Cares Act Tax Rebate Web 2 avr 2021 nbsp 0183 32 WASHINGTON The Internal Revenue Service today issued guidance for employers claiming the Employee Retention Credit under the Coronavirus Aid Relief

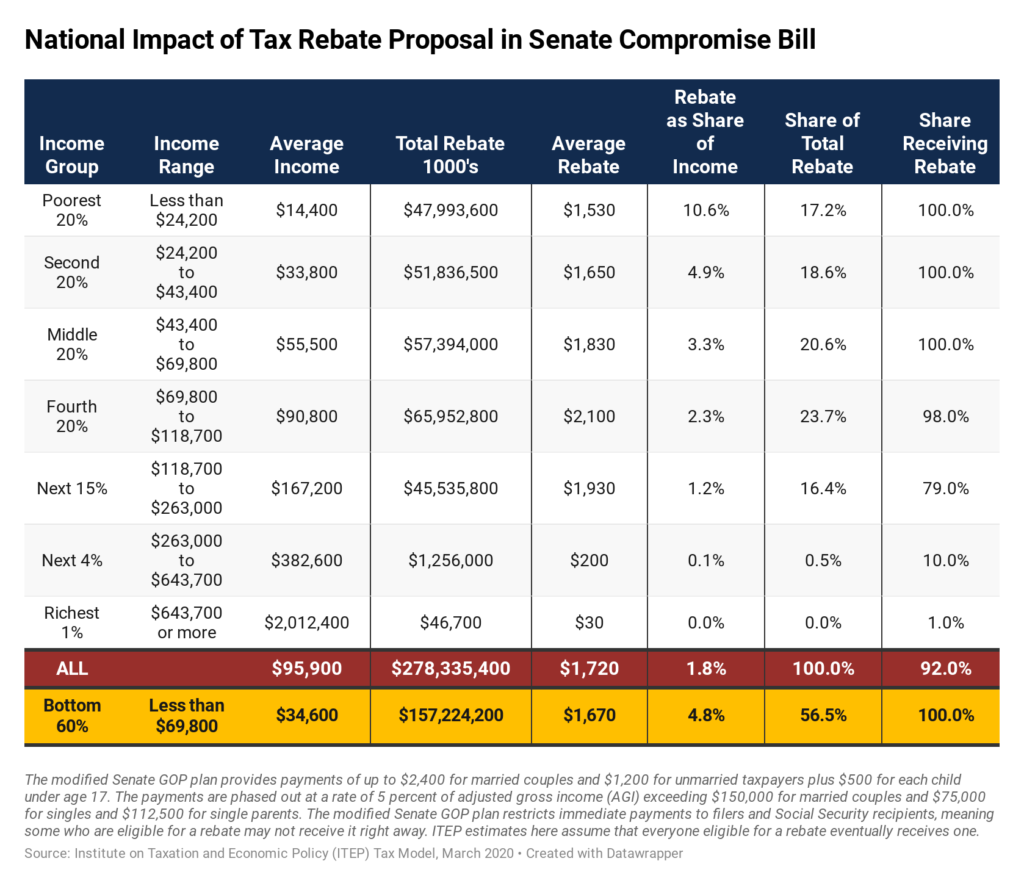

Web 28 avr 2020 nbsp 0183 32 Tax relief for individuals and businesses in the CARES Act includes a one time rebate to taxpayers modification of the tax treatment of certain retirement fund Web 30 mars 2020 nbsp 0183 32 The CARES Act includes a one time payment to tax filers in order to help households cover necessary expenses during the coronavirus outbreak We estimate

Cares Act Tax Rebate

Cares Act Tax Rebate

https://www.propertyrebate.net/wp-content/uploads/2023/05/calam-o-cares-act-ertc-deadline-fast-tax-rebate-application-free.jpg

The CARES Act Recovery Rebates Fee Only Financial Advisor Deer Park

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/the-cares-act-recovery-rebates-fee-only-financial-advisor-deer-park-2.png?resize=1024%2C884&ssl=1

