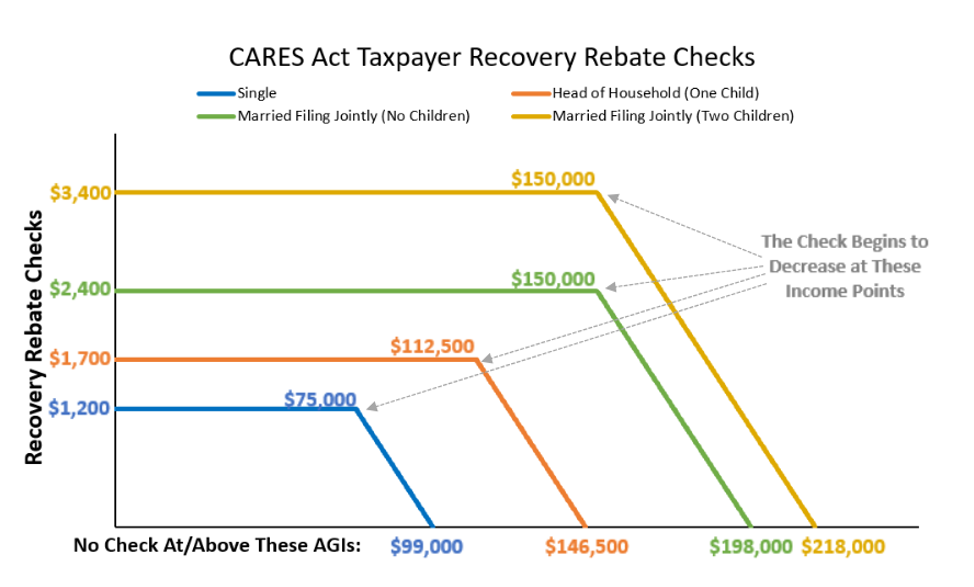

Cares Act Rebate Phase Out Web 17 avr 2020 nbsp 0183 32 The total credit phases out at a rate of 5 of adjusted gross income AGI above 75 000 112 500 for head of household filers and 150 000 for married

Web 26 mars 2020 nbsp 0183 32 Are they eligible to receive any rebate The rebate amount is reduced by 5 for each 100 that a taxpayer s income exceeds the phase out threshold The amount is Web 10 mars 2021 nbsp 0183 32 Phase out The credit is completely phased out for single filers with AGI exceeding 80 000 120 000 for head of household 160 000 for married couples filing

Cares Act Rebate Phase Out

Cares Act Rebate Phase Out

https://s25562.pcdn.co/wp-content/uploads/2020/04/CARES-Act-scaled.jpg

The Peninsula Center Blog CARES Act Recovery Rebate s Interaction With

https://1.bp.blogspot.com/-4vFY6ECdpFU/XXv1qZL8VjI/AAAAAAAAAPs/76ngwC9786QvO-0Ahg5lumSsalfBGAEhgCPcBGAYYCw/s1600/Cathy%2BHeadshot%2B2019.jpg

Calam o Best Done For You CARES Act Rebate Application 2022 Top ERTC

https://p.calameoassets.com/220730110328-59c4275b4e559c1a3706dfb858fff3b8/p1.jpg

Web Starting in March 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act provided Economic Impact Payments of up to 1 200 per adult for eligible Web 30 mars 2020 nbsp 0183 32 The rebate phases out at 75 000 for singles 112 500 for heads of household and 150 000 for joint taxpayers at 5 percent per dollar of qualified

Web An additional 900 billion in relief was attached to the Consolidated Appropriations Act 2021 which was passed by Congress on December 21 2020 and signed by President Web 23 mars 2020 nbsp 0183 32 Over the weekend the Senate updated the CARES Act by expanding the size and scope of the tax rebates The bill has a new phase out threshold for heads of

Download Cares Act Rebate Phase Out

More picture related to Cares Act Rebate Phase Out

Simple ERC Application For Restaurants In Kansas City Maximizes CARES

https://ampifire.com/files/uploaded_images/a5ab055808277c6b49c9dfcbeec36756.jpg

Applications For Final Phase Of CARES Act Hardship Program Now Open

https://westernnews.media.clients.ellingtoncms.com/img/photos/2021/07/06/SandStormAcrossLonelyDesertRoadinSouthernNamibiatakeninJanuary2018.jpg

Calam O CARES Act ERTC Deadline Fast Tax Rebate Application Free

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/calam-o-cares-act-ertc-deadline-fast-tax-rebate-application-free.jpg?resize=1024%2C576&ssl=1

Web 29 mars 2020 nbsp 0183 32 There is a phase out of the rebate which causes a 50 reduction in the rebate for every 1 000 of AGI above these thresholds For example individuals with no Web 20 mars 2020 nbsp 0183 32 The Coronavirus Aid Relief and Economic Security CARES Act S 3548 as introduced on March 19 2020 proposes direct payments of up to 1 200 per

Web 2 avr 2020 nbsp 0183 32 Congress s latest coronavirus relief package the Coronavirus Aid Relief and Economic Security CARES Act is the largest economic relief bill in U S history and Web 31 mars 2020 nbsp 0183 32 Rebates in the CARES Act as Taxpayers eligible for the credit could also receive 500 for each child eligible for the child tax credit The total credit to phase out

Best Done For You CARES Act Rebate Application 2022 Top ERTC Expert

https://ampifire.com/files/uploaded_images/3d97f11a68aa2ddaab945fde2cf11df6.jpg

CARES Act Rebate Calculator Guide Use This Simple ERTC Eligibility

https://www.dailymoss.com/wp-content/uploads/2022/08/cares-act-rebate-calculator-guide-use-this-simple-ertc-eligibility-assessment-62e8d11bd4228.jpg

https://crsreports.congress.gov/product/pdf/IN/IN11282

Web 17 avr 2020 nbsp 0183 32 The total credit phases out at a rate of 5 of adjusted gross income AGI above 75 000 112 500 for head of household filers and 150 000 for married

https://www.finance.senate.gov/chairmans-news/cares-act-recovery...

Web 26 mars 2020 nbsp 0183 32 Are they eligible to receive any rebate The rebate amount is reduced by 5 for each 100 that a taxpayer s income exceeds the phase out threshold The amount is

Use This Fast ERC Relief Fund Application Claim Your CARES Act Rebate

Best Done For You CARES Act Rebate Application 2022 Top ERTC Expert

CARES Act Will There Be A Phase 4 Robert J Taylor

St Johns County Approves Phase One Of CARES Act Funding Program 104

Rep Andy Barr CARES Act Rebate Checks YouTube

Get Fast ERTC Refund Take This Free CARES Act Rebate Eligibility

Get Fast ERTC Refund Take This Free CARES Act Rebate Eligibility

Employee Retention Tax Credit For Businesses CARES Act Rebate

COVID 19 CARES Act JSA CPAs PLLC

CARES ACT 2020 Legacy Wealth Management Group Of Las Vegas

Cares Act Rebate Phase Out - Web 23 mars 2020 nbsp 0183 32 Over the weekend the Senate updated the CARES Act by expanding the size and scope of the tax rebates The bill has a new phase out threshold for heads of