Cares Act Individual Rebate Web 20 mars 2020 nbsp 0183 32 The Coronavirus Aid Relief and Economic Security CARES Act S 3548 as introduced on March 19 2020 proposes direct payments of up to 1 200 per

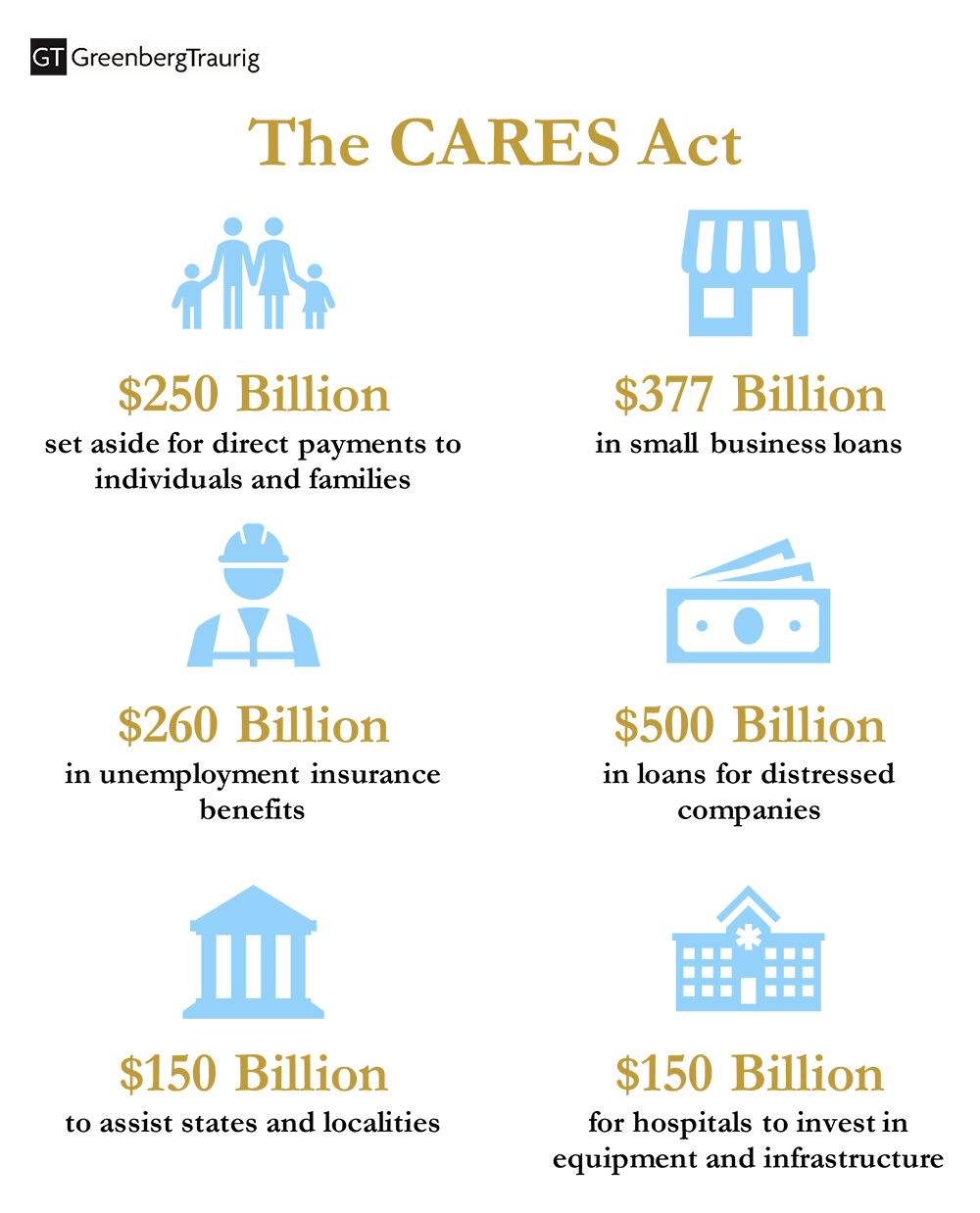

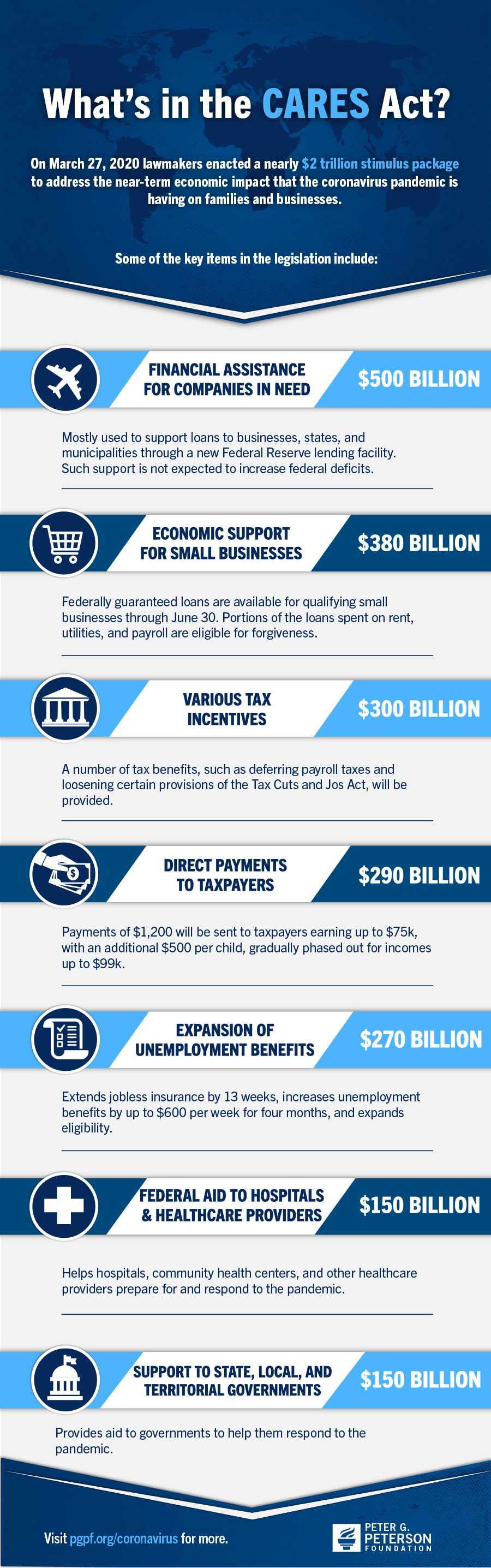

The Act includes the following provisions Allocates 130 billion to the medical and hospital industries Also including medical equipment manufacturers Reauthorizes and allocates funding to public health programs Web 1 avr 2020 nbsp 0183 32 For filers exceeding the income thresholds above recovery rebates decrease by 5 for every 100 of adjusted gross income 99 000 maximum for single or

Cares Act Individual Rebate

Cares Act Individual Rebate

https://cdn.abcotvs.com/dip/images/6103219_myerm007_CARES_act.jpg?w=1600

Cares Act Fraud Tracker CARS HJW

https://i2.wp.com/suquamish.nsn.us/wp-content/uploads/2020/04/CARES-Act-Cash-Rebate-One-Pager.png

The CARES Act Recovery Rebates Fee Only Financial Advisor Deer Park

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/the-cares-act-recovery-rebates-fee-only-financial-advisor-deer-park-2.png?resize=1024%2C884&ssl=1

Web 30 mars 2020 nbsp 0183 32 The CARES Act includes a one time payment to tax filers in order to help households cover necessary expenses during the coronavirus outbreak We estimate Web 1 avr 2020 nbsp 0183 32 The CARES Act proposes recovery rebates of up to 1 200 for an individual taxpayer and 2 400 for joint filers A taxpayer with children will also receive 500 for