Top CARES Act Rebate CPA Firm For San Jose Restaurants Get ERTC Fast

https://i.pinimg.com/736x/7e/7c/a1/7e7ca1aca925ce12c1ad284eb5cfd024.jpg

Web 5 janv 2021 nbsp 0183 32 1 For more on tax provisions in the CARES Act see CRS Report R46279 The Coronavirus Aid Relief and Economic Payroll Tax Cut to a One Time Tax Web 17 ao 251 t 2022 nbsp 0183 32 The CARES Act provided economic relief payments known as Economic Impact Payments or stimulus payments valued at 1 200 per eligible adult based on household adjusted gross income AGI plus

Web If your business is eligible for the ERC for 2020 and you have not yet claimed the credit you can file amended payroll tax forms to claim the credit and receive your tax refund Web 24 juil 2023 nbsp 0183 32 Designed as a refundable tax credit they do not constitute taxable income at the federal or state level But due to a quirk of some tax codes they could increase

Download Cares Act Tax Rebate

More picture related to Cares Act Tax Rebate

Free CARES Act Tax Credit Assessment Best ERC Rebate Eligibility Test

https://i.ytimg.com/vi/EzRWSPD0I8A/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGF4gXiheMA8=&rs=AOn4CLCF45wRoEF8yOmsSgEc-CqhiihUdg

Taxes On New Car Rebates Tennessee 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/tax-rebates-in-the-federal-cares-act-itep.png

Best CARES Act Tax Credit Program 2022 Get Maximum Rebates With ERTC

https://i.ytimg.com/vi/CmMnjevi0RU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIARABGGUgZShUMA8=&rs=AOn4CLC20LeCqVVaYFn4TS6Z-53vbiG19g

Web The CARES Act provides that payments from the Fund may only be used to cover costs that Are necessary expenditures incurred due to the public health emergency with Web 26 janv 2021 nbsp 0183 32 IR 2021 21 January 26 2021 WASHINGTON The Internal Revenue Service urges employers to take advantage of the newly extended employee

Web Starting in March 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act provided Economic Impact Payments of up to 1 200 per adult for eligible Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim

Cares Act Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-recovery-rebates-distributions-rmd-waivers-student-loan.png

Claim CARES Act Tax Credits With PPP Loans In 2022 Guaranteed Maximum

https://i.ytimg.com/vi/ONrUFegdgRI/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgUShEMA8=&rs=AOn4CLCJ1pHzQ4bjFTR80ZQJcVdPe9Ofow

https://www.irs.gov/newsroom/irs-provides-guidance-for-employers...

Web 2 avr 2021 nbsp 0183 32 WASHINGTON The Internal Revenue Service today issued guidance for employers claiming the Employee Retention Credit under the Coronavirus Aid Relief

https://crsreports.congress.gov/product/pdf/r/r46279

Web 28 avr 2020 nbsp 0183 32 Tax relief for individuals and businesses in the CARES Act includes a one time rebate to taxpayers modification of the tax treatment of certain retirement fund

Calam o Get CARES Act Tax Credits Fast 2022 ERC Rebate Audit Proof

Cares Act Recovery Rebate Credit Recovery Rebate

Check Status Of Recovery Rebate Recovery Rebate

Calam o Top ERTC Expert Scott Duncan Guarantees Maximum CARES Act Tax

Calam o Get Fast ERTC Refund Take This Free CARES Act Rebate

How Did The CARES Act Recovery Rebate Work

How Did The CARES Act Recovery Rebate Work

Recovery Rebate Income Limits Recovery Rebate

Who Qualifies For ERTC Rebates 2022 Free CARES Act Tax Credit

CARES Act For Individuals Rebates Retirement Account Changes And More

Cares Act Tax Rebate - Web If your business is eligible for the ERC for 2020 and you have not yet claimed the credit you can file amended payroll tax forms to claim the credit and receive your tax refund