Cares Act Recovery Rebate Accounting Today Web 23 mai 2022 nbsp 0183 32 The Recovery Rebate Credit was part of the federal government s efforts to provide a stimulus to the economy during the early days of the COVID 19 pandemic The

Web 5 avr 2021 nbsp 0183 32 The Recovery Rebate Credit is supposed to allow taxpayers to get either the first or second rounds of stimulus payments they didn t receive last year or earlier this Web 1 f 233 vr 2021 nbsp 0183 32 Originally the CARES Act added this refundable payroll tax credit equal to 50 percent of qualified wages at 10 000 per year per employee paid by eligible employers

Cares Act Recovery Rebate Accounting Today

Cares Act Recovery Rebate Accounting Today

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/the-cares-act-recovery-rebates-fee-only-financial-advisor-deer-park-2.png?resize=1024%2C884&ssl=1

Recovery Rebate Income Limits Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-q-a-about-recovery-rebates-student-loans-health-care-4.png

Check Status Of Recovery Rebate Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2022/11/what-you-need-to-know-about-recovery-rebates-under-the-cares-act-1.png

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 10 mars 2021 nbsp 0183 32 The act creates a new Sec 6428B that provides individuals with a 1 400 recovery rebate credit 2 800 for married taxpayers filing jointly plus 1 400 for each

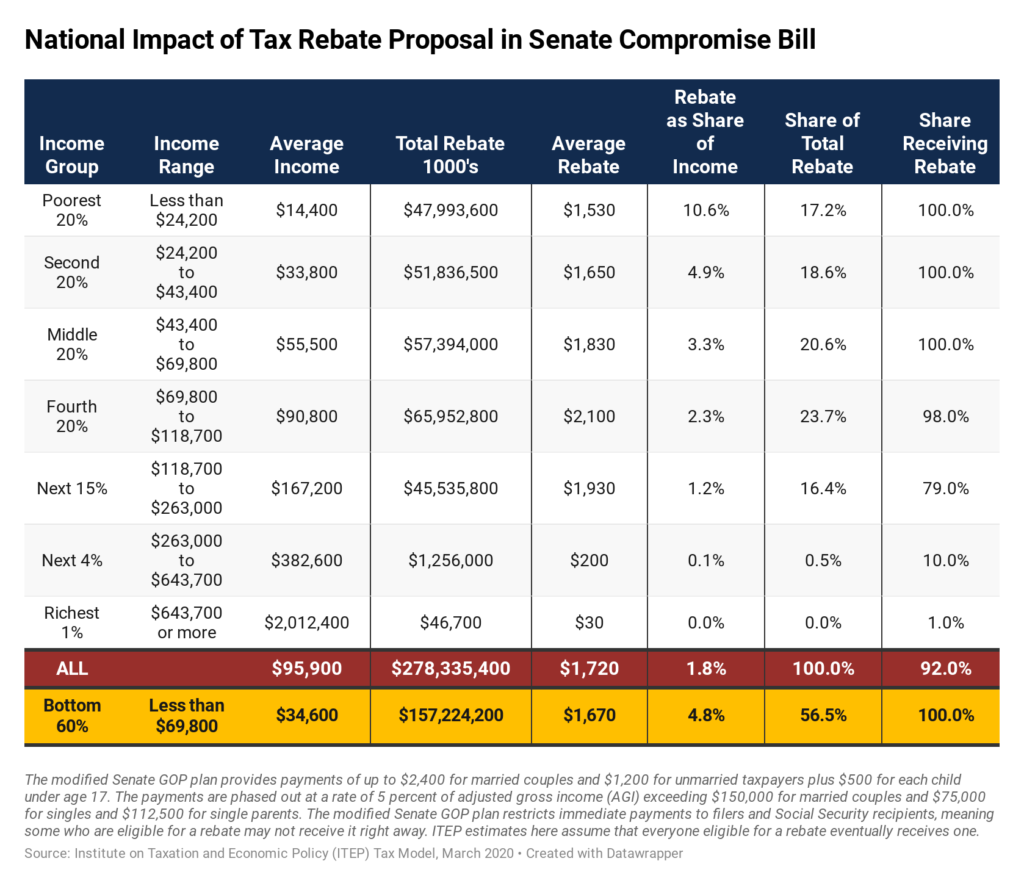

Web 24 mai 2021 nbsp 0183 32 CARES Act signed into law on March payments to the 27 2020 is a refundable Recovery Rebate Credit for individuals The Act authorizes the IRS to make Web 1 avr 2020 nbsp 0183 32 Every United States resident or citizen who filed a tax return in 2018 or 2019 may be eligible to receive a recovery rebate under the CARES Act Filers are eligible