Web Section 2201 of the CARES Act provides recovery rebates for most individuals structured as automatically advanced tax credits disbursed by the Treasury Department The Web 30 mars 2020 nbsp 0183 32 Recovery Rebate for individual taxpayers The bill would provide a 1 200 refundable tax credit for individuals 2 400 for joint taxpayers Additionally taxpayers

Download Cares Act Individual Rebate

More picture related to Cares Act Individual Rebate

Top CARES Act Rebate CPA Firm For San Jose Restaurants Get ERTC Fast

https://i.pinimg.com/736x/7e/7c/a1/7e7ca1aca925ce12c1ad284eb5cfd024.jpg

CARES Act Recovery Rebate For Individual Taxpayers YouTube

https://i.ytimg.com/vi/W0P3zFSMR6s/maxresdefault.jpg

The CARES Act Paycheck Protection Program What You Need To Know

https://wordstream-files-prod.s3.amazonaws.com/s3fs-public/styles/simple_image/public/images/media/images/cares-act-image.jpg?3su6ysWNjZ4UZVwZWYEj5gZlBSepiujj&itok=PrD1lwOq

Web 30 mars 2020 nbsp 0183 32 La loi CARES augmente le montant des pertes que peuvent potentiellement d 233 duire ainsi les contribuables non constitu 233 s en soci 233 t 233 par actions en suspendant la Web 31 mars 2020 nbsp 0183 32 JCT estimated that the individual and business tax provisions in the CARES Act would reduce federal tax revenue by 578 0 billion over the 10 year FY2020

Web 2 avr 2020 nbsp 0183 32 Congress s latest coronavirus relief package the Coronavirus Aid Relief and Economic Security CARES Act is the largest economic relief bill in U S history and Web 2 avr 2020 nbsp 0183 32 Individual Rebates The CARES Act provides a 1 200 stimulus rebate to each eligible individual with adjusted gross income of up to 75 000 150 000 for

Best CARES Act Tax Credit Program 2022 Get Maximum Rebates With ERTC

https://i.ytimg.com/vi/CmMnjevi0RU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIARABGGUgZShUMA8=&rs=AOn4CLC20LeCqVVaYFn4TS6Z-53vbiG19g

Congress Passes CARES Act Overview Of The Relief Available To Small

https://www.gtlaw.com/-/media/images/covid/34007-0320-nat-gva-the-cares-act-infographic.jpg?la=en

https://crsreports.congress.gov/product/pdf/IN/IN11262

Web 20 mars 2020 nbsp 0183 32 The Coronavirus Aid Relief and Economic Security CARES Act S 3548 as introduced on March 19 2020 proposes direct payments of up to 1 200 per

https://en.wikipedia.org/wiki/CARES_Act

The Act includes the following provisions Allocates 130 billion to the medical and hospital industries Also including medical equipment manufacturers Reauthorizes and allocates funding to public health programs

Cares Act Recovery Rebate Credit Recovery Rebate

Best CARES Act Tax Credit Program 2022 Get Maximum Rebates With ERTC

CARES Act For Individuals Rebates Retirement Account Changes And More

Claim CARES Act Tax Credits With PPP Loans In 2022 Guaranteed Maximum

Coronavirus The CARES Act PPP Loans 4A s

Check Status Of Recovery Rebate Recovery Rebate

Check Status Of Recovery Rebate Recovery Rebate

Calam o Get CARES Act Tax Credits Fast 2022 ERC Rebate Audit Proof

Calam o Get Fast ERTC Refund Take This Free CARES Act Rebate

TAX RELIEF PROVIDED BY THE CARES ACT Individual Recovery Rebates

Cares Act Individual Rebate - Web Section 6428 a provides an eligible individual for their first taxable year beginning in 2020 a refundable tax credit of up to 1 200 2 400 for eligible individuals filing a joint tax