And Rebates DJB Chartered Professional

https://www.djb.com/wp-content/uploads/2019/02/Carbon-Tax-Chart.png

Edmonton Grandmother Told To Return Portion Of Carbon Tax Rebate Cheque

https://i.cbc.ca/1.4021296.1489274593!/fileImage/httpImage/image.jpg_gen/derivatives/16x9_620/pagacz-bill.jpg

https://www.federalreserve.gov/econres/feds/files/2021023p…

Web convex combinations of the following four rebate options for the carbon tax revenue i reduce the capital income tax ii reduce the level of the labor income tax iii increase

https://globalnews.ca/news/4586374/carbon-tax-rebate-what-you-need-

Web 23 oct 2018 nbsp 0183 32 The tax will start at 20 per tonne of emissions and grow by 10 a year until it hits 50 The second part of the tax will hit fuel companies in April 2019

How To Get Money Back For Carbon Pricing On Your 2018 Taxes CBC News

FEDERAL CARBON TAX Costs And Rebates DJB Chartered Professional

A Tale Of 2 Taxes How Carbon Pricing And Revenue Rolls Out In Alberta

NSW Government Demands PM To Scrap Carbon Tax And Give Rebates Daily

Filing Your Taxes Your Carbon Rebate Clean Prosperity

Filing Your Taxes Your Carbon Rebate Clean Prosperity

Filing Your Taxes Your Carbon Rebate Clean Prosperity

The Cost Of Carbon Pricing In Ontario And Alberta Macleans ca

From Filling Tanks To Filing Taxes How The New Carbon Tax Will Affect

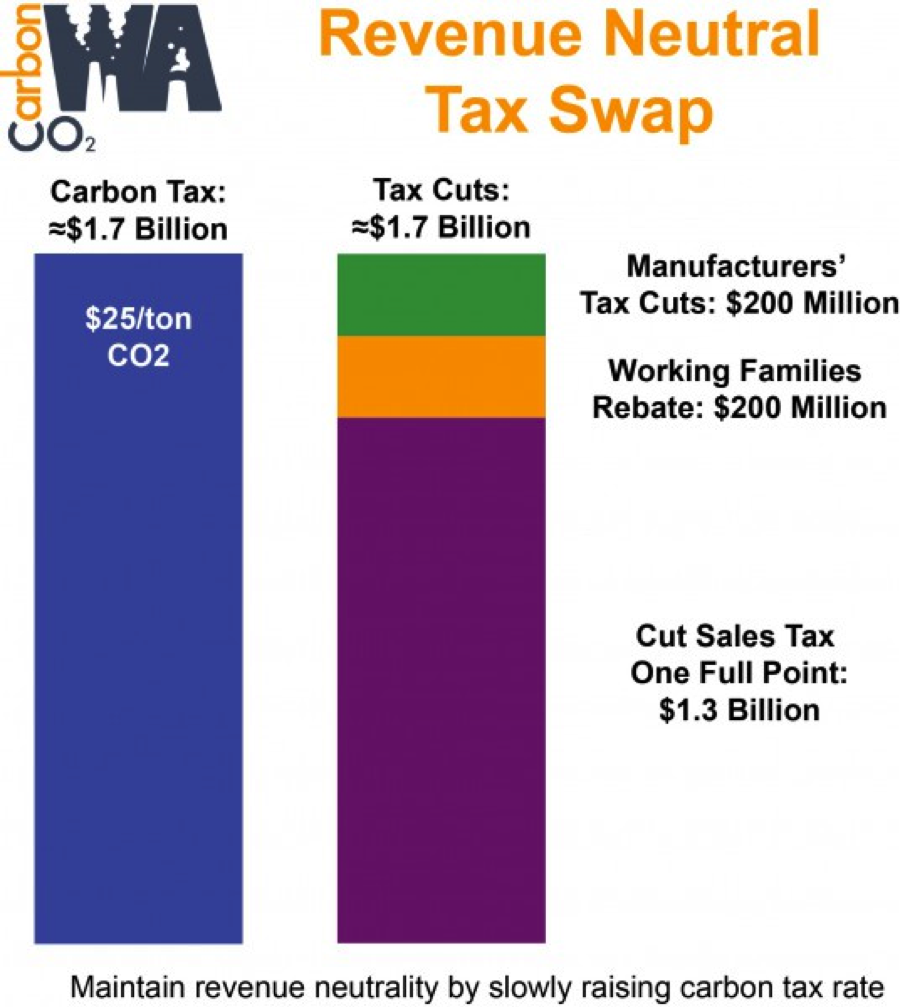

Three Things To Know About CarbonWA s Revenue Neutral Carbon Tax

Carbon Rebate Income Tax - Web If you are eligible for the climate action incentive payment and didn t claim it when you filed your income tax and benefit return it s not too late All you have to do is change your