Download Cares Act Recovery Rebate Accounting Today

More picture related to Cares Act Recovery Rebate Accounting Today

The CARES Act Recovery Rebates Fee Only Financial Advisor Deer Park

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/the-cares-act-recovery-rebates-fee-only-financial-advisor-deer-park-1.png

How Did The CARES Act Recovery Rebate Work

https://www.wealthenhancement.com/cms/delivery/media/MCWGHNDFI3NNG53O5BX2MGDC4EL4

Taxes On New Car Rebates Tennessee 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/tax-rebates-in-the-federal-cares-act-itep.png

Web 17 ao 251 t 2022 nbsp 0183 32 Understanding the Recovery Rebate Credit The CARES Act provided economic relief payments known as Economic Impact Payments or stimulus payments valued at 1 200 per eligible adult Web Starting in March 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act provided Economic Impact Payments of up to 1 200 per adult for eligible

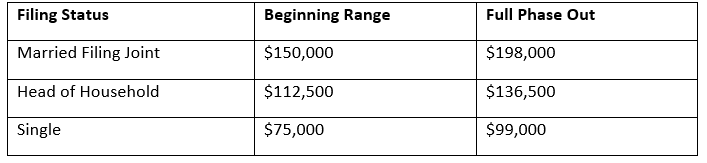

Web 26 mars 2020 nbsp 0183 32 A typical family of four is eligible for a 3 400 recovery rebate What about taxpayers with adjusted gross income over 75 000 112 500 for head of household Web 17 avr 2020 nbsp 0183 32 CARES Act P L 116 136 Updated April 17 2020 The Coronavirus Aid Relief and Economic Security Act CARES Act P L 116 136 which was signed into

Top CARES Act Rebate CPA Firm For San Jose Restaurants Get ERTC Fast

https://i.pinimg.com/736x/7e/7c/a1/7e7ca1aca925ce12c1ad284eb5cfd024.jpg

Recovery Rebates For Individuals Under The CARES Act Bruning

https://bruninglaw.com/wp-content/uploads/2020/04/accounting-analytics-balance-black-and-white-209224-980x653.jpg

https://www.accountingtoday.com/news/irs-sent-millions-in-potentially...

Web 23 mai 2022 nbsp 0183 32 The Recovery Rebate Credit was part of the federal government s efforts to provide a stimulus to the economy during the early days of the COVID 19 pandemic The

https://www.accountingtoday.com/news/irs-reducing-correcting-recovery...

Web 5 avr 2021 nbsp 0183 32 The Recovery Rebate Credit is supposed to allow taxpayers to get either the first or second rounds of stimulus payments they didn t receive last year or earlier this

Calam o Get Fast ERTC Refund Take This Free CARES Act Rebate

Top CARES Act Rebate CPA Firm For San Jose Restaurants Get ERTC Fast

Summary Of Individual Provisions Of CARES Act

CARES Act 2020 Recovery Rebates

Calam O CARES Act ERTC Deadline Fast Tax Rebate Application Free

CARES Act For Individuals Rebates Retirement Account Changes And More

CARES Act For Individuals Rebates Retirement Account Changes And More

Calam o Best Done For You CARES Act Rebate Application 2022 Top ERTC

What Does The Recovery Rebate Form Look Like Bears Printable Rebate Form

Calam o Get CARES Act Tax Credits Fast 2022 ERC Rebate Audit Proof

Cares Act Recovery Rebate Accounting Today - Web 30 mars 2020 nbsp 0183 32 All U S residents or citizens are eligible to receive a payment of 1 200 or 2 400 per married couple plus 500 per child under the age of 17 as of 12 31 2020 A